bizoo_n

APA Corporation (NASDAQ:APA)—formerly named Apache—has the majority of its production in the US, but also has legacy operations in the UK’s North Sea and Egypt, and discoveries in offshore Suriname (near Venezuela).

Because of the challenges of selling its Alpine High natural gas, APA has struggled more than many through the 2019-2021 oil and gas downturn. Ahead of the pack it made a fortuitous contract with liquefied natural gas company Cheniere (LNG) and has benefited from recent higher oil and gas prices. However, it is still unwinding debt and has a steep 88% liability-to-asset ratio.

APA has pledged to return a minimum of 60% of free cash flow to shareholders via dividends and share repurchases. Since announcing the policy in 4Q21, it has returned 76% of FCF or $1.5 billion to shareholders.

Yet be aware dividends are $1.00/share for a small yield of 2.4%.

Still, given its bargain price-earnings ratio, excellent cash flow and returns, increasing US profits, good 1H22 results, well-established runways in Egypt and the UK’s North Sea (despite tax increase there), and Suriname success, I recommend APA Corporation as a speculative buy to energy investors seeking capital appreciation.

I am considering investing in APA.

Oil and Natural Gas Prices

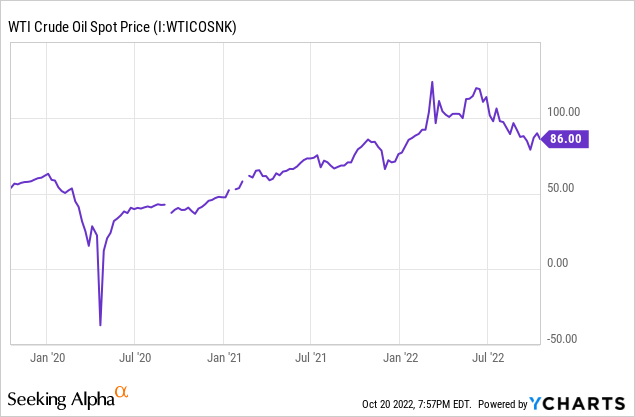

Russia’s invasion of Ukraine upended hydrocarbon supply in Europe and the UK. OPEC+ has tightened supply as inflation has caused economies around the world to falter.

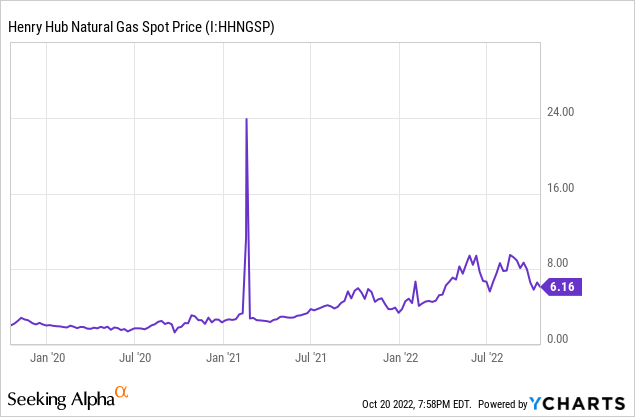

On October 20, 2022, the WTI oil price for November delivery was $85.98/bbl, while Brent for December delivery was $92.57/bbl. Natural gas in the US at Henry Hub, also for November, was $5.37/MBBTU.

After being as high as $100/MMBTU in recent months, the Dutch TTF LNG reference price is $32.37/MMBTU for November and $39.39/MMBTU for December. The Asian JKM LNG reference price is $30.32/MMBTU for December.

Also of interest, the UK NBP (National Balancing Point) reference gas price is $20.59/MMBTU for November and $38.39/MMBTU for December.

LNG tankers now cost as much as $400,000-$500,000/day to operate. Several tankers are waiting offshore Spain, both for regasification berths and to obtain the best spot price, whether in Europe or Asia.

