Mario Tama/Getty Images News

Streaming giant Netflix (NASDAQ:NFLX) reported a massive 200 thousand decline in subscribers for the first fiscal quarter of FY 2022. The subscriber outlook for the second quarter is even worse, with subscriber losses expected to increase to 2M. Shares of Netflix plunged after the delivery of the first quarter earnings card and I believe, as headwinds for streaming platforms continue to grow, Netflix is at risk of revaluing lower!

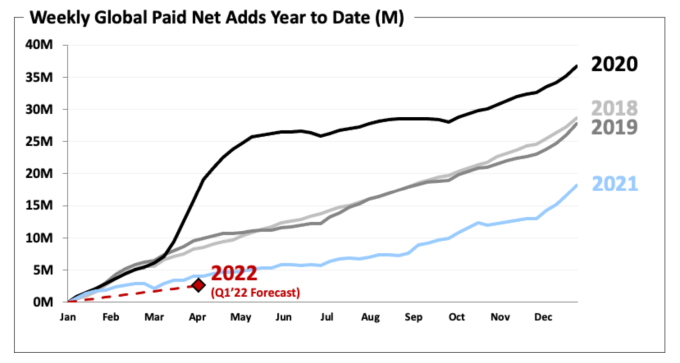

Netflix’s first quarter subscriber loss and outlook

Shares of Netflix plunged 25% yesterday after the streaming firm delivered disappointing subscriber numbers for Q1’22. Netflix, which did a fantastic job of expanding its viewership in the last decade, ended the first quarter of FY 2022 with 221.64M global streaming paid memberships, the firm’s classification for subscribers. Netflix benefited enormously from the COVID-19 pandemic which condemned many people to seek out new forms of entertainment while being confined at home. During the pandemic, Netflix’s subscriber net adds surged, as did its stock.

TechCrunch

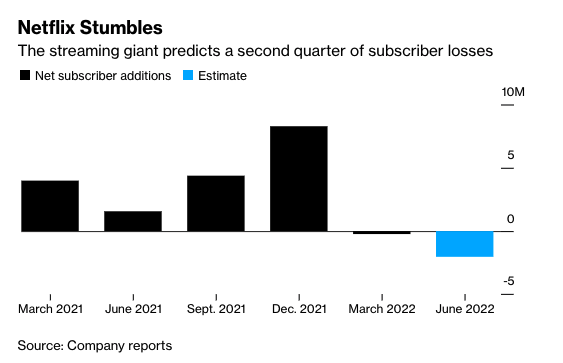

The company projection was for Netflix to add 2.5M subscribers, on a net basis, to its streaming platform in the first quarter, a projection that the company missed badly. In Q1’22, Netflix’s year over year growth rate in subscribers slowed to 6.7%, showing a decrease of 2.2 PP compared to Q4’21. In the year-earlier period, Netflix added 4M new subscribers to its service. As distressing as the decline in memberships in Q1’22 is already, the outlook for the coming quarter is even worse.

Netflix expects to lose 2M subscribers in the second quarter of FY 2022, indicating that pandemic effects that supported strong subscriber growth in the last two years are wearing off. FY 2022 is the first year since FY 2011 in which Netflix is expected to lose subscribers on a net basis and it could spell even more trouble for the stock going forward.

Bloomberg

What is also concerning is that Netflix lost subscribers in three out of four geographic regions in Q1’22 — United States/Canada, EMEA and Latin America — and grew only in the Asia-Pacific market, largely because of popular series such as Squid Game. Netflix lost 640 thousand subscribers just in the important U.S./Canada market in Q1’22. In two out of four markets — EMEA and Asia Pacific — average revenue per membership also declined sequentially, indicating broad-based weakness in Netflix’s subscriber business.

|

in millions |

Q1’21 |

Q2’21 |

Q3’21 |

Q4’21 |

Q1’21 |

|

UCAN |

|||||

|

Paid Memberships |

74.38 |

73.95 |

74.02 |

75.22 |

74.58 |

|

Paid Net Additions |

0.45 |

-0.43 |

0.07 |

1.19 |

-0.64 |

|

Average Revenue Per Membership ($) |

$14.25 |

$14.54 |

$14.68 |

$14.78 |

$14.91 |

|

EMEA |

|||||

|

Paid Memberships |

68.51 |

68.70 |

70.50 |

74.04 |

73.73 |

|

Paid Net Additions |

1.81 |

0.19 |

1.80 |

3.54 |

-0.30 |

|

Average Revenue Per Membership ($) |

$11.56 |

$11.66 |

$11.65 |

$11.64 |

$11.56 |

|

LATAM |

|||||

|

Paid Memberships |

37.89 |

38.66 |

38.99 |

39.96 |

39.61 |

|

Paid Net Additions |

0.36 |

0.76 |

0.33 |

0.97 |

-0.35 |

|

Average Revenue Per Membership ($) |

$7.39 |

$7.50 |

$7.86 |

$8.14 |

$8.37 |

|

APAC |

|||||

|

Paid Memberships |

26.85 |

27.88 |

30.05 |

32.63 |

33.72 |

|

Paid Net Additions |

1.36 |

1.02 |

2.18 |

2.58 |

1.09 |

|

Average Revenue Per Membership ($) |

$9.71 |

$9.74 |

$9.60 |

$9.26 |

$9.21 |

(Source: Author)

Reasons for subscriber losses

Netflix has cited two reasons why industry headwinds are growing. One is that more streaming offers are available in the market, meaning subscribers have more choice and can, at practically no cost, switch to other streaming providers which have built out their content libraries in recent years. The other reason is that users are sharing passwords with each other, making it harder for Netflix to grow its subscriber base. Netflix shared in its shareholder letter than it estimates that 100M households use Netflix without paying for it.

