xijian/E+ via Getty Images

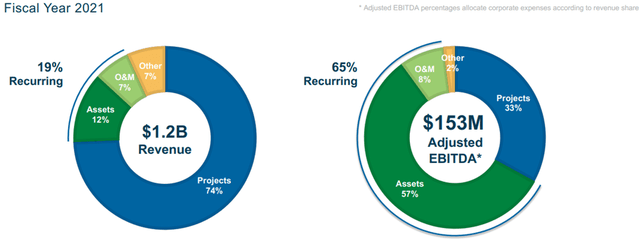

Ameresco Inc. (NYSE:AMRC) is a company operating in the ESPC business (Energy Savings Performance Contract), dealing with optimization and construction of renewable energy plants and energy networks for governmental and private entities. This business accounts for about 74% of total revenues. In addition, Ameresco owns plants to produce renewable energy, mainly solar but also RNG (Renewable natural gas) and is also involved in the construction of battery storage systems and O&M (operations & maintenance). Although these segments represent only a minor part of revenues (c.a. 19%), they have high margins that make this business segment worth 65% of total EBITDA. Furthermore, they are the heart of the company’s growth plans, to have revenue and cash flow more stable over time and less subject to the trend of projects commissioned.

Ameresco Results (Ameresco Investor presentation)

We believe that the company can be a good long-term investment to enter the sector of ESPCs, still not too well known, and ride the wave of billions in investments that will be introduced into the American market to reduce the use of fossil fuels. The company has currently rather expensive multiples, but also great growth prospects, so it can represent a good opportunity at the right price.

An interesting growth strategy

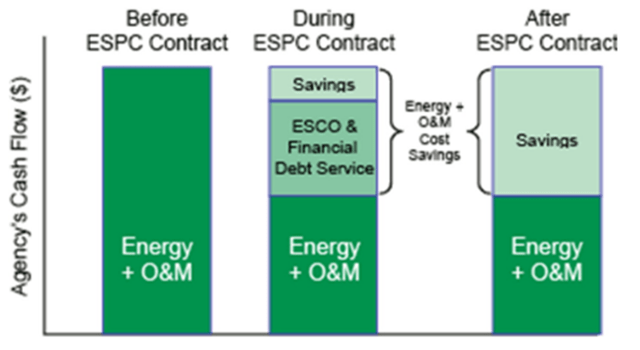

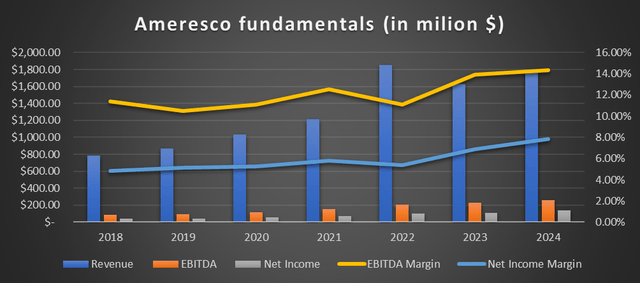

Ameresco in the last 5 years experienced a steady growth in revenues, with a CAGR of more than 10%. The figures were also positively influenced by the pandemic that has further pushed for energy efficiency and lower consumption, especially in terms of fossil fuels. In FY20 and FY21 revenues have therefore grown respectively by 19.1% and 17.8%, reaching $1.22 billion (price to sales of 3.38x). All this is favoured by the business in which Ameresco operates: dedicated to projects which carry out interventions aimed at improving the energy consumption of an asset that can be public or private. By doing this, Ameresco guarantees savings in terms of consumption for the counterparty, a lower expense that is partly absorbed by Ameresco itself while the contract is in place. This allows Ameresco to repay the investments made and obtain a return in the meantime. This mechanism allows the creation of value for both parties, allowing the government, federal states, universities, and private individuals to obtain an investment on their own assets at zero cost; whereas Ameresco receives immediate cash flows through agreements simultaneous to the signing of the contract that allow the sale of the rights to the payment of the project to third parties, favoured by the high credit standing of the counterparties. The company in this process provides O&M services ensuring additional recurring revenue and better service, also characterized by analysis of consumption data to ensure an ever-greater efficiency of energy consumption.

Ameresco operational model (Ameresco)

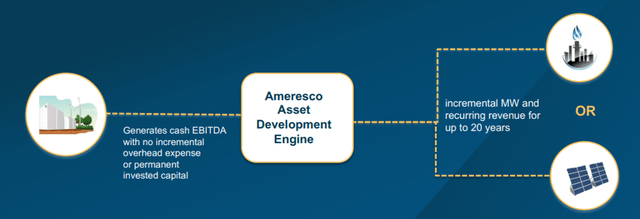

Ameresco, following in the footsteps of some EPCs and solar farm operators such as Canadian Solar (Canadian Solar Stock Is Ready To Gain Back Margins (CSIQ)), has entered the business of storage systems. These allow one to make the best use of the energy produced, especially from renewable plants, reducing waste of energy production the day and summer and ensuring a stable flow of energy at night and during winter. This business area is useful for Ameresco to get additional operating cash flow to use for investments in recurring revenue sources such as solar farms or RNG production, as well as fitting perfectly with the purpose of energy efficiency projects. In the March 2022 presentation, it can be seen that the company has 414 MW in development or construction, which will double total production to 757 MW, of which 64% comes from solar farms and 31% from RNG, in line with its growth plan.

