Vladimir Zapletin

Investment thesis

A year ago, I wrote an article about Ampco-Pittsburgh (NYSE:AP) as the company was recovering from net sales declines after the beginning of the coronavirus pandemic crisis while margins were bearing the hit of supply chain issues, increased raw material prices, increased production and transportation costs, and labor shortages. Things have not improved since then and the share price has dropped another 33.91% since then. The company finally had to increase the price of its forged engineered products by 12% to 18% while implementing an alloy and energy surcharge for all shipments in 2022, and also raised the price of its forged and cast roll products by 12% to 18%.

This is intended to lessen the current problems related to the price of energy, and at the same time, raw material prices are falling at a great speed, with which the cost of goods sold should go down, thus improving gross profit margins in the short to medium term. Still, so far the company is having serious problems generating cash from operations, thus the company is basically losing money. On the one hand, the energy surcharge is taking time to take effect, and supply chain issues remain a headwind. The company’s debt pile is increasing as a consequence and with it the future interest expenses. All eyes are now on the price of energy, both in its cost itself and in the ability of the company to pass this cost on to its customers through energy surcharges.

A brief overview of the company

Ampco-Pittsburgh is a global manufacturer of highly engineered, high-performance specialty metal products and customized equipment utilized by many industries around the world. The company was founded in 1929 and its market cap currently stands at ~$67 million, employing almost 1,500 workers worldwide. Insiders own 6.5% of the company’s outstanding shares, so they are one of the main beneficiaries of the good performance of the company’s operations.

Ampco-Pittsburgh (Ampcopgh.com)

The company’s operations are divided into two segments. The Forged and Cast Engineered Products segment provided 75% of the company’s total net sales in 2021 and manufactures forged hardened steel rolls primarily used in cold rolling mills by producers of steel, aluminum, and other metals, iron and steel cast rolls of different qualities for hot and cold strip mills, medium/heavy section mills, and plate mills, and forged engineered products for customers in the steel distribution market, oil and gas industry and the aluminum and plastic extrusion industries. On the other hand, The Air and Liquid Processing segment provided 25% of the company’s total net sales in 2021 and manufactures custom-engineered finned tube heat exchange coils and related heat transfer products for OEM/commercial, nuclear power generation, and industrial manufacturing, large custom-designed air handling systems for institutional, pharmaceutical, and general industrial building markets, and centrifugal pumps for the fossil-fueled power generation, marine defense and industrial refrigeration industries.

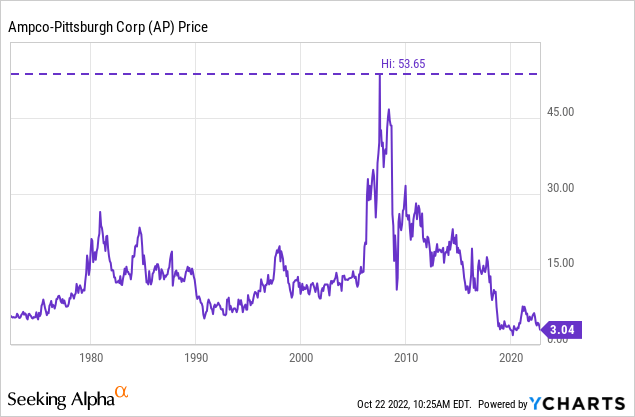

Currently, shares are trading at $3.04, which represents a 94.33% decline from all-time highs of $53.65 on July 19, 2007, and a 33.91% decline since the article I wrote a year ago. In this sense, the price is trading at the lowest price in decades, only matched during the coronavirus pandemic in 2020. The potential upside at this point is enormous, but risks are also very high, which makes this investment an optimal one for those investors with a lot of patience and risk tolerance. But before venturing out, it is very important to understand where the company currently stands.

