Milos Ruzicka/iStock via Getty Images

While Apple (NASDAQ:AAPL) remains a favorite at TechStockPros, we maintain our bearish thesis on the stock. Our bearish sentiment is based on our belief the company is under pressure on two fronts. The first is weaker consumer spending at home, with inflation at a 40-year high. We believe fewer and fewer customers will be incentivized to upgrade their Apple devices to more expensive models. The second is trouble abroad in Apple’s largest iPhone production factory, Foxconn. The factory in Zhengzhou, China, has been hit by a COVID-19 outbreak and protests, causing production to slow down significantly. We expect Apple’s iPhone 14 and iPhone 14 Plus model sales to be relatively flat towards the end of the year and might sell at fewer volumes than Apple’s iPhone 13 series did in the second half of 2021.

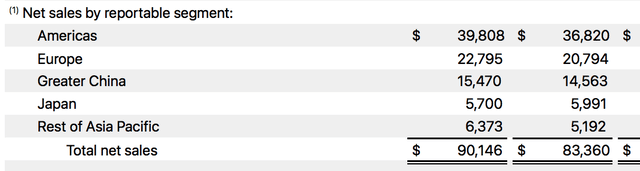

We’re also concerned about Apple’s financial performance as foreign exchange headwinds pile up. Apple’s finance chief, Luca Maestri, elaborated on FX headwinds in the 4Q22 earnings call, stating the company’s total Y/Y revenue will decelerate compared to the September quarter due to foreign exchange headwinds. We expect the strong dollar to gate-keep Apple for double-digit revenue growth. Despite macroeconomic headwinds, Apple’s 4Q22 earnings reported revenue of $90.1B, up 8% Y/Y. We are bullish on Apple in the longer term, but we don’t expect the company to grow meaningfully in the near term. We recommend investors wait on the sidelines for a better entry point on the stock.

Fewer customers opting to upgrade their iPhones

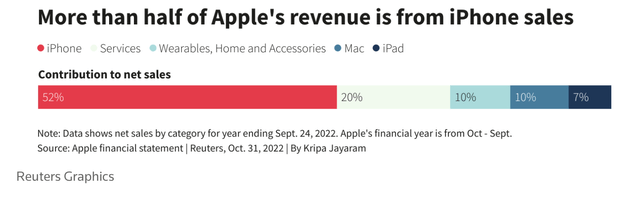

We don’t expect Apple to achieve the expected iPhone 14 and iPhone 14 Plus sales. The current macroeconomic environment is rough, with consumer prices up 9.1% over the year-end in June and current interest rates hiked by 0.75% this year. We believe Apple’s customers are feeling the pressure of macroeconomic headwinds. We expect this to be reflected in sales of Apple’s upgrade cycle products. We believe the upgrade cycle with new iPhones, MacBooks, Watches, and AirPods presented an attractive lineup in the Far Out event. We don’t expect flat sales due to any shortcomings from the company, instead, we expect the underwhelming sales to be the result of the current macroeconomic environment. IDC reported global smartphone shipments declined by 9.7% Y/Y to 301.9M units due to weakening consumer spending. Apple derives most of its revenue from its iPhone sales, amounting to around 41% in 3Q22. We believe the company will face churn as global smartphone shipments drop.

The following graph outlines Apple’s revenue from its iPhone sales.

While Apple’s iPhone remains arguably the gold standard for smartphones, we don’t believe it is immune to weakening consumer spending. Apple achieved an iPhone revenue of $42.63B in 4Q22, a 9.67% Y/Y increase. Apple’s iPhone 14 hit the market as the biggest upgrade in Pro models. The iPhone 14 Plus model is Apple’s first-ever relatively affordable Plus phone. Despite this, the iPhone reported selling lower volume units than iPhone SE3 and iPhone 13 mini. As macroeconomic headwinds persist, we believe Apple will see fewer customers opt to upgrade their Apple devices for more expensive models.

iPhone production to slow down in Apple’s biggest production factory

Apple’s largest assembly factory for iPhones was hit by a COVID-19 outbreak, and we expect to see iPhone production take a hit as a result. Apple relies heavily on China for most of its iPhone production, producing 70% of iPhone shipments globally. We believe the company is vulnerable to the zero-COVID policies in China, specifically in cases of an outbreak. The factory located in Zhengzhou, China, has been battling a new wave of the disease this month, inciting new lockdown restrictions. We expect iPhone production could slump by 30% next month due to the tightening restrictions to control the outbreak.

To make matters worse, protests are reported to have erupted in Zhengzhou, with hundreds of workers marching and chanting, “Defend our rights! Defend our rights!” The Foxconn protesters were met by police brutality as they accused the factory of changing their contracts after placing them in quarantine and eliminating previously promised subsidies. We expect the protests at Foxconn to further pressure iPhone production next month.

Foreign exchange headwinds gatekeeping double-digit growth

We believe Apple will face pressure from FX headwinds due to the strong U.S. dollar. Market volatility, recession, FX headwinds, COVID-19 issues, the Ukraine-Russia war, and China-Taiwan tensions all affect Apple and its competition. Apple CEO Tim Cook stated that the “foreign exchange headwinds were over 600 basis points for the quarter.” We expect headwinds to keep on pressuring Apple’s financial performance into 1H23.

The following graph from 4Q22 outlines Apple’s sales by region, stating Apple’s three-month ended net sales in September 2022 compared to September 2021.

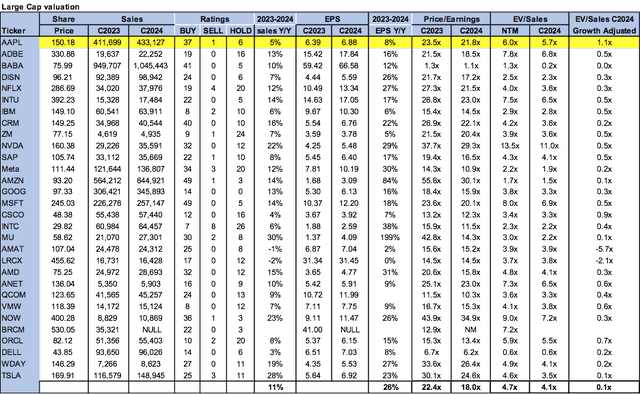

Valuation

Apple is not cheap. On a P/E basis, the stock is trading at 21.8x C2024 EPS $6.88 compared to the peer group average at 18.0x. The stock is trading at 5.7x EV/C2024 Sales versus the peer group at 4.1x. We believe there is more downside to be priced into the stock towards the end of the year. We recommend investors hold the stock.

The following graph outlines Apple’s valuation table compared to the peer group.

Word on Wall Street

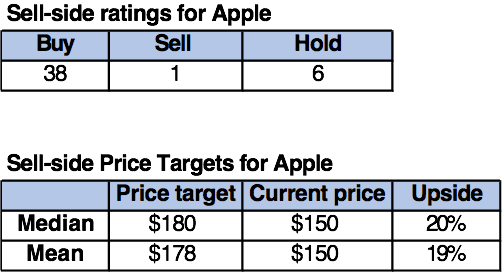

Wall Street is overwhelmingly buy-rated on Apple. Of the 45 analysts covering the stock, 38 are buy-rated, six are hold-rated, and the remaining are sell-rated. We believe Wall Street’s bullish sentiment is because they expect Apple will be relatively resilient to any near-term risks. The stock is currently trading at $150. The median and mean price targets are set at $180 and $178, respectively, with a potential upside of 19-20%.

The following table outlines Apple’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

We maintain our hold rating on Apple. We believe Apple’s stock isn’t a safe haven for investors as consumer weakness continues, and iPhone production slows in China. We expect more downside ahead and recommend investors wait for a better entry point.

Be the first to comment