HJBC

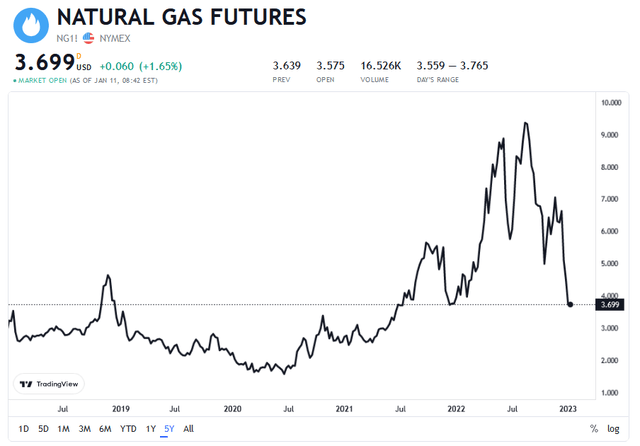

The price of NYMEX natural gas has dropped precipitously from the 2022 highs due to Russia’s perceived weaponization of natural gas deliveries to Europe and the subsequent demand pull from the EU for U.S. sourced LNG (see below). Yet while prices are certainly below the 2022 peak, $3.70/MMBtu is still a very healthy price compared to the price prior to Russia’s decision for conflict in Ukraine. Today, I’ll discuss the reasons for the big drop in the price of NYMEX gas and what U.S. investors can expect going forward.

tradingview.com

Investment Thesis

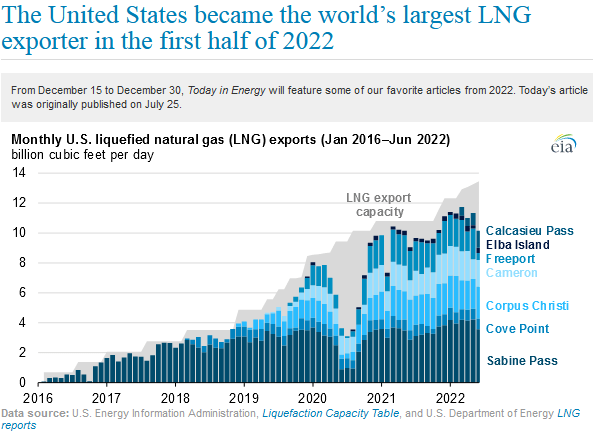

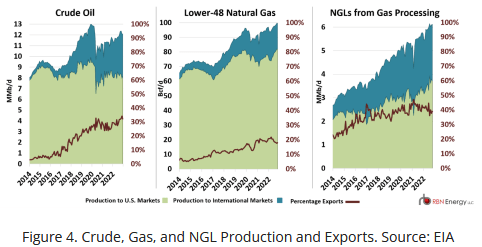

As most of you know, the rise in NYMEX in 2022 was primarily due to demand pull from the EU for U.S. sourced LNG to make up for Russia’s decision to shut-down natural gas pipeline deliveries. Indeed, this dynamic led the U.S. to become the largest LNG exporter on the planet last year:

EIA

As I pointed out in my recent Seeking Alpha article The Age Of Energy Abundance, this proves that the current narrative being pushed by some energy company CEOs and politicians – that shale oil/gas is somehow no longer “short-cycle” and would take years to ramp up – is simply false. Obviously, the industry was able to significantly and very quickly ramp up natural gas production in order to export significantly higher volumes to the EU.

The other false narrative that I have warned energy investors about – that the U.S. is somehow not energy independent and is being held back by regulations and the actions of one particular political party – also is false. Today, the U.S. is not only the largest petroleum producer in the world, and the largest exporter of LNG, it’s also the largest exporter of NGLs (like propane). All that despite the new-found discipline of shale oil producers.

So Why The Price Drop?

The big price drop in NYMEX natural gas was due to two primary reasons:

- A warmer than expected winter in Europe slowed LNG exports.

- Natural gas production in the U.S. continues to climb.

