wdstock

American Eagle Outfitters, Inc. (NYSE:AEO) is far from recession-proof, in fact, it is very economically sensitive. Apparel is consumer discretionary, one of the first categories to be cut when people cut back on spending, and in general, consumers are fickle about brands. With the economy not looking too healthy, those are the primary risk considerations when investing in AEO. That said, management is among the most talented in the apparel retail industry, in my view. They have executed their growth strategy, maintained efficient operations and inventory management to support margins. It’s very easy for a retailer to overstock merchandise that eventually requires significant markdowns to restock shelves with the right SKUs. Without clearing inventory quickly enough and at the right price point, stores become unprofitable and, if prolonged, require closure contingent on other factors like lease agreements.

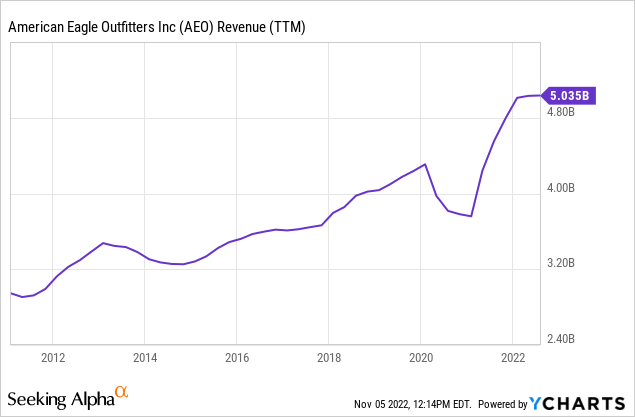

Overall though, AEO has done quite well in this respect with limited store closures and by net expanding its store footprint from 1,047 locations in FYE17 to 1,133 in FYE21 and 1,141 by Q2 2022. AEO’s topline has been quite resilient throughout the retail apocalypse, COVID pandemic, and now looming recession as consumer sentiment has collapsed to multi-decade lows:

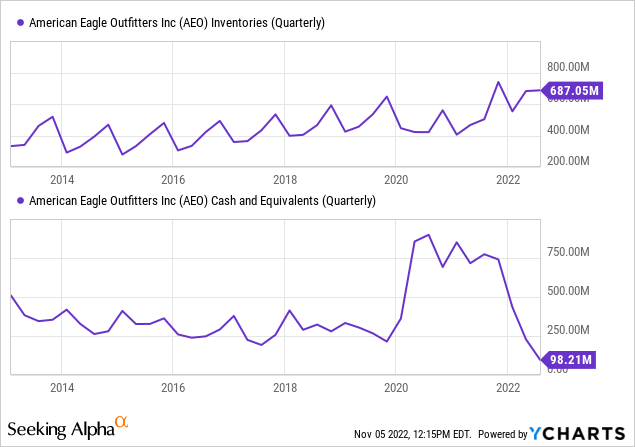

Despite American Eagle’s inventory efficiency compared to the competition, it is not immune from broader economic pressures. Back in September, the company said it was actively clearing inventory, reducing capex, and eliminating its dividend. That’s strategically sound given the company’s margins and cash flow were under pressure, particularly as cash and equivalents fell to a fresh low.

Fortunately, the company remains profitable and cash flow positive, which staves off any liquidity risk. Despite consolidated revenue being essentially flat to slightly up YOY, operating income compressed stemming from all three segments due to markdowns, higher transportation costs, and Quiet Platforms’ minor loss.

Back in 2021, AEO made two supply chain-related acquisitions, including Quiet Platforms and AirTerra to form its “Supply Chain Platform”. Management has discussed that these decisions were driven by the goal of achieving scale and greater efficiencies to compete with larger retailers. For example, AEO has sought to improve customer service by providing same-day and next-day delivery like Amazon (AMZN). Although some net losses have been incurred so far, management has already relayed reduced delivery expenses, less shipments per order, and faster lead times. Given AEO’s already strong inventory management capabilities, such integrations should result in better sales, operating margins, and cash efficiency over the long term.

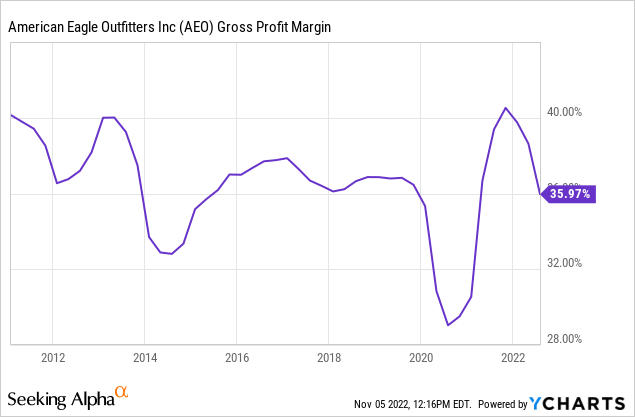

In the near term, management guided that gross margins will decrease to the low 30s in Q4 2022, which will be the lowest mark since the COVID pandemic.

