Feverpitched

Ranked first in the sub-asset class and tenth in the asset class based on Seeking Alpha quant ratings, Amplify CWP Enhanced Dividend Income ETF (NYSEARCA:DIVO) is once again well set to outperform the broader market returns in 2023 after beating the S&P 500 index in 2022. I believe due to the risk of recession, tight monetary policy, and declining earnings, it might not be easy to generate returns through growth and value investing in 2023. DIVO has a proven history of performing well in tough market conditions due to its portfolio concentration on around two dozen high-quality large-cap dividend-paying companies.

Challenges for US Stock Market in 2023

Fiscal 2023 is expected to be a challenging year for stock market investors, particularly for growth and value investors due to the Fed’s strategy of raising interest rates above 5%, a possible recession, and slowing earnings growth. In the latest meeting, the Fed laid out a plan for a slower pace of hikes in the coming months but indicated that the terminal rate could be higher than previously projected. Based on policymakers’ median forecasts, the Fed could raise the rates by another three-quarter point in 2023 to end the year at 5% to 5.25%. The rate hike policy has already crushed the S&P 500 in 2022 while the perception that the Fed isn’t going to pivot anytime soon raised concerns over the recession and a long bear market.

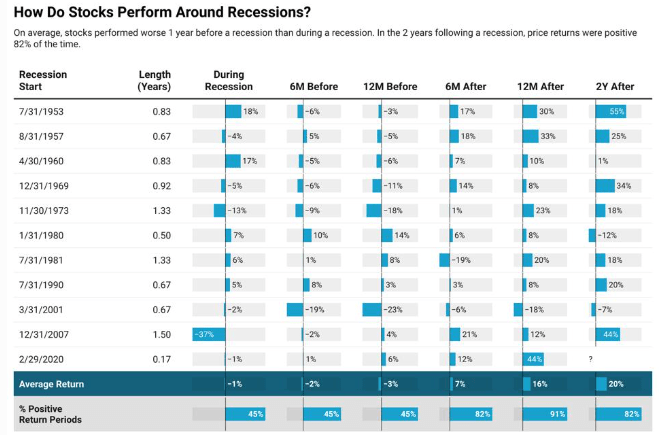

S&P 500 performance before and after recession (Forbes)

According to a Conference Board survey, 98% of CEOs expect a recession in 2023. A recession means slower business activity and lower purchasing power, which isn’t good news for stock markets. Even if the US skirts recession, GDP forecasts of negative 0.5% to 0.5% for 2023 suggest challenging times for corporations and small businesses. Historically, stock markets perform poorly before and during recessions. As shown in the above chart, S&P 500’s average return was typically negative 12 and 6 months prior to a recession.

The stock market also struggles during a recession. In fact, for the first time in two decades, Wall Street strategists predict a downbeat outlook and flat performance for the S&P 500 index. Based on a top-down analysis of 17 Wall Street strategists’ for 2023, the average S&P 500 price target ranges around 4,000, while the bottom-up price target estimate is around 4,400. It appears that there is little chance that US stocks will reverse last year’s losses in 2023, based on top-down and bottom-up price targets.

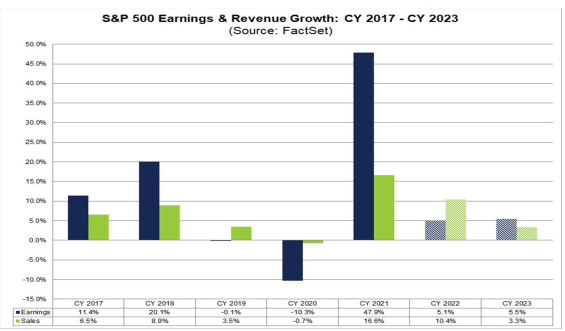

2023 earnings forecast (FactSet.com)

Earnings growth has always been a major driver of stock price performance. According to FactSet data, earnings are expected to grow by just 5.5% in 2023, down from the trailing 10-year average growth rate of 8.5%. Moreover, The S&P 500’s top line could fall into the low single digits in 2023. Morgan Stanley’s Global Investment Committee, however, disagrees with Wall Street’s consensus earnings estimates for 2023 and expects negative year-over-year earnings growth. As a whole, slower economic and earnings growth could enable the current bear market to last for a longer time.

