Eoneren/E+ via Getty Images

One of the Seeking Alpha community members left a comment on one of my articles that I should investigate the Amplify CWP Enhanced Dividend Income ETF (NYSEARCA:DIVO). I wish I had written down their screen name so I could publicly thank them, if you’re reading this article, thank you. I just finished reading through DIVO’s prospectus, the latest presentation, and the information provided on the Amplify ETF website. I have no idea how I have never heard of DIVO prior to reading the comment, and I haven’t been this excited to invest in an ETF in quite some time. I am so impressed with what Amplify has constructed that I just want Monday to come so I can add DIVO to my portfolio.

I have written about many different income investments on Seeking Alpha, and, most recently the Global X Covered-Call ETFs. DIVO is a unique approach to income investing that has also delivered capital appreciation. In a nutshell, DIVO invests in high-quality individual large-cap equities such as Apple (AAPL), Johnson & Johnson (JNJ), and Home Depot (HD) as it focuses on companies that have a history of growing their dividend and earnings. DIVO is designed to offer larger levels of income as it utilizes a tactical Covered-Call strategy on the individual equities instead of taking an index approach like many of the other Covered-Call products on the market. After doing the research, I plan on adding DIVO during the week of 6/27 as this ETF from Amplify takes everything I do within my own portfolio and rolls it into a single ETF. I don’t know if this is a bear market rally or if the bottom is in, but this looks to be an excellent level to add DIVO at, and if this week ends up being a bear market rally instead of a bottom, I will plan on adding more to my future DIVO position later in the summer.

Amplify ETFs

About the Amplify CWP Enhanced Dividend Income ETF, its strategy and mechanics

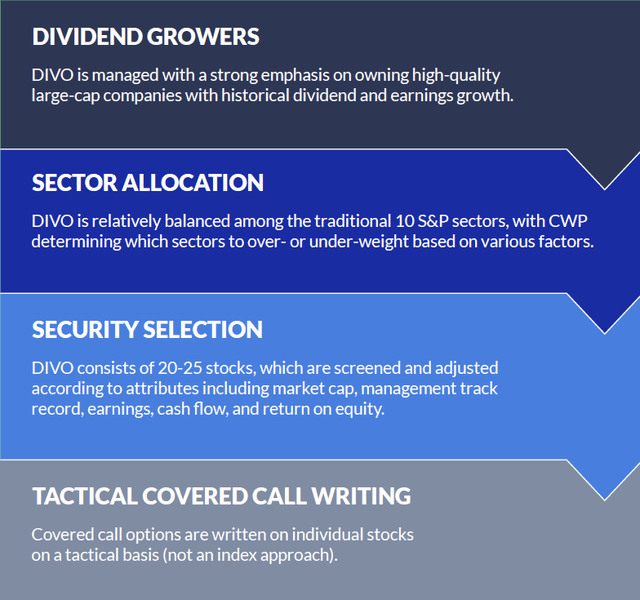

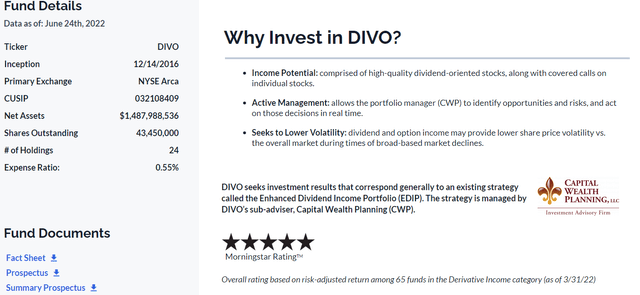

DIVO has two investment objectives first, to generate income, and second to provide capital appreciation to its investors. DIVO invests at least 80% of its net assets in dividend-paying securities trading on U.S based exchanges. Amplify Investments LLC serves as the investment adviser to DIVO, while there are 2 sub-advisors. Amplify is specific that the sub-advisers are not affiliated with the Fund or Amplify Investments. Capital Wealth Planning and Penserra Capital Management each serve as investment sub-advisers to the DIVO. Penserra is responsible for implementing the DIVO’s investment program by trading portfolio securities, rebalancing the Fund’s portfolio, and providing cash management services in accordance with the investment and model portfolios delivered by, Capital Wealth Planning and Amplify Investments. Capital Wealth Planning identifies Equity Securities of high-quality and large-capitalization companies from the S&P 500, which they believe are likely to sustain earnings, cash flow growth, and increase their dividends. Capital Wealth Planning leans toward companies that are likely to raise annual dividends with consistency and constructs the portfolio consisting of 20 to 25 individual equities.

