sorn340/iStock via Getty Images

Americold Realty Trust (NYSE:COLD) is the world’s largest publicly traded real estate investment trust (“REIT”) focused on temperature-controlled warehouses. These types of warehouses are mission-critical assets in the “cold chain“, which is a logistics network used to ensure the shelf life of various products such as agricultural produce, seafood, frozen food, chemicals, and pharmaceutical products.

Despite its shorter public tenure, the company has a long operating history, with 120 years in the business. Due to the difficulties in operating these types of assets, COLD is sheltered from meaningful competition. While other larger industrial REITs do have exposure to cold storage, none operate them as a core aspect of their business.

At present, Lineage Logistics and United States Cold Storage (“USCS”) are their two most significant competitors. And neither is publicly traded, though Lineage does hold the title of being the overall market leader, with a 10.6% global market share as compared to COLD’s 5.7% and USCS’ 1.6%.

While the sector is experiencing elevated demand from investors, private and public alike, COLD’s stake in the market is unlikely to be challenged any time soon. With their leadership position largely protected, the company is poised to capitalize on favorable demand drivers that include shifting habits among food consumers and increased online sales of groceries.

YTD, shares are down 12% and are currently trading closer to their highs than their lows. At 27x adjusted forward funds from operations (“FFO”), the stock does lack bargain appeal. But that’s not enough to tune out the stock altogether.

Occupancy levels are currently lagging and margins have room to improve. Yet, the company still posted upper-single-digit growth in adjusted FFO and double-digit growth in net operating income (“NOI”) in the current reporting period. As these metrics improve, as they should, given favorable projected sector growth rates through 2028, COLD could exhibit accelerating earnings growth. This warrants at least a second look at the fundamentals of its business.

A Geographically Dispersed Portfolio Of Mission-Critical Warehouses

COLD currently has an interest in over 240 warehouse properties, located principally in the United States. They also have a sizeable operating presence in Europe, equating to just under 7% of total net operating income (“NOI”). This does not include exposure to the war-stricken regions of Ukraine/Russia.

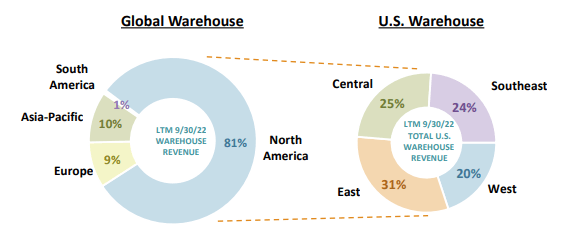

Within the U.S., the company’s operations are concentrated in six states that account for approximately 41% of their owned or leased warehouses. While this does subject COLD to elevated risks associated with individual state-specific conditions, this is offset by their proportionate dispersion across four primary regions in the Central, Eastern, Western, and Southeastern parts of the U.S.

November 2022 Investor Presentation – Snapshot Of Geographic Exposure Of Warehouse Operations

The company is also adequately diversified across various commodity types housed in their warehouse facilities. At a collective total of 31% of revenues, packaged foods and poultry products account for the largest share of warehouse revenues. They do also carry retail products, but its share of warehouse revenues is just 19%. The other 79% is attributable to food manufacturers.

Poised To Capitalize On Favorable Sector Dynamics

Exposure to food manufacturers has several embedded competitive advantages. First, food is essential. And storage of it at temperature-controlled warehouses is mission-critical. As such, the company’s revenue stream can be considered recession resistant.

And over the last 35 years, these manufacturers have increasingly outsourced their warehousing needs to redeploy capital into their core businesses. This has benefitted leading operators such as COLD. In the future, it’s also likely that those that still have in-house operations will at some point offload the property in favor of third-party management.

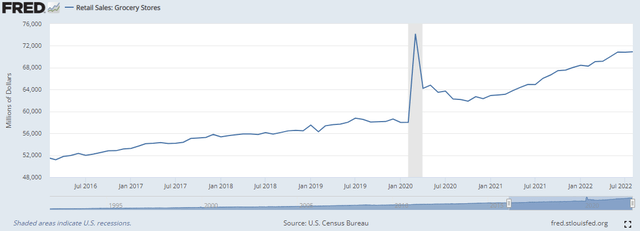

Changes over the past two years in the way consumers buy groceries and meals are also a favorable tailwind for the company. With many individuals spending more time at home due to hybrid working arrangements, home-cooked meals are becoming more prevalent, which is resulting in greater stockpiling of certain foods.

St Louis Fed – Retail Grocery Sales Trend

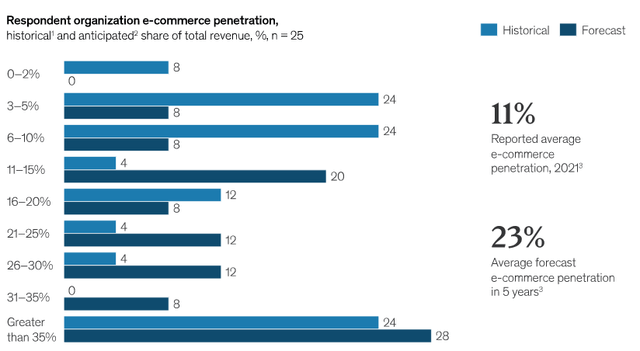

Additionally, more consumers are shopping for their groceries online. And according to a recent survey of executives within the grocery industry by McKinsey & Company in April of 2022, e-commerce penetration is expected to reach 23% in the next five years and even as high as 35% in the years following. At present, current penetration levels are between 11-13%. If e-commerce levels do in fact reach upwards of 30% of the total market, that would necessitate significantly more storage and distribution solutions.

