cosmin4000/iStock via Getty Images

Thesis

Anavex Life Sciences Corp. (NASDAQ:AVXL) has two drug candidates, with Anavex 2-73 being the potential short-term value driver. Anavex 2-73 is being tested for Alzheimer’s, Parkinson’s Disease Dementia and Rett syndrome.

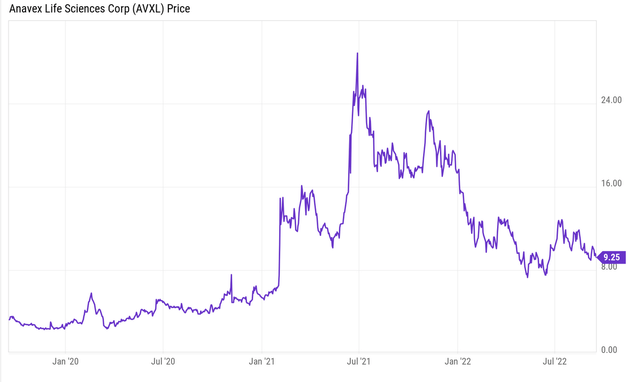

In line with biotech trends, Anavex’s stock has however taken a beating over the last year.

The big upcoming event here is a readout of Anavex’s top-line data readout of a potentially pivotal phase 2b/3 clinical trial in Alzheimer’s, which is expected in the fall of 2022. That readout should be followed by data from a Phase 2 study in Parkinson’s Disease Dementia (PDD), and by a potentially pivotal Phase 2/3 study in Rett disease. I believe the first two of these readouts could be determinant for where the stock is going.

Though I am quite bullish on both of those readouts, I am holding my horses until results including biomarkers will be reported. The reason is my lack of understanding of the science underlying to Anavex 2-73. Anavex has recently elucidated investors on Anavex 2-73’s workings through several publications and conference abstracts. They however do not give me enough comfort as such. Anavex 2-73’s mechanism of action does not seem to rely on the more mainstream ideas in scientific publications on the subject.

Anavex has a $720 million market cap, and an enterprise value of $567 million. It has ample cash to continue operations for years to come. Given the large markets it is targeting, there is a lot of potential upside for this stock in case of successful reporting. Any negative reporting on any of the bigger readouts may however also create downward pressure.

Company

Introduction

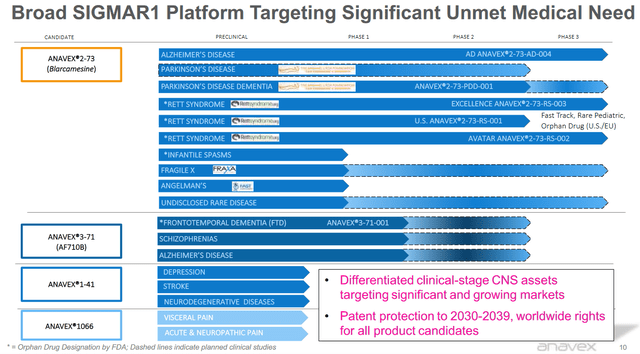

Anavex has a quite diversified pipeline with four drug candidates, of which Anavex 2-73 is most relevant. Anavex 2-73 is furthest progressed, and has several upcoming readouts which will be relevant to investors. I will be focusing on those below.

Anavex pipeline (Anavex corporate presentation)

