sanfel/iStock Editorial via Getty Images

We all know the brand that is U-Haul. Each of us at some point in our lives have likely slid onto a seat of an uncomfortably big truck that we are not at all qualified to drive and gone for a harrowing and stressful journey.

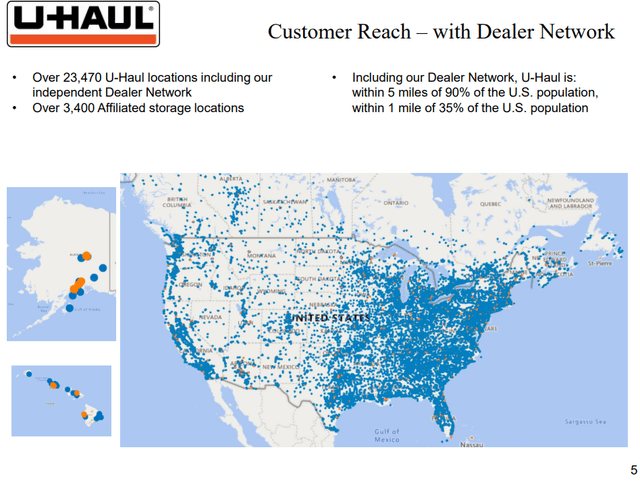

Likely, you know where the closest U-Haul rental location is in your hometown across the country. Now, name the approximate location of the closest Penske (PAG), Ryder or Budget truck rental location? My guess is that less than 10% of you can. This is a monopoly in plain sight.

In this article I would like to discuss AMERCO (NASDAQ:UHAL) and why I believe it is a prime candidate for a long-term investment.

Overview

U-Haul is a household name brand with a decidedly non-household named parent company, AMERCO, which owns U-Haul, RepWest Insurance, AMERCO Real Estate and Oxford Life Insurance.

U-Haul is obviously the crown jewel of the portfolio for AMERCO and rightfully so. Based upon industry data, U-Haul has an affiliation with nearly 1 out of every 5 self-storage locations as either an owner, manager, service provider, or through a rental equipment dealer relationship.

This network of locations and equipment is unheard of and is head and shoulders above any other competitor, by a mile! For a competitor to build out this type of network to rival AMERCO, it would require not only billions in capital but also the intestinal fortitude to willingly invest in a price war that would come along with it.

Frankly this is one industry where it is likely that only a single king can thrive, and U-Haul will be very, very hard to dethrone.

U-Haul currently has over 23,400 locations peppered throughout North America, the closest competitor, Penske holds around 2,500, over nine times less than U-Haul.

The self-moving industry also does not look to be one that is in danger of major disruption for quite some time as it is very straight forward, people move, often, and require a large truck for perhaps a few days and then do not need one again until they move again. Rinse, repeat, deposit.

The business model is as basic as it comes and U-Haul has spent the time and money to build, maintain and develop its brand over decades to the point that when you need to rent a truck the word U-Haul is interchangeable with both moving and truck rental.

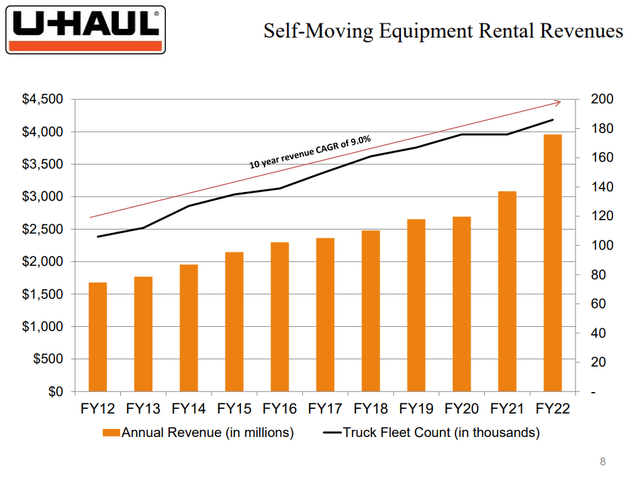

The company was a prime beneficiary of the COVID-19 pandemic, which was quite a surprising development considering the shelter in place orders on the books around the country, yet it is certainly backed up by the numbers. The trend line of this business, even without the pandemic boost in 2021 & 2022, is quite impressive and I believe is indicative of the underlying quality of the operation.

