den-belitsky/iStock via Getty Images

Anavex Life Sciences Corp. (NASDAQ:AVXL) presented the results from its phase 2b/3 clinical 48-week trial for Anavex 2-73/blarcamesine at the CTAD conference on December 1st (revised presentation). Blarcamesine met its primary and secondary endpoints by significantly reducing cognitive decline as measured by ADAS-Cog and CDR-SB, respectively. Anavex stated that it met its other primary endpoint: reduction in decline in activities of daily living as measured by ADCS-ADL, although it has not provided specific data to support this as of yet (press release). Up to this point, Anavex has provided results from the combined 30mg and 50mg dose groups. However, once separate data is provided for the 50mg group, blarcamesine is likely to be the first Alzheimer’s drug or drug candidate to produce a mean improvement in ADAS-Cog scores at 48 weeks.

One might have expected a greater increase in stock value based on the initial announcement of results. Critics, though, succeeded in creating a lot of noise surrounding Anavex’s presentation (and subsequent conference call), teed up in part because the company had not yet completed all the analysis. In the end, though, the one legitimate concern is how will the FDA view the trial. Until that decision is reached, Anavex and its stockholders will be left in a kind of limbo.

Going by the Numbers

On average, those on blarcamesine declined by 45 percent less in cognition as measured ADAS-Cog scores and 27 percent less in cognition as measured by CDR-SB scores than those on placebo. Patients who improved on blarcamesine did so by an average of -4.03 points (a smaller score on ADAS-Cog represents an improvement in cognition). Those who improved by at least -.5 points in ADAS-Cog scores on blarcamesine were 84 percent more likely to do so than those on placebo and 167 percent more likely to improve by a clinically significant 3.5 points on ADCS-ADL scores. Since around 65 percent in both groups were on Alzheimer’s medications, this is one indirect indication that blarcamesine is more effective than the standard of care. Previous data helps to confirm this. At six months, 20 percent of patients on Aricept improved by an ADAS-Cog score by 4 points or more, in Anavex’s phase 2a trial 33 percent of patients in the medium and high concentration groups (4 out of 12 at 57 weeks) improved by an ADAS-cog score of 4 points or more, and 66 percent in the high concentration group (four out of six) improved by an ADAS-Cog score of 4 points or more (Anavex used MMSE scores in the phase 2a trial; a one-point change in MMSE scores equates to about a two-point change in ADAS-Cog scores) (charts on pp. 23, 29). At 57 weeks, the high concentration group improved by a mean 2 MMSE points, at 70 weeks they improved by a mean of 3 MMSE points, and at 148 weeks they declined by a mean of around 1 MMSE point.

Some points of note regarding this. No one in the medium concentration group improved at 57 weeks, so pooling medium and high dose numbers in the phase 2b/3 trial likely diluted the drug’s effects. On the other hand, excluding sigma-1 receptor variants from treatment effects in the larger trial improved results. If around half the population with early Alzheimer’s disease improves cognitively at around a year, and they remained nearly stable for three years, that marks a major breakthrough in the treatment of early Alzheimer’s disease.

In regards to safety, Anavex has stated that most of the side effects have been either mild or moderate, with dizziness and confused state being the most common. These side effects led to 17 dropouts out of 37 in total in the drug group (out of 338 participants). In the conference call, Anavex largely did not address the severity or timing of these side effects. The company suggested that the problem of dizziness was usually mild and might be avoided by taking the drug before bedtime. For confusion, this was at least sometimes resolved by down-titration of the drug. More details are needed on whether anyone else dropped out of the trial due to rare side effects (whether related or unrelated to the drug) and what those side effects were.

What seems abundantly clear, though, is that no one died from blarcamesine, and unlike most anti-amyloid drugs there were no problems with brain swelling or brain bleeds. The great irony behind Eisai Co., Ltd. (OTCPK:ESALY) and Biogen’s (BIIB) drugs is that they only slow the progression of the disease in APOE4 carriers, but these are the patients most likely to have severe and even fatal reactions to the drug (Ban2401/lecanemab: table 16, aducanumab: p. 58/12). Blarcamesine is both far safer than most anti-amyloid drugs and much more effective, at least at the highest dose.