EIA

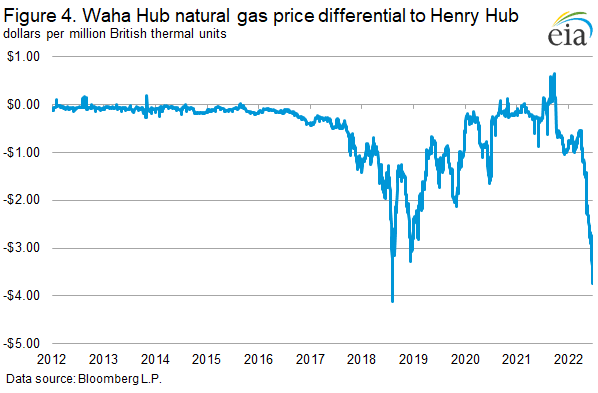

A major issue for APA has been that its Alpine High natural gas is far from markets and competes with “must-be-produced” associated gas which is produced with oil, no matter the gas price.

The Waha-Henry Hub differential is widening again as associated gas production increases, again hitting gas processing and pipeline takeaway limits. Permian gas production was 11.5 BCF/D in 2018, is now 22 BCF/D and is projected to be as much as 27 BCF/D by the end of 2024. US natural gas is projected to be oversupplied between now and the end of 2023-early 2024, when additional US LNG export facilities come online.

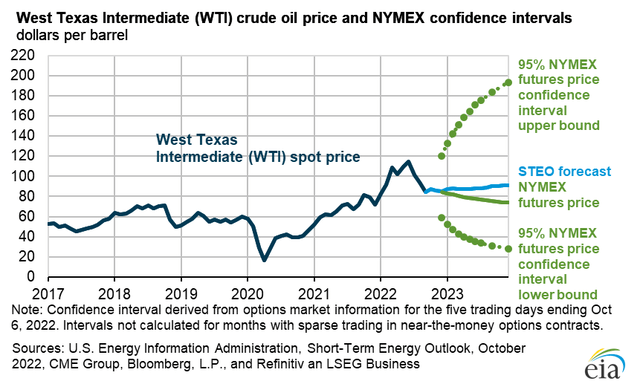

The 5-95 confidence interval chart below shows a year-end 2024 WTI price range between about $30/bbl and $190/bbl.

EIA

Second Quarter 2022 Results

In the second quarter of 2022, APA reported net earnings of $926 million or $2.71/share. Net cash provided by operations was $1.5 billion and adjusted EBITDAX was $2.0 billion. Free cash flow was $814 million for the quarter.

The company produced 385,000 BOE/D; adjusted production excluding Egyptian noncontrolling interest and tax barrels was 305,000 BOE/D. US production was 66% of the total (32% oil), the North Sea represented 13% (80% oil), and the rest was from Egypt, (59% oil).

Also, APA bought Permian Delaware properties for $505 million from a private company. The properties will add about 13,000 BOE/D of production.

The company’s derivative positions are relatively small. As of August 2, 2022, Waha (west Texas reference) basis swaps covered about half of the company’s US natural gas production.

APA is a joint venture partner with Total (TTE) exploring offshore Suriname, near oil-producing countries Venezuela and Guyana. They have made several discoveries but have not yet announced a commercial production schedule.

The company’s full-year capital guidance is $1.725 billion.

kxly.com

Reserves

At December 31, 2021, APA’s total estimated proved reserves were 913 million BOEs, 90% proved developed. Of the 913 million BOE total, 400 million barrels (44%) were oil/condensate, 183 million barrels (20%) were natural gas liquids, and 2.0 trillion cubic feet (or 330 million BOE or 36%) were natural gas.

None of these totals include reserves in Suriname.

The proved reserve volumes divide geographically as

*US 68%

*Egypt 22%

*UK 11%.

The Securities and Exchange (SEC) present value at a 10% discount rate (PV-10), a standard measure of comparison for reserves, is $12.4 billion for year-end 2021.