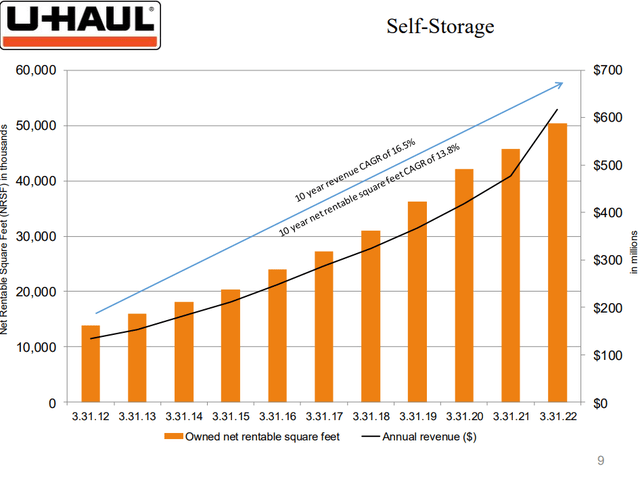

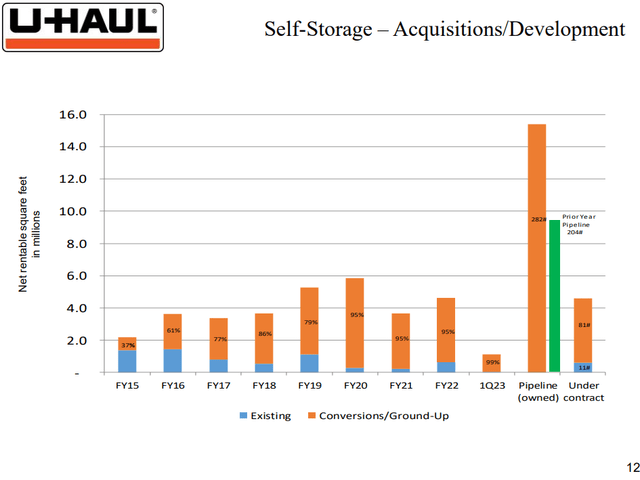

The self-storage business, similarly has been on an absolute tear over the last decade, posting numbers that any publicly traded storage REIT would be proud of.

Clearly, moving equipment rental and self-storage facilities are highly complementary businesses and U-Haul has been working hard over the last decade to integrate self-storage with as many equipment rental locations as it possibly can, to great effect.

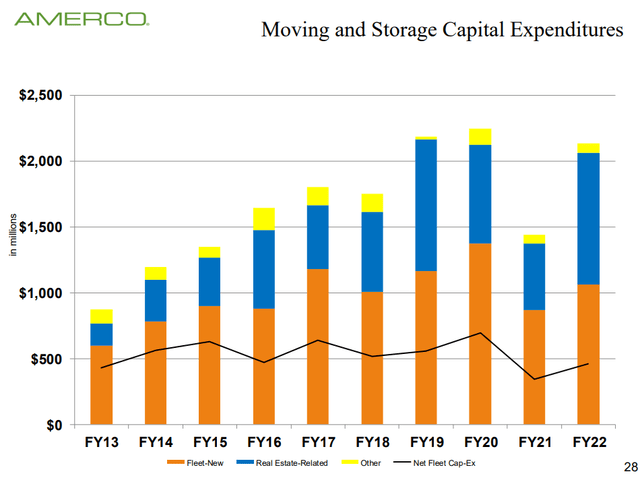

One thing to point out here is that building a self-storage facility is quite capital intensive so it is a major project for the company to take on. This effort has created a significant drag on cash flows given that the build-out costs of these facilities take many, many years to fully recoup. U-Haul is not a REIT and is not valued on AFFO, making these capital projects a significant drag on a few traditional valuation metrics.

It would appear however that this initial drag on cash flows may be on the cusp of turning positive as the company now is approaching significant scale. In fiscal year 2022 for the company, they reported $617 million in self-storage revenue along with nearly $1 billion in storage related buildout costs.

It would appear, if these trends continue over the next few years, that free cash flow from the self-storage operation may in fact be on the horizon. And once positive free cash flow begins to trickle in from this business, a massive stream is not too far behind it.

U-Haul has tackled a huge CAPEX project in building out the self-storage network, however, once the worst of this build out has passed, literally rivers of money will begin flowing out of this highly profitable network of facilities.

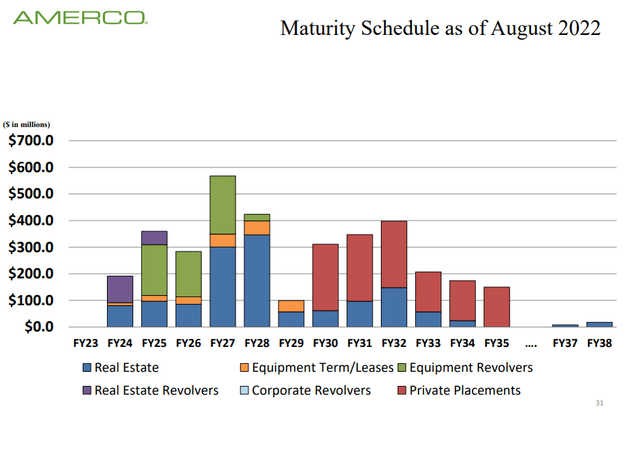

Thankfully, management has tackled this massive CAPEX project in a thoughtful and measured way by using predominantly earnings from the moving equipment business to fund this; however, the company has taken on a decent amount of debt in the process.

This debt however is manageable and currently stands at $6.3 billion, with the debt, net of cash standing at only $3.17 billion. In addition, the debt maturity profile is quite reasonable and well laddered.

Valuation

AMERCO is not a traditional Wall Street type of business and as such has largely eschewed investment bankers. They do not issue much, if any stock, do not participate in public offerings and are 42.7% controlled by the Schoen Family, which means that analyst estimates are virtually nonexistent.

