Pgiam/iStock via Getty Images

Investment Thesis

Knowing when and which stocks to own, actively and selectively, provides a continuing series of net capital gain opportunities delivering wealth accumulation or spendable income at rates which are multiples of what market-index ETFs offer.

If this sounds familiar, it should, because it is our most-used strategy.

You can know what winning institutions know about capital-building stock situations by listening to what the markets tell as capital is being invested. Because today’s markets pay active investors for being in the right places at the right times. They feed off the indolence of passive-strategy investing buy&holders who frequently pass-up timely points of profitable position liquidation.

Increased information technology, communication capabilities, and rapidly evolving competitive practices make this century’s investing markets far more opportune with pricing activity than the 20th century offered. It offered to avoid FOMO of a 5% annual dividend.

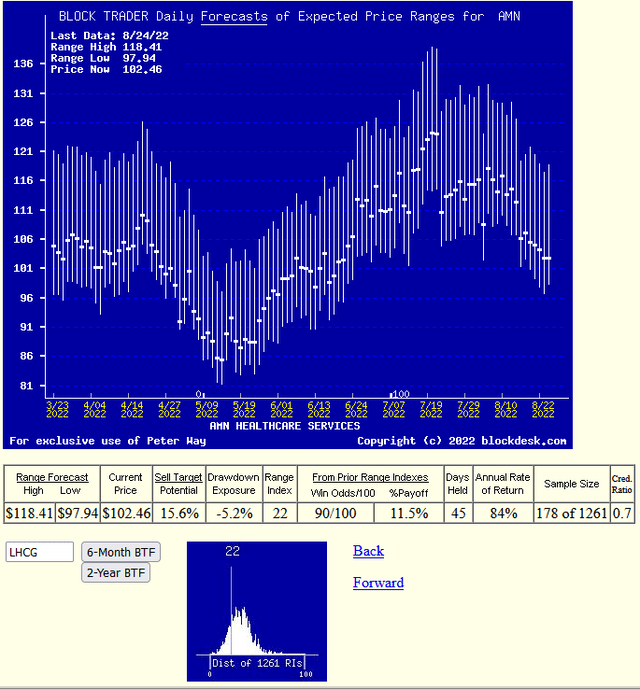

The active investor in AMN Healthcare Services, Inc. (NYSE:AMN) had in the past 5 years 178 opportunities to buy the stock, as it is now, priced with less than a quarter of the range viewed as reasonable, with a higher price some +15% above the present. That prospect had the responsibility of selling the bought holding at the first instance of its close price exceeding the highest forecast price seen reasonable at the time of the forecast.

That discipline produced average gains, ex-ante, of +14.1% in holding periods of 57 market-days on average, a compound annual growth rate [CAGR] of +84%.

Instead of forecasts by analysts of what may be hoped for as price/earnings targets to be sought, the markets define ranges within which prices are reasonably being expected. Ranges warning of currently unmaintainable excesses, and of price depressions unlikely to present buying bargains for long. That clearly defines the expected risk and reward balance for each investment candidate.

Risk and Reward Balances Among Healthcare Providers

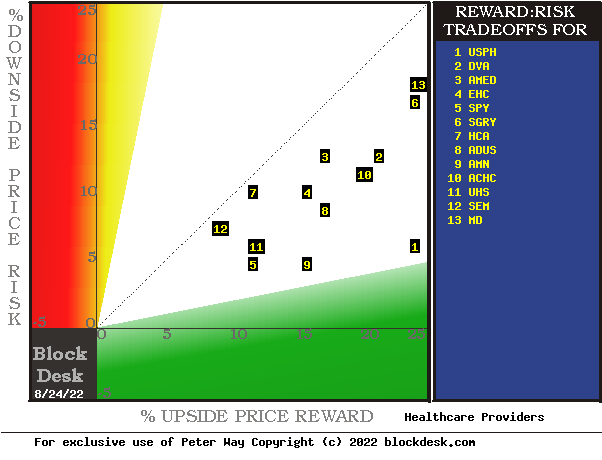

Let’s consider selections from at an “Opportunity Set” of comparable companies ranging from most to least attractive. Here in Figure 1 is how the markets currently appraise their Reward ~ Risk trade-offs, based on behavioral analysis (of what investing systems require to be done, not of emotional investor errors) of actions by Market-Makers [MMs] as they protect their at-risk capital from possible damaging future market-price moves.

Figure 1

blockdesk.com (used with permission)

Their actions are essential to the conduct of irregular large-volume “block trades” which are the frequent movers of stock prices, rather than the continual small-volume traffic of the “investing public” individuals. Upside price rewards are from their potential reward forecasts, measured by the green horizontal scale.

The risk dimension is of actual price drawdowns at their most extreme point while being held in previous pursuit of upside rewards similar to the ones currently being seen. They are measured on the red vertical scale.

Both scales are of percent change from zero to 25%. Any stock or ETF whose present risk exposure exceeds its reward prospect will be above the dotted diagonal line. Capital-gain attractive to-buy issues are in the directions down and to the right.

Our principal interest is in AMN at location [9], closest to the green area indicating a 5 to 1 Reward-to-Risk condition. A “market index” norm of reward~risk tradeoffs is offered by SPY at [5]. Most appealing by this Figure 1 view is AMN.