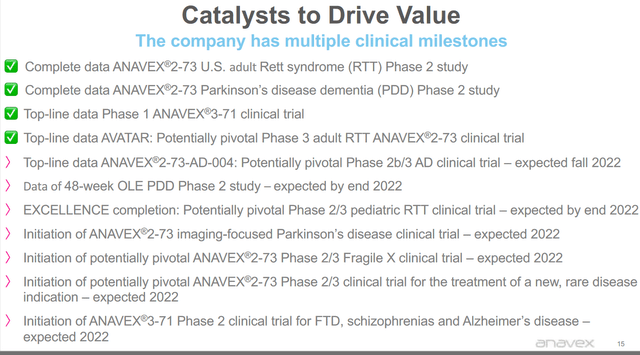

During the call on results for the third quarter of 2022, Anavex mentioned that it is completing finalizing activities to report top-line results of the placebo-controlled Phase 2b/3 study of Anavex 2-73 in early Alzheimer’s disease, expected this coming fall. Data from the 48-week open-label extension of the Parkinson disease dementia Phase 2 study is expected by year-end 2022. Also by year end 2022, Anavex will be reporting on the randomized placebo-controlled Excellence Phase 2/3 study for the treatment of pediatric patients with Rett syndrome.

Anavex catalysts (Anavex corporate presentation)

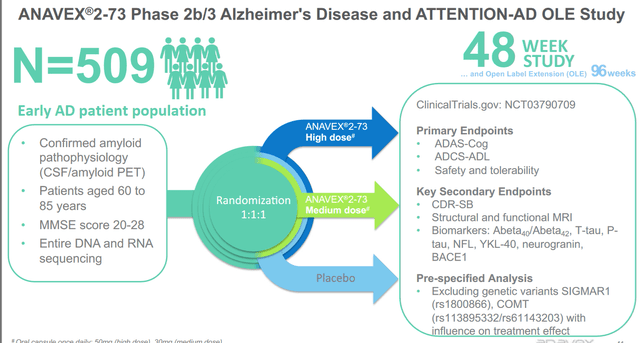

Anavex 2-73 for Alzheimer’s disease

Since 2018, Anavex has been conducting a Phase 2b/3 study in Alzheimer’s disease which is now ready to be reported. Despite not having sites open in the US, this is a well-designed trial allowing all patients with Alzheimer’s disease. The trial is randomized and placebo-controlled, and runs for a period of 48 weeks, with an open label extension study of 96 weeks. Primary endpoints of interest are Adas-Cog to assess cognition and ADCS-ADL for daily function. Key secondary endpoints are, among others, CDR-SB or Clinical Dementia Rating Sum of Boxes, structural and functional MRI, and both blood and cerebral spinal fluid biomarkers of Abeta40, Abeta42, T-tau, NFL, YKL-40, BACE1 and neurogranin.

Phase 2b/3 Alzheimer’s study (Anavex corporate presentation)

The most important results for investors will of course come from the primary endpoints Adas-Cog and ADCS-ADL and secondary endpoint CDR-SB. I am expecting Anavex to report improvement in cognition of patients on Anavex 2-73 compared to placebo for the following reasons.

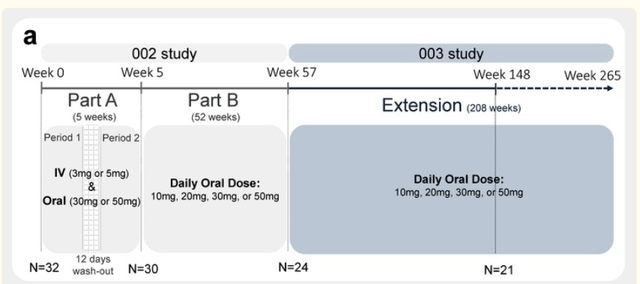

Several reports have already come out of an earlier Phase 2a study. That study had started out as a 5-week randomized placebo-controlled trial, followed by a 52-week open label study, on 32 patients. Hence, the study’s results are largely open label and not placebo-controlled, which is important to know given the placebo-effect often seen in these patients. That study would be followed by an additional 208 week extension, which Anavex has reported on midway at week 148 of the extension study, on 21 patients.