Amplify ETFs

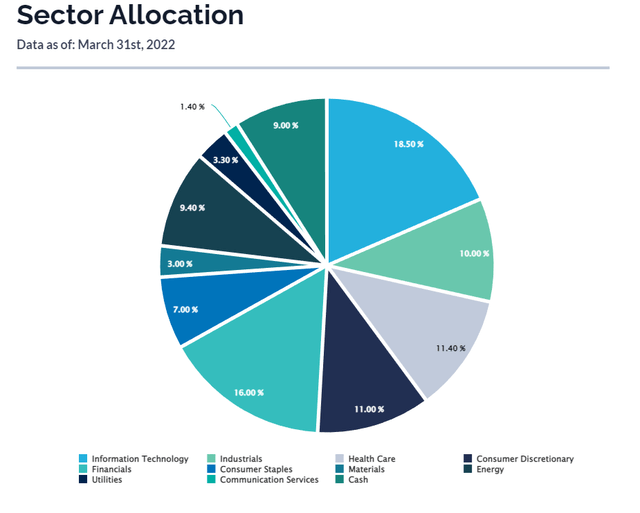

Capital Wealth Planning utilizes two investment rules which are similar to the ones I utilize in my Dividend Harvesting series on Seeking Alpha. DIVO’s portfolio exposure is set up so a single sector will not exceed 25%, and no individual security will exceed 8% of the portfolio’s assets. The equities held within DIVO’s portfolio are screened and adjusted based on these thresholds and other investment attributes, including market capitalization, management track record, earnings, cash flows, and return on equity. In my Dividend Harvesting series, I have a 20% sector and 5% individual threshold to make sure I don’t become overweight in a specific area. These metrics are a plus in my view because the fund’s managers are serious about diversification and creating mitigation to the downside.

Now comes DIVO’s mechanics and how it generates income. DIVO utilizes two methods to generate income, harvesting dividends and writing covered calls on its positions. Capital Wealth Planning has the objective of generating 2-3% of its gross income from harvesting dividends from its equity positions. Next, they utilize a Covered-Call strategy to generate an additional 2-4% from options premiums. Unlike the Global X Covered-Call funds that I cover, Capital Wealth Planning isn’t writing Covered-Calls on an index. They take a tactical approach and write Covered-Calls on the individual positions, but they are not obligated to write Covered-Calls on every position if they feel it’s not in the fund’s best interest. When one of the underlying stocks demonstrates strength or an increase in implied volatility, Capital Wealth Planning identifies that opportunity and sells Call-Options tactically, rather than keeping all positions covered and limiting potential upside. This strategy allows DIVO to generate above-average income while not capping all its future upside potential, making this an interesting hybrid approach toward income investing.

Amplify ETFs

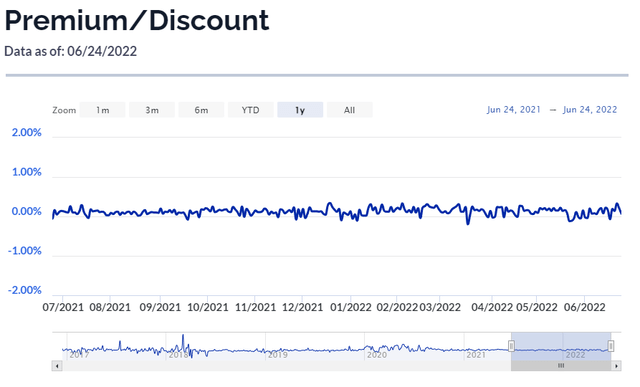

I was surprised when I read that DIVO has an expense ratio of 0.55%. This is less than the Global X Covered-Call funds and cheaper than I had expected. DIVO isn’t a small fund either, its net assets amount to $1.49 billion, and Morning Star has given it a 5-star rating. DIVO’s investments cover 11 sectors of the S&P 500, which range from 1.4% to an 18.5% sector allocation.

Amplify ETFs

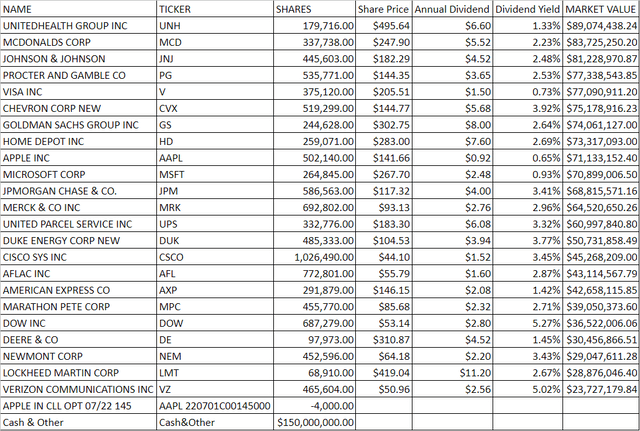

DIVO is comprised of a Crème de la Crème portfolio with many of the largest, well-known companies. There are 23 individual equity positions and call options on Apple. I constructed a look at the portfolio and filtered it by its largest to smallest holdings below. In my opinion, this is a well-rounded portfolio that should be able to navigate volatile markets and capture significant upside in the future. I am currently a shareholder of AAPL, Cisco Systems (CSCO), and Verizon Communications (VZ).