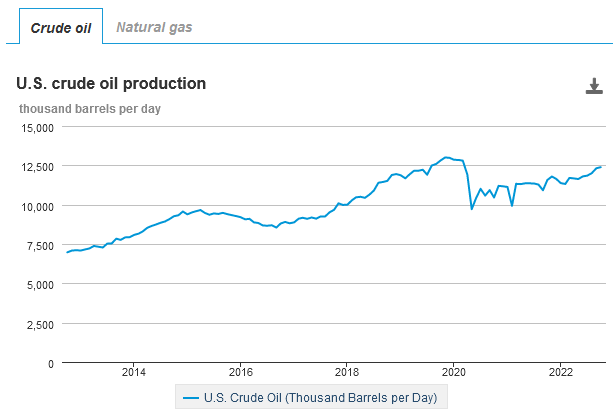

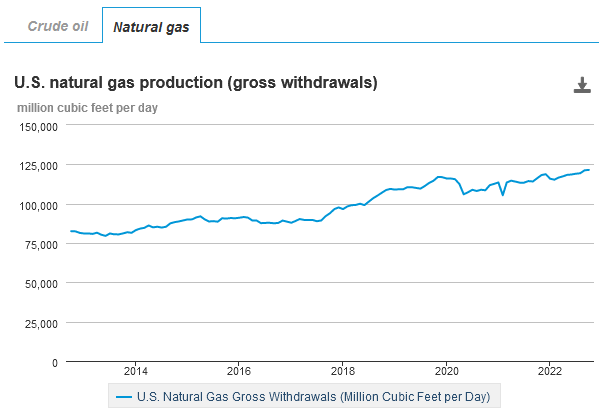

As shown below, note that while U.S. oil production has yet to reach pre-pandemic levels (first chart), U.S. natural gas production has continued to grow and currently exceeds pre-pandemic levels by ~5 Bcf/day (second chart):

EIA

EIA

Natural gas production has continued to climb – despite the drop in oil production – because shale wells get gassier over time. In an excellent blog-post on RBN Energy recently (see When The Levee Breaks), Pioneer Resources (PXD) CEO Scott Sheffield was quoted as saying:

… the (GORs – gas-to-oil ratios) in the entire Permian Basin will continue to go up. We’re seeing that. You’ll see the percent oil drop for all those companies, most likely below 50% over the next 10 years. And the gas itself will get up to about 30 Bcf/d. We’re going to need a (new) gas pipeline at least about every 18 months to two years going forward.

Yet the quest to drill (primarily for oil …) will continue. In another dynamic, the RBN article also pointed out that increased and more efficient gas-processing has led to a dramatic increase in domestic NGLs production:

RBN Energy

This is likely one reason, in addition to the others I pointed out, for Phillips 66’s (PSX) recent takeover of DCP Midstream (DCP): See PSX Grows By Swallowing DCP. After all, PSX’s Sweeny fractionation complex, chemicals operations (primarily through its CPChem 50/50 JV with Chevron (CVX)), and Freeport NGLs export terminal, all require large-scale volumes of NGLs feedstock. Indeed, the U.S. is now the largest exporter of NGLs precisely because this huge surge in production means the U.S. now has the most cost-competitive NGLs on the planet.

How To Invest

What I’m thinking here is that the current crisis in the EU has been – for the most part – mitigated over the short-term, and that has been reflected in the current NYMEX price.

Meantime, the Marcellus play is severely pipeline constrained. So while the producers there can make a decent living at the current price, the prospects for production growth going forward aren’t bright – and won’t be – unless some new large-scale pipeline projects are built (don’t hold your breath).

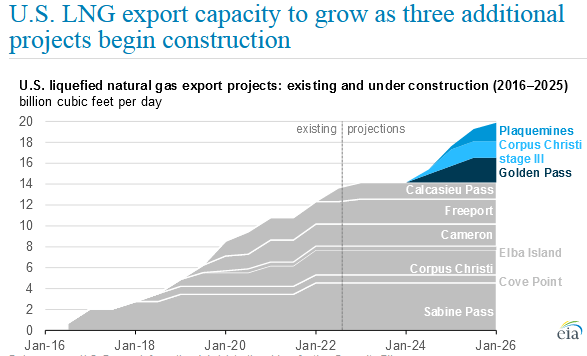

Where the action will be, in my opinion, will be in Texas and Louisiana when new LNG capacity comes online. No new LNG capacity is expected this year, but starting in 2024, three big new LNG export projects will be ramping up that will add ~6 Bcf/d of export capacity:

EIA

Longer term, Sempra Energy (SRE) and ConocoPhillips (COP) have teamed up on an LNG export project at Port Arthur, Texas, that has already been permitted for two trains with an expected combined capacity of ~13.5 Mtpa (mega tons per annum) of LNG (see COP Shift Focus To LNG, Stock On Sale).

The point here is that demand pull for a significant increase in LNG export volumes is coming in the not too distant future, and all of it will be on the Texas/Louisiana Gulf Coast. As I already pointed out, the Marcellus shale producers are not going to benefit this time around as they lack adequate pipeline capacity. That means Texas (primarily the Permian and Eagle Ford shale plays) and Louisiana (the Haynesville shale) will.

