Jae Young Ju

In the past few months, Wolfspeed (WOLF) has been sucking all the air out of the room with its PR promotions about the construction of its $1 billion silicon carbide chip facility housed at the 450-acre Marcy Nanocenter and is the site’s first tenant over two and a half years after breaking ground.

Completed in April 2022, WOLF was granted $650 million in state subsidies to open the 200-millimeter power-electronics chip-making plant. Creating about 600 jobs in the region, that comes to $1 million per job in subsidies.

In a March 17, 2022, Seeking Alpha article entitled “II-VI: Eyes On Carbide Automotive Chip Market As Semiconductor Shortage Ends,” I noted that the SiC inverter market for EVs between 2021 and 2030 could exhibit a CAGR (compound annual growth rate) of 56% compared to just 25% for EV growth.

In the past five months since I wrote that article, WOLF raised to bar on August 17, 2022 during its F4Q earnings call reporting revenue of $228.5M (+56.7% YoY), beating by $20.92M. For its first quarter of fiscal 2023, Wolfspeed targets revenue in a range of $232.5 million to $247.5 million ($231.84M consensus).

Meanwhile, II-VI (NASDAQ:IIVI) was working to get its planned purchase of Coherent (COHR) approved from China’s antitrust regulator. That finally happened on June 28, 2022, after several extensions.

However, in a multitasking windfall, II-VI was able to secure a multi-year contract to supply Infineon Technologies AG (OTCQX:IFNNY) with 150 mm silicon carbide (“SiC”) substrates for power electronics on Aug. 23, 2022.

Just a week earlier, II-VI announced that it closed an $100 million-plus contract to supply Dongguan Tianyu Semiconductor Technology Co., Ltd., with 150 mm silicon carbide substrates to be delivered beginning this quarter and through the end of calendar year 2023. Tianyu is one of China’s first and largest SiC epitaxial wafer manufacturers.

Anticipating SiC Demand

As I discussed in my March 17 SA article, II-VI announced in March 2022 that it’s accelerating its investment in 150 mm and 200 mm SiC substrate manufacturing with a large-scale factory expansion at its nearly 300,000 square foot factory in Easton, Pa. With this expansion, II-VI will reach the equivalent of 1 million 150 mm substrates annually by 2027, with the proportion of 200 mm substrates growing over time.

In addition, to meet the market demand in Asia, II-VI established in 2021 a back-end processing line for SiC substrates, in over 50,000 sq. ft. of new cleanroom space, at II-VI’s Asia Regional Headquarters in Fuzhou, China. Tianyu will benefit from II-VI’s 150 mm SiC global production capacity in both the U.S. and in China.

Significance of the Infineon Agreement

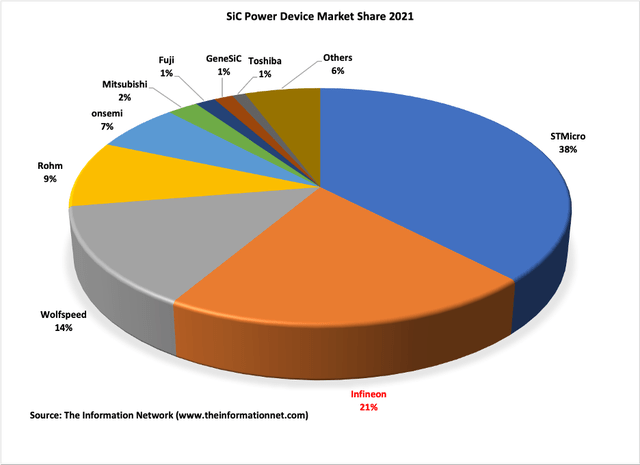

According to our report entitled “Power Semiconductors: Markets, Materials and Technologies,” Infineon held a 21% share of the $1.2 billion SiC Power Device Market in 2021. Infineon was behind market leader ST Microelectronics (STM) and ahead of Wolfspeed, as shown in Chart 1.

Chart 1

Infineon is a pioneer in the commercial use of Silicon Carbide technology as SiC based diodes were introduced in the market in 2001 followed by the worldwide first commercial power modules containing SiC components in 2006. Meanwhile the fifth generation of such parts is available as discrete devices. In power modules, Infineon offers solutions based or empowered by SiC mainly for solar applications and selected motor drive applications.

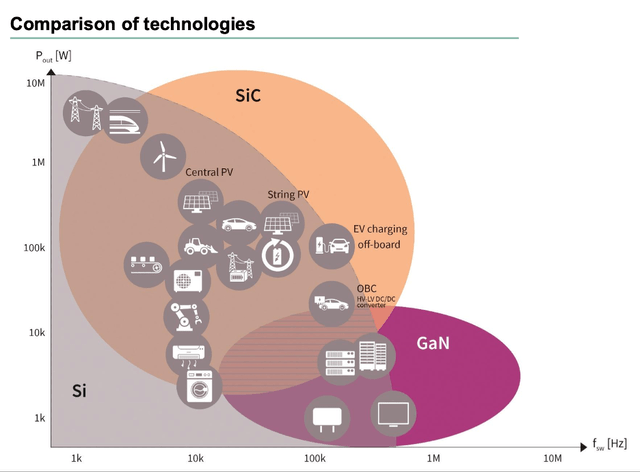

Chart 2 illustrates Infineon’s application portfolio for SiC power devices. Keep in mind that II-VI’s agreement with Infineon is for SiC substrates for power devices, not limited to only automotive applications.

