peterschreiber.media

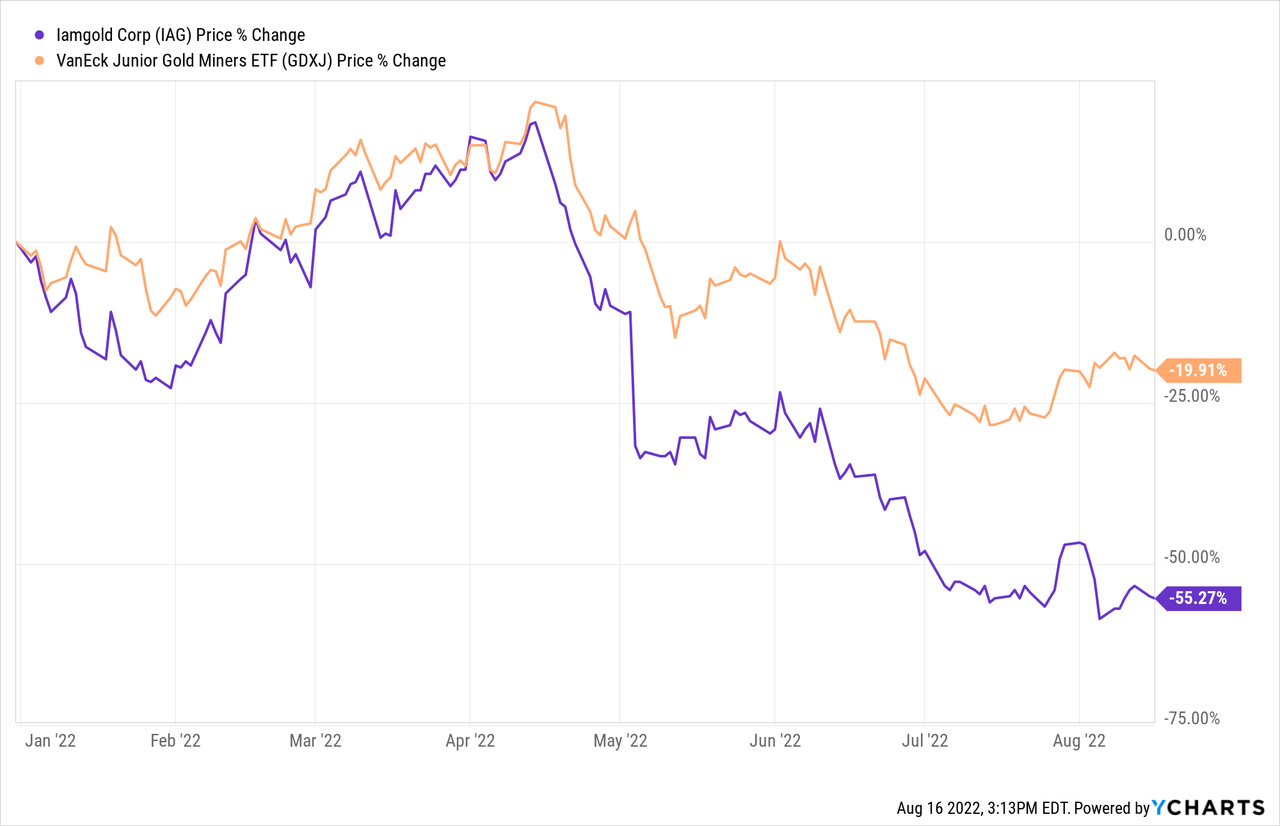

The Cote project was supposed to transform IAMGOLD (NYSE:IAG) from a high-cost gold producer with operations in high-risk jurisdictions into a low-cost gold producer with most of its producing portfolio located in Canada. Two years into mine construction the project has only transformed the company’s balance sheet — from the fortress of yesteryear into today’s slow-motion shipwreck.

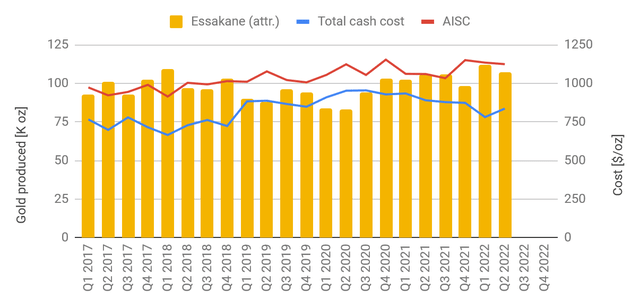

The operating mines have added to the company’s woes with two out of three operations struggling to generate free cash flow. Q2 results have only reinforced our view that IAMGOLD is kept alive by the Essakane mine which has been churning out ~100Koz quarter-in quarter-out at very acceptable cost; however, this mine is located in Burkina Faso’s North where Islamic terrorists pose severe security threats, as evidenced by an assault on a bus convoy taking workers to the mine site in October 2021 and plenty of similar incidents in the area over the past few years.

