Jonathan Knowles/DigitalVision via Getty Images

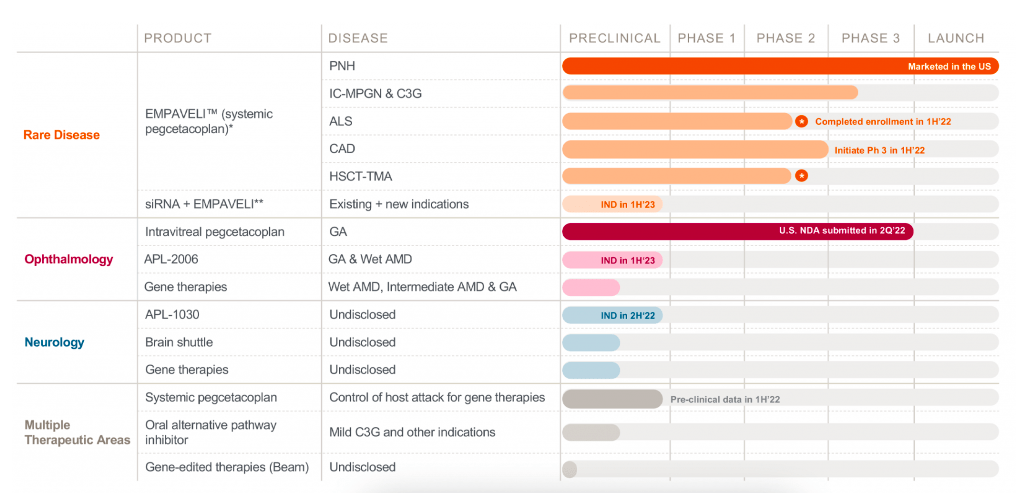

Apellis (NASDAQ:APLS) is the leader in developing therapies targeting the complement system. They have one approved product, one with an NDA that was recently submitted, two phase 3 trials and multiple earlier stage assets and target indications. Here’s how their pipeline looks:

Pipeline (Company website)

Lead candidate pegcetacoplan is approved for Paroxysmal nocturnal hemoglobinuria (PNH) in the US. It was approved in May 2021, branded as EMPAVELI in the US and Aspaveli in EU. It is approved for use in adults with PNH who are:

-

Treatment naïve

-

Switching from C5 inhibitor Soliris® (eculizumab)

-

Switching from C5 inhibitor Ultomiris® (ravulizumab)

In the registrational phase 3 PEGASUS study, EMPAVELI was found to be superior to Soliris in terms of change from baseline in hemoglobin level at Week 16. Moreover, 85% of patients on EMPAVELI were transfusion-free compared to only 15% on Soliris at week 16. The two drugs were comparable in transfusion avoidance.

The company also just submitted an NDA for pegcetacoplan in Geographic Atrophy or GA. The NDA was submitted on June 1, so there’s going to be a 2-month review period, and then a date will be provided. Given pegcetacoplan has a fast track designation in GA, expect the PDUFA in 6 months, or sometime in January 2023. GA is a leading cause of blindness in over five million people globally, and one million Americans. According to company management, “Pegcetacoplan is the only treatment that has shown the potential to meaningfully slow disease progression across three large studies with a representative, real-world population of GA patients.”

The company further says:

The NDA submission is based on results from the Phase 3 DERBY and OAKS studies at 12 and 18 months and the Phase 2 FILLY study at 12 months. In the studies, treatment with both monthly and every-other-month pegcetacoplan resulted in a clinically meaningful reduction of GA lesion growth across a broad, heterogenous population of more than 1,500 patients. Pegcetacoplan demonstrated a favorable safety profile in all three studies.

However, these statements are deceptive. The trials were mixed at best. When the company says there was “clinically meaningful” reduction of GA lesion growth, that’s code for it was not statistically significant – which it was not in the monthly dosage in the DERBY trial, and for DERBY and FILLY trials in the every-other-monthly dosage. In these 3 instances, the molecule failed to show statistical significance against placebo.

Also note that in a presentation last year, the company cited the following:

“Anything over 20% [reduction in lesion growth rate] would be significant in my mind.” – Retina Specialist

It is, therefore, interesting that none of the 6 data points showed a 20% reduction in lesion growth; the highest they achieved was 18%. Before Apellis, Roche (OTCQX:RHHBY) and Gemini (GMTX) failed to get a grip on geographic atrophy using the complement-mediated angle.

Even safety data wasn’t all that benign – there were instances of choroidal neovascularisations, which at 18 months increased to 9% and 6% of patients on the monthly and every-other-month dose respectively. Choroidal neovascularisations are a major cause of vision loss, which can, however, be treated with anti-VEGF therapy, while GA has no approved treatment. Other than that, safety data was decent, with no unexpected surprises.

I should note that after this data was first released, the stock dropped 50% despite efforts at putting a positive spin on the data from both the company and some analysts. Interestingly, DERBY and OAKS were identical trials, and even pooled analysis of their data showed stat sig. However, since they did the two trials, it is now uncertain whether the FDA will accept pooled analysis. Logic dictates that the FDA at least ask for an explanation of the difference in data; so far, the company hasn’t offered any.

In March this year, the company presented much more favorable 18-month data from both these phase 3 studies, DERBY and OAKS:

According to data at 18 months, from months 0-6 to months 12-18, the reduction in GA lesion growth improved with monthly pegcetacoplan to 21% from 13%. With every other-month pegcetacoplan treatment, the improvement reached 17% from 12% for the two periods.

While the improvements were marginal, they were able to push the outcome to one of statistical significance. Durability was also maintained over the 18 months. This data was part of the NDA; however, the company plans to present 24-month data in September, which won’t be; the FDA, however, may request that this data be included, which may cause some delay, as it may be considered a major amendment to the NDA.

Financials

APLS has a market cap of $5bn and a cash reserve of $965mn. R&D expenses were $90.9 million for the first quarter of 2022, while G&A expenses were $51mn. At that rate, they have a cash runway of 6-8 quarters.

The company made $15mn in net US revenue in 2021, while in Q1 2022, they made $12mn. Most of 2021’s revenue – $9mn – came in the fourth quarter, so it seems that sales are gradually picking up.

Bottomline

Given the high unmet need, relatively safe profile, and positive data from one trial, the drug definitely has more than a fair chance of approval. The company does have a solid cash reserve, and revenue may be picking up slowly. The stock is trading midway between its 52-week high and low. I would wait for a price below $35 to get in with a midterm window.

Be the first to comment