Phase 2a study (Publication: A precision medicine framework using artificial intelligence for the identification and confirmation of genomic biomarkers of response to an Alzheimer’s disease therapy: Analysis of the blarcamesine (ANAVEX2‐73) Phase 2a clinical study)

A precision medicine framework using artificial intelligence for the identification and confirmation of genomic biomarkers of response to an Alzheimer’s disease therapy: Analysis of the blarcamesine (ANAVEX2‐73) Phase 2a clinical study

First positive reporting on this trial regarding patients having been on trial for five weeks was in November 2015. In December 2016, Anavex reported a 1.8-point improvement on MMSE and a 4-point improvement on ADCS-ADL score over the course of 57 weeks, with the correlation being positive on all measured scores (MMSE, ADCS-ADL, Cogstate, HAM-D and EEG/ERP).

The results of these studies were later reported to be featured in a publication in the Journal of Neuropharmacology. This reporting added that benefits were shown in 80% of the Alzheimer’s population, which carries a SIGMAR1 gene. Limited benefit was shown in the other 20%. This publication reported cognition improvement of +2.0 points on MMSE and +4.9 points on ADCS-ADL points. Anavex added that a +2.0 point improvement on MMSE corresponding to a calculated ADAS-Cog score change of -3.4 (improvement).

Yet another publication mentions slightly different numbers, where exclusions of certain patient groups seem to be reported on. Including patients with milder disease stage and the exclusion of AD patients carrying SIGMAR1 mutation resulted in a score improvement of 1.7 MMSE and 3.9 ADCS-ADL. The additional exclusion of the COMT mutation results in a score improvement of 2.0 MMSE and 4.9 ADCS-ADL, respectively for the same period.

I am not sure any more which reporting to follow here. Assuming the reporting in 2016 concerned the entire patient group, a 1.8-point improvement on MMSE and a 4-point improvement on ADCS-ADL score seems most relevant.

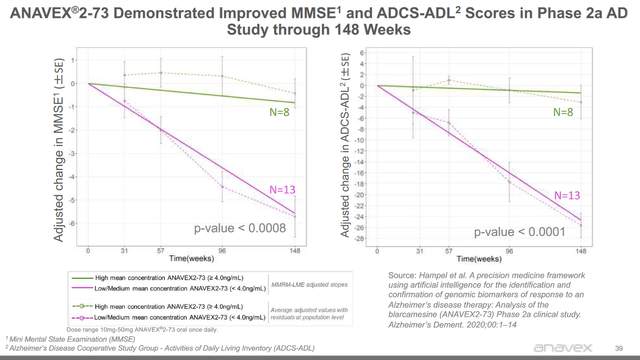

In a 2020 publication on the 21 patients in the extension study over the course of 148 weeks, the following results were reported, which are also incorporated in Anavex’s corporate presentation. Eight patients had been on the high dose, where the other 13 had been on the low dose.

MMSE and ADCS-ADL in Phase 2a (Anavex corporate presentation)

The green lines represent patients on the high dose, whereas the purple lines represent patients on the low dose. The dotted lines represent the actual evolution of the total evaluable patient population. The straight line represents the trend. This also means that patients on the low dose did not show much improvement in my eyes.

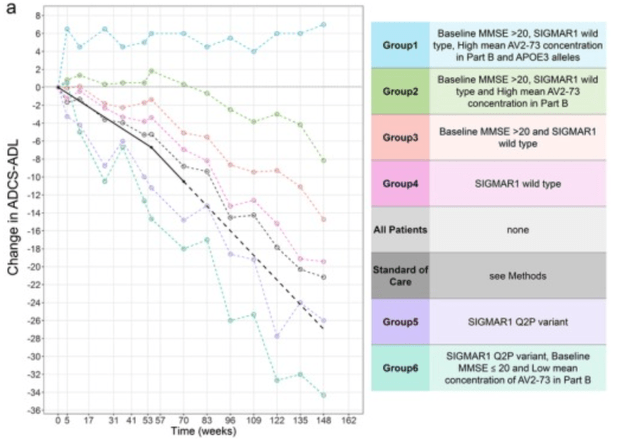

The same publication also showed the variance between patient populations, expressly mentioning that two patients had exceptional therapeutic response.