McKinsey & Company Research – The Next Horizon For Grocery E-commerce: Beyond The Pandemic Bump (April 2022); Survey Of Expected E-Commerce Penetration In Groceries

Heightened Investor Interest In The Sector

Favorable sector dynamics are resulting in a heightened level of interest in the sector. Through the first half of the year, for example, nearly 3.3M square feet of refrigerated warehouse space was under construction, according to a report by CBRE. This is up over 1000% from 2019 levels. Furthermore, much of the development was speculative, meaning the properties were not pre-leased ahead of construction.

Private-equity firm Bain Capital also recently formed a joint venture with another real-estate developer to spend up to +$500M to build up to 15 refrigerated warehouses across the U.S. over the next three to five years.

Driving the venture was the recognition that many existing facilities are aged and located away from cities, which is incompatible with the e-commerce aspect of cold storage, given the perishability factor that must be considered.

Aside from Bain, interest is up across the board. In the same report by CBRE referenced earlier, 39% of investors seeking alternative investment sectors said they were interested in cold storage. This is up from just 7% in 2019.

The Sector Isn’t For Everyone

Still, despite the interest, the sector does have its drawbacks. With so much speculative supply coming to the market, that could quickly create an unfavorable imbalance if the market turns for the worse. Costs of development are also higher due to the intricacies involved in developing storage for frozen and perishable foods.

Others have also avoided the market or abandoned it altogether. At one point in time, for example, Vornado Realty Trust (VNO) made a bet on the industry but bailed out after it failed to materialize as initially hoped for. And Prologis (PLD), one of the world’s largest logistics companies had once cited hesitancy in investing in the sector due to its capital commitments.

Relieving Labor Inefficiencies Is Key To Improving Operating Margins

One particular hurdle in the sector is the labor component, which can create a significant drag on earnings. From an employee perspective, work in a refrigerated warehouse means exposure to extreme cold for extended periods of time. This can create significant physical and mental stress on a daily basis. As has been noted on previous earnings calls, many employees quickly turn over upon realizing work in cold storage isn’t for them.

In addition to reducing turnover, another prime focus for management is increasing their ratio of permanent employees to temporary associates. This would improve productivity and reduce the hourly cost per labor.

In the current period, they exhibited progress on this by achieving a perm/temp ratio of 72/28, which is modestly above 2021 levels and slightly better than their pre-COVID levels of 70/30. As a longer-term goal, management is striving to achieve a ratio of 80/20. This would go a long way to reducing costs and inefficiencies.

Turnover, however, still remains significantly higher than prior periods. At the end of September, the annualized turnover trend was 21% above 2021 levels and 33% higher than pre-COVID levels. This is notable because higher turnover results in significant recruiting and re-training costs, which feeds negatively into warehouse services margin.

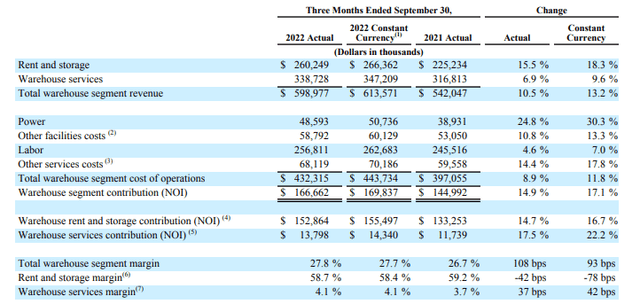

At 4.1%, services margins were 37 basis points (“bps”) improved from last year. But at the end of 2019, the margins were 9.8%. In order to get back to those levels, management must reduce turnover and/or continue increasing their perm/temp ratio, both of which are two very controllable improvement opportunities.

Q3FY22 Investor Supplement – Summary Of Quarterly Warehouse Segment Revenues And Related Margins

Don’t Give Them A Cold Shoulder

Americold’s quarterly operating results continued to show improvement. Global same-store warehouse NOI margins, for example, were up 125bps from last year, driven by gains in services NOI margin, which itself was up 116bps.

AFFO/share was also up 7.4% from last year on strength from their same-store pool, which benefitted from both favorable pricing and a 437bps increase in economic occupancy levels.

Throughput, which refers to the volume of pallets entering and exiting their warehouses, did decline and employee turnover still remains elevated. But NOI still overcame these deficits. And management ultimately raised guidance on overall AFFO for the year.

The stock certainly doesn’t come cheap at 27x the lower end of their forward estimate. It operates in a niche subsector of the industrial market, however, and its market share faces limited threats. They also offer credible expertise in operating cold storage facilities, which positions them strongly to navigate through challenging operating conditions.

Furthermore, its balance sheet is well-positioned with existing liquidity of about +$700M and limited debt maturities through 2026. The mission-critical aspect of their operations also provides a durable stream of cash flows from a quality customer base that includes 14 investment-grade companies among their top 25 customers.

While some investors may be tempted to give the company a cold shoulder due to its current trading levels, others could benefit from its defensive nature and favorable long-term outlook. At the very least, the stock is likely to retake its 52-week highs, should they further improve margins and occupancy levels, which would imply an upside of over 15%. Though it may not warrant an overweight position in the portfolio, there’s enough embedded upside to consider in the event of any pullback in the near-medium term.

Be the first to comment