metamorworks/iStock via Getty Images

Investment Thesis

ams-OSRAM is following an aggressive expansion strategy for the past 7 years, which lead to the development of key technologies and a substantial market share as a semiconductor manufacturer in the optical sensing industry. The once high-flier was mostly driven by sales of its components used in biometric face recognition and other sensing applications in the consumer electronics market, and is facing some headwinds due to the recently closed and often debated acquisition of OSRAM Licht, as well as the loss of market shares from one of its main customers. Although the company can count on a strong positioning in its relevant markets and has a long track record of successfully developed products and technologies, the evident loss of confidence from investors needs to be reestablished by management. The company is fundamentally undervalued by at least 66% and the downside risk is now rather limited, but the quite unexciting recent presentation at the capital markets day, as well as the sustained weakness of the stock, are signs that it may still take some time before a significant uptrend in the share price can be established.

A Quick Look At ams-OSRAM

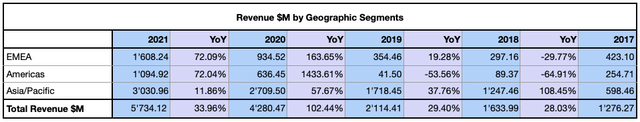

Founded in 1981 and headquartered in Premstätten, Austria, the company was formerly known as austriamicrosystems AG and changed its name to ams AG in May 2012. Its main listing is on the SIX Swiss Exchange, with multiple secondary listings in Europe and the US with the ADR (OTC:OTCPK:AMSSY) or (OTC:OTCPK:AUKUF). The company has a history of growth through acquisitions. The most important were the acquisition of Texas Advanced Optoelectronic Solutions Inc. in 2011, the overtake of CMOSIS in 2015 with the subsequent expansion of its production facility in the Philippines; in 2017 ams acquires Heptagon, a worldwide leader in high-performance optical packaging and micro-optics which allowed the company to establish significant production capacities in Singapore, and Princeton Optronics Inc, a leading provider of Vertical-Cavity Surface-Emitting Lasers ((VCSELs)). Finally, in 2020, ams acquired OSRAM Licht AG, a historical German company and worldwide leading manufacturer of lighting solutions, which became a takeover target after its attempt to turn itself into a photonics specialist did not bring the expected success. The company employs around 29,750 employees worldwide, is now co-headquartered in Munich, Germany, and its most relevant geographic area for its business is in the Asia-Pacific area, where many technology companies are assembling their products mostly through companies in Taiwan, followed by Europe, the Middle East, and Africa (EMEA) and the Americas.

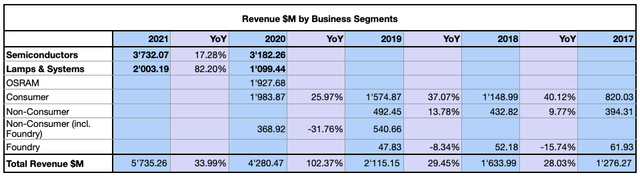

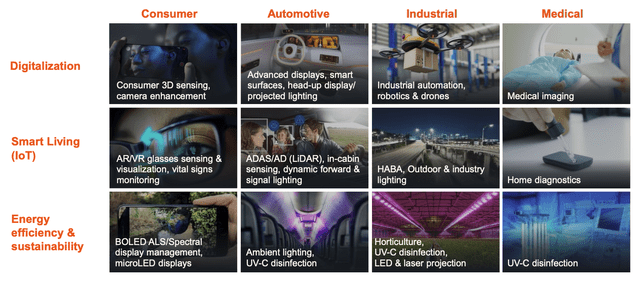

The company divides its business into two segments, Semiconductors, and Lamps & Systems, and offers solutions in sensing, illumination, and visualization. Its products range from sensors and modules in 3D applications, audio, CMOS imaging, light modules, sensors in medical and health solutions, position sensors, power management, temperature, and smart light management sensors, sensor interfaces, wireless sensor nodes, and analog and mixed-signal application-specific integrated circuit solutions for the automotive, industrial, medical, and smart building. The company also provides light detection and ranging, a sensing technology for remote object detection and ranging using a light source and receiver.

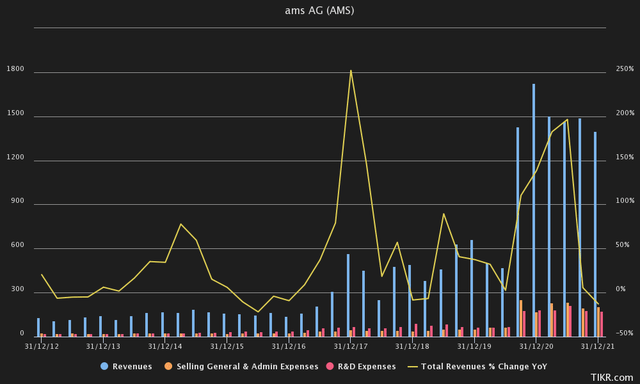

Due to its partially still high dependence on consumer-cycles business, ams is subject to a quite cyclical revenue stream with the last quarter of the calendar year typically ramping up in sales. Looking at the past 10 years, the company’s revenue growth rate experienced some significant peaks, a metric that could now see a more constant development, once the recent acquisition of OSRAM is completed and the business is integrated. Research and Development (R&D) expenses stood at 12.74% at the end of 2021, while Selling, General and Administrative expenses grew to 14.79%, probably also because of the integration costs related to the recent acquisition. The company’s gross margin growth rate accelerated from 44.89% Compound Annual Growth Rate (CAGR) over the last 5 years to 63.32% CAGR in the past 3 years, with gross margin standing at 33.80% in 2021.

ams-OSRAM’s Return on Invested Capital (ROIC) was averaging at 5.72% in the past 6 years, and grew from 0.56% in 2018 to 9.91% in 2021, indicating that the company could probably further increase its efficiency in capital allocation, especially when comparing this metric to some of its competitors Infineon Technologies AG (OTC:OTCQX:IFNNY) with 12.13%, STMicroelectronics N.V. (NYSE:STM) with 24.11%, or ASML Holding N.V. (NASDAQ:ASML) with a staggering ROIC of 76.71% in 2021. On its balance sheet, the company carries a significant amount of debt, recording $3.56B in total debt and a leverage ratio of 2.50x at the end of 2021, with significant interest expense over the past two years where the majority of the debt was added to the balance sheet. Cash from operations is consistently growing since this metric turned negative in 2017, reaching 35.63% CAGR over the past 3 years. The company ceased its dividend payment in 2017, running some short-lived share-buyback and debt-buyback programs in the last few years, but mostly favoring an aggressive expansion strategy over returning value to the shareholders.

The Story Behind ams Stock Weakness

Among other successful products and solutions, ams was one of the key suppliers for Apple (NASDAQ:AAPL) for its Face-ID technology as well as for the ambient light sensor in the iPhone. The development of those technologies was one of the main catalytic elements which projected the stock to its All-Time High (ATH) at CHF 81.91 or $63.37 for the ADR on March 8, 2018. Since then, the stock has suffered in a tremendous downtrend with sporadic short periods of relief, landing the stock at its actual price of CHF 13.54 or $07.31 for the ADR, after a low at CHF 7.82 on April 3, 2020, or $4.50 on April 7, 2020, for the ADR. ams-OSRAM AG is one of those very controversial stocks where institutions see what retail investors miss, or simply deny.

The hype around this stock began when the share price increased significantly over 1.5 years, mostly due to a strong sales increase to its, at that time, biggest customer, Apple. The potential was of course first captured by the smart money and institutions began to accumulate the stock over months, during 2017, while analysts constantly raised their price targets, and attracted retail investors to join the party. The stock outperformed the NASDAQ for almost the whole year of 2017. The sky was the limit. In March 2018 ams’ capitalization topped at over CHF 6.7B, with sales standing at $453.64M at the end of the first quarter, and reaching $1.63B at the end of that year, with $15.49M operating income, no dividend payment, and Earnings Per Share (EPS) down 43% from the year before. The stock was significantly overvalued. Adding to this, competitors such as Sony (NYSE:SONY), Infineon Technologies AG, and STMicroelectronics N.V. were successfully developing their products and components for 3D sensing solutions, and the seasonality of Apple’s business impacted strongly the revenue of ams. In an interview in February 2017, the CEO confirmed that the dependency on big customers like Apple or Samsung Electronics Co., Ltd. (OTC:OTC:SSNLF), which at that time were responsible for around 25% of ams’ revenue, is a concern that is addressed by the company and reduction of such dependency is part of their strategy. As in the coming years, this dependency instead even increased, in an interview on February 7, 2018, just shortly before the stock began to drop, Everke then declared to not be concerned about such a high dependency degree and even see it as a positive factor for the company and a confirmation that its portfolio is well-positioned.