Don’t forget the asbestos-containing component claims

First of all, and before delving into the different aspects of the company’s current situation, it is important to remember that Ampco-Pittsburgh is involved in a large number of claims due to personal injury caused by exposure to asbestos-containing components in the past. The company expects to have settled all claims by 2052, so it is a headwind that will accompany the company for at least 30 more years. Nevertheless, the insurance has covered a majority of the company’s settlement and defense costs.

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Total claims pending | 8,319 | 8,457 | 6,212 | 6,618 | 6,907 | 6,772 | 6,102 | 5,891 | 6,097 |

| Change | +3.90% | +1.66% | -26.55% | +6.54% | +4.37% | -1.95% | -9.89% | -3.46% | +3.50% |

During 2021, the number of pending claims increased by 3.50% as there were 1,233 new claims served vs. 605 claims dismissed and 422 claims settled. Still, 2,941 of the 6,097 claims pending at the end of 2021 were considered administratively closed as they were either filed six or more years ago, previously classified in various jurisdictions as inactive, or were transferred to a state or federal judicial panel on multi-district litigation, so the number of active pending claims at the end of 2021 was 3,156. During the first half of 2022, the number of active pending claims increased by 327, which represents a 10.35% increase from the same period in 2021.

By the end of 2021, the company has accrued asbestos liabilities of $180.3 million ($23.0 million current and $157.3 million long term) and recorded asbestos-related insurance receivables of $121.3 million ($16.0 million current and $105.3 million noncurrent).

Net sales keep growing

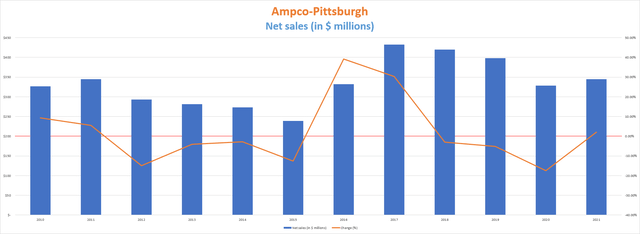

The company’s net sales have been unstable over the past decade, although they have managed to trend upwards in the last stretch, that is, in 2021 and so far in 2022.

Ampco-Pittsburgh net sales (10-K filings)

Net sales increased by 8.79% year over year during the first quarter of 2022, and by 10.99% during the second quarter, boosted by increased prices and energy surcharges. Backlog is 19% higher year-to-date boosted by a 35% increase in the Air & Liquid Systems backlog and 15% in the Forged and Cast segment’s backlog. This is good news as the Air & Liquid Systems segment has historically been more profitable than the Forged and Cast Engineered Products segment.

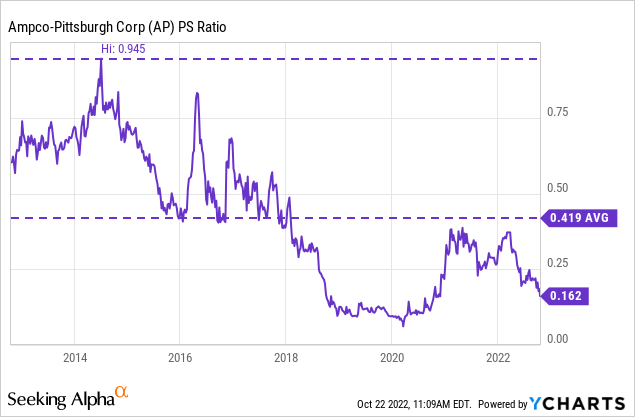

In this sense, the company is increasing its sales as well as orders. Still, investors are less and less willing to pay for the company’s sales, that is, even though sales increase, the share price continues to fall because they give less value to these sales as the company is unable to convert them into actual cash.

The current PS ratio of 0.162 is 82.86% lower than the highest point of the decade reached in 2014, and also 55.66% lower than the average of the last decade. This means that the company currently generates net sales of $6.17 for each dollar held in shares by investors, annually. Here lies the great potential upside in the event that the company manages to increase its profitability in the future as the sentiment is enormously pessimistic. Therefore, it is very important to focus on the company’s main problem that prevents the situation from being reversed: its profit margins.

