Leonid Ikan

After over two years of immense volatility, the crude oil market has found a plateau. Oil prices have settled into the ~$90 to ~$110 range – prices not seen in over a decade. However, with the leveling off of crude oil inventories, we can expect prices to remain flat for some time. The recent slowdown in oil prices significantly contributed to July’s flat CPI print, ushering in expectations of a return to general market stability.

As I’ve mentioned in recent articles, this view has some potential risks. Notably, the leveling-off of oil prices is primarily driven by a massive decline in the government’s Strategic Petroleum Reserve and not organic production growth. In the short run, this effort has led to more stable energy prices and cooling inflation. However, in the long run, the SPR will need to be refilled – potentially reversing the commercial oil inventory rise if production is not restored. U.S crude oil production is rising, primarily by using previously-drilled oil wells and not newly drilled ones – meaning organic production growth may slow unless oil companies dramatically increase CapEx spending. Given the slowdown in oil prices and rising production costs, capital investment growth is not guaranteed.

I believe this situation bodes well for the energy market, but it may be months before the bull market returns, given the ongoing SPR drawdown. In the meantime, investors may find more significant and stable returns in midstream oil companies such as those in the energy MLP ETF (NYSEARCA:AMLP). AMLP invests in a set of master limited partnerships in the oil and gas energy infrastructure industry. These firms do not typically generate an income based on the price of oil (or other energy products) but fees relating to energy flows and storage. This factor gives them less commodity-price volatility and significantly higher dividend yields than found in exploration and production firms. In my view, midstream energy is superior in the short run due to its reduced commodity-price risk. However, AMLP does have a few potential risks relating to the slowing U.S economy.

Midstream Energy Economics Offer Stability

Over the past decade, midstream energy companies have been closely correlated to oil and natural gas prices. From the late 2000s to ~2019, the U.S saw immense growth in energy production and midstream infrastructure. The growth spurt was not driven by high oil prices but by technological improvements that allowed for rapid expansion of the U.S shale patch. As production surged, energy prices tumbled, leading many producers to lose money despite significant growth investments.