Overall we see IAMGOLD in a precarious situation and we see plenty of potential downside for the already underperforming share price in the near-to-mid-term. Nevertheless, as much as we wouldn’t go anywhere near the common shares of this company, we are still tempted by another avenue to benefit from IAMGOLD’s securities in the current situation.

The Cote Disaster

IAMGOLD is currently building the Cote mine in northeastern Ontario and owns 64.75% of the project with Sumitomo owning most of the balance. When completed this mine will be one of the larger gold mines in Canada with just under half a million ounces of annual production at projected all-in sustaining costs of $854/oz over an 18-year mine life.

When the construction decision was taken in mid-2020 IAMGOLD’s share of initial capex was pegged at ~$900M (using middle-of-the-range numbers). By early 2022 the mine was 49% complete — yet IAMGOLD’s estimated share of the remaining capex had barely budged and stood at $875M. The latest update came with a full technical report and indicated 57% completion; and the projected remaining capex attributable to IAMGOLD had risen to a whopping $1,335M.

The NPV(5%) on the other hand has been almost halved from $2B in 2020 to $1.1B to date ($715M attributable to IAMGOLD) — and that’s ignoring the capital that has been spent during this two year period. In fact, if we are honest and consider IAMGOLD’s sunk costs so far (all of $1.35B according to the Q2 books) then the NPV(5%) works out to a negative $-620M. And of course, if we continue to look at the numbers honestly, we will also note that the already meager 13.5% IRR turns distinctly negative as well once we account for sunk costs.

No matter how we look at the Cote project — it has turned into a nightmare for investors, and it will require a major financial effort to complete. And unfortunately, there is very little reason to believe that the three operating mines will generate the means to support this completion.

Q2 Review

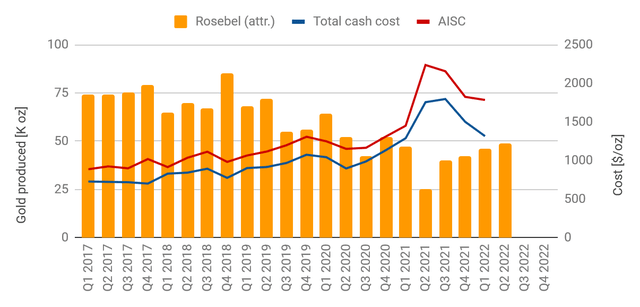

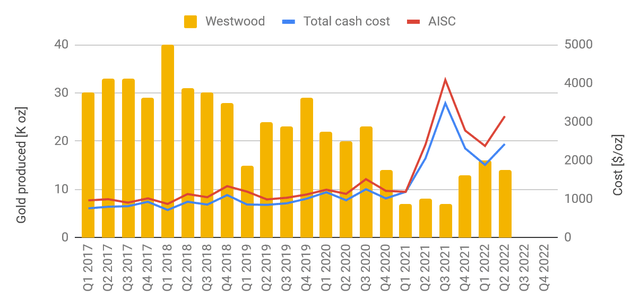

IAMGOLD operates three gold mines: the Essakane mine in Burkina Faso, the Rosebel mine in Suriname, and the Westwood mine in Canada. The following three charts illustrate gold output and all-in-sustaining costs for these three mines. These charts also illustrate our comment above: Essakane has been a reliable operation in terms of output as well as cost control; unlike Rosebel and Westwood where output has declined and costs have exploded well above the gold price due to numerous challenges.

Essakane production profile (Company filings, author’s data base)

Rosebel production profile (Company filings, author’s data base)

Westwood production profile (Company filings, author’s data base)

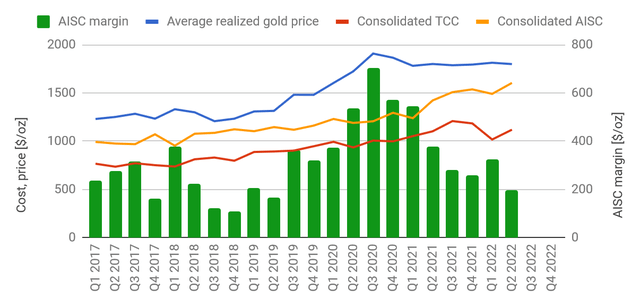

Essakane accounts for around two thirds of the company’s total gold output (up from 50% five years ago) and generates solid free cash flows in the current gold price environment. Unfortunately, the same does not hold true for the other two mines. The astronomical cost profiles at Westwood as well as Rosebel have dragged consolidated margins down as illustrated by the green bars in the chart below. In fact, in Q2 the company made less money per ounce than in Q2 2017, even though the realized gold price has increased by $560/oz during this time.