Profitability issues remain a major challenge

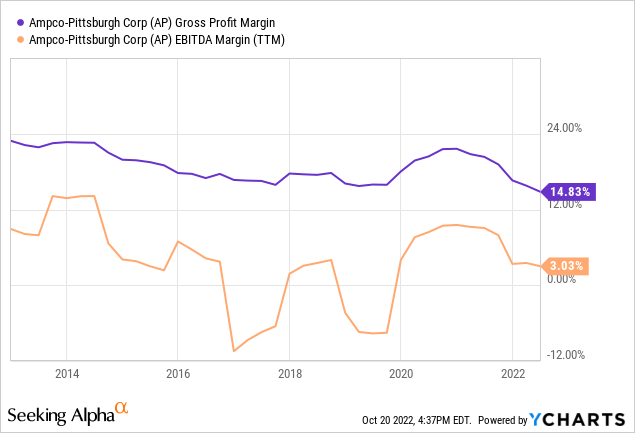

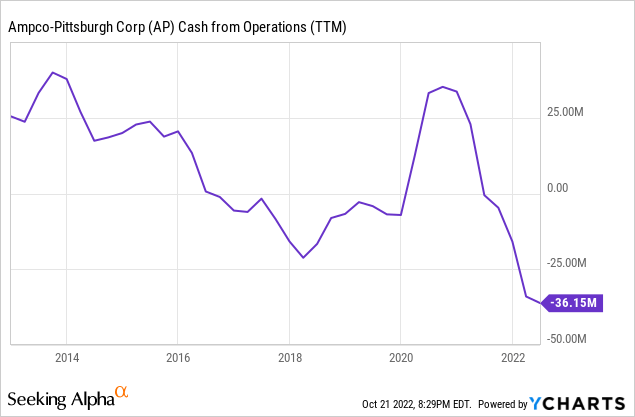

The company had problems generating positive cash from operations in 2016, 2017, 2018, 2019, and 2021, so it is important to understand that until now, the patience of investors has been tested continuously and for a long time, creating an almost permanent (and growing) pessimism. Profitability issues have historically been directly linked to higher raw material prices, declining volumes, and overcapacity in the global steel market, but now the rise in energy prices has come to deal another blow to margins. Gross profit margins were 14.72% during the second quarter of 2022, and the EBITDA margin was 6.39%, leaving trailing twelve months’ gross profit margins of 14.83% and EBITDA margins of 3.03%.

Despite recent price increases, the company’s operations were negatively impacted by the lag in product surcharge coverage in the Forged and Cast Engineered Products segment and supply chain delays in the Air & Liquid Systems segment during the second quarter of 2022.