Amplify ETFs

DIVO’s performance since inception and income characteristics.

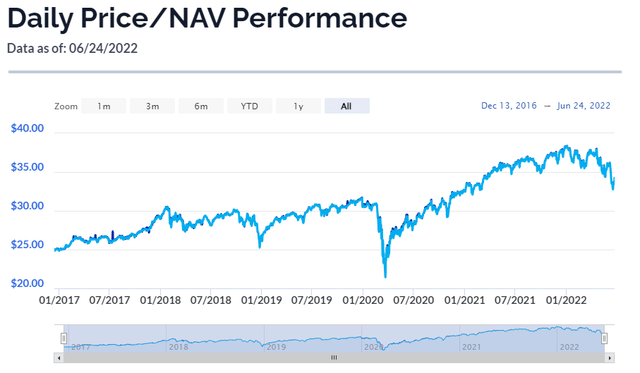

On 12/13/16, DIVO made its debut at $25 per share. Since then, shares of DIVO have appreciated to $34.27, generating 37.08% ($9.27) of capital appreciation for its investors.

Amplify ETFs

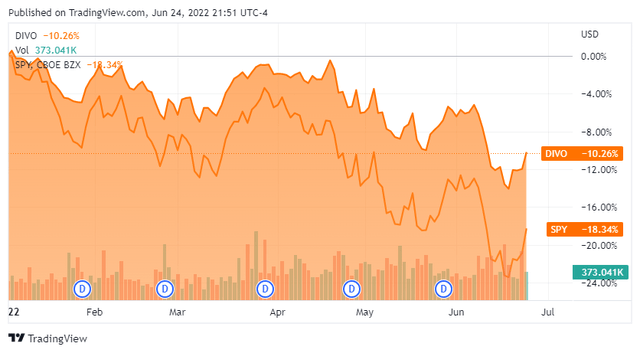

Capital appreciation is the 2nd investment objective for DIVO. I am impressed with its capital appreciation since its inception, as DIVO has lived up to both of its investment objectives and hasn’t sacrificed capital appreciation for income. DIVO is also holding up better than the S&P 500 in 2022, which I track by the SPDR S&P 500 Trust ETF (SPY). DIVO has declined by -10.26% in 2022, while SPY has declined by -18.34%. By concentrating its positions across the fund’s investment criteria, Capital Wealth Planning has constructed a portfolio of world-class companies that have protected investor capital better than index funds in 2022.

Seeking Alpha

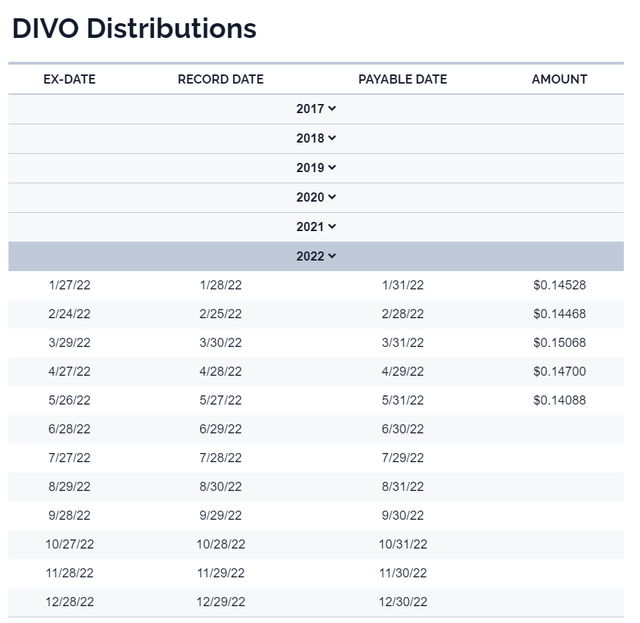

Now for the 1st objective, income. DIVO paid its first distribution in April of 2017. Since then, DIVO has gone from paying quarterly distributions to monthly distributions. Since April of 2017, DIVO has paid 54 distributions, and shareholders have collected $9.19 in income per share. If you had purchased shares of DIVO when it went public at $25, you would have generated 36.74% of your initial investment in income over the years. Today, DIVO has a distribution rate of $1.78 which is a forward yield of 5.19% based on its current share price of $34.27.

Amplify ETFs

Conclusion

After researching DIVO, I couldn’t find anything I didn’t like. This interesting hybrid fund delivers a continuous flow of income from dividend harvesting and writing Covered-Calls when opportunities present themselves. DIVO’s portfolio is also constructed from what many would consider high-end quality companies. DIVO has an impressive track record, has delivered 36.74% of its initial share price in income, and has appreciated by 37.08% since its inception. As an investor with a long-term mindset, I believe the markets will ultimately appreciate and that DIVO will allow me to capture modest appreciation while generating above-average sustainable income along the way. I think DIVO is a buy for any income portfolio, and I will be adding DIVO to mine the week of 6/27.

Be the first to comment