Prices used in the calculation are shown below.

|

Avg. |

||

|

Realized |

||

|

US |

Oil/Condensate |

$65.67/bbl |

|

US |

NGLs |

$28.83/bbl |

|

US |

Gas |

$3.20/mcf |

|

Egypt |

Oil/Condensate |

$68.01/bbl |

|

Egypt |

NGLs |

$49.91/bbl |

|

Egypt |

Gas |

$2.82/mcf |

|

UK |

Oil/Condensate |

$68.78/bbl |

|

UK |

NGLs |

$40.95/bbl |

|

UK |

Gas |

$12.53/mcf |

Competitors

APA is headquartered in Houston, Texas.

With US operations in the Permian Basin, Eagle Ford shale, Austin Chalk, the US Gulf Coast, and the Gulf of Mexico, APA competes with virtually every company exploring and producing in the US except Utica/Marcellus-only or Powder River-only companies.

International competitors include BP (BP), Chevron (CVX), ConocoPhillips (COP), Exxon Mobil (XOM), Qatar Petroleum, Shell (SHEL) and Total.

In Suriname, companies work with Suriname state company Staatsolie.

Governance

At October 1, 2022, Institutional Shareholder Services ranked Apache’s overall governance as an 8, with sub-scores of audit (8), board (3), shareholder rights (6), and compensation (10).In this ranking a 1 indicates lower governance risk and a 10 indicates higher governance risk.

Updated ESG scores from Sustainanalytics were not available.

On September 30, 2022, shorts were 3.8% of floated stock. Insiders own only 0.4% of shares.

The company’s beta is 3.69, quite far above the overall market, but in line with oil and gas price turmoil in the US and abroad.

The largest institutional stockholders on June 29, 2022, some of which represent index fund investments that match the overall market, were Vanguard (12.8%), BlackRock (8.2%), State Street (7.0%), Harris Associates (5.1%), Hotchkiss & Wiley (3.7%), and Invesco (3.6%).

Vanguard, BlackRock, State Street, and Invesco are signatories to the Glasgow Financial Alliance for Net Zero. GFANZ is a group that, as of May 31, 2022, managed $61.3 trillion in assets worldwide and which (despite less energy supply due to reduced Russian exports to Europe) limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner.

BlackRock, which alone manages assets worth $8 trillion, has just been downgraded to neutral by UBS due in part to pushback Blackrock has received from US state treasurers against (and for) the company’s net zero advocacy.

In a recent semi-reversal, BlackRock (and Vanguard), among others who signed the GFANZ pledge, told a British parliamentary committee they may continue investing in hydrocarbons (or as was confusingly worded, that they would not agree not to make new investments in hydrocarbons.)

Financial and Stock Highlights

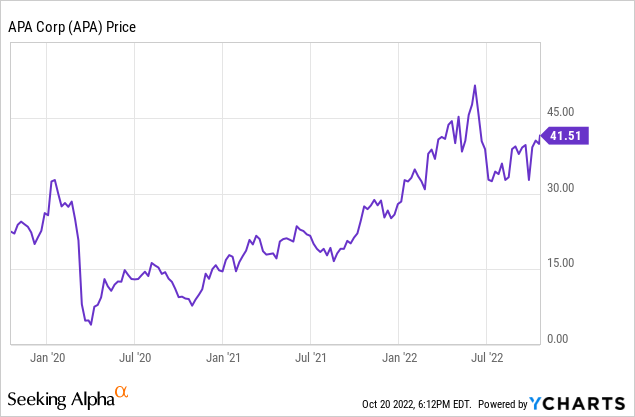

APA’s market capitalization is $13.55 billion at an October 20, 2022, stock closing price of $41.51 per share. The company’s 52-week price range is $22.94-$51.95 per share, so its closing price is 80% of its one-year high. The price is 76% of the one-year target of $53.81.