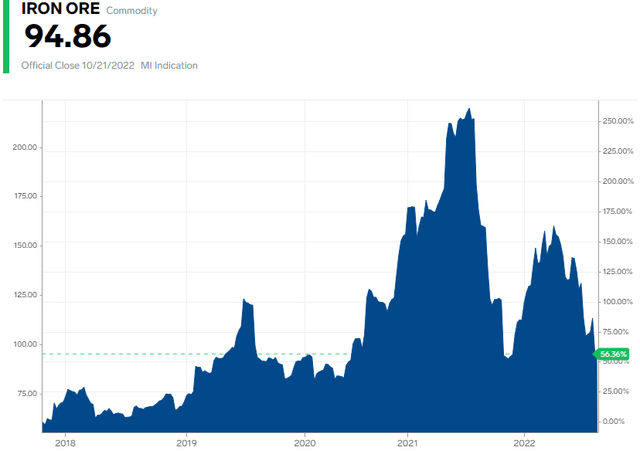

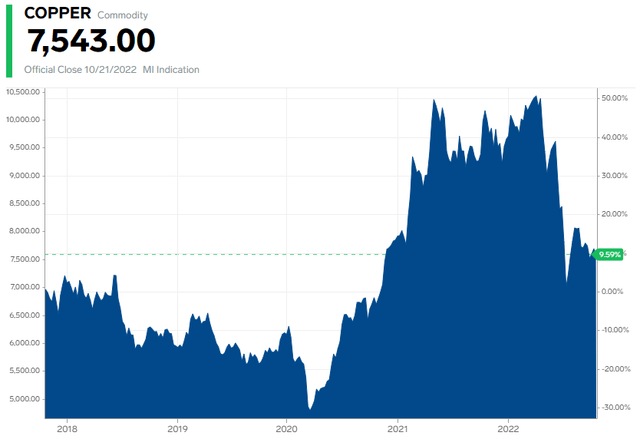

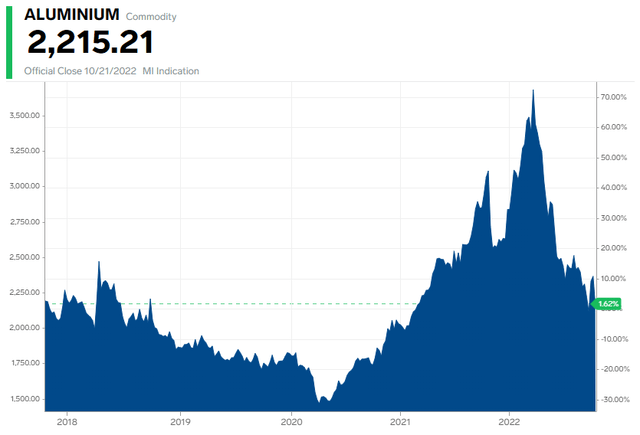

The price of commodities has continued to decrease, including iron ore, copper, and aluminum, but the increased energy prices especially in Europe is a headwind that is currently affecting the company’s operations while supply chain issues keep impacting the business. Management’s hope is that full implementation of the energy surcharge will finally stabilize profit margins now that commodity prices are at more comfortable levels.

Iron Ore commodity price (Markets.businessinsider.com/commodities/iron-ore-price) Copper commodity price (Markets.businessinsider.com/commodities/copper-price) Aluminium commodity price (Markets.businessinsider.com/commodities/aluminum-price)

Until now, these decreases have not offset the increase in the cost of energy as trailing twelve months’ cash from operations is at the lowest level of the last decade at -$36.15 million. Still, inventories increased by $21.5 million during the past twelve months and receivables increased by $15.6 million while accounts payable also increased by $9.7 million, so much of this used cash still has to be paid for.

Things are not looking good at all at the moment, and that is why the stock price has fallen so much. In this sense, part of the discount that we are obtaining by acquiring Ampco-Pittsburgh’s shares at the current price is due to the situation in which the company finds itself, so any tailwind that may arrive would likely mean an above-average return for investors who have ventured into this turnaround bet.

The first installation of capital equipment for the Forged and Cast Engineered Products segment is expected to finish by the end of the year, and the energy surcharge has yet to materialize in all orders. Once these materialize, the company should be able to take advantage of the commodity price decline tailwind. Also, the company is transferring some of the UK’s production to Sweden to take advantage of lower energy costs, and the backlog is increasing faster in the Air and Liquid Processing segment, which enjoys better margins. Time plays against the company, as the level of debt will continue to grow if it fails to reach more acceptable margins in the medium term, and for this to happen, commodity prices will need to continue their downward trend while energy prices will need to find some relief. Both represent macroeconomic factors beyond the control of the company.