The once praised customer relationship with Apple, became ams’ curse and rising doubts about its’ long term relationship as a key supplier of the American technology giant arise, as the latter seemed to switch to a different technology for its Face-ID and other key technologies supplied by ams in its smartphones. At that time, despite never being directly confirmed, most estimations saw Apple accounting for over 45% of ams sales. This is certainly the type of risk that is avoided by institutional investors and the following sell-off at high volumes clearly shows their reluctance to keep a stock with such high uncertainties, as it reminded 2015 when a similar situation significantly impacted ams’ stock price. Retail investors who jumped on the hype during the ascension of the stock were instead less prone to believe that the party was over and that’s the kind of situation where dollar-cost averaging and cognitive biases are very dangerous and caused many investors to book terrific losses in their account. A quick look into some Swiss and European stock market forums gives unfortunately a clear image of how this stock turned from being the star of many retail investors to their worst investment during the past 4 years. ams-OSRAM is a victim of its success.

Last year it was then indirectly confirmed by the management of ams, that the most significant and lucrative part of the business with Apple has indeed been lost to a competitor or at least was now subject to dual sourcing. It was long speculated that Apple would in a first move improve its Structured Light technology used in the Face-ID and adopt a smaller notch, and then likely switch to an approach using Time of Flight (TOF) Light Detection and Ranging ((LiDAR)), a technology already integrated into the world-facing camera on the iPhone 12 Pro models and recently also on the iPhone 13 Pro series. The fact that Apple awarded II-VI Incorporated (NASDAQ:IIVI) with $410M in May 2021, after the company already received funding of $390M from Apple’s Advanced Manufacturing Fund in 2017, is also an important aspect to consider in the change in sourcing for Apple’s Vertical-Cavity Surface-Emitting Lasers (VCSELs) and other components necessary for its Face-ID and ToF technology. The CEO of ams, Alexander Everke, once declared in an interview that without ams, the iPhone X would not exist. Such haughty statements are probably not appreciated in Cupertino and Apple is well known for imposing strict Non-Disclosure Agreements (NDA) with its suppliers.

But why is the stock so miserably performing even at such a relatively low level? The management couldn’t establish trust in institutional investors over the last years of a roller-coaster. Insider transactions were more than once debated in the newspapers. In 2018 a report described accumulated profits of CHF 86.4M since the end of 2015 generated through well-timed trades with options and shares on behalf of the management; alone between December 2016 and 2017 more than 60 transactions with an acquisition value of CHF 18M resulted in around CHF 50M of profit. In 2020 the Austrian FMA and the German BaFin financial authorities conducted an examination of suspicious insider transactions with shares of OSRAM Licht AG during the initial phase of the takeover of the German group. When Bank of America’s analyst Adithya Metuku asked the management during the conference call on May 4, 2021, if there were any plans to change the way of communicating on financial reportings, by indirectly pointing to the ongoing financial authorities examinations, the question was ignored by the CEO and CFO of the company, after a short technical problem. Adding to those episodes, stock repurchases to unfavorable prices, a debate on a secondary listing in Hong Kong, the continuously increasing stellar compensation of the CEO which earned a total compensation of around EUR 20M in 2020 including the equity incentive plan, up from total earnings of EUR 7.3M in 2019 and EUR 2.2M in 2018; all those elements are not exactly encouraging confidence, which is indeed needed to attract long term investors. The takeover of OSRAM gave the impression of happening at an unfavorable moment and a high price, confirmed also by a very uncertain capital increase needed for accomplishing the CEO’s high ambitions. In my opinion, the acquisition felt somehow forced, probably due to the pressure made on the company since they were losing the business with Apple and overcapacities and relatively high indebtment, after the Austrian group invested heavily in its manufacturing capacities in Singapore, weighed significantly on its balance sheet and made the future of the company highly uncertain.

What’s Coming Next

The recent Capital Market Day on April 5, 2022, wasn’t a success story for the company. The stock tanked 8.39% at the SIX and the ADR dropped 7.06% in the US, leaving a feeling of disappointment after the 4 hours of presentation by the management. The recent conflict in Ukraine was reported to have a very low impact on the company with less than 1% of the revenue, and the execution of OSRAM acquisition and integration was reported to be in line with the commitments or even providing around EUR 50M additional cost-synergies and around EUR 120M fewer integration costs than previously expected. The company is a top 3 player in optical semiconductors, reportedly the only player in the industry covering the full optical value chain to its customers, and active in many key societal megatrends which will drive the demand for the coming years.

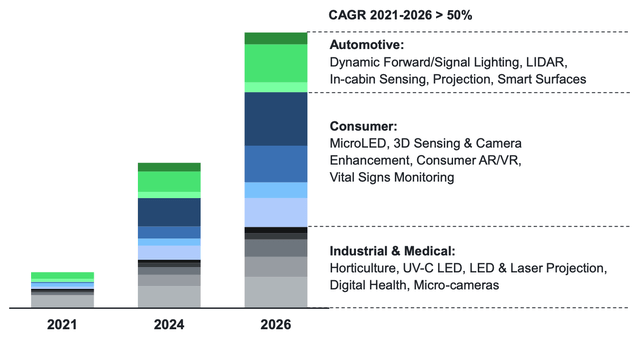

ams-OSRAM’s revenue is estimated to grow at over 10% CAGR between 2021 and 2026, while the addressed market is forecasted to grow at 8-10% CAGR, and the semiconductor market growth is expected to grow at 5-7% CAGR during the same period, with the major growth drivers expected to be in sensing applications in the automotive industry, visualization solutions in the industrial and medical markets, as well as in the consumer applications.

The portfolio of the company substantially improved its balance among the three key end-markets, from respectively 5%, 82%, and 13% in the automotive, consumer, and industrial and medical markets in 2019, to 41%, 28%, and 31% at the end of 2021. The long-term targets of the end-market and application mix for the company are even further focusing on balancing the revenue streams to respective 35-40% in the automotive and consumer markets and 25-30% in the industrial and medical markets.

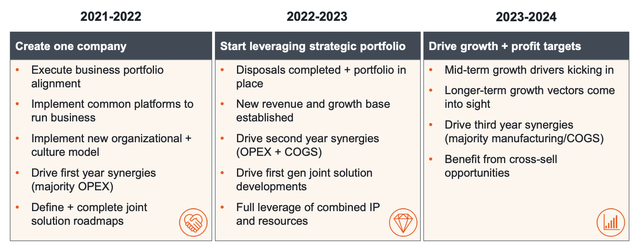

The CEO of ams-OSRAM confirmed his commitment to leading the company to become an uncontested leader in optical solutions with double-digit revenue growth and a diversified portfolio. The coming years are divided into 3 distinct phases from creating a unified company by executing the OSRAM integration, through 2023 the company will start leveraging the strategic portfolio and the combined business opportunities, and finally by 2023-2024 achieving solid growth and profits targets and focusing on long-term growth vectors while also benefiting from cross-selling opportunities.

Valuation

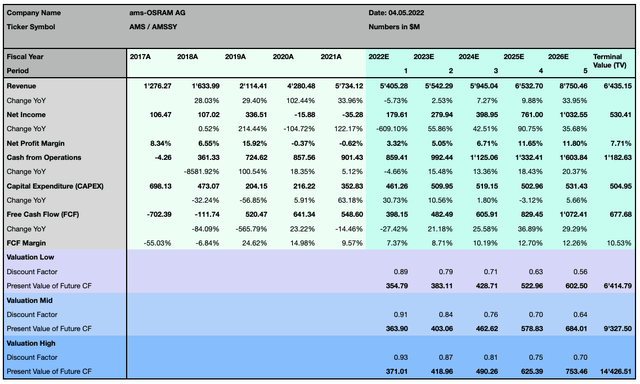

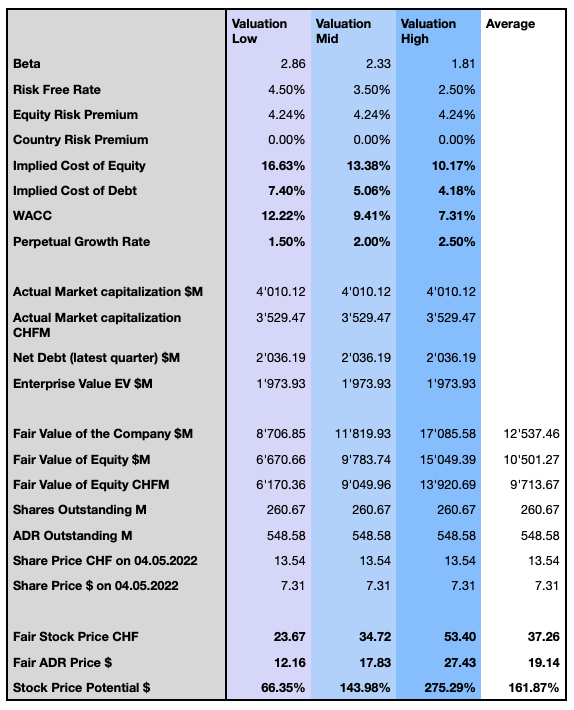

To determine the actual fair value for ams-OSRAM’s share price, I rely on the following Discounted Cash Flow (DCF) model, which extends over 5 years based on 3 different sets of assumptions ranging from a more conservative to a more optimistic view, based on the metrics determining the Weighted Average Cost of Capital (WACC) and the terminal value. In 2024, ams-OSRAM expects to reach around $5.5B in sales, averaging a 10% year-over-year revenue growth rate, and an EBIT margin of over 15%. I consider a similar cautious forecast in my valuation model, especially concerning the perpetual growth rate, which ultimately has a significant impact on the DCF valuation model.

Author, using data from S&P Capital IQ

The valuation takes into account higher interest rates, which will undeniably be a reality in many economies worldwide and lead to a higher weighted average cost of capital. Major risks are now related to the recent conflict in eastern Europe, complications in the supply chain, further international sanctions, and a negative spiral in the already tense relationship between the US and China in particular in the technology sector, which could negatively affect the semiconductor industry and affect ams-OSRAM’s business. OSRAMS’s integration is indeed advancing and ams could already sell some unwanted parts of its business. At this point, I see it unlikely that the integration process could result in substantial operating difficulties or be more demanding in resources as supposed in the recent estimations. Major opportunities for the company are now seen within microLED applications, 3D sensing as well as AR/VR applications, LiDAR, and other sensors for autonomous vehicles.

Author

The most likely valuation, in my opinion, based on the assumptions of the DCF model, gives a minimal upside potential of 66.35% and prices the US ADR at $12.16 and the ordinary share at CHF 23.67. The mid-valuation model sees the US ADR at $17.83 and the ordinary share at CHF 34.72 or 143.98% higher than the actual price level. The most optimistic scenario, despite being the least likely in my modelization, prices US ADR at $27.43 and the ordinary share at CHF 53.40, with 275.29% upside potential.

Market Timing

From a technical analysis point of view, the stock was moving sideways for the past 24 months, while being mostly in a long-term downtrend since its ATH in March 2018. Redundant price-action cycles offered great chances for swing traders to take advantage of the moves in the last 3 years. For long-term-oriented investors, the stock was instead a waste of time and money with high opportunity costs when compared to peers in the industry. While investors who bought at the lows during the beginning of the Covid-19 pandemic, could book a profit in their books, many investors in ams are probably still in a losing position.

Since the main listing is at the SIX Swiss Exchange, the technical analysis refers to that market, but I provide parallel price levels for the ADR. The most relevant support level in the short term can be found at CHF 11.50 or around $6.50 for the ADR. The closest resistance levels are at CHF 15.20 and CHF 16.30 or around $8.10, $8.50, and $9.00 for the ADR. The stock broke out of the recent low and may continue this short-term trend reversal to form a proper base over CHF 16.30 or $9.00 for the ADR. This would give a positive signal for both long-term investors as well as swing traders and could avoid a re-testing of the recent low, under these levels the risk of a retracement of the recent rebound, is still too high. Long-term investors who believe in the CEO’s motto “Go Big or Go Home” could take advantage of this low price level to set up their long-term position, momentum and position traders could observe the stock and determine an appropriate entry point, following their strategic criteria, as the stock seems to move consistently in the same price range, and fundamentally, the downside risk is rather limited.

The Bottom Line

At the recent capital markets day presentation, the market share loss in 2021 was only shortly mentioned by the CEO, but no specific reference or comment was made about it. The once highly praised and openly brandished customer relationship with Apple has turned into an almost embarrassing situation for the management who had to act fast to avoid facing a steep loss in revenue, substantial overcapacities, and being overrun by the strong competition in the industry. The coming years will show if the OSRAM acquisition delivers the expected value for the shareholders, but the initial skepticism is slowly dissipating and the new combined company shows a strong setup for capturing the potential in strong growth markets. Despite still showing relative weakness, the stock price is significantly undervalued in fundamental terms. Patience is required for long-term investors willing to enter at this point or who jumped in during the past months, while swing and position traders could consider the stock at this level and take advantage of the redundant price-action cycles which are now lasting for an extended time.

Be the first to comment