NicoElNino

Aon plc (NYSE:AON) isn’t an insurance company, as some would believe. Some of my readers contacted me about the company regarding an article, and more than one characterized the business as a great insurance business – which it isn’t – not exactly, at least.

In this article, we’re going to take a first look at AON, show you what the company does, and why it could be a decent investment for a conservative and very long-term investor.

Let me show you what we have here.

Aon plc – What does the company do?

So, first off. Aon is a 40-year-old company but with a history that goes back to the purchase of a Detroit-based insurance agency that specialized in low-cost low-benefit accident insurances, underwriting, and on-site policy sales. The real history goes back beyond the great depression. Multiple M&As resulted in the Combined Insurance Co. Of America, and this company existed all the way through the 1970s. At that point, they merged with Ryan Insurance Co, an auto credit insurer that went into brokering and upscale insurance products. Following that merger and company control under Patrick Ryan, the company was reformed and changed its name to Aon.

Aon began building a global presence through M&As of various insurance brokerages and groups. Aon was actually, for a brief period of time and thanks to a merger, the largest insurance broker on the planet.

Multiple acquisitions and divestitures later, where the company among other things divested underwriting, employee benefits outsourcing, and others, we now find Aon headquartered in London, England, with a substantial global as opposed to just US presence, and with a track record of one of the only financial firms that have weathered the current macro remarkably well.

By that, I mean that Aon is up 22% YTD. This is an achievement in this environment.

So, just what is Aon?

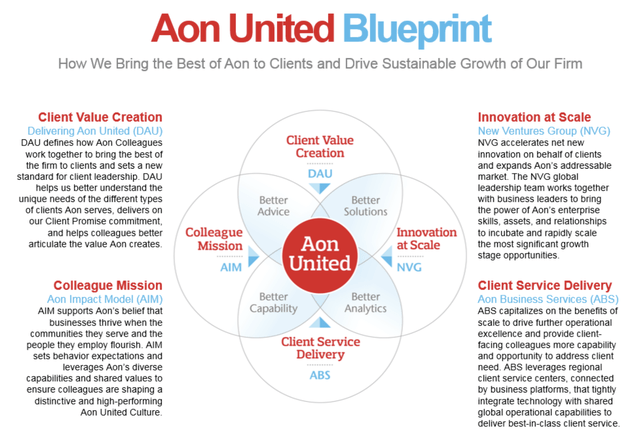

Aon is a global professional services firm that provides risk, health, and wealth Solutions. The company seems to make an achievement out of making it complex for laymen to understand what it does.

Through our experience, global reach, and comprehensive analytics, we are better able to help clients meet rapidly changing, increasingly complex, and interconnected challenges.

(Source: Aon 10-K)

This, of course, could mean anything from financial services to facility cleaning.

What the company actually does can be summed up in 4 segments.

- Commercial Risk Solutions addresses retail brokerages, specialty solutions, global risk consulting, and captives management. The company assists corporations with risk advice as well as completely tailored solutions for risk transfer options and delivery of such options.

- Reinsurance solutions address treaty and facultative reinsurance as well as capital market solutions. Again, the objective is a risk transfer, and the company partners with reinsurers, insurance, investment firms, and other companies.

- Health Solutions focuses on consulting and brokerage services, voluntary benefits, and human capital solutions as well as other adjacent services. Again, Aon partners with insurers to develop new solutions.

- Wealth Solutions consults on retirement, pension, and investments. The company offers designs on their retirement programs with risk management, pension de-risking, governance solution, and integrated administrative services.

The company’s revenues are a product of its commissions, compensation from its collaborative partners in insurance and reinsurance, and customer fees. These vary depending on premium, contract type, and size. The company also earns interest income from the premiums, claims, and in-transit funds by investing them in interest-bearing securities, typically within a short-term time period. There’s a decent amount of seasonality to company earnings, with buying patterns giving a strong 1Q and 4Q.

Competition for the company exists on several levels. The insurance and risk industry is incredibly fragmented and highly competitive. The company competes with other insurance brokers and consulting companies, such as Marsh & McLennan (MMC), WTW, Arthur J Gallagher & Co, Lockton, and others.

Aon is A-rated, and has a market capitalization of close to $60B. At 0.8%, it has no real dividend worth mentioning more than in passing – because the growth rate over the past 20 years averaged less than 5% annually.