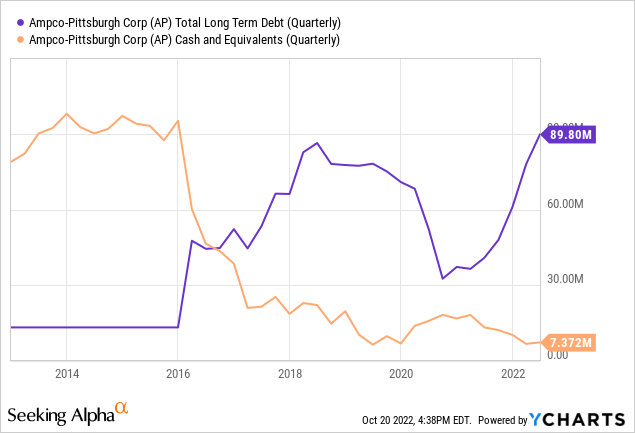

Long-term debt keeps growing while cash on hand remains low

The dividend remains canceled since 2017 as the company entered into a deleveraging phase after acquiring Åkers AB for ~$80 million and ASW Steel for ~$13.1 million in 2016. ASW Steel was finally sold to Valbruna Canada in 2019.

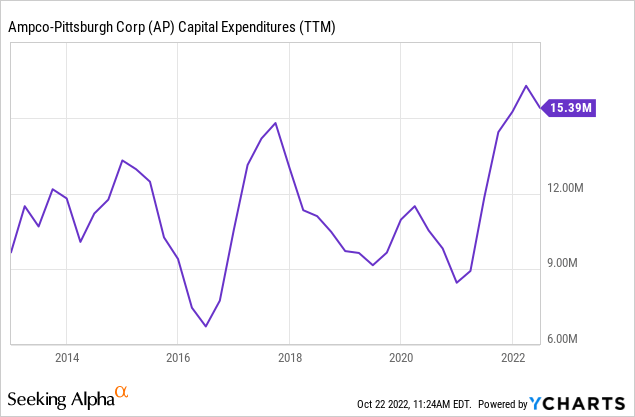

After successfully deleveraging the balance sheet to very acceptable levels of ~$30 million, the company’s long-term debt increased again at the end of 2021 and the first half of 2022. There has been no acquisitions and cash on hand has not increased either, so it is debt acquired to be used in the company’s operations and capital expenditures.

Capital expenditures have increased mostly in the Forged and Cast Engineered Products segment for equipment modernization under the company’s CapEx program, which is expected to intensify in the second half of 2022 and end in 2023.

Risks worth mentioning

The first risk I would like to mention is the cyclical nature of the industries the company serves. In this sense, any economic or cyclical downturn would likely translate into poorer performance, and the company is currently navigating a time when making its operations profitable is crucial to its survival.

Second, but not less important, is the price of raw materials and energy. If energy prices continue to rise and/or the price of raw materials used in the company’s operations reverses and inflationary pressures return on that front, the company’s margins could remain depressed or even fall further, which would be disastrous for its ability to generate positive cash from operations.

We must also take into account that the current increase in long-term debt will translate into future interest expenses. If the company continues to borrow in order to complete its CapEx program and compensate for low margins, interest expenses will limit the room for maneuvering to reverse the current situation in the future.

Conclusion

The situation of the company is not easy at the moment, and that is why shares are trading at such low prices compared to the past. It is necessary for the price of energy to stabilize and for the price of raw materials to continue to fall in the short and medium term so that margins can return to acceptable levels and thus ensure the future of the company. The management is doing everything it can right now. On the one hand, it is modernizing equipment in order to improve efficiency and moving operations to places where energy prices are lower, but debt is increasing as a result of higher capital expenditures and working capital, so a stabilization of profit margins rapidly becoming an urgency. Also, the increasing backlog in the Air and Liquid Processing segment is poised to give some relief to margins.

In this sense, time plays against the company, although thanks to the increase in inventories and accounts receivable, there is still enough margin to continue enduring the current situation for quite some more time while waiting for the current macroeconomic landscape to improve.

Be the first to comment