jetcityimage

The iShares Core Conservative Allocation (NYSEARCA:AOK) is not actually so conservative given the biggest market theme: the rate hikes. With substantial bond allocation they have run afoul of the monetary regime by sporting a high duration portfolio. While fixed income might seem attractive, REITs would be the way to assure some cash flow while also acknowledging the current rate hike regime.

The AOK Breakdown

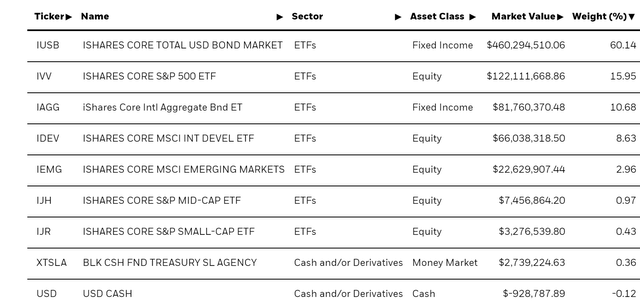

Let’s have a look at the major AOK holdings.

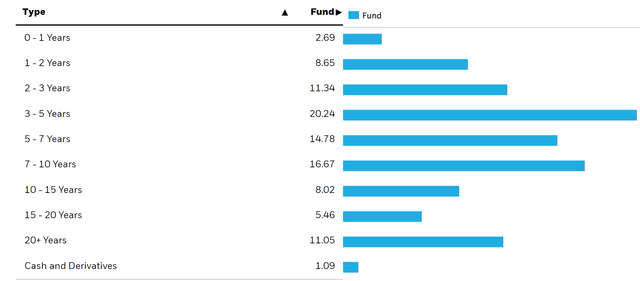

The majority of the cash has gone into the iShares Core Total USD Bond Market (IUSB) ETF. With information on this ETF we can make some assertions around their risk exposures. The detailed holdings lets us determine the risk to interest rate hikes, which will likely continue longer than expected given recent unemployment figures in the US, which refuse to fall. The weighted average duration of the IUSB is 5 years, which is not short. Indeed, just looking at the maturity breakdown you do see that most of the bonds are medium term. Those fixed coupons are not going to be very valuable as rates continue to rise, and a 5 year duration means that there is substantial leverage to the changes in interest rates in terms of bond capital appreciation, and that for much of the portfolio, the coming of maturity to bail out of capital depreciation lies beyond the likely horizon of a recession, which if starting next quarter with falling unemployment is unlikely to last more than 2 years.

Besides the IUSB, there is the iShares Core Intl Aggregate Bond ETF (IAGG) which similarly has quite a high duration, probably also around 5 years looking at the maturity table.

IAGG Maturity Profile (Blackrock.com)

Moreover, 10% of this ETF is invested in unrated bonds, and a lot of it is Chinese government bonds. Credit quality isn’t really our concern, but with the IAGG the total allocation to high duration fixed income securities is in excess of 70%.

Conclusions

The desire for fixed income is understandable when capital appreciation is hard to come by in a reliable way. If you can be confident that your horizon is indeed 5 years, a lot of those bonds will mature by the time you rotate funds out, which limits the potential volatility of those underlying assets. But even then, that’s more mental accounting because those cash streams will have lost value if rates and inflation together remain higher than in the pre-COVID environment.

If you are looking for fixed income, there are ways to do that from equity. Consider something like REITs. They have no duration and many lease agreements can flex with growth in real discount rates. Also, you’ll own a share of a property portfolio. The dividends of those, especially on US REITs, also tend to be reliable, and REITs perform both in the downturn and in the recovery of a recession.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment