curraheeshutter/iStock via Getty Images

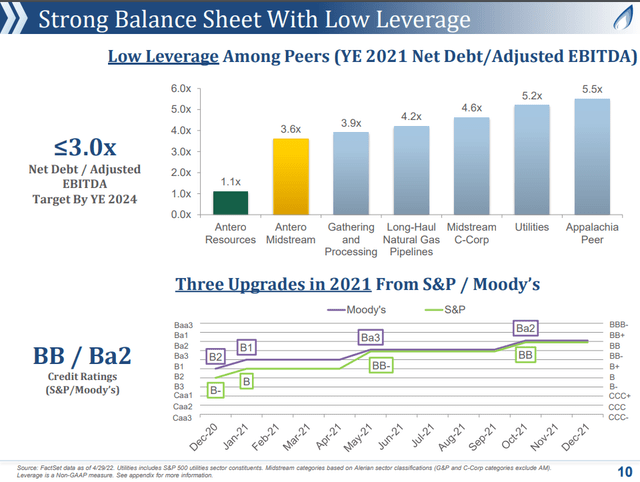

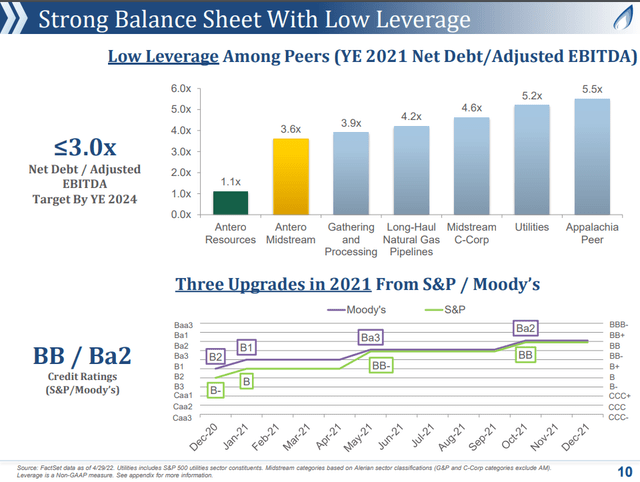

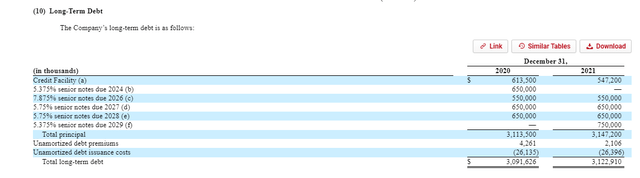

Antero Midstream Corporation (NYSE:AM) is a compelling pipeline operator after a recent pullback from $11+ to ~$9. I have to say I liked and bought some at ~$11 as well. It is trading at a 9.67% forward yield but one of the main criticisms of the company is its low dividend coverage ratio. In terms of commonly employed valuation metrics, AM trades at an EV/EBITDA ratio of 8.6x and at 6.11x free cash flow. The company prides itself on its low leverage ratios compared to peers and I’ve found that checks out. The company still has $3.13 billion of long-term debt vs. its market cap of $4 billion and EBITDA at $735 million.

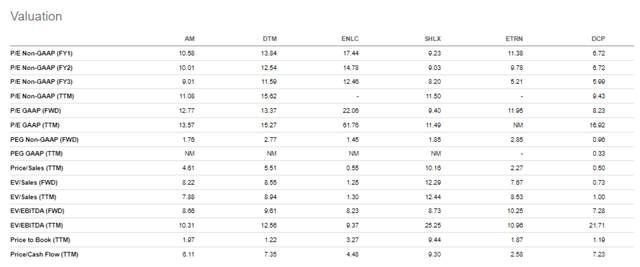

I pulled Seeking Alpha data on a number of midstream companies to get a better idea of valuation ranges. I did not handpick the comps but went with those provided by SA, including DT Midstream (DTM), EnLink Midstream LLC (ENLC), Shell Midstream Partners (SHLX), Equitrans Midstream Corporation (ETRN), and DCP Midstream (DCP). Valuations look like this:

Valuations Midstream Operators (SeekingAlpha.com)

Antero Midstream doesn’t look particularly cheap nor particularly expensive. There are a few reasons why I’m holding onto some shares besides the sweet ~9% dividend.

Midstream companies are not as economically sensitive as upstream operators, which is always a big selling point with me. Throughput is usually not so much dependent on market prices for gas (Antero transports natural gas and NGL’s). The CEO expects growing throughput in the second half of 2022 as per the most recent earnings call:

Looking ahead, we expect throughput to be approximately flat in the second quarter as compared to the first quarter, and then are expecting an increase in throughput in the back half of 2022. As Paul mentioned, we have de-risked this growth profile through our visibility into AR’s development plan and integrated business model, acting as the first step in the LNG value chain.

This marks a critical inflection point for Antero Midstream as we expect to consistently generate free cash flow after dividends for the foreseeable future. As you can see on the right-hand side of the page, we expect increasing free cash flow after dividends in 2023 and further growth into 2024 and beyond as capital declines and EBITDA increases. This is a result of both volumetric growth and margin expansion. In total, we are targeting $700 million to $800 million of free cash flow after dividends from 2022 through 2026, which remains unchanged.

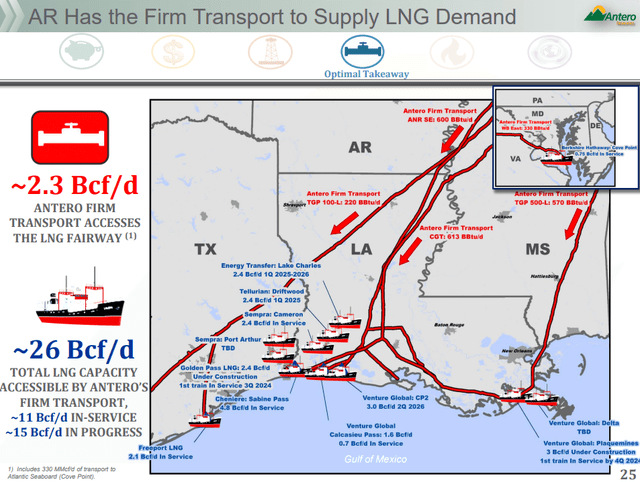

Antero Midstream barely responded to the increase in average gas prices we’ve seen for the year, and to an extent that makes sense because it gets paid to transport the stuff. It doesn’t get paid to pump and produce product. However, the rising prices are (at least partially) driven by Russia’s invasion of the Ukraine. AM can supply many liquefaction facilities (and more in the future) that turn natural gas into LNG. Europe is now clamoring for LNG, and there’s a huge price difference between U.S. natural gas and European natural gas.

Antero Midstream routes to port capacity (Antero Midstream presentation)

Increased liquefaction capacity pushes up the range of possible U.S. natural gas prices in the coming years. Odds that AM’s primary customer Antero Resources (AR) remains highly profitable are much improved, and with it the sustainability of AM’s business model.

The company is very proud of its relatively strong balance sheet. See presentation here:

EIC presentation (Antero Midstream company presentation)

Antero Midstream leverage ratio (Antero Midstream presentation)

I pulled up the 10-K and the debt isn’t only pretty far out but interest rates are quite reasonable, mostly fixed and the company can take out a lot of debt (before maturity) if it pays a penalty:

Debt maturity schedule Antero Midstream (10-K Antero Midstream)

It looks fine to me. Given the above, I wouldn’t be ready to buy Antero Midstream, but I don’t think there is a lot wrong with it. However, the real kicker here to me is the 29% Antero Resources stake. The company owns 139 million shares in Antero Resources. At current market prices, these have a market value of around ~$3 billion. That’s in the context of a market cap of $4 billion for Antero Midstream and a $7.5 billion Enterprise Value. Almost all of Antero Midstream’s revenue is derived from Antero Resources, and that firm has been on a tear. As a producer, it is greatly boosted by higher gas and NGL prices.

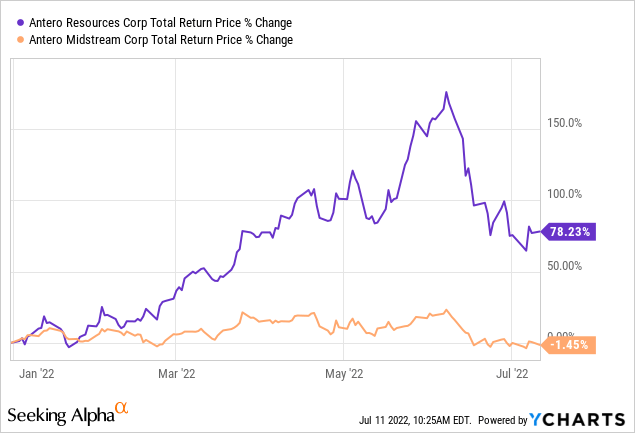

Even though AM owns a 29% stake it is down slightly in 2022 with Antero Resources up a stunning 78% (I’ve written that one up originally on The Special Situations Portfolio around ~$5). I’m thinking the market is overlooking this valuable stake or discounting it too much (because it is a related party). If Antero Resources would institute a dividend at its current rate of earnings, it would throw off something like $3 per share at a 50% payout ratio. AM would generate $400 million on its stake. The AR dividend would easily cover AM’s entire 9% dividend by itself.

These are all hypotheticals, but given Russia’s invasion of Ukraine has spurred Europe into seriously rethinking its energy security, I’m fairly confident the U.S. gas future has brightened considerably. Antero Midstream currently looks like an attractive company to own for the longer term (think 3 years or longer) to benefit from the existing dividend and growth in throughput.

Be the first to comment