MoMo Productions/DigitalVision via Getty Images

Some investors may look at REITs as a monolith, ignoring entirely the different niches that each one has been built to focus on. Some investors may go only one step further and categorize them into either commercial or residential entities. But the fact of the matter is that the world of REITs is far more complicated than that. Even within the residential space, you’ll have companies with different areas of focus and different regions of operation. A great example of this can be seen when looking at American Homes 4 Rent (NYSE:AMH). With an emphasis on single-family properties, American Homes 4 Rent is an interesting company that has generally done well over the past few years. Despite concerns about the economy, and even with interest rates currently climbing, the fundamental picture for the company remains robust. Despite this, shares of the company have come under pressure recently. For those focused on the long haul, now might be a good time to consider buying in. But more likely than not, the high cost of the shares suggests that further downside might be on the table near term. And due to this, I would make the case that the company still represents a ‘hold’ prospect for now.

Performance continues to improve

Back in November of 2021, I wrote an article discussing the investment worthiness of American Homes 4 Rent. At that time, I called the company a quality operator in its space. I said that continued growth and robust cash flows were promising and that the company’s long-term prospects were looking up. However, I also said that shares of the company were rather pricey at that time. At the end of the day, this led me to rate the business a ‘hold’, because I felt that the positives and negatives were roughly balanced. Since then, the company has actually performed slightly better than I would have anticipated. You see, when I rate a company a ‘hold’, my belief is that performance for the foreseeable future will more or less match the market more broadly. However, while the S&P 500 is down by 18.5%, shares of this REIT have dropped a more modest 11.3%.

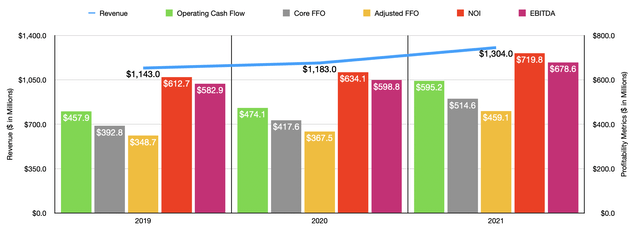

This share price performance comes at a time when the company’s fundamental condition only continues to grow stronger. Consider how the business ended its 2021 fiscal year. Revenue then came in at $1.30 billion. That’s 10.2% higher than the $1.18 billion the company reported just one year earlier. A significant contributor to this increase was a rise in the number of single-family properties the company has on its books. This number increased from 53,584 at the end of 2020 to 57,024 at the end of last year. That translates to a 6.4% increase year over year.

On the bottom line, the picture also improved. Operating cash flow came in at $595.2 million. That compares favorably to the $474.1 million reported for the 2020 fiscal year. Core FFO, or funds from operations, increased from $417.6 million to $514.6 million. On an adjusted basis, this metric increased from $367.5 million to $459.1 million. Net operating income, also known as NOI, grew from $634.1 million to $719.8 million. And finally, we have EBITDA. According to management, this figure came in at $678.6 million in 2021. This represents an increase of 13.3% over the $598.8 million the company reported just one year earlier.

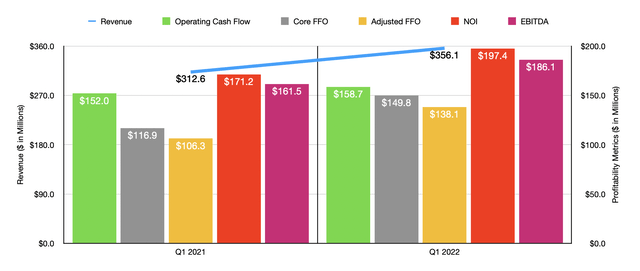

As management continues to buy additional properties, revenue for the business continues to expand. In the first quarter of the company’s 2022 fiscal year, revenue came in at $356.1 million. That’s 13.9% higher than the $312.6 million reported the same quarter of 2021. By the end of the latest quarter, the number of properties on the company’s books totaled 57,984. That’s 7.4% above the 53,984 the company had at the end of its first quarter last year. As revenue has risen, profitability has followed suit. Operating cash flow went from $152 million in the first quarter of 2021 to $158.7 million the first quarter this year. Core FFO improved from $116.9 million to $149.8 million, while the adjusted reading for this increased from $106.3 million to $138.1 million. NOI managed to increase from $171.2 million to $197.4 million, while EBITDA increased from $161.5 million to $186.1 million.