Introduction of alternative monetization models to counter subscriber churn

Netflix has said that it will introduce ad-supported formats as an alternative to subscription plans in a bid to expand viewership and find new sources of revenue. Netflix has resisted calls for the introduction of advertising models on its platform for a long time, but as subscriber losses mount, the firm is forced to explore new monetization models.

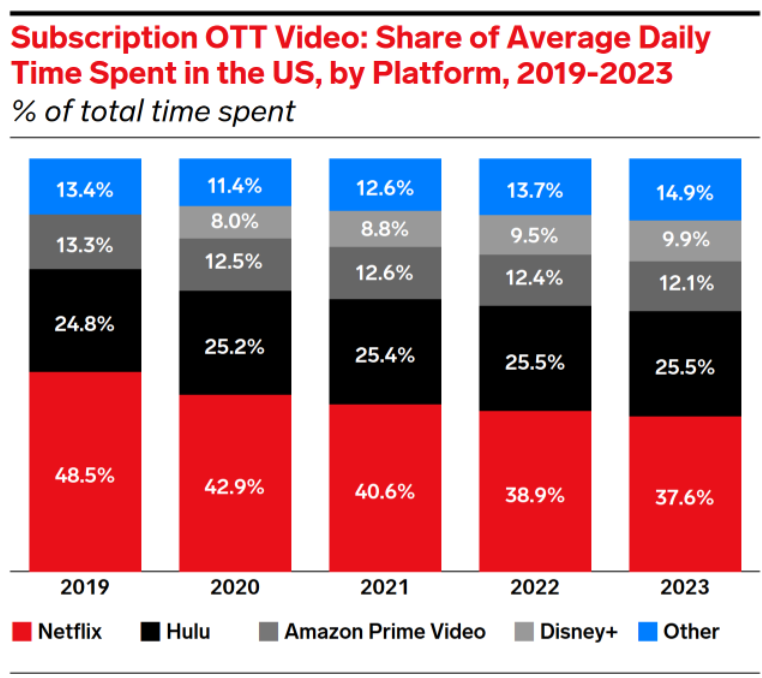

Netflix had a significant lead over legacy media companies until recently but the competition has wised up and adjusted their business models in recent years. All major entertainment companies have now started their own streaming services which means competition for Netflix will continue to increase. Based off of projections from eMarketer, Netflix is expected to lose market share going forward while Disney+, Hulu and other streaming platforms are expected to make additional gains. This is because rival streaming platforms are spending heavily on content production to offer viewers a broader catalog of movies/series which is expected to draw subscribers away from Netflix.

eMarketer

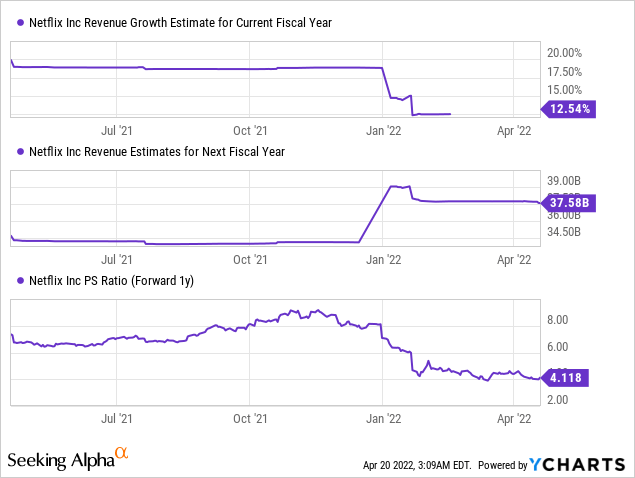

Slowing revenue growth and valuation risks

Netflix does not project subscriber gains or losses on a full-year basis. It makes a subscriber projection, on a net basis, only one quarter in advance. However, the material drop-off in subscribers expected for Q2’22 significantly increases Netflix’s revenue risks going forward. For that reason, I expect revenue estimates for Netflix to start trending down as analysts will undoubtedly update their top line predictions after yesterday’s poor Q2’22 subscriber guidance.

A declining subscriber base is also a big risk for Netflix’s valuation, considering that Netflix still has a high valuation (P-S ratio of 4.1 X). Although shares of Netflix are not as expensive as they were in FY 2021, which is when they peaked at $700.99, they are still expensive.

Risks with Netflix

The biggest risk for Netflix is continual subscriber losses. Increasing competition in the streaming industry as well as password-sharing have been cited by Netflix’s management as reasons for subscriber losses and as justification for the introduction of an ad-supported streaming format. However, considering how badly Netflix missed its own guidance for Q1’22, investors may have doubts about the streaming firm’s high valuation. Going forward, shares of Netflix are likely to react very negatively to any new announcement of subscriber losses. Because subscriber losses are likely translating to slowing revenue growth for Netflix, shares of the streaming firm could see a lower valuation factor.

What would change my opinion on Netflix is if the firm reversed subscriber losses in the coming quarters and if ad-supported monetization efforts resulted in revenue growth.

Final thoughts

Stay-at-home stocks like Netflix are at the cusp of a new reality. Pandemic-fueled subscriber growth is waning and Netflix is likely to lose more subscribers this year as competition in the industry heats up. Because of the revenue risks associated with subscriber losses, I believe shares of Netflix are at risk of revaluing even lower in FY 2022. Given the uncertainty relating to Netflix’s subscriber growth for the rest of the year, I believe NFLX has an unattractive risk profile and the 25% drop yesterday is not yet a buying opportunity!

Be the first to comment