Justin Sullivan/Getty Images News

Thesis

My last article on Apple Inc. (NASDAQ:AAPL) was co-produced with Envision Research earlier this month. That article analyzed why AAPL is a good candidate for an inter-generational account. Shortly after that article, I read the news on July 13 that Jony Ive, AAPL’s former Chief Design Officer, has officially ended his relationship with AAPL.

I have been thinking over and preparing this article since then. This new article is totally “new” in that it just wants to pay tribute to Jony Ive. In my mind, Jony Ive, together with Steve Jobs, transitioned (or more precisely, elevated) AAPL from a tech business to the most successful luxury brand (or fashion brand if you want to call it).

Tech caters to a pretty strong and eternal human need: the need to do things faster. But luxuries cater to an even stronger human need: the need to be different. And in my view, this is the key difference between AAPL and pretty all the other big tech names. This differentiation is the key to why I feel comfortable investing in AAPL not only for myself but also in our inter-generational account. Tim Cook’s went a step further and make AAPL also the most efficiently run luxury brand.

With this, let’s dive in and see Ive’s legacy, together with Tim Cook’s opportunities and challenges ahead, more closely.

Brief recap: Jony Ive and AAPL

Jony Ive’s partnership with AAPL started about 30 years ago. Ive had either led or left his touch on the design of pretty much every AAPL device – both hardware and software – in the past 3 decades starting from its Newton (introduced back in 1993) all the way to the more recent AAPL watch and augmented reality headset.

In his earlier days with AAPL, it was an understatement to say that design was not the focus of the business, and Jony Ive planned to leave. However, everything changed when Steve Jobs came back to take over AAPL in 1997. Both of them share an almost paranoid pursuit of design (and also dyslexia).

The first-generation iMac short after Jobs’ return serves as a good example as you can see from the photo below. The translucent shell may not seem the sleekest design today. But compared to the mainstream designs (e.g., the IBM models at the same time), it was an immediate hit and sold more than 800k units in the year of its release.

Elevation from mundane hardware to a luxury brand

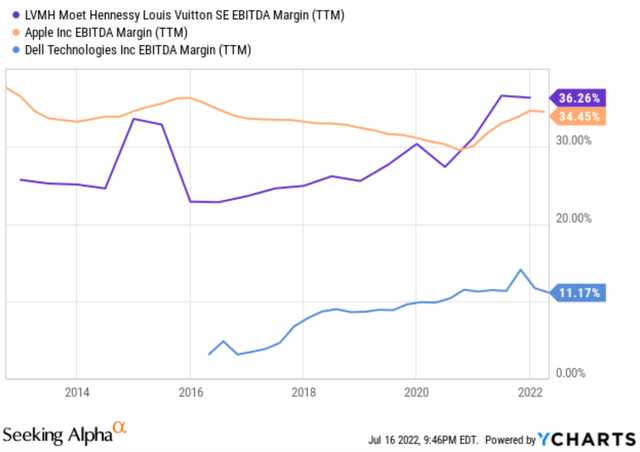

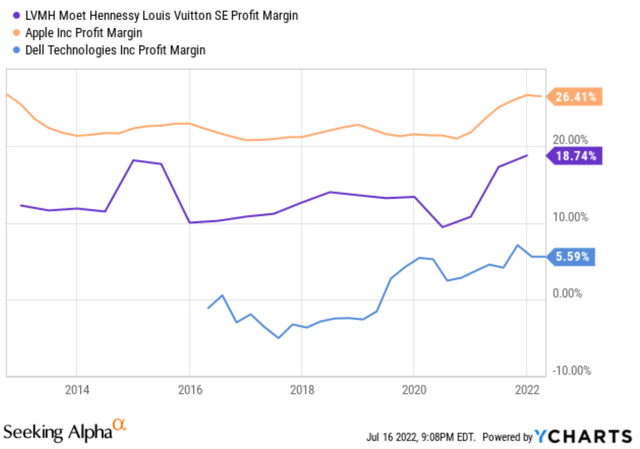

As mentioned above, Tech caters to the eternal human need to do things faster. But luxuries cater to an even stronger human need: the need to be different. Thanks to Ive and Jobs’ wicked talent for design and marketing, AAPL is the one tech company (the only one to my knowledge) that successfully completed the elevation from a tech business into a luxury brand. You can see that its margin is comparable to or even higher than top luxury brands such as LVMH Moët Hennessy – Louis Vuitton (OTCPK:LVMHF), both boasting EBITDA margins above 30%. In contrast, the most successful computer (or hardware in general) typically earns a fraction of the margin. Probably, the elevation is even more vivid when we descend from the forest level, and we look closer at some of AAPL’s specific products in the next section.