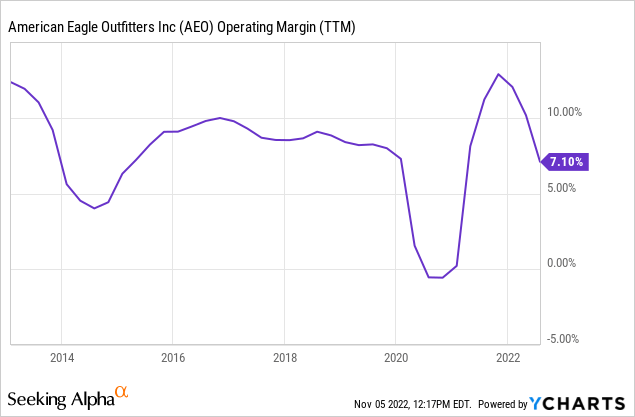

However, I think once the company clears through this cycle of excess inventory, gross margins will normalize, and cost efficiencies will bring operating margins back to their historical average. My estimate is that operating margins should revert to an average range of 7-10%, similar to the pattern shown in recent years excluding COVID.

Another growth opportunity for AEO is its plan to open two flagship stores in Japan. AEO already has an online presence in Japan, but if this reopening proves successful in these locations, there may be another leg of organic growth for the company.

I think AEO’s sales will eventually surpass $6 billion or more, but it’s certainly possible that growth sputters for a while around its TTM revenue of $5 billion. If we combined this revenue and operating margin estimate, AEO can produce $350 million in operating profit on the low end. Factoring in its total interest expense of $16 million and an effective tax rate of 25% generates about $250 million in net income or about $1.39 in EPS. That equates to 8x earnings. If we take the blue sky scenario of $6 billion in sales and a 10% operating margin, that’s a much better $2.43 in EPS, or 4.5x earnings. Arguably, a cyclical retailer should not trade any higher than 8x earnings, except AEO is not your typical retailer. Again, AEO demonstrates a fairly consistent ability to deliver organic revenue growth, particularly still having runway with Aerie, and is further optimizing its supply chain. It also has limited financial leverage.

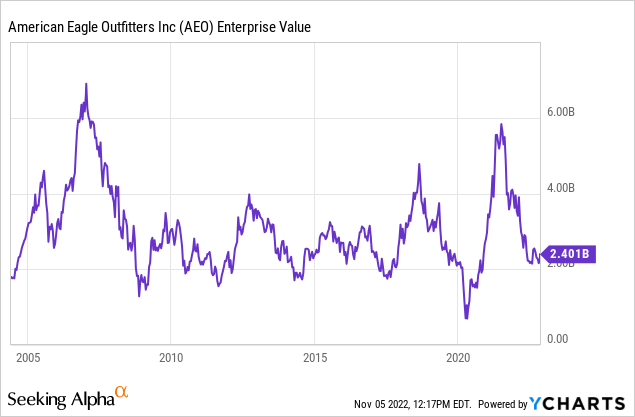

Taking these factors together, I think there’s a good argument for AEO to be revalued toward a total enterprise value of $3 billion, or about $16/per share. This price target equates to almost 50% upside from current prices.

Downside Concerns

The main downside risk considerations are that the economy and/or consumer sentiment could remain much weaker than expected, which would negatively impact sales and margins. Also note that when sales and margins trend downward, the market tends to overshoot and valuation multiples could fall further.

Secondly, but less relevant, is that AEO paused its dividend. Although I think this decision is in the best interest of shareholders to preserve the balance sheet, some investors are invariability disappointed. This is the second suspension in the last few years, so it can be frustrating owning this stock for income. However, I think it’s much better to own a stock where management fundamentally cares about the financial health of the business than appeasing a certain class of shareholders. Put another way, if management cares about shareholders, it will take care of the business first. Anyway, I think once this significant inventory overhang is cleared and/or the economy stabilizes, management will have more clarity and ultimately reinstate the dividend.

Bottom Line

I generally caution against bottom-picking, which is very difficult. Investors should be careful with legging into their positions given the Q4 inventory and gross margin guidance. Performance could get uglier before it gets better. Management still seems cautious about the apparel industry and the broader economy. While I expect some volatility and downside price momentum over the coming quarters, I fall into the bull camp at today’s prices. AEO’s management team will continue to execute its growth strategy and further improve operational efficiency with its supply chain acquisitions. The company’s valuation trending at multi-year lows is another attractive factor, which I think will lead to long-term upside. How do you think AEO will perform? Let me know in the comments section below. As always, thank you for reading.

Be the first to comment