When it comes to the 2022 fiscal year, management has provided some guidance. They have not offered up any estimate as to what revenue might be. But they did say that they plan to invest Between $1.6 billion and $2.0 billion into additional assets. Between $1.2 billion and $1.5 billion of this will be related to the purchase of wholly-owned land and development. Another $300 million to $400 million will relate to the pipeline of assets the company has in front of it. And $100 million will be its share of capital expenditures associated with joint ventures and property enhancements for the year. The spending on wholly-owned properties should add between 3,300 and 3,900 homes to its portfolio.

On the bottom line, the company expects to generate core FFO per share of between $1.53 and $1.59. At the midpoint, this would translate to core FFO of $543.3 million. Assuming that the year-over-year increase anticipated from this will be indicative of how the other profitability metrics will perform, investors should anticipate adjusted FFO of $484.7 million. Operating cash flow should be around $628.4 million, with the removal of preferred distributions and non-controlling interests decreasing this to roughly $572.1 million. Based on my math, NOI should come in at around $759.9 million, while EBITDA should total $716.4 million. With this strong cash flow, it remains to be seen whether management will make some other interesting financial moves. We do know that the company, after the end of the first quarter this year, bought back $155 million in preferred stock, saving investors pre-tax cash flow of $9.1 million annually. It’s not unthinkable that management could make other interesting maneuvers like this.

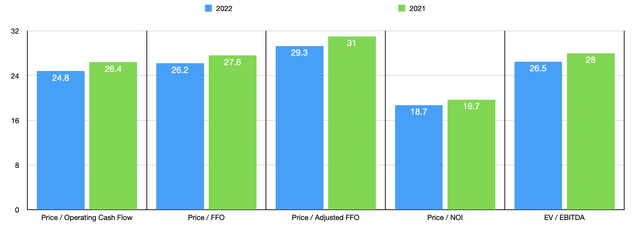

Using the data we have, it’s not difficult to value the company. On a forward basis, the firm is trading at a price to adjusted operating cash flow multiple of 24.8. This is down from the 26.4 reading that we get if we use 2021 results. Year over year, the price to core FFO multiple looks set to drop from 27.6 to 26.2. The adjusted figure for this should decline from 31 to 29.3, while the price to NOI multiple should drop from 19.7 to 18.7. Meanwhile, the EV to EBITDA multiple should decline from 28 to 26.5. To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price to operating cash flow basis, these companies range from a low of 17 to a high of 25.4. Using our 2021 results, American Homes 4 Rent was the most expensive of the group. The same held true when relying on the EV to EBITDA approach, which yielded a range of 18.9 to 27.6.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| American Homes 4 Rent | 26.4 | 28.0 |

| Equity LifeStyle Properties (ELS) | 23.2 | 27.6 |

| UDR (UDR) | 20.4 | 22.5 |

| Camden Property Trust (CPT) | 23.3 | 18.9 |

| Essex Property Trust (ESS) | 17.0 | 20.1 |

| American Campus Communities (ACC) | 25.4 | 27.6 |

Takeaway

Based on the data provided, American Homes 4 Rent seems to be a strong company still. Long term, I have no doubt that the business will continue to grow. However, I do believe that shares are still a bit lofty on both an absolute basis and relative to similar players. If the company can fall further and achieve the financial figures that I estimated, it is possible that my opinion could change for the better. But for now, and given the uncertainty of the broader economy, I have decided to retain my ‘hold’ position for the firm.

Be the first to comment