Pgiam/iStock via Getty Images

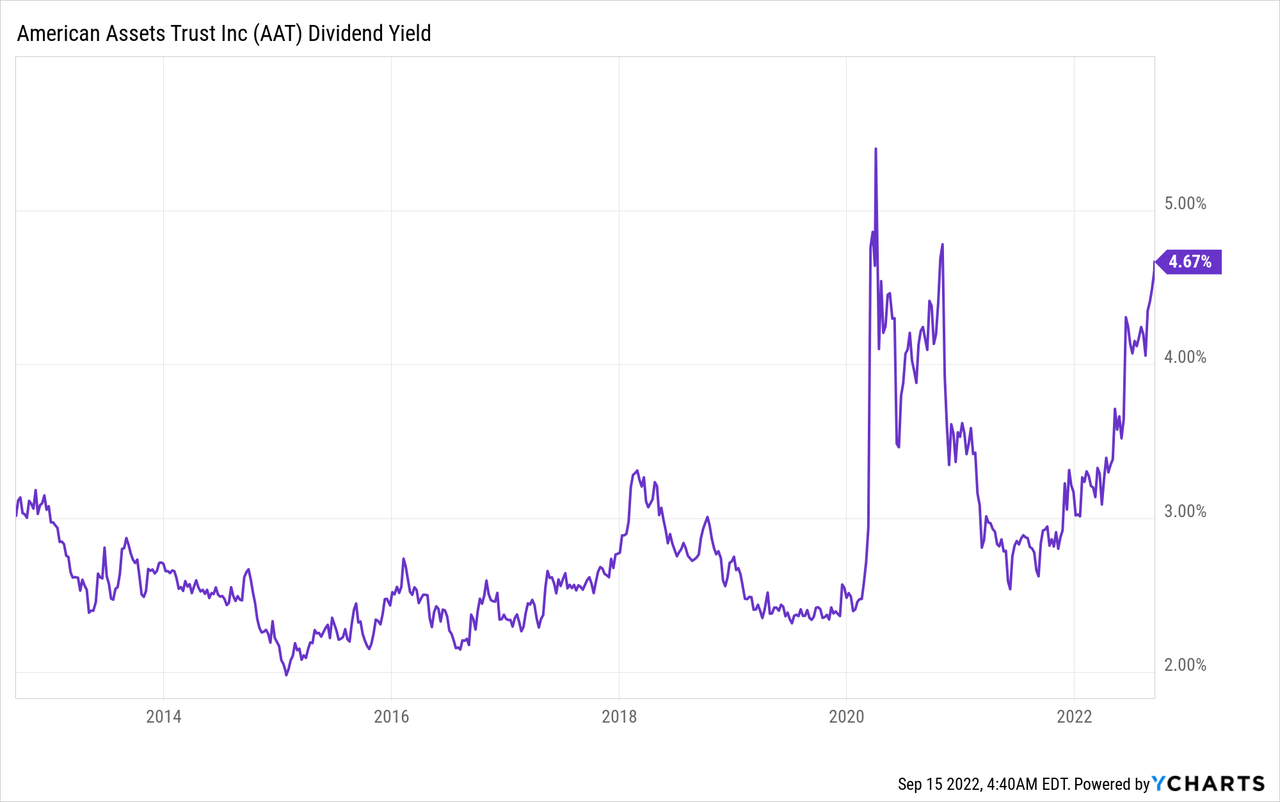

This year is painful for most investors, as the S&P is going through a bear market, with a 17% decline so far this year. Even worse, the economic outlook is gloomy, as inflation remains around a 40-year high level and the risk of an upcoming recession has greatly increased. While this period is painful for most investors, they should realize that the prevailing conditions are ideal for purchasing stocks with solid long-term fundamentals at bargain prices. American Assets Trust (NYSE:AAT) undoubtedly fits this description. This high-quality REIT is trading at a 10-year low price-to-FFO ratio while it is also offering a nearly 10-year high dividend yield of 4.7%. As it has grown its FFO per unit every single year in the last decade, except for 2020 due to the pandemic, its nearly 10-year low stock price presents a rare investing opportunity.

Business overview

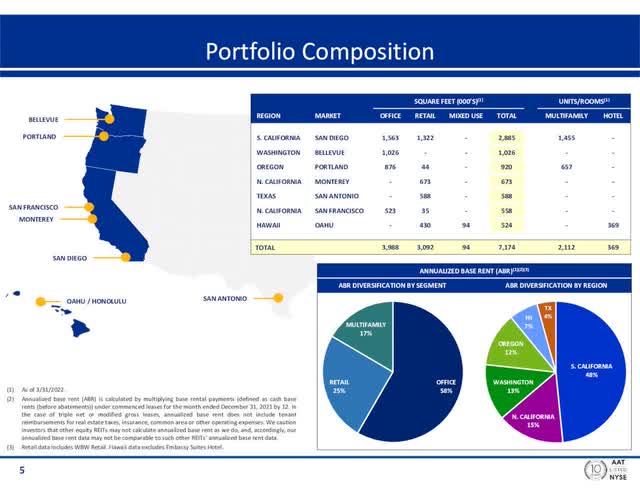

American Assets Trust is a REIT with 55 years of experience in its markets. It generates nearly half of its rent revenues in Southern California and the remaining revenues in Northern California, Washington, Oregon, Hawaii and Texas.