Individual variations ADCS-ACL Phase 2a trial (A precision medicine framework using artificial intelligence for the identification and confirmation of genomic biomarkers of response to an Alzheimer’s disease therapy: Analysis of the blarcamesine (ANAVEX2‐73) Phase 2a clinical study)

Of note: 16 patients on this trial had Sigmar1 wild type gene expression. The black line is the normal evolution of standard of care, obtained from literature, namely a –6.7-point change in one year and a −10.5 change in 18 months or at week 70. The dotted line then represents the evolution that patients on standard of care are supposed to follow after week 70 up to week 148.

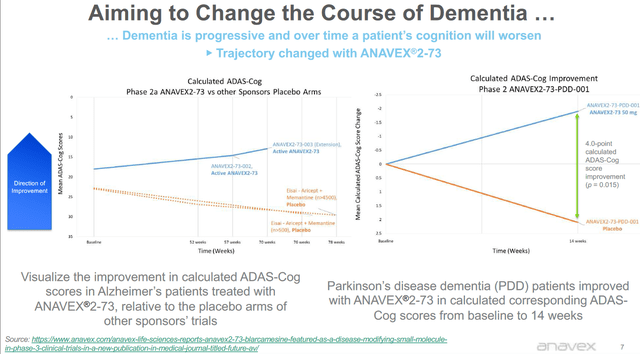

The corporate presentation of Anavex also contains this slide on what appear to be results on Adas-Cog rating scale.

Calculated Adas-Cog results slide (Anavex corporate presentation)

To be clear, Anavex has not yet reported Adas-Cog results either in Alzheimer’s or in Parkinson’s Disease Dementia, so these slides should not be misinterpreted. Anavex has on several occasions calculated what the results in Adas-Cog would be in light of already existing reporting. It has done so for Alzheimer’s results at week 57, but not at week 148. For the Alzheimer’s patients at week 57, it had mentioned a calculated Adas-Cog score of -3.4 that correlated to a +2.0 points improvement on MMSE at week 57. Of note: the 2016 reporting mentioned a +1.8 point improvement for the total patient group. In Parkinson’s Disease Dementia patients, Anavex has reported calculated Adas-Cog results at week 14.

Anavex 2-73 for Parkinson’s Disease Dementia – the open label extension study

Anavex is not actively pursuing a treatment for Parkinson’s, but it is for Parkinson’s Disease Dementia. Anavex considers that up to 80 percent of patients diagnosed with Parkinson’s eventually experience Parkinson’s disease dementia. The Alzheimer’s Association reports that symptoms of mild cognitive impairment commonly start five years after diagnosis, with some studies reporting that Alzheimer’s dementia starts 10 years after diagnosis. That means the possible treatment period will in any case be more limited.

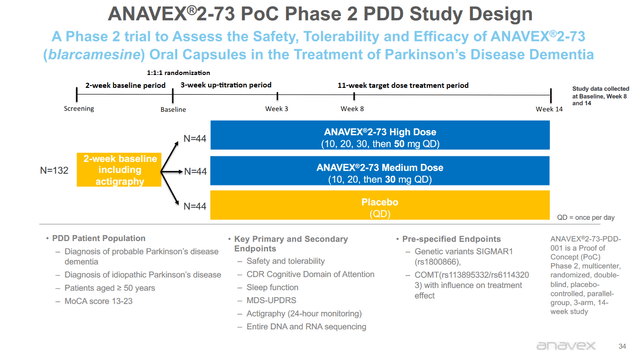

Anavex has been conducting a Phase 2 double-blind, placebo-controlled study that randomized 132 patients and treated them with a low dose of 30mg and a high dose of 50mg over the course of 14 weeks. After that trial, patients could opt to continue treatment, or placebo patients could opt to start treatment.

Phase 2 PDD design (Anavex corporate presentation)

On October 15, 2020, Anavex reported clinically meaningful, dose-dependent, and statistically significant improvements in the Cognitive Drug Research (CDR) computerized assessment system analysis. On November 6, 2020, Anavex reported improvements in CDR system Cognitive Domain of Attention assessed by Choice Reaction Time and Digital Vigilance and CDR system Episodic Memory.