Nevertheless, historical trends suggest that dividend investing, particularly high-yield investing, can help investors thrive during tough times. Besides the positive impact of dividends on total returns, there are many factors that contribute to dividend payers’ outperformance in difficult times. For instance, dividend-paying stocks tend to have a well-established business model and stronger financial stability to generate excess cash flows and earnings to maintain and grow dividends. Moreover, dividends are mostly offered by mature companies that are better able to withstand cyclical headwinds.

How DIVO Can Outperform in 2023?

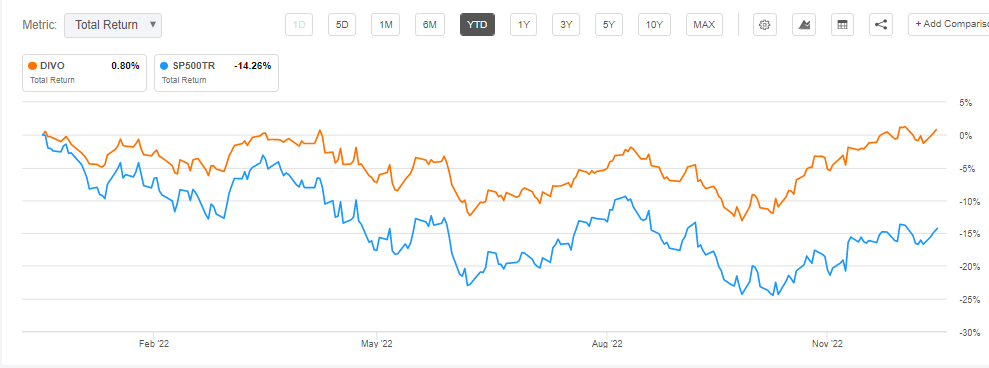

DIVO vs. S&P 500 total returns (Seeking Alpha)

As for DIVO, it has outperformed S&P 500 index both in price and total returns in 2022, which is considered one of the worst years for the stock market in the last two decades. Year to date, its price dropped only 3% compared to a 15.5% decline for the broader market index. The ETF has a low beta compared to the broader market index due to its significant portfolio concentration on well-established large-cap dividend-paying stocks. In addition, DIVO’s dividend yield of around 5% helped in enhancing total returns. DIVO has seen positive total returns year to date, compared to a negative 14% return for the S&P 500.