Margins (Company filings, author’s data base)

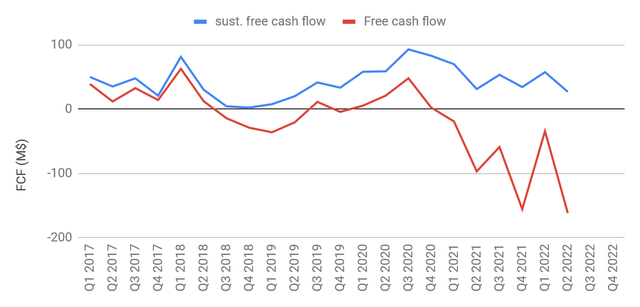

Shrinking margins are reflected again in the next chart showing free cash which has turned deep red thanks to capital spending for the Cote project; but even if we net out growth capital (blue line in the chart below) the company’s ability to generate free cash flow leaves a lot to be desired. In fact, at the current run rate of well below $200M per year, the sustaining free cash flow hardly matters in the face of the ballooning capital requirements documented in the latest technical report for the Cote mine.

FCF (Company filings, author’s data base)

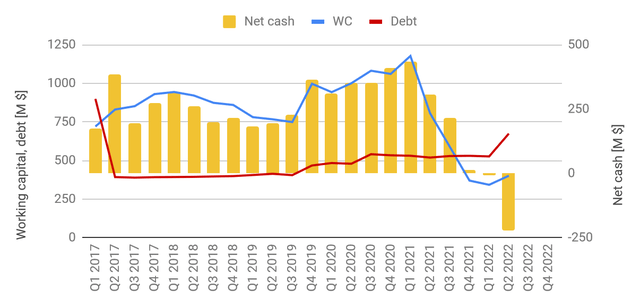

Several quarters of negative free cash flow have left their mark on the balance sheet. Working capital stood at $400M at the end of Q2, down from $1B at the end of 2019, and the formerly ubiquitous net cash position has turned into net debt for the first time in many years.

Balance sheet (Company filings, author’s data base)

Where To From Here

Had everything gone according to plan, then today’s balance sheet reflects approximately how it should have looked at the end of the Cote mine construction. Alas, things have taken a different turn, and IAMGOLD will need additional capital to the tune of $1.3+B over the next couple of years to complete the Cote mine — that’s presuming everything will go according to the latest plan.

IAMGOLD still has $350M available for draw-down on its credit facility, and Essakane should also generate a similar amount during this time (as long as security risks do not manifest themselves). Plus there is still some wiggle room on the balance sheet. Nevertheless, the back of our trusted envelop estimates show a shortfall of roughly $600M — and that’s already assuming improvements at Westwood and Rosebel, and no further challenges at Cote.

We submit this shortfall is manageable, but not without some painful decisions. Management has already alluded to “actively pursue various alternatives to increase liquidity to deliver Côté on its updated schedule” and that will most likely result in an asset sale, with Rosebel as the most likely candidate (will Newmont (NEM) show interest given the proximity of the major’s Merian operations?). And on top of that we would expect a mixture of debt and equity to be issued in due time.

Summary & Investment Thesis

IAMGOLD will need to raise around $600M in order to complete construction of the Cote mine. The company is still in sufficient shape to achieve its goals, but not without some significant sacrifices. These sacrifices will most likely result in a reduced portfolio, shareholder dilution, and increased debt. None of these options are good news for the share price, and combined with the reported challenges at two of the three operating mines are all designed to put further pressure on the company’s share price in the near-to-mid-term. As a result we are decidedly bearish with regards to the company’s common shares.

However, if one presumes that current challenges can be overcome and the Cote mine will eventually go into production, then there is an alternative way to invest in IAMGOLD’s securities. The company has issued $450M of Senior Notes with an interest rate of 5.75% per annum due in October 2028. Last we looked these notes were trading for 60c on the Dollar. That’s close to a 10% yield on the current cost base, plus 67% in capital gains on maturity.

IAMGOLD as a company will most likely continue to struggle, and the share price will most likely reflect these struggles for some time to come. However, at this point we believe that IAMGOLD will continue as a going concern, and it will eventually emerge from its present tribulations, scathed but not beyond repair. We therefore deem the company’s debt as a relatively low-risk investment, at least when compared to its common shares. And we sure like the rewards associated with this low-risk investment as outlined above. As a result we are bullish IAMGOLD Senior Notes.

Be the first to comment