Trailing twelve-month EPS is $8.88, giving a current price-earnings ratio of a bargain 4.7. The average of analysts’ expectations for 2022 and 2023 EPS is $8.55 and $9.90, respectively, for forward price-earnings ratio range of 4.2-4.9.

TTM returns on assets and equity are a stellar 27% and 316%, respectively.

Trailing twelve months’ operating cash flow was $4.3 billion and levered free cash flow was $3.5 billion.

At June 30, 2022, APA had $11.4 billion of liabilities including $5.2 billion in long-term debt, $2.8 billion in current liabilities, and $2.1 billion in asset retirement obligations. Assets are $12.9 billion for a very steep liability-to-asset ratio of 88%.

Be aware that balance-sheet (this an accounting number, NOT market capitalization) shareholder equity on June 30, 2022, was only $1.5 billion.

A dividend of $1.00/share (doubled in September 2022 from $0.50/share) yields 2.4%. The company recently increased its buyback authorization by 40 million shares. Again, APA has pledged to return a minimum of 60% of free cash flow to shareholders via dividends and share repurchases.

Overall, the company’s average analyst rating is 3.0, or “hold” from the 29 analysts who follow it. However, at least one of these considers the company to be significantly undervalued.

Notes on Valuation

At one point a few years ago APA’s book value per share was negative due to its large write-offs. Current book value is still small at $1.75/share. That it is a fraction of the market price indicates positive investor sentiment.

As noted, SEC PV-10 reserve value is $12.4 billion. Market capitalization is $13.55 billion. Enterprise value is $18.2 billion. The ratio of enterprise value to EBITDA is an astonishingly low (bargain) 2.6, far below the maximum of 10.0.

The $13.55 billion market capitalization gives APA $44,400 per flowing BOE and $100,200 per flowing barrel of oil. Both numbers exclude production attributable to 1) noncontrolling interest in Egypt and 2) Egypt tax barrels.

Positive and Negative Risks

It is not unusual for countries to unilaterally attempt to change the terms of their agreements with multinational producers. This could be a risk in Suriname. APA is long-established in Egypt, so it appears less likely there.

Indeed, eastern Mediterranean oil and gas competition could pick up, which would potentially involve Egypt.

And while the UK is encouraging more offshore exploration, it has also enacted a new 25% tax on oil and gas producers–added to an existing 40% rate–for a total tax rate of 65%.

Increasing Permian basin oil production and increasing gas-oil ratios as the field ages will increase the production of associated gas, risking more over-supply. The field is predicted to reach 27 BCF/D of natural gas production by 2024.

Risks include US political and regulatory risk—particularly with banks, and several states adopting a race-to-zero-hydrocarbons posture. All are led by the US Biden administration which remains bizarrely keen to eliminate US oil and gas production entirely.

Inflation, while it can raise the price of oil since oil is denominated in dollars, also increases operating and financing costs. The current level of inflation is at a decades-high. APA has cited the difficulties in getting supplies and well-trained crews in some locations.

Investors should consider their oil and natural gas price expectations as the factors most likely to affect APA. While OPEC+ and the Russian invasion of Ukraine have reduced the ready supply of oil and natural gas, high prices and poor economies worldwide could lead to demand destruction.

Recommendations for APA Corporation

After struggling through write-downs and near-death low natural gas prices, APA Corporation is emerging as an interesting combination of a US gas and oil company—particularly in the Permian—and a small but experienced international producer.

The company sports bargain current and forward price-earnings ratios, an attractive enterprise value/EBITDA ratio, and progress in paying down debt.

Although it has an investor-friendly share repurchase program, I don’t recommend APA to dividend-hunters.

Similar to much larger companies with quiet success abroad, APA’s focused international operations in the UK and Egypt, the Suriname discovery wells, and even its increasing US success may make APA Corporation’s stock interesting to investors seeking capital appreciation. I recommend it as a speculative buy.

apacorp.com

Be the first to comment