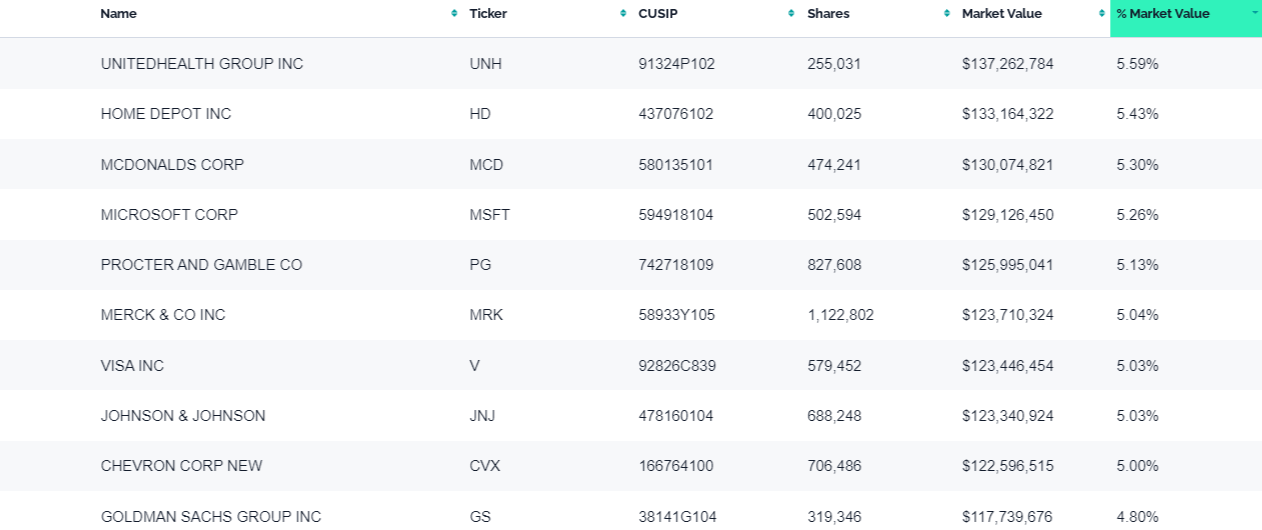

A recession and bearish calls for the S&P 500 index make historical data alone unreliable for predicting the future. To determine how DIVO’s dividends and share price will perform in 2023, it is important to examine its portfolio holdings. There are usually around two dozen high-quality large-cap stocks in its portfolio with a proven track record of dividends, earnings, and cash flow growth. DIVO’s top 10 stock holdings account for more than 50% of the overall portfolio. The fund seeks to hold three to five positions in the best large-cap dividend-paying companies from various sectors, primarily in the healthcare, financial, energy, technology, consumer discretionary, and industrial.

DIVO’s stock holdings (amplifyetfs.com)

A total of 18% of DIVO’s portfolio weight comes from stocks in the healthcare sector, including UnitedHealth Group (UNH), Johnson & Johnson (JNJ), Merck & Co. (MRK), and Amgen (AMGN). Each of these companies is considered to be the best dividend payer in the large-cap healthcare category. For instance, in the past five years, UnitedHealth Group has generated average dividend growth of 17% while its share price has surged 142%. Amgen recently increased its quarterly dividend by around 10% while its shares surged 19% in 2023. Merck & Co. has also raised dividends for 12 consecutive years, while Johnson & Johnson ranks among dividend aristocrats. In 2022, Merck’s share price rose by about 45% due to its double-digit revenue and earnings growth.

Over the years, DIVO’s active portfolio management has played a key role in limiting risk and generating robust performance in both bear and bull markets. The fund has recently reduced the risk by selling stakes in technology companies like Cisco Systems (CSCO) and Qualcomm (QCOM). As of mid-December, the fund held a stake in three high-quality large-cap dividend-paying companies including Microsoft (MSFT), Apple (AAPL), and Visa Inc (V).

Each of these companies has the potential to generate billions of dollars in cash flow. Thus, their dividends are not at risk, and their shares are likely to be less volatile than their peers. Meanwhile, the fund also held a stake in large-cap dividend-paying stocks from the consumer discretionary and consumer staples sectors. Moreover, around 12% of its portfolio is allocated to the financial sector, which is likely to benefit from higher interest rates. Companies like Lockheed Martin (LMT), Deere & Co (DE), and Chevron Corp. (CVX) are also a member of its portfolio.

Overall, it appears that high-yielding DIVO has the characteristics to thrive in bear markets. Its high yield is likely to support total returns while the low beta of its portfolio holdings would help in lowering the volatility when compared to the broader market.

DIVO is in a Buying Range

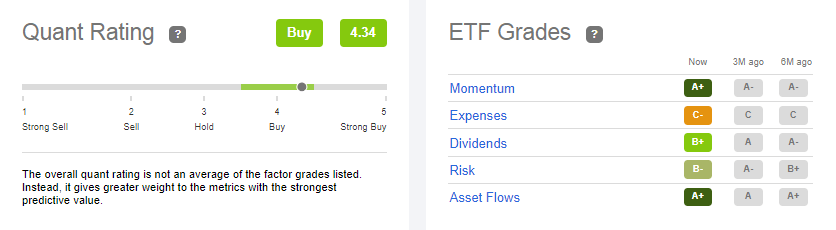

Quant ratings (Seeking Alpha)

Despite DIVO’s potential to offer healthy returns, finding a better entry point is still crucial. The ETF appears to be in a buying zone based on Seeking Alpha’s quantitative data, which considers five key factors, including momentum, expenses, dividends, risk, and asset flows. The ETF earned a buying rating with a quant score of 4.34, making it the top ETF in its subsector and the tenth in its asset class. A plus grade on momentum and asset flow suggests its shares could perform well, while a B plus grade on dividends indicates a solid cash flow and high cash return.

In Conclusion

Since fiscal 2023 is shaping up to be a tough year for stock market investors due to tighter monetary policy and a looming recession, consider making adjustments to portfolios accordingly. DIVO is among the ETFs that have the potential to offer downside protection and generate healthy gains over the long term. Its concentrated portfolio of high-quality and well-established dividend-paying companies is likely to add stability to the portfolio. In addition, active portfolio management helps management avoid tail event risk and capitalize on growth opportunities.

Be the first to comment