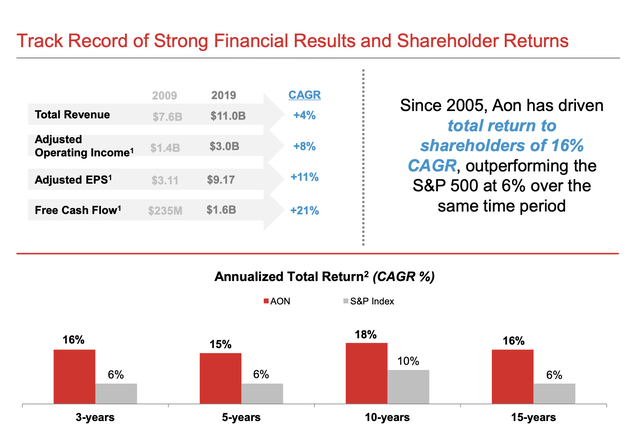

Aon has outperformed the market, averaging at almost 11% annually for the past 20 years, turning a $10,000 investment into $84,672 inclusive of dividends. The company has a very strong track record of beating the market and its sectors on any timeframe you look at.

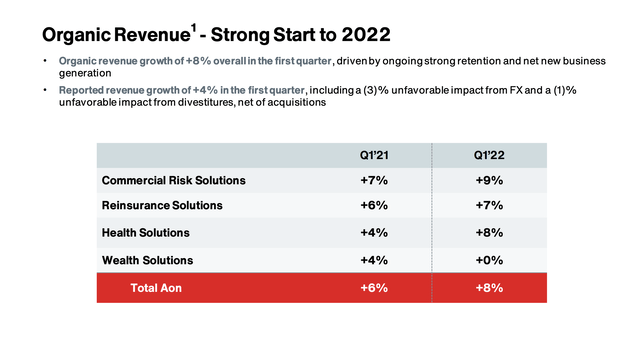

Analyzing this company’s performance isn’t the easiest, as Aon doesn’t provide a segment-by-segment breakdown of operating income, even if they do provide a revenue breakdown. Commercial Risk Solutions is the company’s by far largest generator of revenue, at over 50% of the company’s annual. Wealth Solutions is the smallest at around 12%. Aside from Wealth Solutions, all of the company’s income segments are quite seasonal in their ebb and flow. Since Aon’s income profile is mostly fixed, this goes some way to explaining the company’s seasonality.

Aon is very well-placed for growth in new markets. These new markets that are relevant for the company are things like cyber risk and IP insurance – but these new business areas are unlikely to be the primary driver of revenue growth. Like its peers in the straight insurance and reinsurance market, the company’s primary growth driver, for the time being, is its ability to push pricing in the current environment. Companies everywhere have been increasing prices, and Aon is no different. But unlike some of its peers, management itself in Aon has guided for these tailwinds in pricing are starting to decelerate, meaning that the company’s growth will be coming from new areas and businesses – which might be somewhat limited in scope.

The guidance that the company gives us might sound compelling – I expect around 3-5% organic revenue growth p.a. as a result of new business and pricing increases, but not much more than that, with other guidance perhaps being just a tad too optimistic.

Why?

Because as I see it, that does not account for the risk of inflationary pressures. While inflation will be a tailwind short-term for revenues, it remains important to consider the client-side perspective of the question. Clients could, in theory, offset cost pressure by reducing the amount of insurance purchased, which of course would be a potential net negative for the company here. If interest rates keep climbing, we may actually start to see lower overall premium rates since underwriters start to consider higher yields a thing on invested funds.

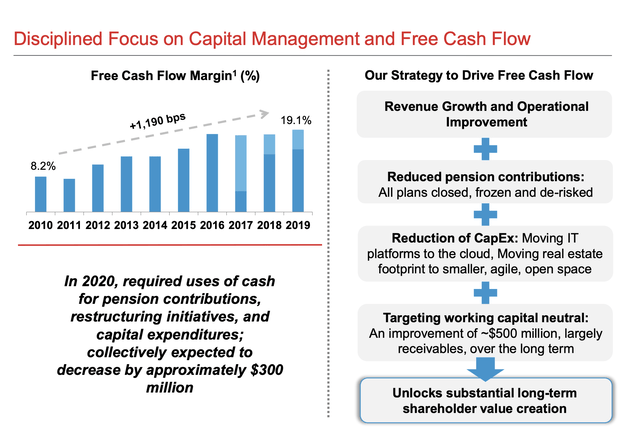

I also don’t see a convincing bullish case for the company’s argument for margin expansion. Historically speaking, Aon has achieved margin expansion and efficiencies by restructuring costs, which seems to be able to be done at only limited amounts from here on forward.

