Andrzej Rostek

Introduction

Apart from Alliance Resource Partners (NASDAQ:ARLP) enjoying record-setting operating conditions during 2022, earlier in the year it also seemed they were entering a new era away from thermal coal, as my previous article discussed. Even though only two quarters have since elapsed, it now disappointingly appears they are already falling back to their old ways with further fossil fuel investments once again taking center stage, as discussed within this follow-up analysis.

Coverage Summary & Ratings

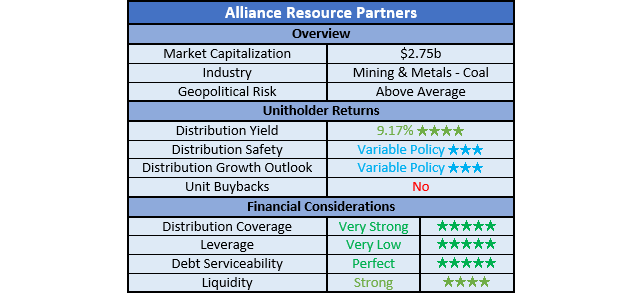

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

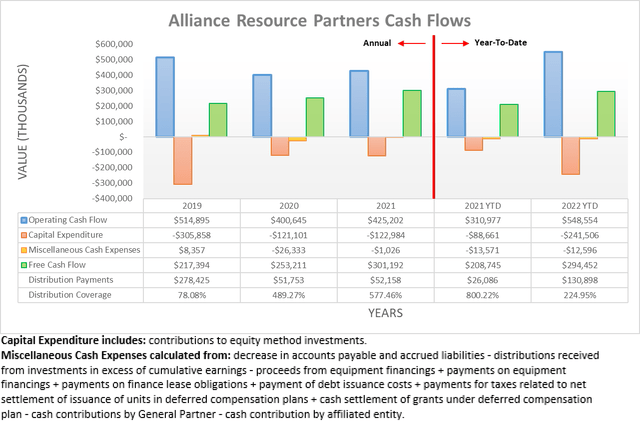

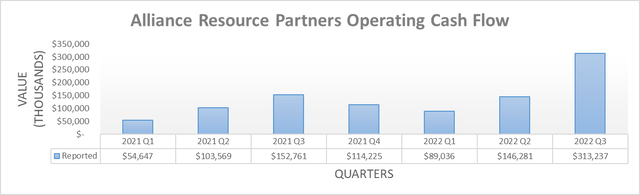

After seeing their cash flow performance surge during the first quarter of 2022 on the back of the Russia-Ukraine war, these already strong results ended up paling in comparison to what was laying ahead in the second and third quarters. This saw their operating cash flow of $89m during the first quarter climbing rapidly to $548.6m during the first nine months, thereby easily beating their already strong result of $311m one year prior during the first nine months of 2021.

If zooming into their cash flow performance on a quarterly basis, the sheer magnitude of the cash windfall they saw during the third quarter of 2022 is easily evident with their operating cash flow growing to a never-before-seen $313.2m. This is a massive sum of cash to generate during merely one quarter and provides management with more cash than ever-imagined to execute their plan and position the partnership for the future in the age of clean energy. In fact, across the first nine months they still generated $294.5m of free cash flow, even after seeing their capital expenditure almost triple year-on-year to $241.5m versus $88.7m during the first nine months of 2021.

Whilst booming operating conditions are obviously welcomed by unitholders, they nevertheless carry the long-term risk that as a fossil fuel partnership, they will succumb to the allure of falling back to their old ways. This could come about via overly aggressive expansion projects, loss of focus on operating costs, too generous of unitholder returns or more relevant right now, ignoring long-term threats from the clean energy transition.

Even though the global energy shortage following the Russia-Ukraine war saw demand for thermal coal rise and seemingly made renewable energy less of a threat, it does not change the long-term outlook. The thermal coal that primarily drives their financial performance remains a fuel of last resort and as such, one day will see its demand decline once again and as always, equity investments have no maturity date and therefore, the long-term outlook remains very important. To this point, the United States Energy Information Administration still sees 23% of coal electric generation capacity going offline by the end of the decade, which is the market that represented 81.60% of their coal sale volumes during 2021, as per their 2021 10-K.