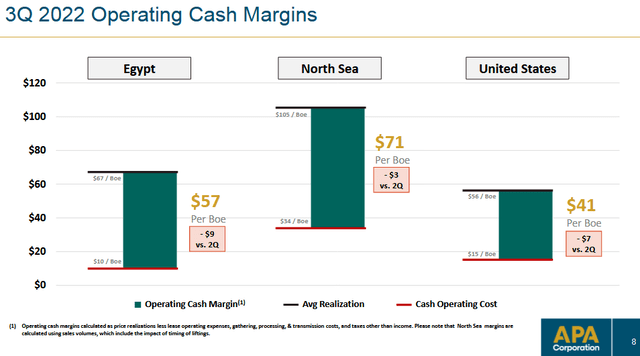

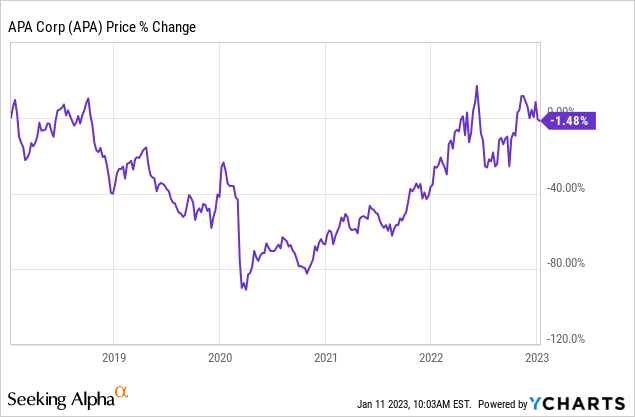

In the Permian, investors should consider a company like APA Corp (NASDAQ:APA), which I still call Apache. As I pointed out in my Seeking Alpha piece way back in June of 2018, APA’s huge Alpine Discovery in Texas was, primarily, a wet gas play. At the time, the price of gas was quite low and the irrational exuberance over this discovery was over-the-top (see Is Apache’s Alpine Discovery All Wet?). That was especially true given the location of the Alpine field and the significant investment in infrastructure required simply to get the molecules to market. At the time, I recommended investors sell the stock at $42.56 (in favor of COP) and APA subsequently dropped to under $9 post-pandemic crash.

However, today APA stock has ridden the wave of higher oil & gas prices back up to $43.55 – slightly above where it was at the time of my 2018 piece. In its Q3 earnings report, APA reported free-cash-flow generation of $609 million and EPS of $1.28/share and adjusted EPS of $1.97. Starting in Q4, the annual dividend will be doubled to $1/share. Over the first three quarters of 2022, APA has bought back $884 million in stock while generating $2.1 billion in FCF. In addition, the company has eliminated $3.1 billion in bond debt since June of 2021.

Apache has a nicely diversified portfolio with some excellent high-margin overseas production:

APA

So, gone are the days of Apache over-spending on Alpine infrastructure (pipeline gathering and processing) during a time of low gas prices. Like most shale producers, APA has become much more disciplined with capex, has paid down significant debt, and is sitting on an asset (Alpine) that one day in the not too distant future may be a significant beneficiary of increased U.S. LNG exports. Meantime, the stock trades at a forward P/E of only 5.1x and yields 2.3%.

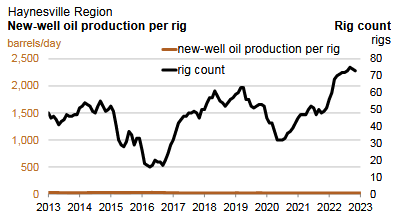

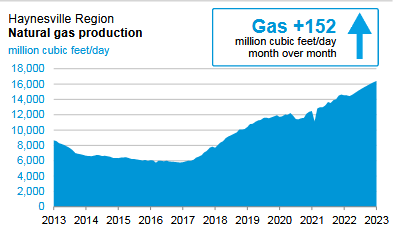

Another potential beneficiary of increased LNG export capacity is Chesapeake Energy (CHK) due to its drilling activity in the Haynesville. Many energy investors might be surprised to find the rig count in the Haynesville has more than doubled from the pandemic lows:

EIA

While production has zoomed higher:

EIA

I doubt many people in the EU have ever heard of the Haynesville shale, but the fact is, they’re burning Haynesville sourced nat gas molecules as you read this. But I will save a deep-dive on CHK for another day.

Summary & Conclusions

In the new post-Ukraine invasion that broke the global energy supply-chain and led to huge inflation the world-over, the EU will increasingly depend on the U.S. for its natural gas supply going forward. Meantime, the topsy-turvy up-ended market currently has NYMEX gas in the dead of winter selling at significantly lower price than in the summer. However, down the road significant new domestic LNG export capacity is coming online, and those exports will depend, primarily, on natural gas production in Texas and Louisiana. A company like APA should be a primary beneficiary.

I’ll end with a five-year price chart of APA and note that the company is basically back to “par”. I suspect the next five years will be much better for APA shareholders.

Be the first to comment