Anavex is now about to report on that 48-week long open label extension study. That extension study will report on safety, adverse events, RSBDQ for sleep behavior, MDS-UPDRS motor scores, Montreal Cognitive Assessment and microbiota.

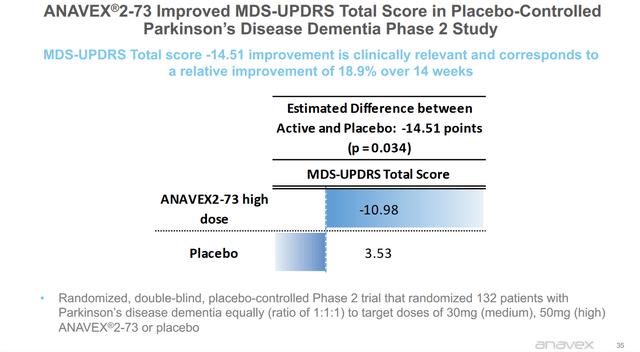

In a recent poster during the AD/PD 2022 conference, Anavex had shown improved MDS-UPDRS scores of -10.98 compared to baseline over the course of 14 weeks. Compared to patients on placebo, which showed a -14.51 point improvement, or a relative improvement of 18.9%.

MDS-UPDRS response PDD Phase 2 study (Anavex corporate presentation)

Here also, Anavex calculated Adas-Cog results but did not actually measure them. Anavex focused on the high dose group to make the calculation of Adas-Cog results, and reported (own highlighting).

“The calculated corresponding ADAS-Cog mean change from baseline score is -1.9 (improvement) for patients in the 50 mg dose group, an 8% mean improvement from baseline to 14 weeks. The difference between the ANAVEX®2-73 group and the placebo group in the change from baseline at 14 weeks was a 4.0-point improvement of calculated corresponding ADAS-Cog score (p = 0.015).”

I have not seen calculated Adas-Cog results for patients on the low dose in the Parkinson’s Disease Dementia trial. In that sense, the calculated 4.0 point improvement is partial information, in my eyes. I would assume the low dose patient population did not perform well.

Anavex 2-73 for Rett syndrome

Anavex has completed both a Phase 2 and Phase 3 trial in adult Rett syndrome, and is currently conducting a Phase 2/3 trial in pediatric Rett Syndrome. Anavex’s Rett syndrome program received fast track designation, orphan drug designation and rare pediatric disease designation. The Phase 3 study in adult Rett patients took seven weeks and was conducted in 36 patients. Anavex has reported here that treatment with Anavex 2-73 has led to a statistically significant improvement for All Patients in the Endpoints RSBQ AUC, ADAMS and CGI-I.

There are about 11,000 patients with Rett syndrome in the US, and is a severe neurodevelopmental disorder that occurs mostly in young girls. In that sense, the pediatric patient population will be the most relevant one.

Anavex will report on its Phase 2/3 trial in pediatric Rett syndrome by the end of 2022.

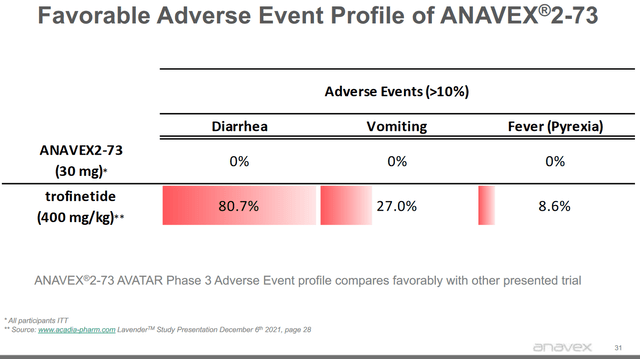

Recent news here comes from an unexpected corner. Last week saw the FDA accepting Acadia Pharmaceuticals’ (ACAD) new drug application of Trofinetide for Rett syndrome. Acadia Pharmaceuticals had reported good results for this drug candidate. The FDA has granted priority review to Acadia Pharmaceuticals’ application, and is to decide on the application by March 12, 2023. If the FDA were to approve Trofinetide, then that would mean Anavex 2-73 may lose orphan drug designation for Rett syndrome, and may in any case face competition. There seems to be one advantage, highlighted by Anavex, and that is that Anavex 2-73 has a more favorable safety profile.

Anavex 2-73 adverse event profile (Anavex corporate presentation)

My take on the science behind Anavex 2-73

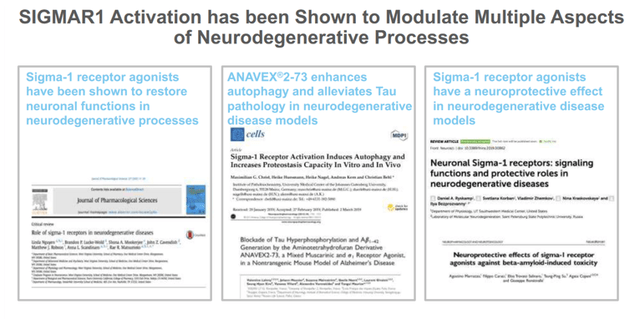

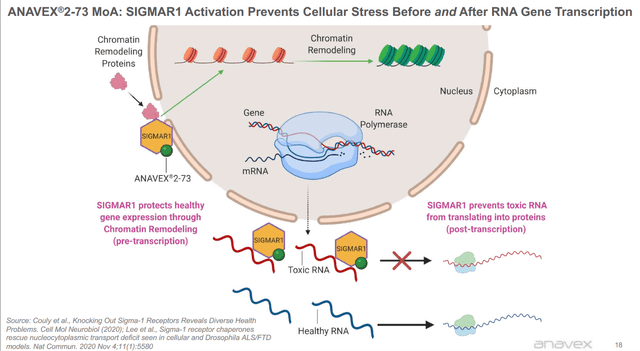

Anavex2-73 activates the Sigma-1 receptor (S1R) protein. Anavex states that this receptor protein serves as a molecular chaperone and functional modulator involved in restoring homeostasis. Anavex 2-73 is supposed to lower the toxic accumulation of misfolded proteins, mitochondrial dysfunction, oxidative stress and neuroinflammation. Anavex states that those five factors are all involved in Parkinson’s, Alzheimer’s, and Rett syndrome, and I would agree that that is so in any case for Alzheimer’s and Parkinson’s disease, both ageing-related multifactorial diseases. Obviously the proteins involved in both are different however.

Mechanism of action publications (Anavex)

On July 31, 2022, Anavex reported that Anavex 2-73 countered expression levels of genes downregulated in both Alzheimer’s disease, Parkinson’s disease and other degenerative diseases.

Mechanism of action slide (Anavex)

I will say at this point that I do not see where to exactly situate Anavex as a treatment of neurodegenerative diseases. At Alzheimer’s conferences, nowadays, participants are invited to vote on how comfortable they are with different disease paradigms: amyloid hypothesis, tau hypothesis, immune hypothesis, endolysosomal dysfunction hypothesis, mitochondrial dysfunction hypothesis, epigenetic dysregulation hypothesis, cell cycle hypothesis or ‘something else’. I would place Anavex 2-73 somewhere in between the mitochondrial dysfunction hypothesis and cell cycle hypothesis.

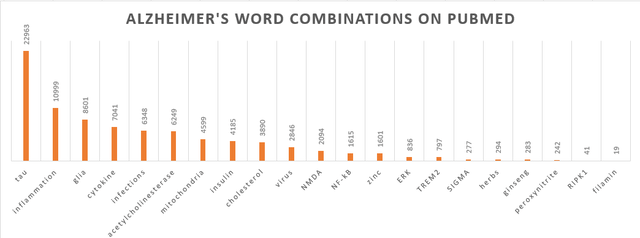

Notwithstanding the science as published by Anavex, I do express serious concerns about whether Alzheimer’s disease can be resolved by peroxynitrite scavenging, zinc chelation, panax ginseng or Korean herbs. I believe PubMed publications are indicative of where science stands on this matter, and I do not believe this is where the solution lies. I also do not read any of this in Anavex’s publications. The below chart is an effort to show where the science is concerned with. For reference, publications featuring Alzheimer’s on PubMed total 203,089 results, and those featuring ‘amyloid’ total 62,589 publications. Amyloid was not included in the above chart given its high number in comparison with the others.

Pubmed word combinations with ‘Alzheimer’s’ (Own work)

My take here is that positive results of late have mostly been coming from trials involving drug candidates that show promise in reducing neuroinflammation and altering glial activity. I have reported on some of these companies before, some of which are under the radar. For me, Biogen’s Aduhelm (BIIB) would be related to amyloid only, as would be Eli Lilly’s (LLY) donanemab or Cognition Therapeutics’ (CGTX) CT-1812. Voyager Therapeutics’ tau antibody would be related to tau only. BioVie’s (BIVI) drug candidate NE3107 would be related to inflammation, glial cells, cytokines, insulin, NF-kB and ERK. INmune Bio’s (INMB) drug candidate XPro would be related to inflammation, glial cells and cytokines. Athira Pharma’s (ATHA) drug candidate fosgonimeton is related to the NMDA receptor. Of note also: ‘filamin’ gets the least hits, yet Cassava Sciences’ (SAVA) simufilam has been reported to reduce neuroinflammation and to show an effect on microglial activity as shown by responses on the sTREM2 biomarker. In ALS, BrainStorm Cell Therapeutics (BCLI) has reported positive results by modulating the immune response and glial cells. In that regard, I remark that Arcadia Pharmaceuticals’ Trofinetide as a competitor of Anavex 2-73 in Rett syndrome is designed to reduce symptoms by potentially reducing neuroinflammation, inhibiting the production of inflammatory cytokines, inhibiting the overactivation of microglia and astrocytes, and increasing the amount of available IGF-1. This may be another confirmation of these inflammatory and glia- or immune-related pathways being quite successful for the treatment of neurological diseases.

But all of these larger neurodegenerative diseases are multifactorial, and will require more than one treatment for the entire patient population. That leaves room for a patient-specific treatment, possibly with a combination of drugs.

My take on the possible opportunity

Anavex has undoubtedly sold off like so many other biotech companies have at this point, having come down well from its 2021 highs. With such big readouts ahead, I believe the company would be trading elsewhere in a bull market. Obviously we are not in one.

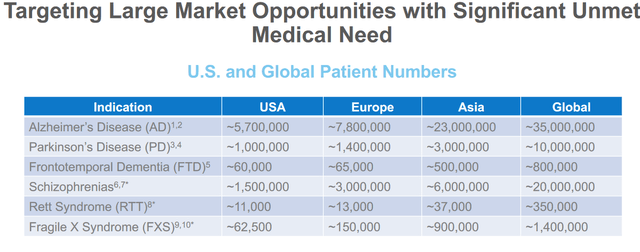

Price chart evolution (Ycharts)

The market opportunities for Alzheimer’s disease and Parkinson’s disease are gigantic, with respectively 13.5 million and 2.4 million patients in the US and Europe combined. The estimated total healthcare cost for the treatment of Alzheimer’s disease in 2020 is estimated at $305 billion, with the cost expected to increase to more than $1 trillion as the population ages. The Parkinson’s market is expected to triple by 2029, with sales expected to reach $11.5 billion. With a market cap of $711 million, clearly there is quite a bit of upside to this stock in case of a positive readout in Alzheimer’s or Parkinson’s disease.

Market opportunities (Anavex)

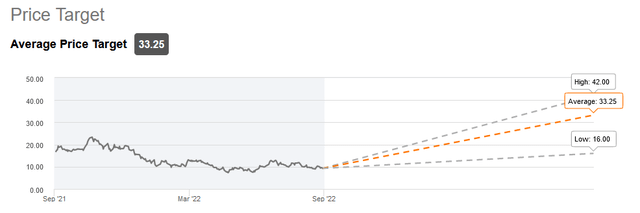

Analysts have much higher price targets in mind for Anavex than the current share price. And I believe that the upcoming readouts will in any case give direction to the share price.

Analyst price targets (Seeking Alpha)

In light of the earlier data reported by Anavex as set out above, I believe that both upcoming readouts will be positive. I expect Anavex to report an improvement in cognition over 48 weeks in the overall Alzheimer’s patient population, and to report improvement of patients in the open label extension study of the Parkinson’s Disease Dementia trial. This trial will report on a time period during which the drug effect in patients seems to show an upward movement, although there seems to be quite some difference between patients.

The negative trend of data beyond the 57-week time point is of concern, as is the fact that a part of the patient population may not respond well to treatment. That negative trend will not be reported on at this time, but it exists nonetheless and may be taken into consideration by the FDA as well when considering whether Anavex 2-73 is a disease-modifying treatment, or not. To that extent, I again highlight stances in scientific publications on NFL as a biomarker of neuronal degeneration or neuronal repair. I believe the FDA gives a certain weight to this measure across neurodegenerative diseases, and Anavex will report on it as being part of its upcoming Alzheimer’s readout.

Financials and statistics

Anavex’s market cap is $711 million at the time of writing, with an enterprise value of $567 million. Shares outstanding are 78 million, and the float is 75.59 million. Three percent of the total shares are held by insiders. Institutions hold 34% of Anavex shares.

Short interest is at 12%, with 15.18 days to cover at the current volume.

Anavex’s cash position on June 30, 2022 was $153.2 million. It believes it has sufficient cash runway for the next four years. Net loss for the last quarter was $12.4 million. On the basis of that number, I would assume that Anavex at least has cash for the coming three years.

Risks

As mentioned above, both upcoming readouts may give direction to where Anavex’s stock is going in the longer run. Obviously the Alzheimer’s trial has the greatest opportunity, and results here may have the biggest effect on the share price. If any of these results are not interpreted as positive, then chances are the stock will face downward pressure. Given the total amount of shares and the low volume, that downward pressure may be severe.

There is constant regulatory dependency for all trials as well. Approval eventually depends on an external body composed of highly-skilled people, which will critically assess the entirety of the available data when assessing possible approval. Constantly changing competitive threats, as one sees in Rett syndrome, are a last factor to take into account.

Conclusion

Anavex is about to report on potentially the most game-changing trial of its lifetime so far. I believe the readout of patients diagnosed with Alzheimer’s disease who have been on trial for 48 weeks will be positive, as it will fall within the period of previously reported cognition improvements. I expected Anavex to report improved cognition over that period. That readout is due for the fall of 2022, so it is imminent.

I also believe that Anavex will report good data in the open label extension study in Parkinson’s Disease Dementia, scheduled for the end of 2022.

Anavex 2-73 is facing competition in Rett syndrome, but seems to have a better safety profile than its competing drug.

Finally, the stock has sold off formidably well at this point, knowing its biggest catalyst is right around the corner.

These four elements are strong reasons to be bullish on the stock.

For lack of sufficient understanding of the mechanism of action of Anavex 2-73 and its place in the state of the science, given the disparity between patients reported and given the seemingly down-trending data after the 57-week timepoint, I will personally wait to take a position. I am curious to see which biomarkers Anavex will report on in its upcoming readout in Alzheimer’s disease. Depending on that readout, I may take a position.

Therefore, though I am bullish on its upcoming readouts on cognition measures, I rate the stock currently as a hold.

Be the first to comment