Iurii Garmash/iStock via Getty Images

This article was originally published for Deep Value Returns members on 29 March. Article has been made current.

Investment Thesis

Antero Resources (NYSE:AR) is an unhedged gas and liquid natural gas (”LNG”) explorer. It is in a very nice position to benefit from massive gas demand in the US together with high gas prices.

What’s more, its balance sheet is arguably one of the best in this space. And this is translating to sector-leading capital returns to shareholders.

Allow me to make this clear, nobody is too late to this name yet. The runway here is long. And paying approximately 6x this year’s free cash flow is a very attractive entry point for new investors.

Revenue Growth Rates Don’t Tell You Much

In the case of Antero, there’s very little point in knowing where the revenue growth rates have been. It’s all about the future. Looking ahead.

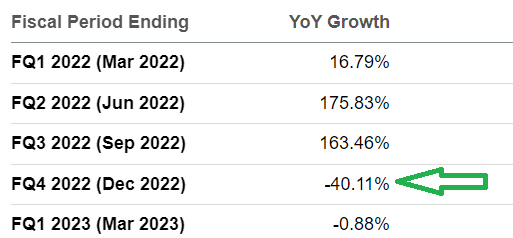

Antero’s revenue consensus estimates

Then, further complicating the picture, there’s the expectation right now that as we get further into 2022, those revenue growth rates fall off a cliff.

However, I believe that those estimates do not accurately represent the rapidly unfolding situation in the gas market. So, let’s get into what’s the opportunity here.

Why Antero Resources? Why Should I Care?

Antero is an exploration and production company of natural gas. But don’t be put off, the dynamic here is a lot easier to understand than you may at first think.

This is the backdrop. Russian sanctions have caused a meaningful restriction in gas out of Russia into Europe. This has led to gas prices in Europe spiking higher.

Trading Economics, natural gas prices in Europe

However, as you can see above, and where much of the focus has not been put on is that the prices of gas in Europe were already trending higher before the Russian sanctions.

The Russian sanctions simply put a spotlight on this market. But these dynamics were already in place before the sanctions. Furthermore, not to state the obvious, but even if Russia has a ceasefire with Ukraine, this doesn’t mean that the sanctions are going to get removed any time soon. Sanctions are typically very sticky. Easy to put on, but difficult to remove.

Moving on, what attracts me to Antero is that the business has an unhedged book. What this means is that if the prices of gas were to remain elevated in the US, this would meaningfully drive its revenue growth. So, why would prices in the US remain elevated?

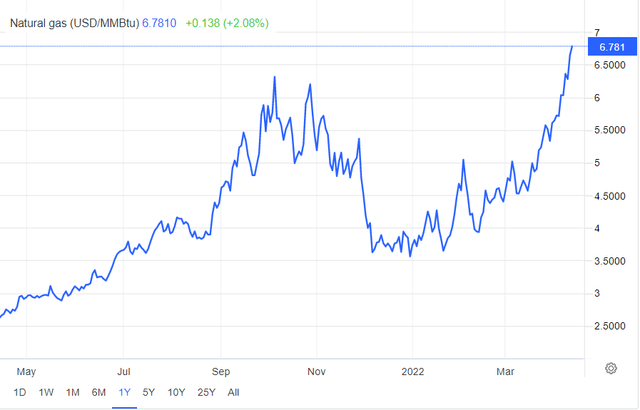

Trading Economics, prices in the US

As you can see above, despite a lot of volatility in the natural gas market, prices for gas are clearly trading higher. And if you think about it, companies that were previously reliant on natural gas for their inputs will still require natural gas, even if prices are higher. Why?

Because the alternatives are few and far between. You don’t want to be reliant on renewables because oftentimes these have proved unreliable. And for many products, there is simply no alternative.

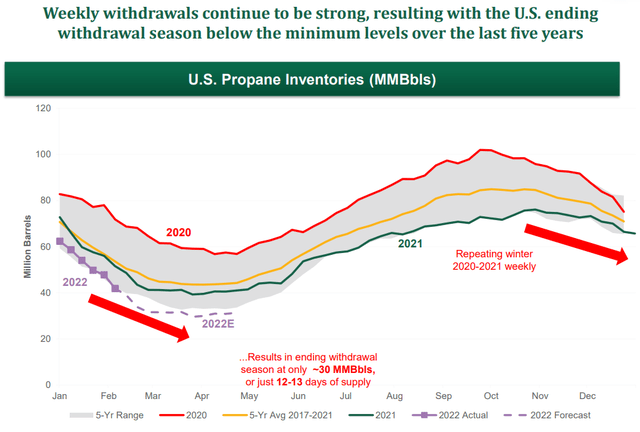

Now, consider the following chart.

As you can see above, propane inventories are meaningfully below the 5-year average (yellow line). So, you have low inventory in the US, high prices, and demand hasn’t gone down at all.

In fact, if anything, demand is rapidly growing, as you can’t build anything of substance without natural gas. You want to make an EV car? You need natural gas to make steel. You make to build a bridge? Same.