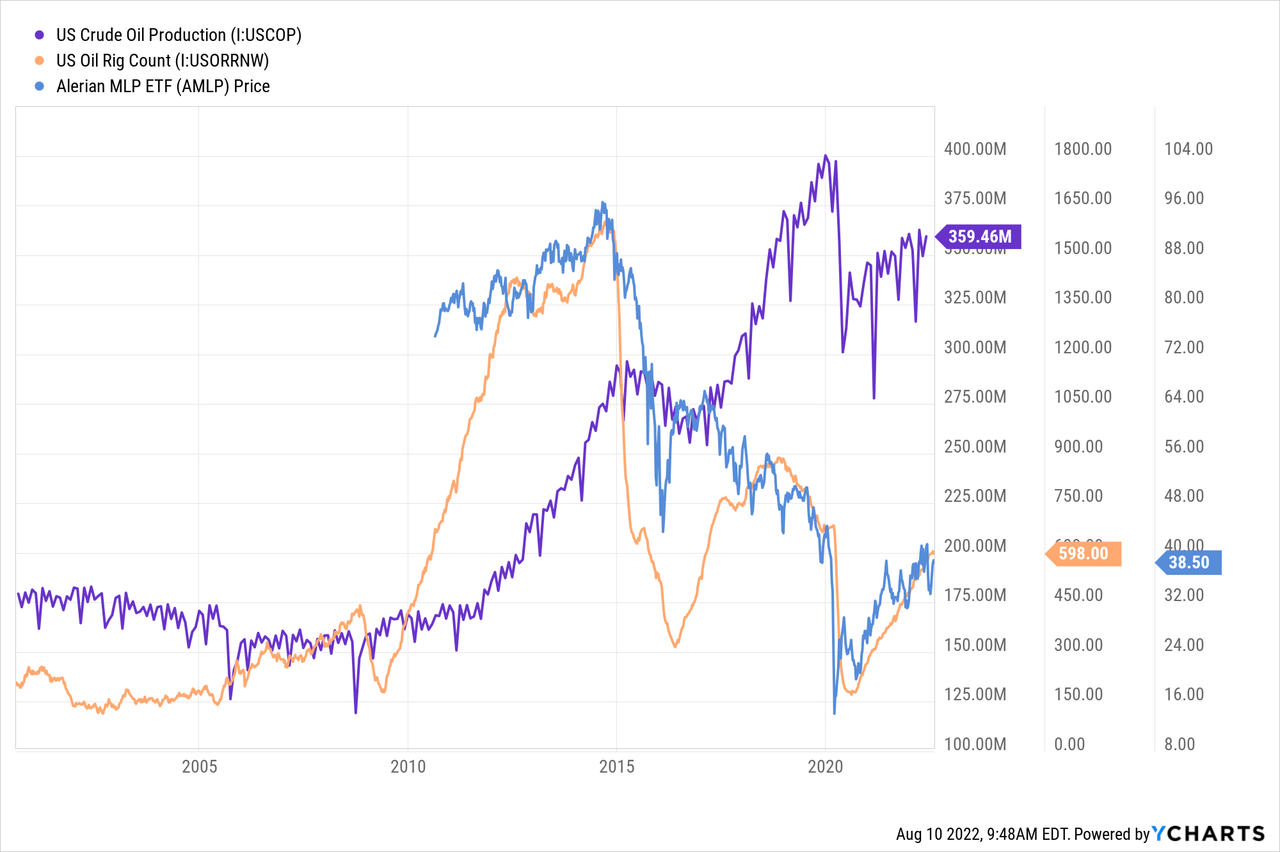

Midstream companies suffer when producers are not breaking even as flows and fees decline. The oil rig count determines changes in production as rigs drive drilling activity. In general, AMLP’s price is closely correlated to the oil rig count as declines in drilling lead to reductions in midstream profits. See below:

The U.S oil rig count surged after 2010, leading to immense oil production growth. The oil market fell into a glut by late 2014, rapidly causing crude to decline from ~$100 to <$50. Many energy companies underwent financial restructuring during this time and raced to reduce production growth, leading to declines in the U.S oil rig count and total production. Prices rose above $60-$70 (roughly the new-well breakeven cost), triggering another period of production growth than ended abruptly in 2020 on global lockdowns.