Description of Subject Company

“AMN Healthcare Services, Inc. provides healthcare workforce solutions and staffing services to hospitals and healthcare facilities in the United States. It operates through three segments: Nurse and Allied Solutions, Physician and Leadership Solutions, and Technology and Workforce Solutions. The company also provides allied health professionals, such as physical therapists, respiratory therapists, occupational therapists, medical and radiology technologists, lab technicians, speech pathologists, rehabilitation assistants, and pharmacists. The company was founded in 1985 and is based in Dallas, Texas.” – Source: Yahoo Finance

Yahoo Finance

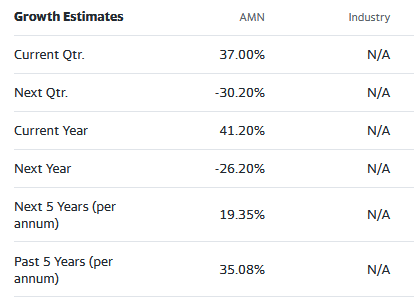

These growth estimates have been made by and are collected from Wall Street analysts to suggest what conventional methodology currently produces. The typical variations across forecast horizons of different time periods illustrate the difficulty of making value comparisons when the forecast horizon is not clearly defined.

The Figure 1 map provides a good visual comparison of the two most important aspects of every equity investment in the short term. There are other aspects of comparison which this map sometimes does not communicate well, particularly when general market perspectives like those of SPY are involved. Where questions of “how likely” are present other comparative tables, like Figure 2, may be useful.

Figure 2

blockdesk.com (used with permission)

Why do all this math?

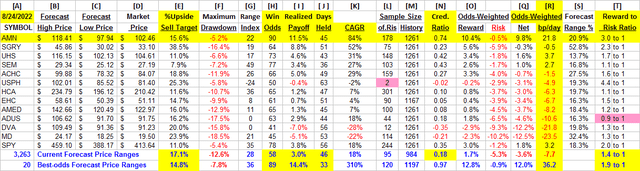

Figure 2’s purpose is to attempt universally comparable answers, stock by stock, of a) How BIG the prospective price gain payoff may be, b) how LIKELY the payoff will be a profitable experience, c) how SOON it may happen, and d) what price draw-down RISK may be encountered during its holding period.

Readers familiar with our analysis methods after quick examination of Figure 2 may wish to skip to the next section viewing price range forecast trends for AMN.

Column headers for Figure 2 define investment-choice preference elements for each row stock whose symbol appears at the left in column [A]. The elements are derived or calculated separately for each stock, based on the specifics of its situation and current-day MM price-range forecasts. Data in red numerals are negative, usually undesirable to “long” holding positions. Table cells with yellow fills are of data for the stocks of principal interest and of all issues at the ranking column, [R]. Cells with pink fills, like column [N] and [T] warn of deficiencies from minimum standards.

The price-range forecast limits of columns [B] and [C] get defined by MM hedging actions to protect firm capital required to be put at risk of price changes from volume trade orders placed by big-$ “institutional” clients.

[E] measures potential upside risks for MM short positions created to fill such orders, and reward potentials for the buy-side positions so created. Prior forecasts like the present provide a history of relevant price draw-down risks for buyers. The most severe ones actually encountered are in [F], during holding periods in effort to reach [E] gains. Those are where buyers are emotionally most likely to accept losses.

The Range Index [G] tells where today’s price lies relative to the MM community’s forecast of upper and lower limits of coming prices. Its numeric is the percentage proportion of the full low to high forecast seen below the current market price.

[H] tells what proportion of the [L] sample of prior like-balance forecasts have earned gains by either having price reach its [B] target or be above its [D] entry cost at the end of a 3-month max-patience holding period limit. [ I ] gives the net gains-losses of those [L] experiences.

What makes AMN most attractive in the group at this point in time is its ability to produce earnings most consistently at its present operating balance between share price risk and reward, the Range Index [G]. Credibility of the [E] upside prospect as evidenced in the [I] payoff is shown in [N].

Further Reward~Risk tradeoffs involve using the [H] odds for gains with the 100 – H loss odds as weights for N-conditioned [E] and for [F], for a combined-return score [Q]. The typical position holding period [J] on [Q] provides a figure of merit [fom] ranking measure [R] useful in portfolio position preferencing. Figure 2 is row-ranked on [R] among alternative candidate securities, with AMN in top rank.

Along with the candidate-specific stocks these selection considerations are provided for the averages of some 3200 stocks for which MM price-range forecasts are available today, and 20 of the best-ranked (by fom) of those forecasts, as well as the forecast for S&P 500 Index ETF as an equity-market proxy.

As shown in column [T] of figure 2, those levels vary significantly between stocks. What matters is the net gain between investment gains and losses actually achieved following the forecasts, shown in column [I]. The Win Odds of [H] tells what proportion of the Sample RIs of each stock were profitable. Odds below 80% often have proven to lack reliability.

Recent Forecast Trends of Primary Subject

Figure 3

blockdesk.com (used with permission)

Many investors confuse any picture of time-repeating stock prices with typical “technical analysis charts” of past stock price history. Instead, Figure 3’s vertical lines are a daily-updated visual record of price range forecast limits expected in the coming few weeks and months. The heavy dot in each vertical is the stock’s closing price on the day the forecast was made.

That market price point makes an explicit definition of the price reward and risk exposure expectations which were held by market participants at the time, with a visual display of the vertical balance between risk and reward.

The measure of that balance is the Range Index (RI). Here in AMN, the current market quote is actually 22% of the full forecast range of $98 to $118 between the bottom of the forecast range and the current market quote, making the upside prospect the full +15.6% to the forecast top from the current market.

With typical holding periods of 45 market days out of a 252-day year history’s advantage of the +11.5% average accomplished could be repeated over five times a year, which compounds into a CAGR of +84%.

Conclusion

Based on direct comparisons with other Education-oriented publishers, there are several clear reasons to prefer a capital-gain seeking buy in AMN Healthcare Services, Inc.

Be the first to comment