And this pent-up demand doesn’t even take into consideration President Biden’s infrastructure bill that’s going to ramp up throughout this year.

There’s just so much demand. And then, to further add to the demand curve, you have to understand that in Europe, they’ve been steadfast on the green agenda, and that has led to massive problems in energy. The US will not want to go down the same path.

What’s more, between relying on coal for energy or natural gas, natural gas is multiple times cleaner. And the US has come to understand that we simply need natural gas.

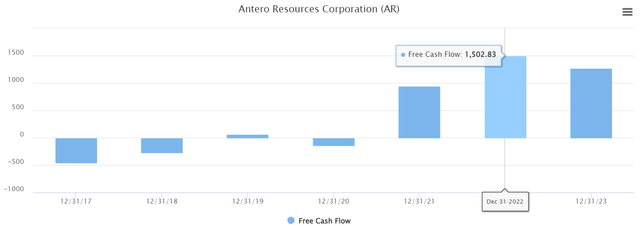

Cashflows Could Meaningfully Increase

When Antero’s guided for its 2022 free cash flow, it was pointing at the midpoint to around $1.6 billion. And those were the figures that analysts inputted into their financial models.

However, I believe that over the coming month as we get further into the upcoming Q1 2022 earning season, analysts will end up upwards revising their estimates. That’s a very rewarding position to be in as a shareholder.

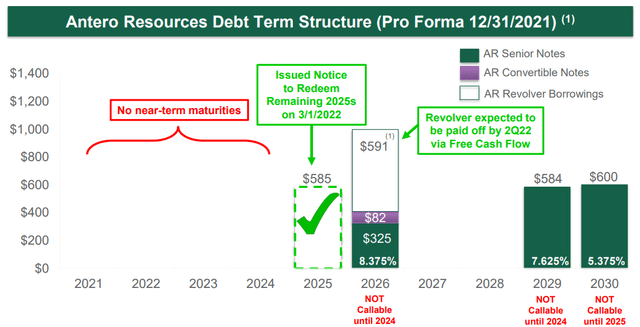

AR Q4 2021 investor presentation

Also, as you can see above, at the start of March 2022, Antero has bought back its 2025 notes, which will save on interest expenses by $30 million. And then, the next stack of debt isn’t due until 2026, with its $600 million revolver to be paid down in Q2 2022.

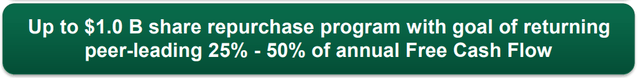

In sum, however we look at this business, it’s a business with a clean balance sheet, that’s rapidly deleveraging. Furthermore, it’s a business that’s using its excess free cash flows for buybacks:

AR Q4 2021 investor presentation

As you can see above, Antero is looking to return to shareholders somewhere around 25% to 50% of its free cash flow via repurchases.

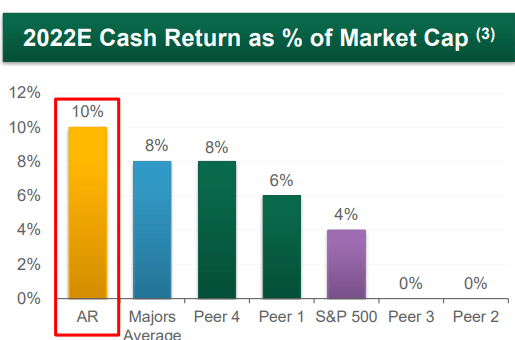

AR Q4 2021 investor presentation

As you can see above, Antero’s free cash flow return as a percentage of market cap is around the highest of its peer group. This high level of cash return will support its stock’s price.

AR Stock Valuation — Nice Risk Reward, ~6x FCF

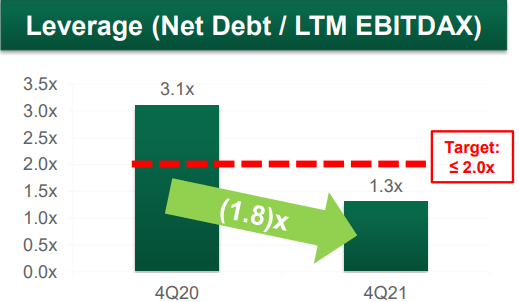

AR Q4 2021 investor presentation

As you can see above, Antero’s net debt to EBITDAX (EBITDA plus exploration) is way below its 2x target. This implies that as Antero progresses through 2022, it’s in a very strong financial position.

Therefore, given that Antero has favorable outlooks and a meaningfully stronger balance sheet, I believe that paying just 6x this year’s free cash flow is seriously cheap.

The Bottom Line

Antero’s stock will be volatile as investors look to oil prices for direction.

And while the two are directly related, oil can be transported and sold with ease around the world.

But liquified natural gas can’t be easily transported around the world. This implies that if until we figure out a way to transport LNG to Europe over the next 3 to 4 years, this will further ramp up demand for LNG producers. There are many ways to win here and paying around 6x free cash flow certainly seems very cheap to me.

Be the first to comment