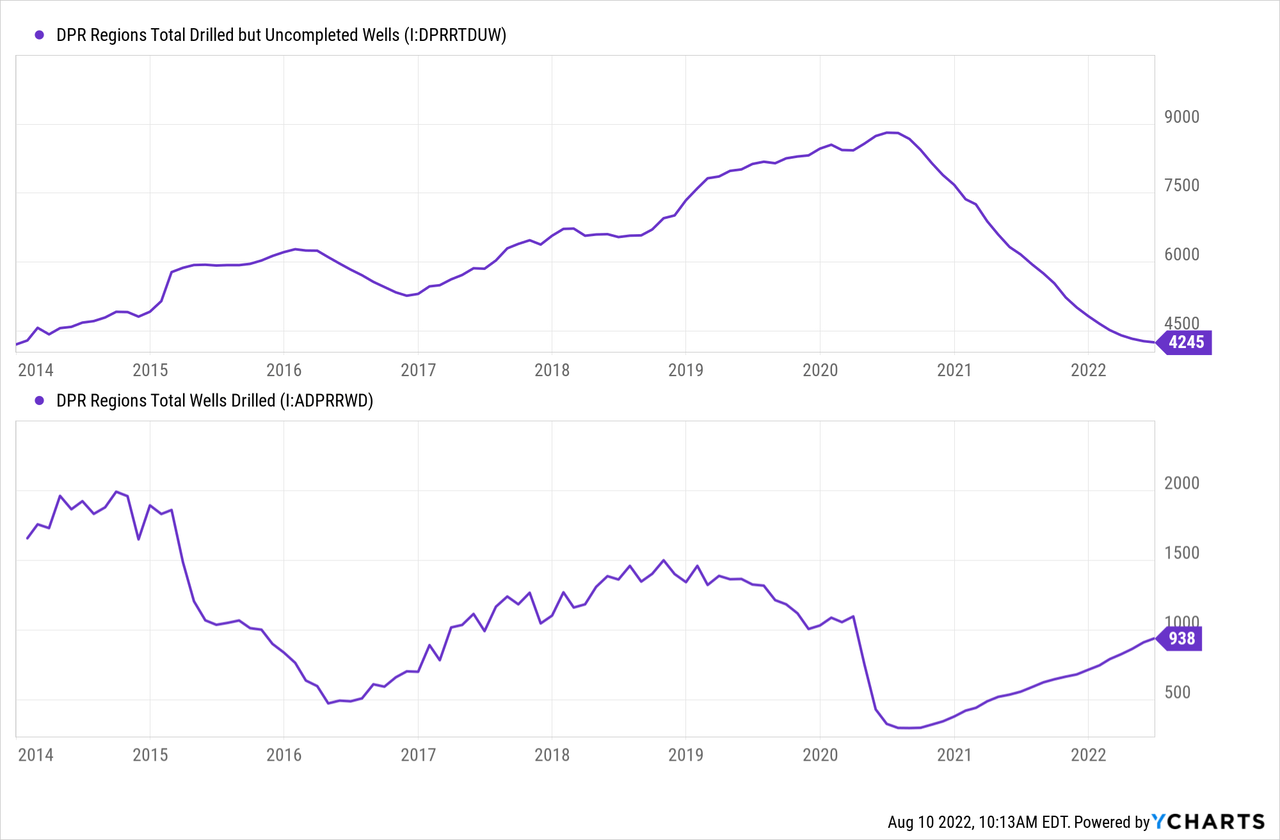

Since then, there has been a modest recovery in the U.S oil rig count, and crude production has retraced about half of its 2020 declines. For output to remain flat, there must be relatively sizeable constant drilling activity due to significant depletion rates in young oil wells. I believe the U.S rig count must be above ~600 for today’s production level to remain flat. Total U.S oil production has risen over the past 18 months while the rig count (the driver of total wells drilled) was meager. Oil companies have been utilizing previously “drilled but uncompleted” oil wells to make the difference. The inventory of these “DUC” wells is now bottoming out after hitting a decade low. See below:

Without a supply of “DUC” wells, the U.S rig count must rise materially higher for overall U.S oil production to grow. Midstream oil companies may benefit from this situation as fees and volumes usually rise with the rig count. Of course, a higher rig count requires an increase in energy producers’ CapEx spending, which does not appear likely. Even if oil companies seek to increase investment, they may lack the labor and machinery supply to do so.

