anusorn nakdee

Amyris’ (NASDAQ:AMRS) woes continue as growth disappointed to the downside and expenses have remained elevated in the most recent quarter. Management also significantly reduced guidance, which has been attributed to reduced investment in new brands rather than weak demand. Reckless spending over the past 18 months and a failure to improve the balance sheet or secure financing when macro conditions were more favorable have left Amyris with few options. If a molecule licensing deal is not finalized in the next few months an equity raise or asset sale becomes likely.

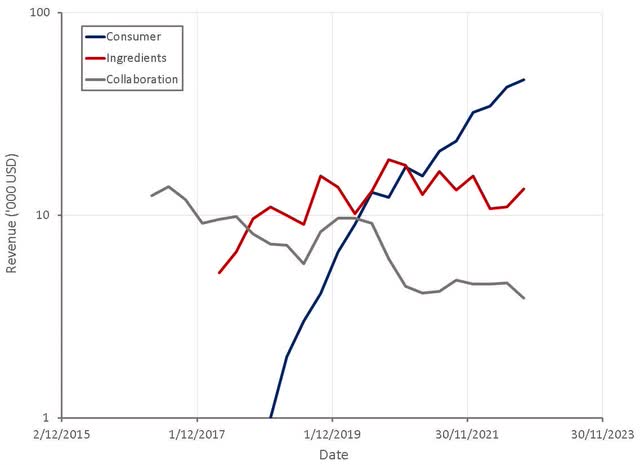

Consumer revenue growth was reasonably robust in the third quarter, although may be beginning to plateau. DTC consumer revenue was about as expected, but retail revenue disappointed, most likely due to a slower than expected introduction of new doors. Collaboration revenue continues to decline as Amyris shifts the focus of their business model to consumer brands and molecule licensing.

Amyris expect to be producing 5 ingredients at Barra Bonita in the fourth quarter. Ingredients demand continues to outstrip Amyris’ ability to supply and they are still working through a backlog of orders. As a result, ingredients revenue is expected to step up in the fourth quarter, with CEO Melo mentioning growth of over 50%. It is not clear if this is YoY or QoQ though.

Management lowered revenue guidance significantly and attributed this to smaller investments in Stripes and Ecofabulous, with capital being directed to currently profitable brands. I think this is an admission that a lack of cash is now dictating the company’s behavior.

Longer term, management pointed towards a goal of at least 1 billion USD revenue in 2025, excluding molecule transactions, although Melo also suggested revenue might be more like 1.5-1.7 billion USD. This is still a sizeable step down from a prior target of 2 billion USD.

Figure 1: Amyris Revenue (source: Created by author using data from Amyris)

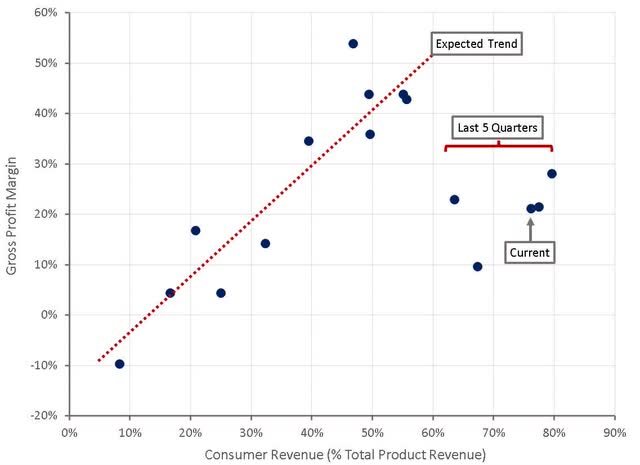

Gross margins were poor despite a reduction in electricity prices in Europe, the start-up of Barra Bonita and a reduction in freight rates, although this was not that surprising for a number of reasons. Increased ingredient revenue was a drag on product gross margins, and it appears likely that Spain remains an important and expensive source of ingredient production. The impact of Barra Bonita on costs is not currently clear. While management have suggested that unit costs are significantly lower, the facility is only currently operating at partial capacity, which may be negatively impacting costs.

Consumer gross margins continued to deteriorate and are now just under 60%. This could be due to cost inflation, distribution channel mix and / or product mix. Management stated that they continue to bear significant air freight costs for components from China. It is baffling that this continues to be an issue after 12 months. Consumer revenue has fallen short of management’s expectations and yet they are still air freighting components to meet demand, despite supposedly building inventory in previous quarters to avoid this issue.