If thinking back to my previous analysis, following the first quarter of 2022 they announced two new investments into non-resource related business ventures that aimed to start aligning their partnership with the clean energy transition. The first one, Francis Energy, related to electric vehicle charging but alas, this has now already been placed on hold, as per the commentary from management included below.

“ARLP has recently elected to hold its commitment to Francis Energy to support development of its EV infrastructure charging network at our initial $20 million convertible note investment.”

-Alliance Resource Partners Q3 2022 Conference Call.

Disappointingly, in the space of merely two quarters, their electric vehicle recharging investment appears to be discontinued or at best, pushed into the background, likely to be forgotten with nothing new highlighted thus far to take its place. If nothing else, this apparent failure highlights the importance of not taking their foot off the accelerator, metaphorically speaking, as emerging growth investments are far from simple, nor guaranteed success. Meanwhile, at least their second non-resource related business venture, Infinitum Electric, apparently is progressing well, as per the commentary from management included below.

“We are increasingly confident in the management team that our commercial plans and technology of infinitum electric, startup developer and manufacturer of high efficiency electric motors ARLP invested in last April.”

-Alliance Resource Partners Q3 2022 Conference Call (previously linked).

Whilst positive to see this business venture lasting at least six months since being announced, it is merely one small investment with yet-to-be-quantified future returns, nor capital expenditure requirements. Considering their routine circa $500m+ operating cash flow primarily from thermal coal, they are definitely going to need to step up their investments far higher than the mere $25m spread across several years announced thus far, as per the commentary from management included below.

“Adding to our earlier investments in EV charging infrastructure through Francis Energy, and energy efficiency through Infinitum Electric’s industrial electric motor technology, we announced this morning our $25 million commitment to NGP ETP IV, a private equity fund sponsored by NGP Energy Capital Management, LLC. While ARLP’s commitment to this fund will be deployed over several years…”

-Alliance Resource Partners Q2 2022 Conference Call.

It remains to be seen if they unveil any new business ventures in the future, although suffice to say, it would be nice to see more of their cash windfall allocated to aligning their partnership for the coming decades. Meanwhile, they have not been shy to throw plenty more cash back into their existing fossil fuel business segments, as per the commentary from management included below.

“We also remain focused on growing our oil and gas and coal royalty segments, the recent acquisition of an additional 4,322 acres in the Permian increases ARLP’s total mineral position to approximately 62,008 net royalty acres and provides line of sight growth in future oil and gas royalty volumes.”

-Alliance Resource Partners Q3 2022 Conference Call (previously linked).

Evidently, their lack of progress towards non-fossil fuel business ventures does not stem from prioritizing unitholder returns over everything else but rather, they are remaining “focused” on growing oil, gas and coal business segments. Apart from the $94.5m cost of their oil and gas royalty acquisition, they have also pursued various bolt-on expansions to their River View and Tunnel Ridge mines, as discussed within their third quarter of 2022 results announcement, along with their updated capital guidance for 2022 of $312.5m at the midpoint. Admittedly yes, this is likely to be far more profitable in the short-term, although they risk depleting their cash windfall without making sufficient progress aligning the partnership for the long-term whereby fossil fuel demand wanes.