American Assets Trust Business Overview (Investor Presentation)

Source: Investor Presentation

The REIT has a retail portfolio of about 3.1 million square feet, an office portfolio of 4.0 million square feet and 2,112 multifamily units.

American Assets Trust benefits from some key characteristics of its markets. First of all, most of its markets have zoning regulations that limit the development of new properties. In addition, the trust operates primarily in premier coastal markets, with high population density, superior economic growth and high barriers to entry. Thanks to all these factors, American Assets Trust has strong pricing power and thus it enjoys material rent raises year after year. This is clearly reflected in the performance record of American Assets Trust, which has grown its FFO per unit every single year in the last decade, with the exception of 2020 due to the pandemic.

The pandemic temporarily hurt some of the tenants of the office and retail properties of American Assets Trust. Consequently, the trust incurred a 14% decrease in its FFO per unit in 2020. However, thanks to the recovery of its business from the pandemic, the REIT is on track to exceed its pre-pandemic level of FFO per unit this year.

In the second quarter, American Assets Trust grew its same-store net operating income by 4% and its FFO per unit by 14% over the prior year’s quarter, primarily thanks to increased tourism in Hawaii. Moreover, thanks to sustained business momentum, the REIT raised its guidance for its FFO per unit in the full year from $2.13-$2.21 to $2.21-$2.27. At the mid-point, the new guidance implies 12% growth, to a new all-time high. Furthermore, management has raised the dividend by 7% this year, thus confirming its confidence in the sustained recovery of the REIT.

Overall, American Assets Trust is on track to post all-time high FFO per unit this year while its stock price has declined close to a 10-year low. The only period in the last decade in which the stock traded below its current level were the first months of the coronavirus crisis, in 2020.

Inflation – Valuation

The unprecedented fiscal stimulus packages offered by the government in response to the pandemic and the ongoing war in Ukraine have led inflation to skyrocket to a 40-year high this year. Such high inflation exerts great pressure on the margins of most companies, as it greatly increases their cost basis.

American Assets Trust is resilient in the highly inflationary environment prevailing right now. Thanks to the limited supply of new properties in its markets, the REIT is in a strong negotiating position with its tenants and hence it implements material rent hikes year after year. This is clearly reflected in the consistent growth record of the company and the all-time high FFO per unit this year.

The only effect of inflation on the REIT is its negative effect on the valuation of the stock. High inflation significantly reduces the present value of future cash flows and thus it exerts pressure on price-to-FFO ratios. However, the impact of inflation is greater on high-growth stocks, such as technology stocks. That’s why the tech sector has plunged much more than the S&P 500 in the ongoing bear market.

American Assets Trust has grown its FFO per unit at a 4.5% average annual rate over the last decade. Therefore, a decline in its valuation level due to inflation can be justified but the sell-off of the stock seems exaggerated. Due to its 28% decline this year, the stock is currently trading at a 10-year low price-to-FFO ratio of 12.0. This FFO multiple, which is much lower than the 10-year average of 20.0 of the stock, is extremely cheap given the reliable growth trajectory of the REIT.

It is also important to note that the Fed has prioritized restoring inflation to its normal range. As the Fed is doing its best to accomplish this, it will almost certainly lead inflation towards 2%-3% within the next 2-3 years. When inflation begins to subside, the market will probably reward American Assets Trust with an expansion of its valuation level towards its historical average. If the price-to-FFO ratio of the stock expands from 12.0 to the 10-year average of 20.0, the stock will enjoy a 67% rally. Even better, analysts expect the REIT to continue growing its FFO per unit at a mid-single-digit rate in the upcoming years and hence the shareholders will receive a double gift; higher FFO per unit and a greater price-to-FFO ratio.

Dividend

Due to its 28% decline this year, American Assets Trust is now offering a nearly 10-year high dividend yield of 4.7%.

More importantly, the dividend is well covered, with a healthy FFO payout ratio of 56%.

The only point of concern is the interest expense, which consumes 54% of operating income. However, the net debt (as per Buffett, net debt = total liabilities – cash – receivables) of American Assets Trust stands at $1.6 billion, which is only 73% of the market capitalization of the stock and about 10 times the annual FFO. Moreover, the REIT has received investment credit ratings from the three major credit rating companies.

Furthermore, management has raised the dividend by 7% this year. When a dividend is at the risk of being cut, management does not raise it. To cut a long story short, American Assets Trust is offering a nearly 10-year high dividend of 4.7%, with a wide margin of safety.

Risk

Thanks to the aforementioned competitive advantages of American Assets Trust, the REIT is in a reliable growth trajectory. Therefore, the only material risk factor for the stock is the unlikely scenario of high inflation for several years. In such an adverse scenario, the valuation of the stock would probably remain under pressure for years. However, the Fed has made it clear that its primary goal is the correction of inflation right now, even at the expense of slower economic growth. Therefore, inflation is likely to begin to revert towards normal levels sooner or later.

Final thoughts

Bear markets are ideal for purchasing stocks with solid fundamentals at bargain prices. American Assets Trust is a high-quality REIT, which is trading at a decade-low valuation level and is offering a nearly decade-high dividend yield of 4.7%. As soon as inflation begins to subside, the stock is likely to enjoy a steep relief rally. On the other hand, due to the markedly negative market sentiment prevailing right now, the S&P 500 and the stock of American Assets Trust are likely to remain in a downtrend in the short run. Therefore, investors may want to wait for a further 5% correction of the stock before purchasing it.

Be the first to comment