Figure 2: Amyris Gross Profit Margins (with smoothed transaction revenue) (source: Created by author using data from Amyris)

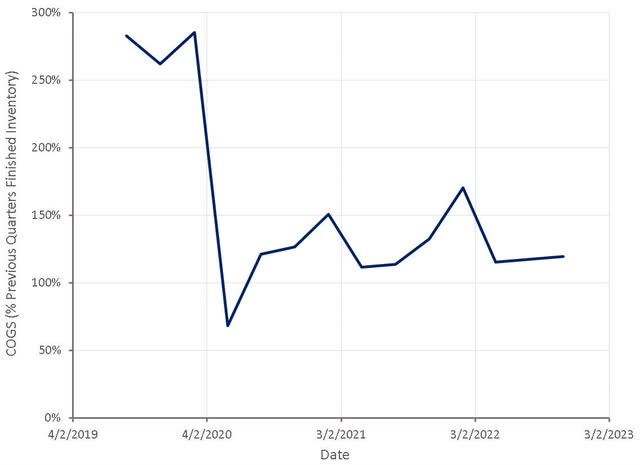

Along with Barra Bonita and the insourcing of consumer production, Amyris is also working on reducing packaging costs. Management has pointed towards a 50% reduction in Biossance unit COGS from packaging changes and insourcing production. The impact of these initiatives may not have been felt in the third quarter because they were only partially complete and because any improvements in costs may need to flow through inventory before showing up in COGS. Amyris uses a weighted-average basis for ingredients inventory, but I am unable to find information on their accounting method for consumer products. If FIFO is used, COGS in the third quarter are more likely to reflect costs from the second quarter, as Amyris has been carrying close to a quarter’s worth of finished inventory.

Figure 3: COGS (% Previous Quarters Finished Inventory) (source: Created by author using data from Amyris)

If this is the case, Amyris’ gross profit margins could begin to improve in the fourth quarter as lower cost inventory flows through the income statement. A number of input costs have fallen significantly (freight, electricity) and this should be easing cost pressures. It is not clear how long it will take for this to show up in the financial statements though. For example, Amyris may have contracts for some items, or may be paying spot rates. So far, Amyris’ gross profit margins remain far below where they should be based on the current product revenue mix.

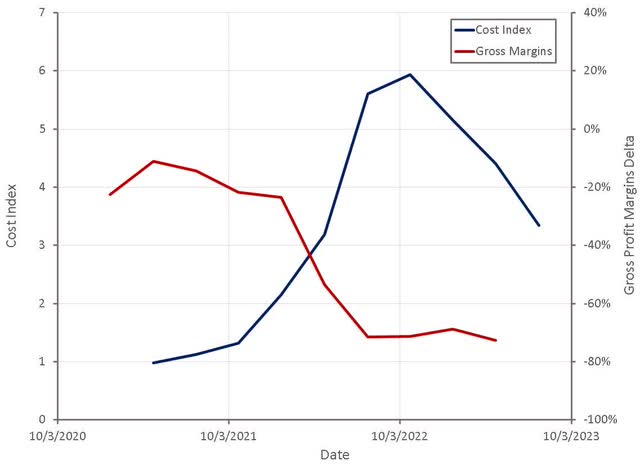

Figure 4: Amyris Costs and Gross Margins Relative to Expectation Based on Product Mix (source: Created by author using data from Amyris and The Federal Reserve)

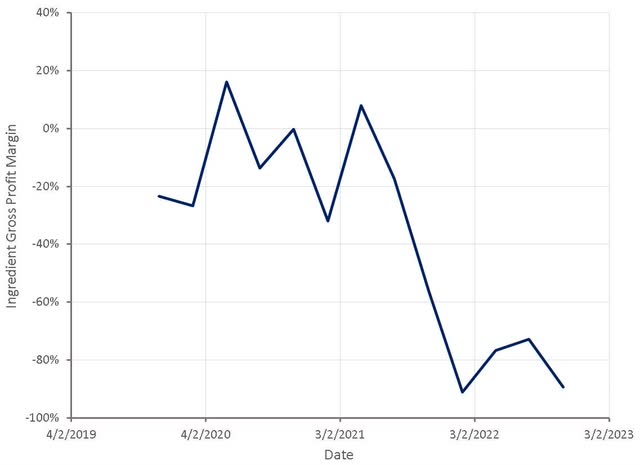

Ingredient gross margins appear to have declined again in the third quarter, which is somewhat surprising. The deterioration in margins also occurred on the back of price increases that were implemented for select ingredients on July 1st. Electricity prices in Spain appear to have been lower in the third quarter, and some of Amyris’ production was coming from the relatively low-cost Barra Bonita facility. It is unknown how production was split between Barra Bonita and CMOs, but management suggested that higher ingredient costs were due to unfavorable contract manufacturing unit economics. The economics of Barra Bonita may also not be particularly attractive until the facility is operating at capacity. Management also stated that air freight was necessary for some ingredient intermediate products.

