ollo/E+ via Getty Images

Thesis

AMREP Corporation (NYSE:AXR) still remains undervalued due to its robust balance sheet (over $90m in land assets with less than $10m in debt with an EV $43m). Despite the rough economic climate, the balance sheet continues to grow and gross margins continue to improve but remain understated. The stock is undervalued compared to peers and has a potential upside of around 100%.

Intro

AXR is a land development and homebuilding company with significant exposure to New Mexico. The company currently own around 17,000 acres of land in New Mexico, where revenue drivers are from the sale of both developed and undeveloped land to homebuilders and developers. Therefore, undeveloped land is purchased bare of which AXR then obtain planning and approvals, install utilities, and add infrastructure in order to sell as developed lots and gain an uplift on the price.

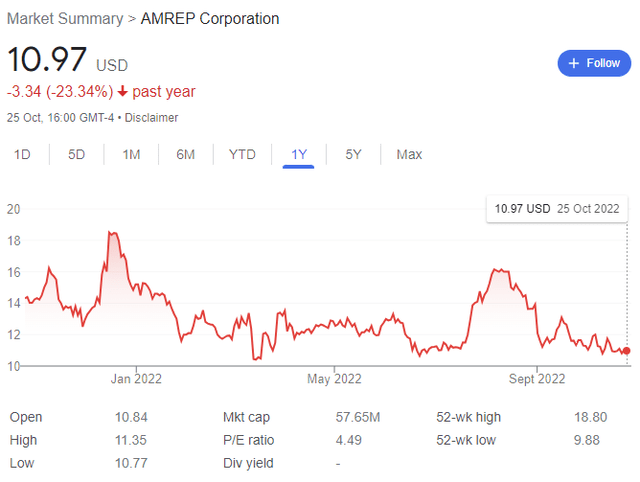

Share price this year has been jumpy and has fallen with market to hit ~23% decline year to date.

Balance Sheet and Income Statement Analysis

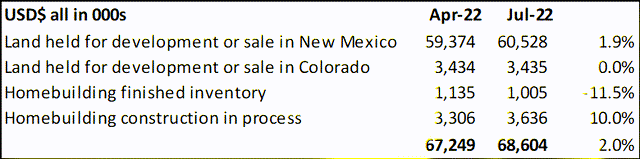

AXR’s balance sheet is incredibly strong, where they are currently sitting on around 16m of cash, implying that almost 40% of EV is cash alone. However, the more important element of the balance sheet is the current land assets. The company is currently sitting on $64m of undeveloped land alone. Homebuilding makes up another $4.5m of assets. And despite the unfavorable environment, the real estate assets of the balance sheet grew 2% between April and July in 2022.

This is interesting as you would typically think that in an environment where house prices have peaked, either revenues will be limited (as sales are not being made), or the balance sheet would shrink given that assets are being sold off. However, in the 3 months ending July-22, $11m of sales were made, 50% from homes and 50% from land.

SEC

A significant amount of land sales have been made, around $5m, when land on the balance sheet grew $1m, indicating that a significant margin is being made here. In terms of homes, sales were around $5m as well, but home assets on the balance sheet only fell by -$130k, again, implying that there is a huge margin.

These results are explained by revenue metrics, where revenue per acre sold has historically over the past several years on developed land has grown from around $300k per acre in 2014 to $450k per acre in 2021, an annual growth rate of 6%. However, in 2022, land is currently being sold for $520k per acre, which is a 16% increase from the cost in 2021. The sales figures have improved significantly and the company states that their gross margin for land has increased from 31% in 2021 to 45% in 2022, and home sales gross margin improved from 16% to 25%.

However, given that the balance sheet has remained significantly robust and hasn’t moved despite the strong sales, the gross margin is a lot higher than what is being stated. The balance sheet is holding assets that have been recorded at costs from decades ago, so assets are being sold for a price substantially higher than what is publicly available on the balance sheet, and we also know that cash generated by these sales are being put back into developing more land.

Valuation

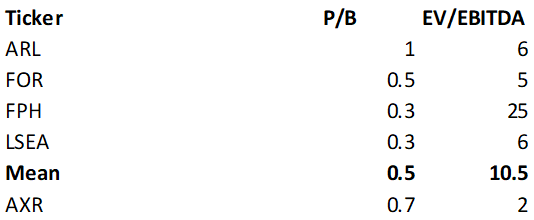

Given the robust balance sheet and strong sales with high margins, the fall in share price does not give it a fair valuation. The share price has followed the rest of the market and investors are too focused on the fact it is a development and home building company, and thus as rates rise, valuations of these companies should suffer given he drop in mortgage demand. However, the current health of the company gives it a perfect position to head into the current recession and come out on top. Margins improved significantly during a period where the share price fell, meaning that gross margins of 31% and 16% in 2021, when the share price grew, were seen as good margins, implying that the margins we are seeing today should be described as great. The strong balance sheet gives the company a P/B of 0.7x (slightly above peers) and the healthy sales give it an EV/EBITDA of 2, which is substantially below peers.

Yahoo Finance

Given what was discussed above, we know the AXR’s P/B is higher than what is stated. While it is in line with peers, it is below 1 which is too low given its cost structure. EV/EBITDA on the other hand is significantly below the average. Even if we exclude the 25 from FPH, peer group EV/EBITDA is around 6x whereas AXR is 2x. If we look at a brief sum of the parts valuation, AXR would be better valued at around its book value, implying a potential upside of 100%. However, if we were to look at EV/EBITDA comparisons, upside would look closer to around 200%.

Risks

- 99% of the current year’s sales of developed land have been made to only four homebuilders. Due to the current economic climate of reduced mortgage demand thanks to increasing rates, this concentration of customers is risky as reduced demand/sales from one customer can lead to a substantial drop in revenue.

- Historical success has been on development and sales of commercial real estate, which the company no longer has. Therefore a shift towards more residential real estate, in an environment where the base rate is expected to hit almost 5% next year, may be a little risky.

- Costs are expected to increase, not only due to increasing rates, but additional macro factors such as supply chain issues, material costs, labor costs, and delays in approvals and thus construction and subsequent sales. If these costs become more significant over the next 12 months (as they are expected to), we could see these margins come back down.

- In addition, AXR is a microcap stock with very little coverage and volume, therefore a realisation of its intrinsic value may not occur.

Conclusion

In conclusion, despite the fall of more than 20% of AXR’s share price, the company is financially healthy with a robust balance sheet and strong sales momentum. The economic environment is currently unfavourable, but margins have improved significantly over the past year. Based on the analysis AXR’s share price has a potential upside of over 100% from current prices.

Be the first to comment