alfexe/iStock via Getty Images

Introduction

Following years of sporadic shareholder returns, it seemed that Barrick Gold (NYSE:GOLD) entered 2022 ready to mark a change for the better in this otherwise concerning era of war and inflation, as my previous article highlighted. Since being published, to the delight of their shareholders, their dividends doubled as they implemented a new shareholder returns policy that if continued, will see a moderate dividend yield of 4.52%. When looking ahead, it appears that more could follow, as discussed within this follow-up analysis that also reviews their subsequently released results for the first quarter of 2022.

Executive Summary & Ratings

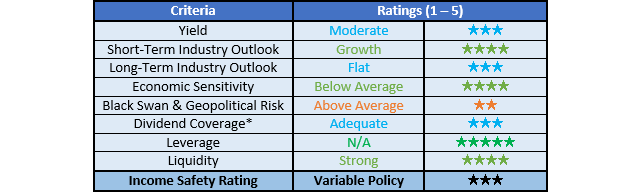

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

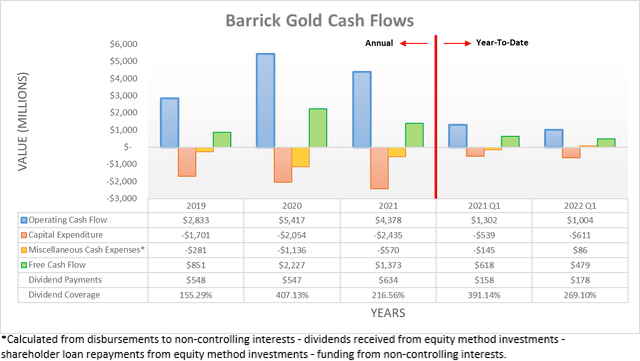

When reviewing their cash flow performance thus far into 2022, initially it seems disappointing to see their operating cash flow down 22.89% year-on-year to $1.004b during the first quarter versus their previous result of $1.302b during the first quarter of 2021. Especially since their realized gold price increased modestly to $1,876 per oz versus $1,777 per oz respectively during these same two periods of time, as per their first quarter of 2022 results announcement. Whilst normally this would be the fault of temporary working capital movements, even removing their build of $131m only lifts their underlying result to $1.135b for the first quarter of 2022 and thus still down 16.54% year-on-year against their equivalent previous result of $1.36b for the first quarter of 2021 that also removes its smaller working capital build of $58m. The majority of their disappointing cash flow performance appears to stem from their gold production decreasing 10.08% year-on-year during the first quarter of 2022 to 0.99m/oz versus their previous result of 1.101m/oz during the first quarter of 2021 but when looking ahead, thankfully this appears to only be a bump in the road, as per the commentary from management included below.

“As expected, production was lower following the record quarter 4 performance driven by the processing of high grade stockpiled ore while the gold strike mill was being repaired. Plans are in place and KPIs are being monitored closely to ensure that the full year guidance will be met.”

-Barrick Gold Q1 2022 Conference Call.

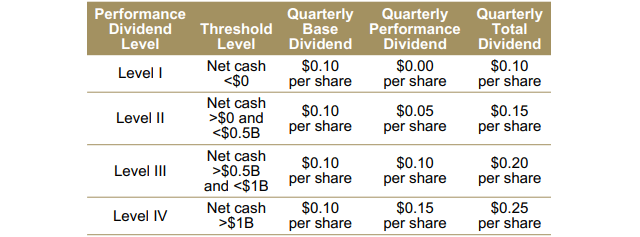

When looking back at their previously linked first quarter of 2022 results announcement, they state gold production guidance for 2022 of 4.4m/oz at the midpoint, which is essentially the same as their production of 4.437m/oz during 2021, as per their fourth quarter of 2021 results announcement. This indicates that the coming quarters should see a large consecutive gold production increase, thereby lifting their cash flow performance, which notwithstanding the inherently volatile nature of gold prices, bodes well to fulfil the potential of their new shareholder returns policy, as the table included below displays.

Barrick Gold First Quarter Of 2022 Results Announcement

It was positive to see their new shareholder returns policy focus on dividends with a quarterly base of $0.10 per share, which is subsequently boosted by a variable performance dividend set at four different levels depending upon their net cash position. Since their net cash position ended the first quarter of 2022 at $743m, as subsequently discussed, this resulted in a level III performance dividend, thereby effectively seeing their total dividends doubled versus earlier in 2022.

Whilst this is already a positive start to what is hopefully an era of higher shareholder returns, there are still reasons why more could follow within the medium-term, unless gold prices unexpectedly plunge. Their quarterly dividend of $0.10 per share cost $178m during the first quarter of 2022 and thus obviously their doubled dividends will cost $356m during the second quarter. Since this is less than the free cash flow of $479m that they generated during this same period of time, it will leave more cash on the table that builds their net cash position higher, thereby lining up an upgrade to their level IV performance dividends in the coming quarters.

Even if they were to pay their level IV performance dividends, thereby seeing a total quarterly dividend of $0.25 per share, these would only cost $445m and thus still less than their free cash flow of $479m from the first quarter of 2022, which as a reminder was weighed down by both temporarily lower production and a $131m working capital build. When looking ahead, this means that unless gold prices unexpectedly plunge, shareholders should at minimum expect to see their total quarterly dividends grow to $0.25 per share as they reach the level IV performance dividend with the possibility to see even more in the coming years if they revise their performance dividends relatively higher to reflect their cash generation. If gold prices rally higher, which as my previously linked article highlighted is a possibility given this era of war and inflation, it would create even more upwards pressure on their dividends at these performance levels.

On a side note before moving onwards, readers may notice that management states their free cash flow was only $393m and thus lower than the $479m calculated within this analysis. This simply differs due to their number excluding the $86m of dividends received from equity method investments net of disbursements to non-controlling interests, which are listed within the miscellaneous cash expenses of my graph included above. Since these two items obviously influence their cash balance and should continue reoccurring as they are operational in nature, I feel their inclusion provides a clearer picture for dividend investors.

When looking elsewhere, there have also been interesting developments on the geopolitical front with four G7 nations banning the import of Russian gold, excluding that already in circulation. On the surface, this may sound immaterial, especially with China and India still both readily buying Russian commodities. Although according to the Observatory of Economic Complexity, the United Kingdom accounted for 90.5% of their gold export destinations during 2020, the latest data available, plus a very significant portion during the preceding years, likely functioning as an intermediary. Since gold is very desirable across every corner of the globe, they will likely be able to reroute trade but generally speaking, this often still causes losses via lower efficiency, added costs and logistical delays given its extreme value. Unfortunately, it remains to be seen exactly how much this ultimately impacts gold supply and thus prices globally but suffice to say that it can only help gold miners located outside of Russia.

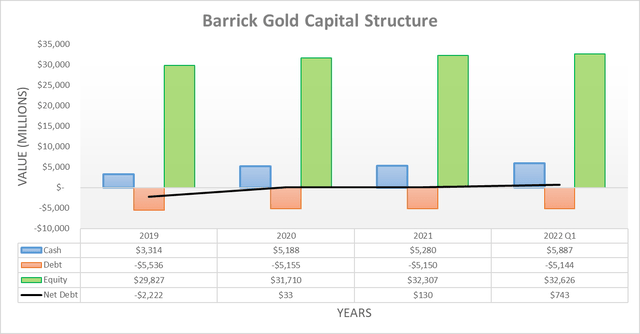

Despite already enjoying a very impressive net cash position upon ending 2021, their excess free cash flow after dividend payments and a further $260m of investment sales saw this expand during the first quarter of 2022, thereby now leaving a net cash position of $743m and thus giving rise to their Level III $0.10 per share performance dividend. Once again, this obviously means that they have zero leverage, which makes assessing their leverage redundant whilst opening the door to see higher shareholder returns in the future, either via relatively higher dividends or share buybacks, the latter of which already appears on the table, as per the commentary from management included below.

“The board has also approved a $1 billion share buyback plan which will afford us the opportunity to acquire our shares when they are trading below what we consider to be their intrinsic value.”

-Barrick Gold First Quarter Of 2022 Results Announcement (previously linked).

Despite being positive to see management allocating even more capital towards shareholders, the opaque nature of when these share buybacks will be activated slightly tarnishes their appeal. Whilst waiting for their share price to trade beneath its intrinsic value is certainly better than blindly paying anything for their share buybacks, it nevertheless leaves investors waiting to see what management views as their intrinsic value. If completed at their current market capitalization of approximately $32b, these would remove circa 3% of their outstanding shares.

Depending upon the prevailing operating conditions at the time and the speed at which they are conducted, in theory, these share buybacks may see a move back to a net debt position. Thankfully even a quick back of the envelope calculation shows that given their operating cash flow fluctuates $4b to $5b per annum, they can very easily afford to cover $1b of net debt and thus it would not be surprising to see their share buybacks expanded in the future.

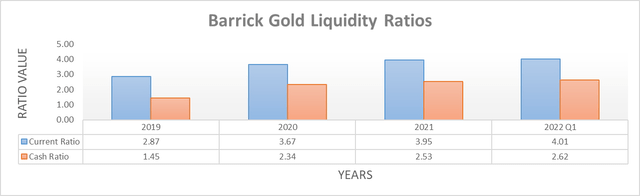

After seeing their net cash increase during the first quarter of 2022, it was not surprising to see their already strong liquidity further improve with their respective current and cash ratios increasing to 4.01 and 2.62 versus their previous respective results of 3.95 and 2.53 at the end of 2021. Thanks to their net cash position, they obviously have no issues meeting future debt maturities, plus as a dominant player in the gold mining industry, they should see easy access to debt markets if required, even if central banks tighten monetary policy. If they were to draw down $1b of their cash balance to fund share buybacks, their current and cash ratios would still be strong at 3.57 and 2.17, thereby further supporting their short to medium-term outlook for shareholder returns.

Conclusion

It was positive to see their dividends doubled as management rewarded their shareholders and thankfully not only are these supported, more could follow as their net cash position appears likely to continue growing larger and outpace their variable dividend policy. The main risk is the possibility of gold prices plunging but given the seemingly intensifying inflation on the back of the global energy shortage and geopolitical backdrop as the war in Eastern Europe enters its fifth month, this does not seem too probable within the foreseeable future and thus it should not be surprising that I still believe my buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Barrick Gold’s SEC filings, all calculated figures were performed by the author.

Be the first to comment