Ameresco

FY21 results

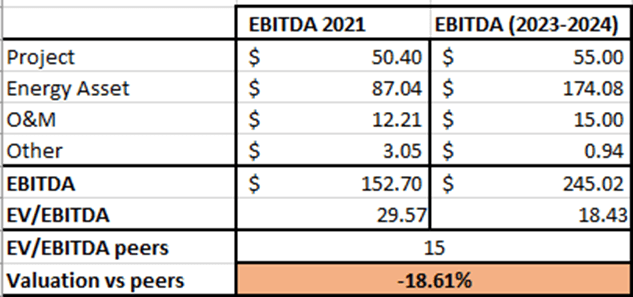

Ameresco ended FY21 with revenues of $1.22 billion up 17.8% over FY20 on par, with adjusted EBITDA coming in at $152 million with a margin of 12.56% (vs 11.10% in FY20). 58% of EBITDA derived from the energy assets segment, up from 54% in 2020 and in line with the company’s plans to increasingly shift to recurring cash flow sources such as electricity sales and O&M. Ameresco also increased its profitability with profit increasing YoY by 30% to $70.5 million. Looking at the balance sheet, the company has a net debt of $405 million, which has been steadily increasing in recent years in order to finance its renewable energy production facilities. At the moment, however, it is fully sustainable with a Net Debt/EBITDA of 2.65x and an interest coverage ratio of 5.45x which, according to Damodaran’s table would give it a high credit rating and a low probability of default.

Even though the company has consistently produced profits in recent years, it has a very negative OCF due to negative changes in NWC caused in turn by the business in which Ameresco operates. Incoming services (Ameresco’s periodic remuneration based on the energy savings produced) are often postponed in time to outgoing services (energy efficiency intervention) and this causes a need to burn resources in the first phase in order to obtain future benefits. Ameresco manages to partially cover itself from this mismatch between income and expenditure through the assignment of its credit to third party companies, but not totally. Therefore, it remains to be seen whether in the future, in a phase of greater business maturity, Ameresco will be able to optimise its NWC cycle and produce more stable and positive operating cash flows. We believe this can be done through a greater focus on energy production in owned facilities, but it may take a few more years because large solar farms certainly cannot be built overnight. This mismatch between revenues and expenditures is also the cause of the increase in debt, which is necessary to continue to make investments in new proprietary plants, investments that have also necessitated a $120 million capital increase.

Outlook

Over the next 3 years, Ameresco is expected to continue its growth path, peaking in 2022 due to the large amount of work in the backlog. In addition, the company’s margins, after a brief correction in 2022 due to record revenues, will also rebound in 2023 and 2024 due in part to the higher incidence of the Energy asset segment, which has much higher margins than the Projects segment.

Mare Evidence Lab

Risks

Ameresco is subject to several risks due to the business in which it operates but its balance sheet appears to be in a relatively calm situation at the moment. The main risk, however, remains the large dependence of revenues on the public sector (70%), about 30% of which are directly from the federal government. Such a large amount of revenue deriving from the public sector can be a problem because while in the private sector the focus is almost always on convenience and quality, the public can be subject to political choices that can be detrimental. In addition, Ameresco is subject to a strong mismatch between revenues and expenditures that causes a huge need for liquidity, with the increase in debt and investments underway the company, this could make way for other capital increases in the coming years. Lastly, the last risk the company may face is that of continued inflation which could negatively affect the contracts it has in place.

Conclusions

Ameresco is certainly a very interesting company, an important player in an increasingly growing market (ESPC) and with a focus on solar energy, which seems to be the most efficient source of renewable energy production and that will be most used in the future. Looking at the solar and RNG plants under construction by the Company, analysts’ estimates of EBITDA in the $250M area between 2023 and 2024 can be considered consistent. However, we wanted to conclude the analysis with a valuation that shows the extremely overvalued status of the stock. Currently, some competitors in the sector are trading at an EV/EBITDA multiple of 15x, while the company has a value of 29.27x, which in our opinion is decidedly exaggerated, also considering an EV/EBITDA that should be around 18x between 2023 and 2034. We remain therefore interested in this company and its business, but at the moment, we expect a valuation at least 30% lower for a first entry.

Mare Evidence Lab

Be the first to comment