Figure 5: Amyris Ingredient Gross Margins (source: Created by author using data from Amyris)

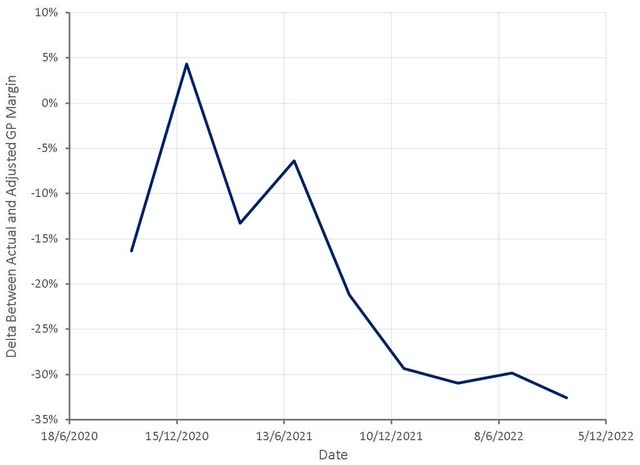

Management expects freight and logistic expenses to decline as they transition fermentation to Barra Bonita and component sourcing and consumer manufacturing to Brazil. The wording of their statements seems to suggest that freight costs will remain above normal in the fourth quarter though, even if they do decline significantly. The difference between Amyris’ GAAP gross margins and adjusted gross margins is currently largely due to freight costs, and the difference between the two remains at extreme levels.

Figure 6: Difference Between Actual and Adjusted Gross Margins (source: Created by author using data from Amyris)

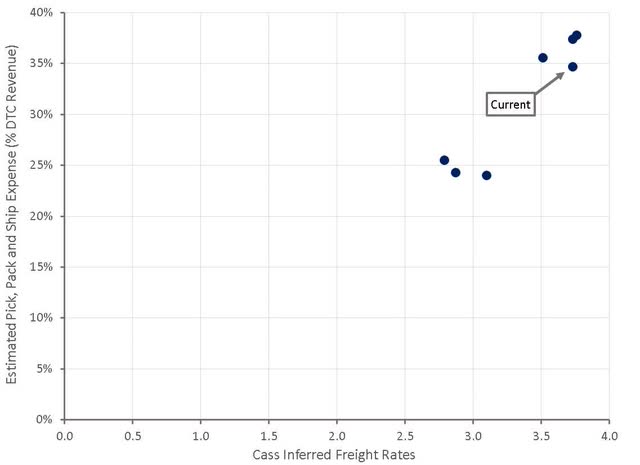

Shipping and handling also continues to be a problem, with pick, pack and ship costs increasing by 5 million versus the same quarter last year. Amyris has implemented changes with their 3PL providers and parcel service to obtain better rates and a more suitable service model. Amyris expects these efforts to reduce shipping and handling expenses by 30%. Shipping and handling costs are probably double what they should be though, and even with a 30% reduction, shipping and handling expenses will still be too high.

Figure 7: Estimated Amyris Shipping and Handling Expenses (source: Created by author using data from Amyris and Cass)

Amyris is currently trying to cut marketing expenses by reducing the number of agencies and more heavily leveraging micro and nano influencers. Management suggested that they realized 7.7 million USD in cost savings (17% of consumer revenue) in the third quarter based on these actions. Amyris’ approach relies on identifying like-minded online communities and targeting them using micro / nano influencers at the center of the community. This approach yielded a 3-4x increase in sales for OndaBeauty.com with minimal costs. While this is impressive, the approach probably won’t scale. Influencers are likely to follow a Pareto distribution. A small number of influencers can probably drive a significant increase in sales but beyond these influencers the return on spend is likely to decline significantly.

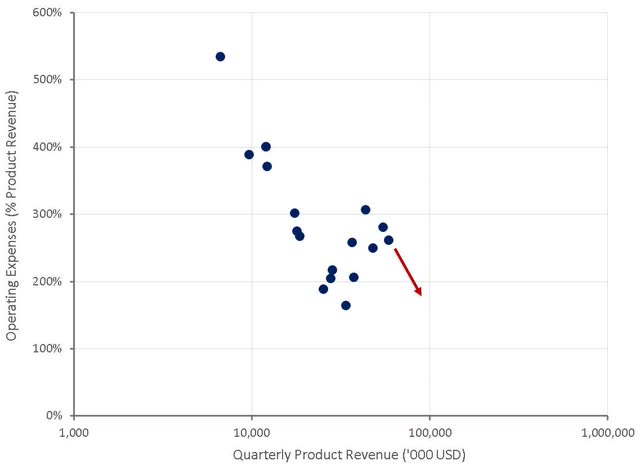

Amyris’ operating expenses have begun to plateau somewhat, and as a result the company is now realizing some operating leverage. This trend should continue in coming quarters, provided that revenue growth remains robust.

Amyris suggested a target 10% operating income margin in the fourth quarter of 2023, based on 200 million USD revenue. This would require operating expenses in the vicinity of 100 million USD, which is not feasible. Operating margins at this point are still likely to be negative 10-20%.

Figure 8: Amyris Operating Expenses (source: Created by author using data from Amyris)

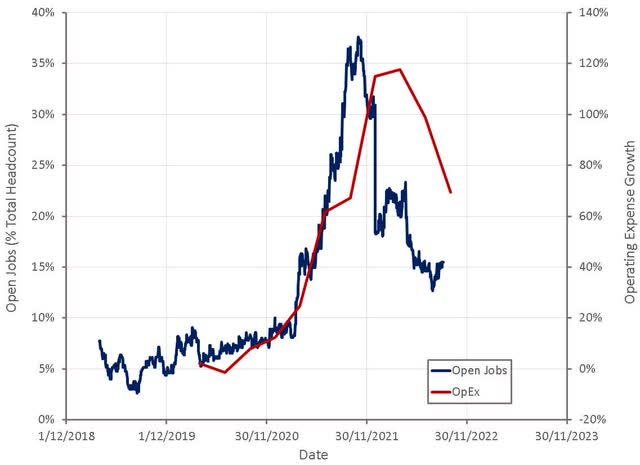

Absent a large reduction in headcount, revenue growth is Amyris’ only viable path to profitability, and this continues to be a long-way off. Based on job openings, it appears Amyris does not even have plans to reduce hiring, let alone cut headcount.

Figure 9: Amyris Job Openings and Operating Expense Growth (source: Created by author using data from Amyris and Revealera.com)

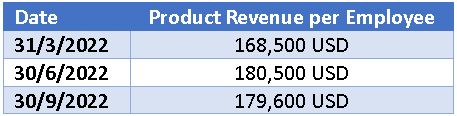

Based on product revenue per employee, Amyris’ headcount is too large for their revenue base. If management is expecting lower growth, it would seem prudent to begin right sizing the company. The company’s lack of cost control is exemplified by general and administrative expenses, which increased by 10 million USD over the past year (14% of total revenue and 43% of the increase in revenue).

Table 1: Amyris Product Revenue per Employee (source: Created by author using data from Amyris)

Amyris’ cash runway likely only extends to the end of 2022 / early 2023, making the finalization of a molecule licensing transaction before then crucial. Amyris stated that they are confident the deal will close by year-end, although the timing of any cash transfer is unclear and also important. The deal is reportedly pending approval by the boards of each company, which is expected in the coming weeks. The deal is expected to generate over 500 million USD with 350 million USD cash upfront. Amyris are also supposedly well into negotiations for their next deal, which would occur sometime in 2023. There appears to be an increased focused on licensing deals, with management suggesting these would occur annually for the next 3-4 years. This may be a recognition that Amyris still needs access to a large amount of cash to achieve profitability and that outside financing is not currently a viable option.

Conclusion

While Amyris’ third quarter results were bad, they were not that surprising. Revenue growth was slightly disappointing, as was management’s guidance, but this a reflection of the current macro environment. Costs are likely improving, but still working their way through to the income statement. High freight costs, ingredient COGS, shipping and handling expenses and staffing levels are the most pressing concerns. The molecule licensing deal is now crucial, but even with this Amyris has a short runway to sort their issues out.

Be the first to comment