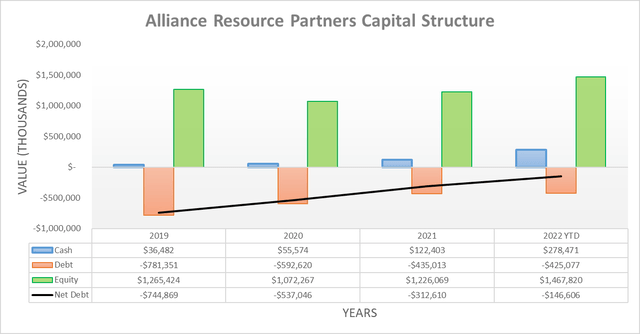

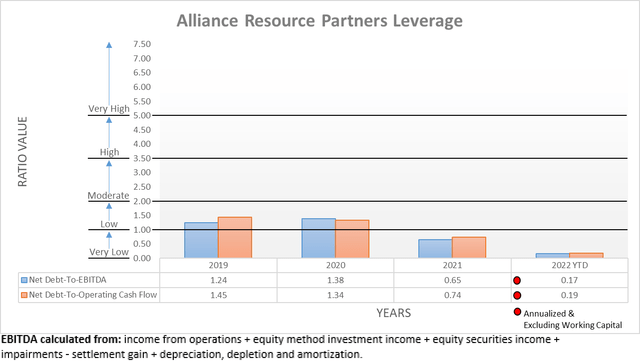

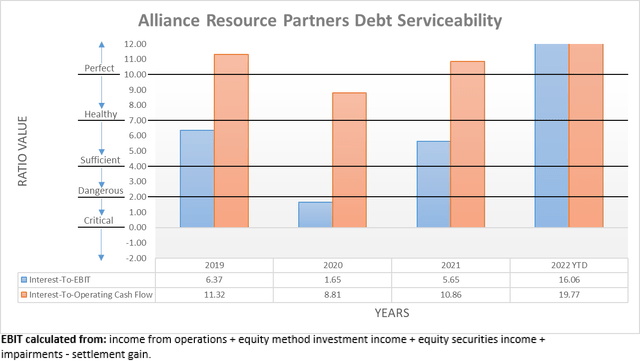

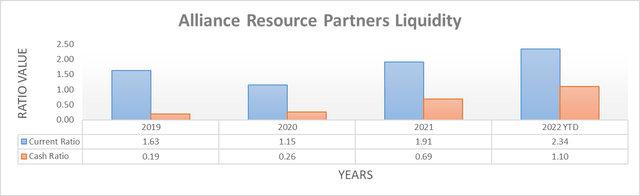

Thanks to their cash windfall growing even larger since the previous analysis, the second and third quarters of 2022 saw their net debt continue plunging, despite their otherwise high outflows. As a result, their net debt is now only $146.6m and thus slightly less than half where it ended the first quarter at $303.2m. Whilst this represents a sizeable improvement in percentage terms, realistically, it would still be redundant to reassess their leverage in detail given it was already very low and thus could not have possibly changed, which by extension, also applies comparably to their debt serviceability. Meanwhile, their cash balance also swelled to $278.5m from $128.2m across these same two points in time, thereby more than doubling and thus also making it redundant to reassess their already strong liquidity in detail.

The three relevant graphs are still included below to provide context for any new readers, thereby showing their net debt-to-EBITDA of 0.17 and net debt-to-operating cash flow of 0.19, both of which are far below the threshold of 1.00 for the very low territory. Unsurprisingly, they also enjoy perfect debt serviceability with their interest coverage sitting at 16.06 and 19.77 when compared against their accrual-based EBIT and cash-based operating cash flow, respectively. Finally, they also see a current ratio of 2.34, thereby easily making for strong liquidity on the back of their very large cash balance that leaves their cash ratio at 1.10. If interested in further details regarding these topics, please refer to my previously linked article.

Conclusion

I am not a fan of their thermal coal focus but to give credit where due, they have done a remarkable job cleaning up their balance sheet. Regardless, I feel it would be prudent for investors not to get blinded by the big dollars thermal coal is earning right now and remember that it remains a fuel of last resort. As a result, once the global energy shortage eases in the coming years, they will once again be left with declining demand that poses a headwind, thereby making it important to seize this cash windfall to avert such a future. Disappointingly, they appear to be already falling back to their old ways of prioritizing fossil fuel investments and thus following my other article that focused on their valuation, I continue to believe my sell rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Alliance Resource Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment