jir

Thesis

Leading payments technology company Mastercard‘s (NYSE:MA) stock has been somewhat of an enigma for investors. Despite its wide competitive moat and robust profitability, MA has struggled to gain upward momentum since staging its highs in April 2021. MA attempted to re-test that high again in February 2022, but sellers rejected its buying upside decisively.

We believe MA’s sluggishness over the past 15 months is justified. The post-COVID surge sent it into well-overvalued zones in 2021. Therefore, the market needs a distribution zone to digest MA’s remarkable recovery while allowing the company to prove the robustness of its execution over time.

Our analysis suggests that MA’s growth premium has been digested significantly. Moreover, the improvement in its valuation proves the competitiveness and solid profitability of its business model. Therefore, we believe the secular growth drivers underpinning Mastercard’s highly-diversified business remains intact.

We postulate that MA seems well-balanced heading into a potential recession, which could weaken consumer discretionary spending further. As a result, we require a steeper discount to its current valuation to further de-risk its execution risks through the cycle.

MA’s price action has also moved into a critical juncture on its long-term chart. Given the distribution, it has already lost its medium-term bullish bias but is still supported above its long-term moving averages. We also gleaned that a potential bullish reversal could occur over the next couple of months if buying support returns to deny further selling downside.

Therefore, we believe it’s appropriate to reiterate our Hold rating, giving more allowance for Mastercard to prove its execution through the coming recession.

MA Stock’s Valuation Is More Well-Balanced Now

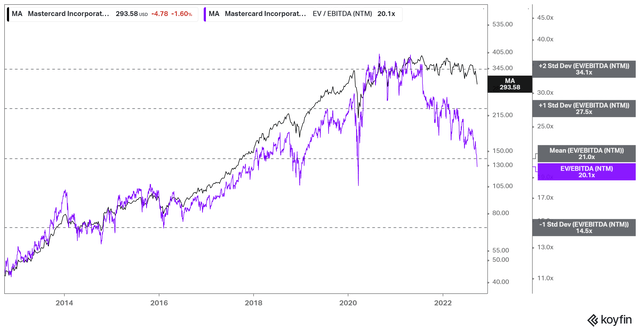

MA NTM EBITDA multiples valuation trend (koyfin)

As seen above, MA’s remarkable recovery from its March 2020 COVID lows helped send it into overvalued levels in early 2021, at the two standard deviation zone above its 10Y mean.

Therefore, we aren’t surprised that MA has failed to gain upward traction over the past fifteen months, as the market needed to distribute its massive gains. Furthermore, coupled with the normalization of its post-COVID growth, we believe the digestion is justified despite its robust profitability.

However, we assessed that MA is no longer overvalued, as it continues to gain operating leverage. Notably, it has reverted to its 10Y EBITDA multiples mean. However, the market could de-risk MA further to improve its valuation, given the looming recession. Hence, we believe an entry level with an adjusted EBITDA multiple of about 18x may be appropriate, implying a downside of about 10% from the current levels.

It Also Depends On Mastercard’s Execution Through The Recession

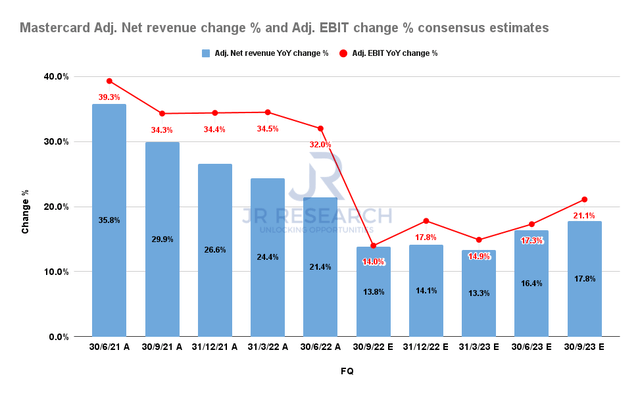

Mastercard Adjusted net revenue change % and Adjusted EBIT change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) are confident that Mastercard’s recovery through the cycle remains intact as its growth normalized from the post-pandemic reopening.

Management’s commentary from its recent conference suggests that Mastercard is cautiously optimistic about the strength of the consumer, despite worsening macro headwinds.

Therefore, the signals are pretty mixed for investors to assess as we need more data to evaluate whether consumer discretionary spending could weaken markedly through the coming recession.

Moreover, a weaker consumer will likely impact its operating leverage, reducing its profitability estimates and affecting its EBITDA multiples. Therefore, we posit that the market could likely de-risk MA’s valuations further to factor in these uncertainties.

Is MA Stock A Buy, Sell, Or Hold?

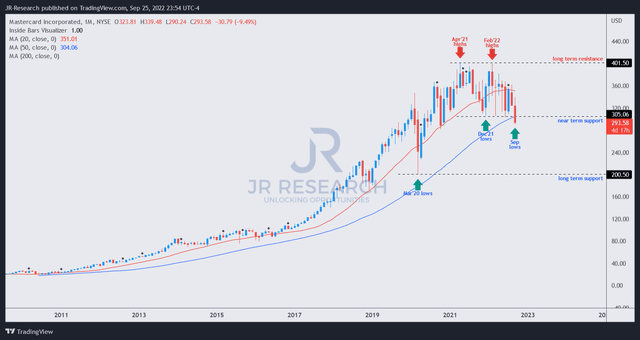

MA price chart (monthly) (TradingView)

MA has faced significant resistance at its long-term resistance zone, as seen in its long-term chart above. That zone also coincides with the overvalued levels discussed in our valuation analysis.

Investors should note that MA is re-testing its near-term support, in line with its 50-month moving average (blue line). Therefore, we deduce that MA is at a critical juncture as it attempts to maintain its long-term uptrend.

However, investors need not get unduly concerned, as MA could still stage a bullish reversal over the next couple of months if the price action proves to be a bear trap (indicating the market denied further selling downside decisively).

As such, we believe it’s appropriate to wait for more constructive price action as MA is still not undervalued as we move closer to a recession.

We reiterate our Hold rating on MA.

Be the first to comment