Going by the Science

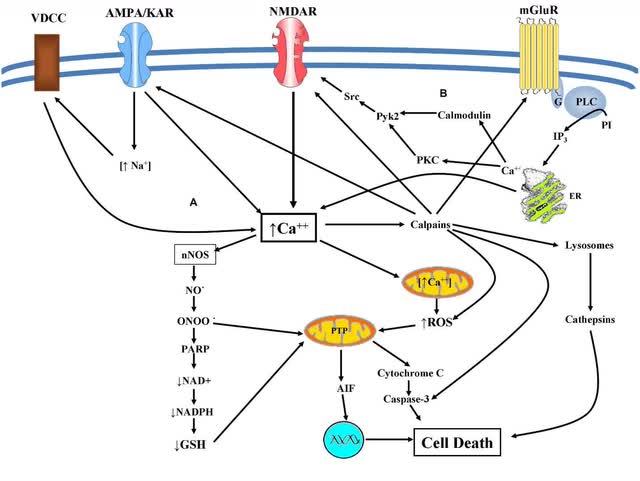

Blarcamesine is a sigma-1 receptor agonist. Sigma-1 receptor agonists inhibit the release of intracellular calcium into the cytosol. This limits oxidative stress, nitrosative stress, neuroinflammation, and mitochondrial dysfunction in early Alzheimer’s disease and likely in a number of other neurological diseases and conditions.

Pathways in Neurological Diseases (Frontiers in Cellular Neuroscience)

As Alzheimer’s progresses, calcium influx rather than calcium release from the endoplasmic reticulum becomes the major problem. To a certain extent, sigma-1 receptors may limit calcium influx. Blarcamesine, a tetrahydrofuran derivative, potentially is also a peroxynitrite scavenger (ONOO-), which may at least partially explain why it is more effective than the sigma-1 receptor agonist Aricept at the highest dose. But as the disease progresses, some of the enzymes and receptor types on the right side of the chart are damaged by oxidation and nitration (g protein-coupled receptors and protein kinase C, for instance), so the primary function of sigma-1 receptor agonists in terms of treating Alzheimer’s disease is lost.

Anavex’s next clinical trial results will be for pediatric Rett syndrome, which is part of the autism spectrum disorder. Many of the same routes as displayed in the chart above lead to Rett syndrome. Especially for pediatric Rett’s, then, one should expect good results from Anavex. Beyond that, the severity of the disease state may in part determine when blarcamesine could best help in the treatment of a variety of neurological diseases and conditions.

What Will the FDA Do?

The FDA does consider the results of clinical trials run outside of the United States if meeting certain criteria, and it may accept results from clinical trials with as low as 300 participants (Anavex is cutting it very close if you remove the 30mg group). Whether it will do so in the case of blarcamesine is very difficult to predict. The out route for them would be to approve the drug which would be the best currently available treatment of Alzheimer’s disease but require further confirmatory trials. Separate from this, regulatory agencies in other countries such as Australia and Canada, potentially could grant approval to blarcamesine, with or without additional confirmatory trials.

Challenges and Outlook

Anavex would face some difficult decisions if it needs to run another phase 3 clinical trial without the ability to sell blarcamesine. The company still has $149.2 million cash or cash equivalents on hand, which would be enough to run another phase 3 clinical trial for Alzheimer’s disease (financial information). There is a potential for a partnership of some kind, but big pharmaceutical companies in the Alzheimer’s field have either given up on finding a treatment altogether or keep plowing ahead with anti-amyloid treatments.

In the short term, the best thing the company could do would be to release the data for the 50mg group. This may take time, as several participants were either titrated up or more often titrated down during the course of the trial to address tolerability issues. That is why the 30mg and 50mg groups were pooled. In the meantime, Anavex could give the number of participants who improved on either dose, but if almost no one improved on the low dose and 100 people on the high dose improved, the pooled number does not look very impressive. The risk for investors in the long-term is not so much the initial criticisms, some of which have already been refuted by the company (such as the math “error”) or by the results themselves, but if the data is convincing enough for the FDA to grant some form of approval. Anavex keeps repeating that phase 2b/3 results are consistent with phase 2a results and that further data will be even better. They, I believe, are right on both points. So the FDA’s decision really comes down to the points I discussed above (size of the trial and no U.S. sites).

It has taken seven years for Anavex to get to this point, with a very methodical and low-profile CEO in Christopher Missling, a small dedicated team, and very loyal investors. Certainly, there have been some missteps along the way, but Missling has delivered a drug that can lead to improvement in some early Alzheimer’s disease patients and which may help to treat at least a few other neurological diseases and conditions as well.

So far, the AVXL news has not been widely embraced in a field that has been for years dominated by the amyloid hypothesis for Alzheimer’s disease, but for some, at least, that could change once the current data is objectively reviewed and additional results are released. The temporary pullback in Anavex Life Sciences Corp. stock value may be reversed soon, if either or both of these occur. A positive FDA decision, though, would be the game changer.

Be the first to comment