Chart 2

Infineon sells SiC MOSFETs and other power devices to more than 3,000 customers today, including Delta Electronics, Hyundai, Schneider Electric, and Siemens. They’re building them into electric vehicles, motor drives, solar inverters, and industrial-grade switch-mode power supplies (SMPS) that demand up to tens of thousands of watts.

Significance of the Dongguan Tianyu Semiconductor Technology Agreement

“Dongguan Tianyu Semiconductor Technology, TYSiC, has the largest installed base of CVD reactors in China. The monthly production capacity is 5000 pieces. With the state-of-the-art epitaxy capability and most advanced test and characterization equipment, we provide cutting edge customized product solutions of both n-type and p-type dopants epi-wafers for customers in the globe who fabricate Schottky Diodes, JFETs, BJTs, MOSFETs, GTOs and IGBTs.” – Source TYSiC

Market Demand for SiC Wafers

Power devices based on SiC also lose less power to heat, opening the door to more compact and lightweight heatsinks. Altogether, these attributes translate into cost savings at the system level.

Infineon has previously stated that SiC can help boost the range of electric vehicles on a single charge by 5% to 10%, or give auto makers the ability to use smaller, lighter, and less costly batteries.

SiC devices are competing for around 80% of the power electronics at the heart of the powertrain in electric vehicles, including the main traction inverter that converts direct current stored in the car’s battery pack into alternating current and feeds it to the electric motor turning the wheels.

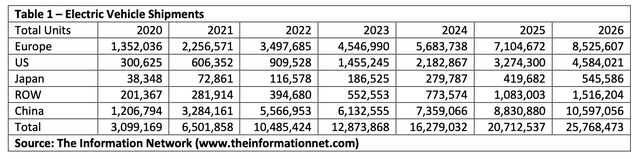

According to our report entitled “Global and China EV Batteries and Materials: Technology, Trends and Market Forecasts,” the EV market will grow significantly between 2020 and 2026. As shown in Table 1, the total EV market is expected to grow nearly 4X between 2021 and 2026. The European Market is projected to grow nearly 4X as well. Although Infineon is a European company, its customer base is global.

The Chinese market is projected to grow more than 3X, but it will remain the largest market, with more than 10 million EVs sold (BEV and PHEV). This is a benefit of II-VI’s agreement with China’s Dongguan Tianyu Semiconductor Technology.

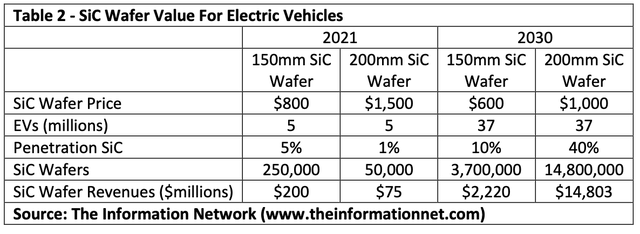

Table 2 shows that SiC wafer revenues were $200 million for 150mm wafers and $75 million for 200mm wafers in 2021. These figures are based on penetration rates for SiC of just 5% for 150mm and 1% for 200mm.

In 2030, the penetration rate of 150mm SiC wafers will be 10%, although penetration will reach a peak in 2026 before decreasing. The penetration rate of 200mm SiC wafers will increase continuously growing to 40% in 2030.

The benefits of 200mm wafers are obvious. The introduction of 200 mm substrates brings down the overall device cost because of the ability to make more chips than on a 150 mm for practically the same production cost. Also, fully depreciated 200 mm surplus silicon processing equipment from the migration of the silicon-chip industry to 300mm wafers are now available for SiC production.

This analysis is for SiC Inverters only and does not include on-board chargers and charging pumps.

Based on these parameters, 150mm SiC wafer revenues will reach $2.2 billion in 2030, but revenues of 200mm SiC wafers will reach $14.8 billion.

The tailwinds for II-VI are its being first-to-market for 200mm wafers, large current capacity, and the $1 billion in planned SiC investments, all discussed above.

Investor Takeaway

II-VI is scheduled to announce FQ4 earnings results on Wednesday, Aug. 24, 2022, and I plan to analyze performance following the call. But my most recent previous article on II-VI addressed its SiC. The monumental announcement today of IIVI supplying market leader INFFY with SiC wafers was a catalyst for this article.

Indeed, IIVI also is focusing on the industry, announcing back in December 2021 that starting in March 2022 the company would be accelerating its investment in 150 mm and 200 mm silicon carbide substrate and epitaxial wafer manufacturing with large-scale factory expansions in Easton, Pa., and Kista, Sweden. This is part of the company’s previously announced $1 billion investment in SiC over the next 10 years.

Historically, Infineon has had strong momentum in SiC wafers for various applications and has a 21% share of the $1.2 billion market. As validation of the tailwinds for SiC the IIVI agreement will provide Infineon with more capacity, even though it has previously made significant agreements with other SiC wafer suppliers.

- In 2018, Infineon acquired Silectra to internally source SiC wafers.

- In 2018, Infineon signed a $100 million SiC wafer supply agreement with Wolfspeed. As WOLF ramps its own internal SiC chip production, I suspect this deal is in jeopardy.

- In 2020, GTAT agreed to supply Infineon with SiC boules. GT Advanced is now owned by onsemi, which makes SiC chips, and I suspect the previous deal is also in jeopardy.

IIVI is taking advantage of additional need for SiC wafers from Infineon as existing wafer suppliers, competitors of IIVI, require more internal supply and discontinue their supply agreements with Infineon. With the anticipated strong growth of SiC chips, as discussed above for EV only, I anticipate this IIVI-INFFY agreement is just the start of an expanded supply chain agreement.

Be the first to comment