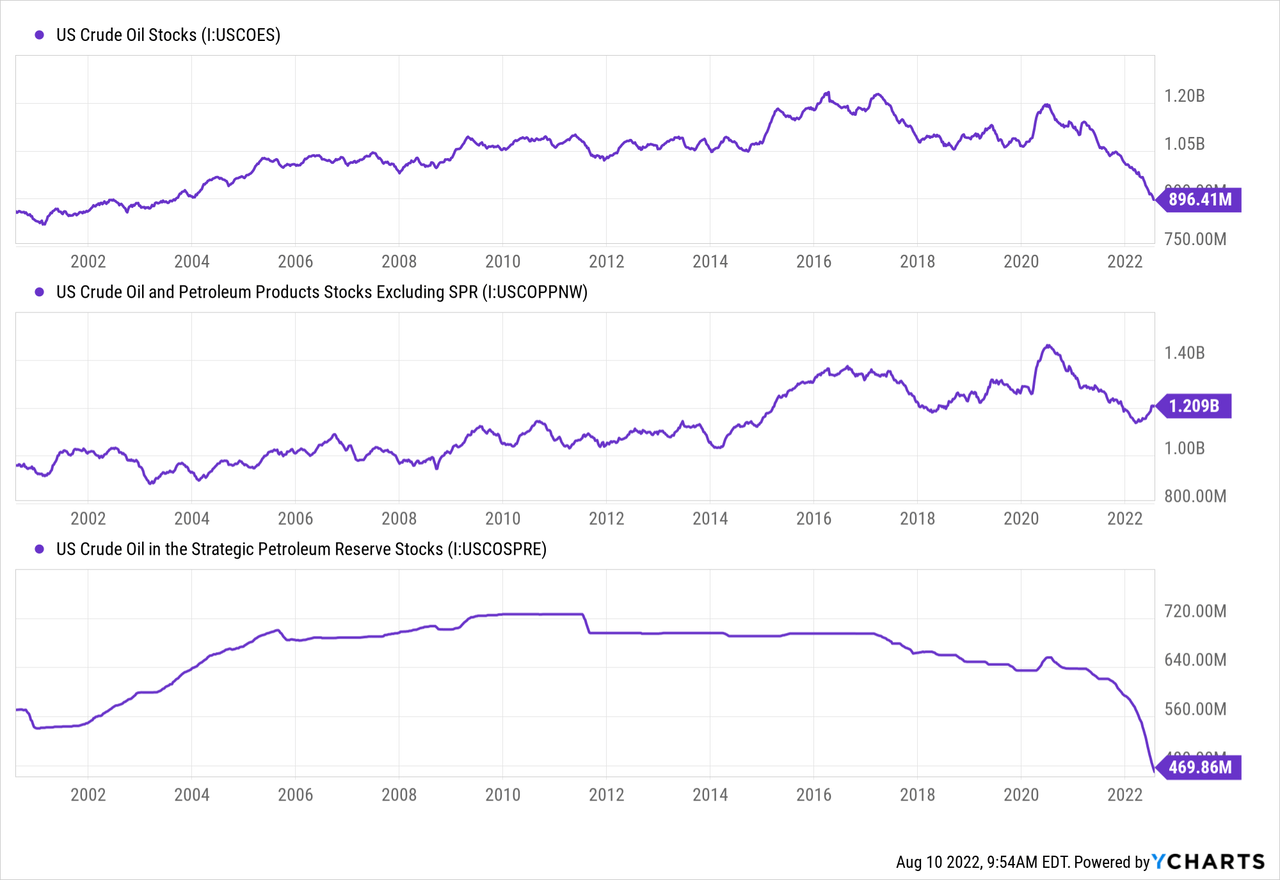

As such, I doubt oil production will continue to grow and may even slip as the many newly completed wells undergo first-year depletion. Still, I highly doubt a significant production decline will impact midstream volumes dramatically. Eventually, the slowdown in production growth combined with the ongoing depletion in oil storage levels may result in another large wave higher for crude oil. As you can see below, the recent “growth” in commercial U.S oil inventories is caused by SPR reductions:

Domestic energy prices are largely driven by commercial inventories, which have steadily increased since June. However, total oil inventories, including those in the SPR, have declined dramatically. SPR withdrawals will need to end by mid-2023 if the current pace is held. Since it appears unlikely that U.S. oil production will expand by then, the eventual end of SPR withdrawal will likely result in rapid and significant commercial crude oil storage declines – likely triggering higher oil prices.

I believe the only way this potential oil shock can be avoided is for energy demand to decline. As I’ve noted, energy demand destruction is a possible risk factor for MLPs. The U.S. economy is in a technical recession, and real wages continue declining despite the moderate inflation slowdown. However, for now, I expect seasonal oil demand to hold steady due to the significant recent declines in gasoline prices, as evidenced by the recent rise in refinery capacity utilization. Oil demand may be much lower (and prices much higher) if not for immense SPR releases. However, SPR releases will pin prices down and keep demand up until the year ends – given no new black-swan events.

Investing In Energy Market Stability

This deep dive into today’s oil market economics points to a few conclusions. Firstly, over the coming 6-12 months, oil prices will likely remain within their current range as supply, demand, and the impact of SPR releases are unchanged. Secondly, once the SPR withdrawal ends, oil prices may rise significantly higher unless there is a large increase in production or a significant decline in demand. In my view, production growth is doubtful given the labor and parts shortages. However, there is a moderate risk of a decline in oil demand given today’s slowing economy and a generally unstable global economic and geopolitical environment. However, for now, it appears highly unlikely that U.S. energy demand will decline enough to impact midstream firms materially.

I believe AMLP is an excellent investment today because it can deliver strong returns under stable conditions. Midstream companies are less dependent on the price of crude oil as long as oil remains above ~$70 – the breakeven cost for newly drilled wells. This factor means AMLP should continue to be far less volatile than most other energy companies, meaning its sizeable dividend yield of ~8% should deliver cash flows without significant principal risk. Unlike many high-yield investments, AMLP (and its constituents) are highly inflation-hedged due to their energy market connection.

Most midstream oil companies are priced as if they carried the same oil-glut risks as they did from 2013 to 2019. I believe the fundamental situation has reversed as the energy market is now fluctuating around a chronic shortage instead of a chronic glut. In today’s market, the revenue of these energy infrastructure companies may not rise, but their low risk of falling means MLP’s fair-value yield is likely to contract over time. Most higher-risk bonds pay yields of 5-6% today; given AMLP may have lower risks than them, I believe its fair-value yield is at least below 6%. AMLP’s price would rise by ~33% if AMLP’s yield contracted to 6% while its dividend remained constant. It may take time for risk-perception facing midstream MLPs to decline, but this factor may eventually offer today’s long-term AMLP investors excess returns.

One downside to the ETF is its higher 87 bps expense ratio which could be avoided by buying its constituents directly. However, AMLP allows investors to allocate to MLPs without needing to file K-1s. I believe AMLP’s chief risk is a recession-driven oil demand shock. Investors may want to be mindful of this factor, but I think the recent declines in gasoline prices substantially mitigate it. Overall, I remain bullish on AMLP and believe the fund may have a better outlook than it did a year ago. AMLP is not likely to deliver extreme potential excess returns like exploration and producer stocks. Instead, I believe AMLP will offer stability, a strong yield, and the potential for a slight increase in principal value.

Be the first to comment