Aon has performed extremely well during the first part of the year, executing well on the tailwind on premium pricing increases and positive inflation impacts – but I view these as likely to disappear, as the company itself has said in earnings calls. When this happens, it’s my stance that Aon’s growth will be single-digit between 3-5%, which to my mind begs the question of how much we should be paying for a 0.8% yielding, A-rated company that, in my mind, is already overvalued.

Aon’s valuation

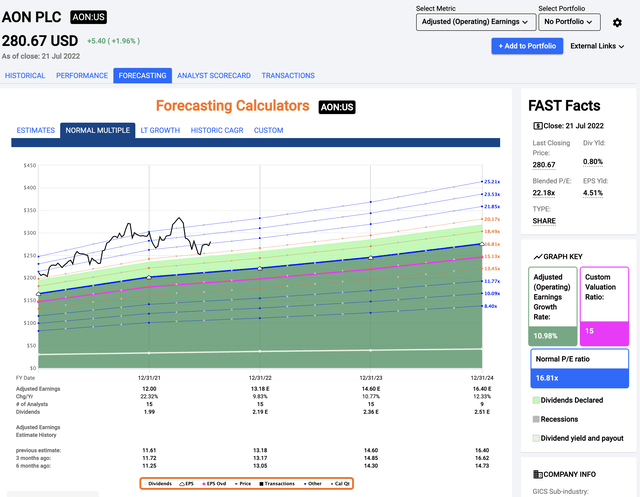

So – as I mentioned. My thesis for the company is based on the company’s upside not being as great or as high as the company itself, or forecasts are expecting, coupled with an already relatively rich sort of valuation at 22.18X P/E. This is well above the company’s 20-year average of around 16.8X, and thus can be characterized as an extreme premium.

Is this likely to continue? Aon has lost quite a bit of valuation from its highs a few months back, but it’s entirely possible that we could fall further here.

Aon Valuation (F.A.S.T graphs)

There is no doubt in my mind that the company is one of the leading insurance and risk players on the market. That’s why it continually outperforms. However, don’t kid yourself in that you can’t lose money or underperform when investing in a business like this. You quite easily can. If you had invested at 22X+ P/E back in 2002, your annual RoR would have been below 3% per year for 10 years due to the valuation that you invested in.

It goes to show you that valuation is the gospel you should be at the very least considering when looking at a company – any company – and especially a quality company with a low yield like this. Because you don’t have dividends to offset the slow growth, that you have in higher-yield companies.

For that reason, my current thesis on Aon plc is as follows.

I don’t think that you should invest in a company above 20X P/E – at the very least. Long-term, I believe it likely that your returns might be sub-par if this is done. Below 20X P/E, you’re investing below the 5-year P/E average – this is the most expensive I would consider attractive here. If you consider the 5-year average accurate going forward, your RoR would be 8.2% annually until 2024E. Not really interesting as I see it.

S&P Global considers the company a “BUY” with a range of $250 up to $335, with an average of around $300 – yet only 2 out of 13 analysts are at a “BUY” here, with 12 at either “HOLD” or “SELL”. These recommendations speak louder than the overall price target averages with their 7% current upside.

Me, I would consider the $250 low-end target an excellent price to start accumulating shares. I could stretch as high as $255, but no higher than that.

Because of that, and currently, Aon plc represents a “HOLD” for me, and i believe investors should be very careful when looking at this company at this valuation. There is an uninteresting amount of risk to the investment prospect.

You shouldn’t consider this company here.

Thesis

My thesis for Aon plc is as follows:

- Aon plc is a superb, fundamental company in financial services and insurance, and risk brokering. It’s one of the leaders in its field and deserves your attention at the right price.

- However, a mix of near-term challenges related to macro, inflation, and premium headwinds calls into question how high an upside on a 3-year basis the company actually has. As things stand, I don’t believe management forecasts a bullish perspective quite as much and would go more conservative here.

- Because of that, Aon plc is a “HOLD” to me for the time being.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (bolded).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment