Just_Super

Investment Thesis

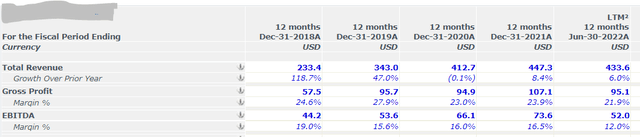

Appen (OTCPK:APPEF) was an Australian tech darling until recent times, when tough times hit the global tech industry. The company was experiencing high revenue growth rates as large tech customers (i.e., FAANGs of the world) accelerated their investment into AI products; however, the dependency on these same customers has led to declining revenues in the current year. While the overall recessionary environment has had a negative impact, the fast adoption of AI has resulted in new competition enter the market with peers focusing on tech enabled solutions (vs. the people centric model which Appen focuses on) which has further deteriorated Appen’s prospects. This has led to the need for additional investment into new capabilities (organic and via M&A) which has resulted in lower profitability in the near term. While the overall risk remains elevated and the decline in share price is justified, the stock is now trading at sub 4x EBITDA and presents an opportunity for long horizon investors to establish a position. We discuss several catalysts which could lead to a turnaround and generate outsized returns for patient investors.

Company Overview

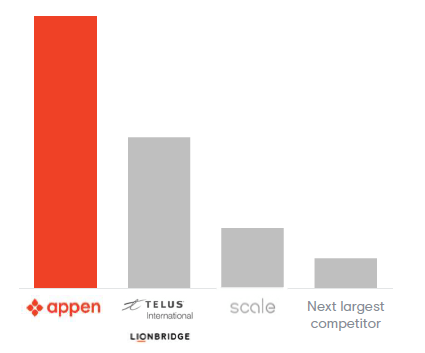

Appen is the global leader in the development of high-quality datasets that are used to build and continuously improve artificial intelligence (AI) systems. In fact, there is only one other known competitor which provides this type of service at scale (Lionbridge AI – acquired by TELUS International in 2020). To get AI systems to a level which allows for autonomous decision-making, these systems need to be “trained” using vast amounts of data. Think of an autonomous vehicle which needs to be “taught” how to react in different situations (e.g., lane change, pedestrians, street signs, weather changes etc.). This requires large amounts of video and image data. However, for this data to be useful to a machine, it needs to be annotated (i.e. labelled) which generally requires human involvement. While tools have been developed to make the annotation process faster, a large number of people are required to pass judgement on raw data to remove bias. Ultimately, the quality of the data determines how well the AI system works.

Appen market positioning (Company materials)

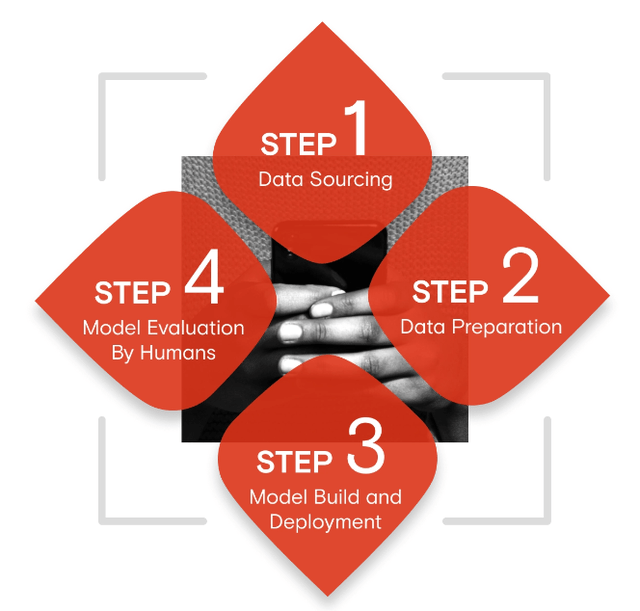

Appen employs a large base (1 million+) of temporary/gig workers known as the crowd, which are spread across the globe (170+ countries) and annotate data remotely. While the company is headquartered in Australia, it serves global tech clients across the globe. The company has also entered other parts of the AI value chain by developing/acquiring tools which allow for efficiency in the annotation process. While historically the company’s customer base has been large tech companies, the company is diversifying into other enterprise clients as AI adoption accelerates outside of big tech players.

AI algorithm development cycle (Company website)

Why has the stock underperformed in recent times?

High Dependency on Global Tech Customers

Approximately 80%+ of the company’s revenue is generated by its top 5 customers, which are the large tech companies. These companies provide their own software platform for the data annotation work, however, employ Appen to provide its crowd, which performs the data labelling. Historically, these companies have accounted for the vast majority of the AI market and have invested heavily in this area. Some examples of products which require data annotation services include Alexa (Amazon), Siri (Apple), Maps (Google), Marketplace (Facebook) etc. While this investment into AI benefitted Appen in recent years, the current macro environment has put a halt on this spend, which has impacted the company’s recent performance.

Select Appen Customers (company website)

Increased Competition

Given the accelerating adoption of AI, many new competitors have entered the space. These include companies such as Scale AI and Cloud Factory. These competitors are well funded and have raised money at lofty valuations. These companies have also focused on developing tools which allow for faster automation vs. focusing on employing humans to do the work.

While new competitors may enter the market, it is important to note that the incumbency advantage enjoyed by Appen is not insignificant. It is challenging to replicate the scale of having a 1 million + crowd members across 170 countries. Having this scale allows Appen access to contracts offered by large tech companies who prefer to work with established players vs. peers in more nascent stages.

Evolving Business Model Requiring Upfront Investment in new Tools

Given the evolution in the AI data annotation market, Appen has had to invest funds into R&D in order to keep up with new competitors. This is also important to serve the Enterprise segment, which unlike large tech players does not have their own annotation tools. These investments have led to lower profitability as these clients are generally looking for short term contracts which are less profitable than the work Appen does for large tech customers.

Recent financial performance (CapIQ)

Why should long-term investors consider a position in the stock?

Rising AI Adoption

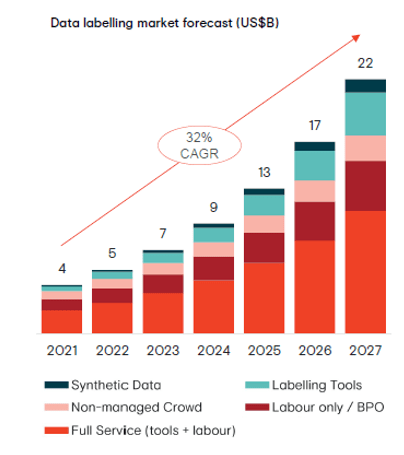

As discussed above, while major tech companies have accounted for the vast majority of investment into AI in recent years, adoption is increasing in other industries. Use cases include autonomous vehicles, back-office digital transformation, medical imaging etc. The overall market for these services will continue to grow rapidly despite the current economic environment. Additionally, given Appen’s services are required to service all types of use cases, the company is well positioned to take advantage of the overall AI market growth (i.e. its use case agnostic).

AI data annotation market size (Cognilytics research )

Strong Balance Sheet

Despite the recent poor financial performance, the company has ~$40M of cash on the balance sheet, is in a net positive cash flow situation (despite R&D investments) and has no debt. These are all positive signs and could mean that Appen survives the current environment over many smaller competitors and can take advantage of any vendor consolidation at large tech customers.

Potential Multiple Uplift as Software Business Expands

Given the investment into software tools, as this part of Appen’s business expands, it could lead to a multiple uplift usually enjoyed by SaaS companies over general service providers who don’t have their own IP.

Potential for a Buyout

Appen received a buyout offer for AUD $9.5 per share earlier this year. While that deal ultimately fell through, this shows the value placed on the company by a well-established competitor. Given the current share price (AUD $2.5), we believe private equity buyers may look at the company with a view of taking it off the public markets. Private equity players have raised a significant amount of cash over the past few years and, despite higher interest rates, need to deploy this cash on profitable assets where value can be created.

Risks

- Customer Concentration: As discussed above, the vast majority of Appen’s revenue is generated by its top 5 customers (big tech players) who have been impacted by the macro environment

- Liquidity: The company is listed on the Australian Stock Exchange. US investors may need to invest in the OTC market, where shares of the company are very thinly traded.

- Low Revenue Visibility: Appen performs project based work, which leads to lower revenue visibility and is less recurring in nature

- Technology Investment: Appen needs continuous investment into R&D to keep up with its investors. The company may also look to engage in M&A which comes with integration risk

Conclusion

While there will be some near term pain, Appen could present patient investors with a discounted opportunity to ride the AI wave. The company’s balance sheet appears to be strong, and we believe the prevailing macro conditions impacting spending by large tech players will change in the future. It is not inconceivable that a company like Appen, even with lower than normal revenue growth expected in the future, could trade at 8-10x EBITDA, which would represent >100% upside from current levels.

Be the first to comment