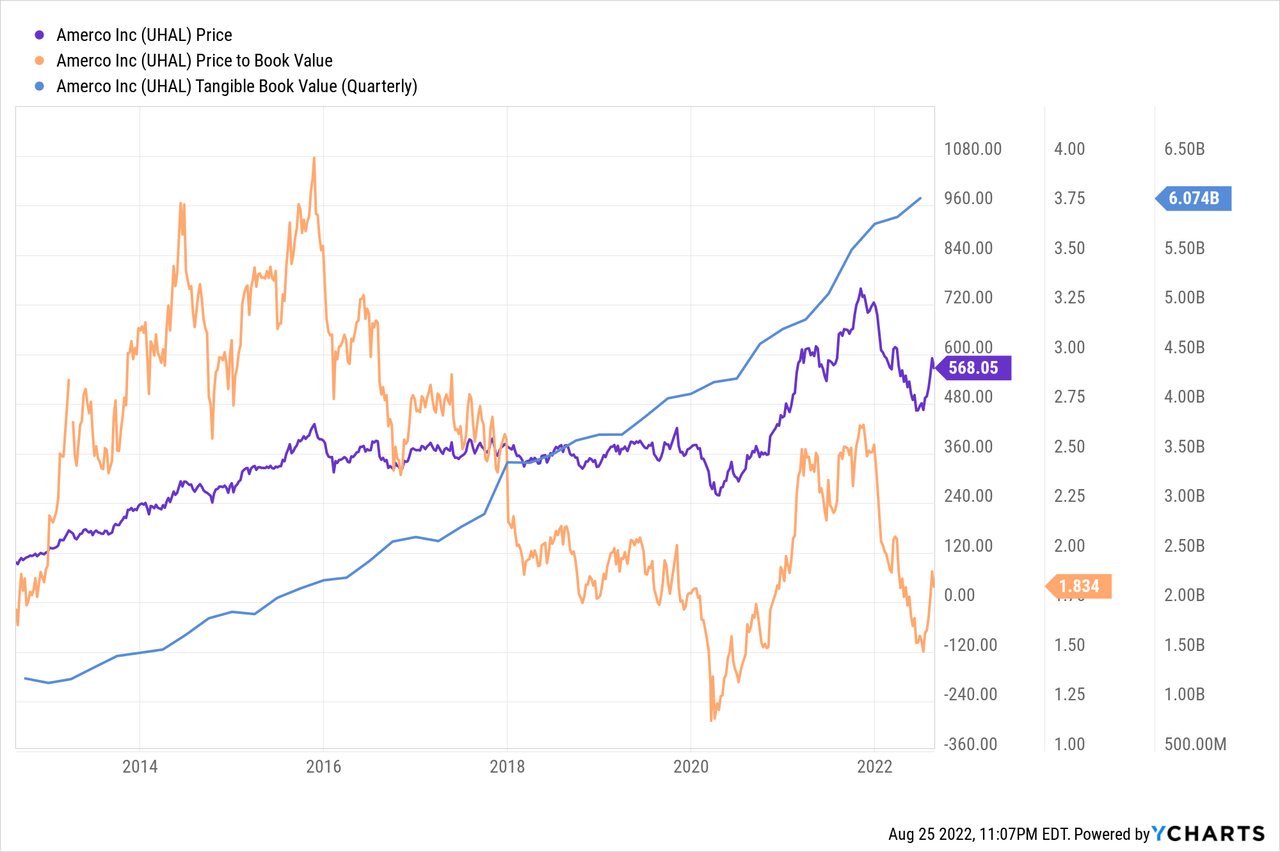

As of today’s date, the company is trading at a PE on expected 2023 earnings of 9.75, however, this is the estimate from only a single analyst. When I look at AMERCO, I like to look at book value metrics.

The reason that I am a fan of book value in this company has to do with the continual reinvestment into the business by management. This is especially true when thinking about the storage business and the real assets the company is purchasing through the CAPEX buildout.

The trend line in tangible book value is truly a magnificent sight for shareholders and the price to book value currently stands at 1.84, which is on the cheap side over the last 10 years.

I will specifically note that the company is highly likely to experience headwinds from the current economic situation and I expect next year’s earnings may suffer as the economy worsens, however, given the significant value that is nearly continuously created at the company and the attractive book value assigned, I believe long-term investors will find the current price attractive.

Bottom Line

My investing thesis on this company is actually quite simple, AMERCO holds a near bulletproof monopoly in a highly profitable industry with a significant adjacent business that is also highly profitable on an operating basis, one that it is exploiting and building out very effectively.

The company has massive earnings power that is underappreciated by the market given that it is plowing nearly all cash back into the business by way of the self-storage build-out. Once this build-out reaches critical mass in the coming years, the combined businesses will likely be throwing off gobs of free cash flow.

This company is certainly not a Wall Street darling, and as such, could remain mispriced for quite some time. However, I am a long-term investor and will continue to patiently build out my position here at what I view as attractive valuations while I wait for the company to become fully appreciated.

I look forward to your comments below. Thank you for reading and good luck to all!

Be the first to comment