The pricing power

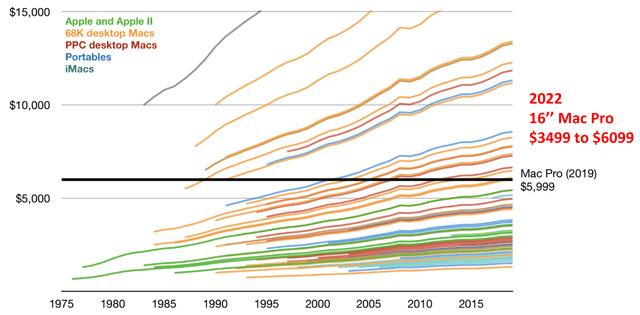

Here I want to draw your attention to the following chart and use the Mac Pro as an example to showcase AAPL’s pricing power and its fashion nature. It is a busy chart with quick a bit of information. But the gist just jumps out: the pricing is outlandish, but people are still flocking to buy.

Take the then-new Mac Pro 2019, for example. The base configuration cost $5,999, not only far above the most powerful Mac ever sold but also far above any other topline laptop even in today’s market. Fast-forward to now, the trend continues. The newly released 2022 Mac Pro starts with a base price of $3,499. And once you pick some larger memory and hard drive, the price tag rises to $6,099 – even before any software or accessories. Yet, users are more than willing to pay such premier pricing – a hallmark of a successful luxury brand.

According to this Dediu report, with 7% of the global market shared, the Mac series captures almost 60% of all the profit in the global laptop market. And Apple keeps gaining market share, as Macs sales grow twice the rate of other PC brand names in Q4 2022.

As a result, in terms of bottom-line margin, AAPL is even more successful than the top luxury brand as you can see from the following chart. Its net profit margin consistently exceeds 20%, leading LVMH consistently by about a whopping 10% over the years. And the most successful computer businesses (or hardware in general) such as DELL again only earn a fraction of what AAPL earns.

Jony Ive’s legacy and Tim Cook’s challenges ahead

In his book entitled “After Steve,” Tripp Mickle predicted that Jony Ive’s departure would be enough to wipe out 10% percent of the company’s stock price. This, of course, is not what has happened. And in a way, this is an even better demonstration of Ive’s legacy. It signals that Ive and Jobs’ design-first spirit has been institutionalized at APPL and has become part of its DNA.

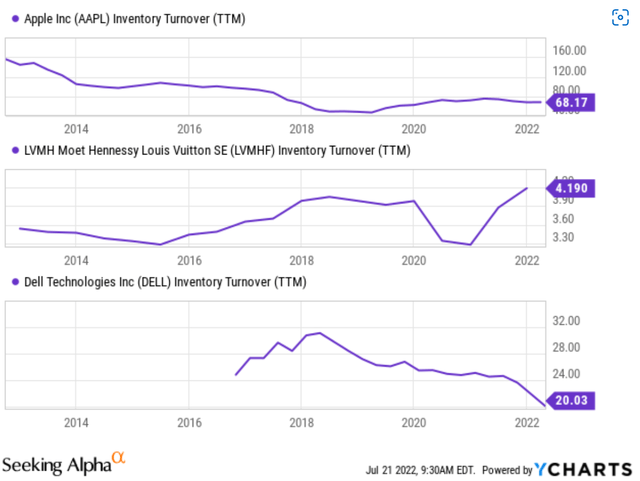

Tim Cook went a step further and made AAPL also the most efficiently run luxury brand (and one of the most efficient tech businesses too). AAPL, thanks to Cook’s unmatched operational prowess, outperforms both tech businesses and luxury brands in most of the operating metrics such as inventory turnover, asset turnover, days of inventory outstanding et al. As an example, you can see that AAPL’s inventory turnover rates are currently about 17x higher than LVMHF and more than 3x higher than DELL.

Looking forward, globalization is suffering a setback in recent years (due to trade wars, pandemics, the Russian/Ukraine war, et al.). And AAPL will be facing a new set of challenges managing its global logistic chains, as detailed next.

Final thoughts and risks

I wish Jony Ive the best of luck with his post-Apple days. I will be keenly forward to seeing his new designs with his new LoveFrom clients (which include Airbnb and Ferrari).

At the same, I also wish AAPL the best in the post-Ive era. I see a very clear division of labor for Apple’s design after Ive’s departure. Its Chief Operating Officer Jeff Williams will continue to oversee the design teams. Its industrial design will be led by Evans Hankey and software design by Alan Dye. As aforementioned, I feel Ive’s legacy has been institutionalized at APPL and has become part of its DNA. And I trust the new team to keep coming out with designs to keep surprising and thrilling AAPL users.

In terms of other future challenges, Tim Cook is facing a post-globalization challenge. These challenges are articulated in the following question from Citigroup analyst Jim Suva during the last earnings report (slightly edited and emphases added by me). On the one hand, as Cook acknowledged, “in this business, you don’t want to hold a ton of inventory”. On the other hand, the rewind of globalization requires AAPL to work more strategically with cycle times and hold strategic inventory in places where you need the buffer. It will be a new set of challenges for Cook (or his successor) to find a new balance.

When we hopefully someday get past all of these (COVID, power outages, trade wars, shipping challenges), do you start to reconsider the way you do the supply chain albeit just-in-time ordering and outsourcing so much of your chips? Or do you actually consider like holding more buffer inventory internally?

Be the first to comment