Stephen Brashear/Getty Images News

Shares of Boeing (NYSE:BA) are down ~3.9% during midday trading after posting its third quarter earnings. Pre-market action was mixed with shares down as much as 3% and up as much as 1.5%. In terms of profits and losses, Boeing fell short of expectations with significant variance in performance between the segments. In this report, I will discuss the results, management comments and compare the results against what I expected. Overall, Boeing’s earnings were bad with a few bright spots here and there.

Boeing Produces A Big Miss In Q3

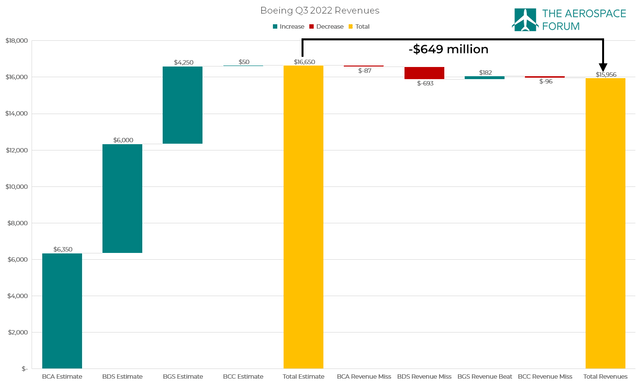

In my earnings preview I projected $16.65 billion in revenues and a 10 cent per share loss. Boeing posted $15.96 billion in revenues and a $6.18 loss per share. When releasing the preview, I already noted that there were several complicated cost mechanisms that are difficult to estimate beforehand and these could be affecting the accuracy of the estimates. We now see that this is exactly what happened. So, it is interesting to see segment by segment how the performance met or fell short of expectations.

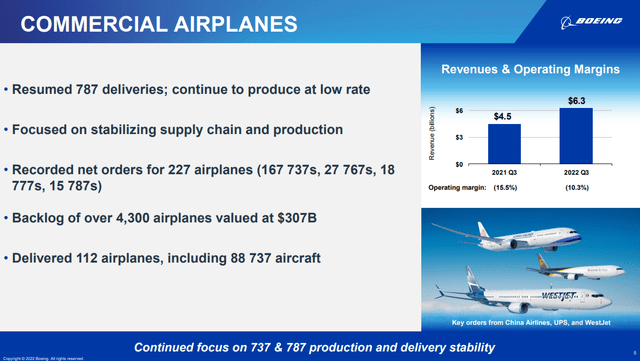

Boeing Commercial Airplanes sheet (Boeing)

Commercial Airplane deliveries of 112 led to revenues increasing from $4.5 billion in Q3 2021 to $6.3 billion this year. Margins improved from negative 15.5% to negative 10.3% reflecting lower abnormal costs, but higher period expenses and R&D costs. Previously, I had estimated $6.35 billion in sales for the third quarter which was $87 million higher than what Boeing posted. Significantly bigger than expected was Boeing’s loss from operations ($643 million), while I was looking for a loss no bigger than $360 million. It is not quite clear to me from Boeing’s earnings release where the $283 million gap is coming from. The company cited higher period expenses but no amount has been specified. The 10-Q should provide more insight but is not available at the time of writing.

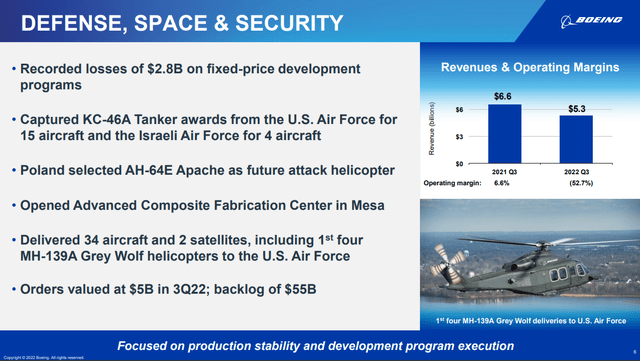

Boeing Defense, Space & Security sheet (Boeing)

While the Commercial Airplanes unit is getting back on track, the Defense, Space & Security unit is undoing a lot of Boeing’s improving performance. Whereas I estimated sales of $6 billion on margins of 10%, actual revenues were $5.3 billion and Boeing recognized $2.8 billion in charges on fixed price developments on the KC-46A, VC-25B, MQ-25 and T-7A Redhawk bringing its loss from operations to $2.8 billion. Those are projects where Boeing won by either underpricing the competition or facing significant pressure to reduce costs and it is now absorbing the penalty of fix-price contracts instead of cost-plus-fee contracts as costs are rising. Previously, we saw Calhoun hinting that the VC-25B or Air Force One Program contract is one that he would not have agreed on if it were a contract out for bidding today. Perfectly understandable, but the reality is that Boeing has those contracts now and even after years of having the programs in the portfolio, there seems to be no end to the cost growth pointing at significant issues with cost control. Boeing recently appointed a COO for BDS, who will report directly to BDS CEO Ted Colbert, and it is most certain that the poor financial performance at BDS is a reason for this.

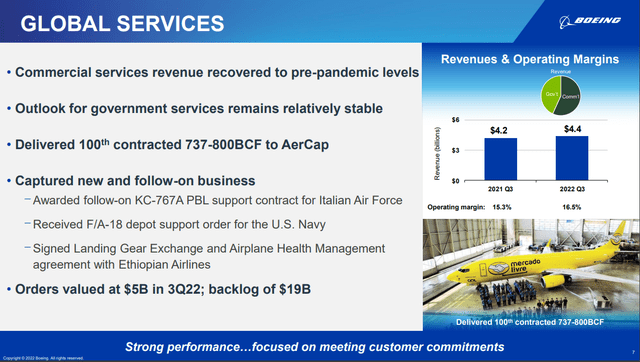

Boeing Global Services sheet (Boeing)

The segment that showed better than expected performance was Boeing Global Services and that is really the segment that is keeping Boeing up somewhat. In fact, from the main segments it is the only profitable one at this point. I anticipated sales of $4.2 billion to $4.65 billion on margins between 14 and 16 percent. Boeing reported sales of $4.4 billion on margins of 16.5%. The services segment is something that Boeing has been more focused on for some years and it is paying off now with revenues exceeding pre-pandemic levels.

Boeing revenue shortfalls (The Aerospace Forum)

My estimates for revenues were significantly lower than the ~$18 billion that analysts were aiming for, but Boeing even missed the significantly lower revenue expectations that I had. Putting everything together, it can be seen that this was primarily driven by the revenue miss at BDS.

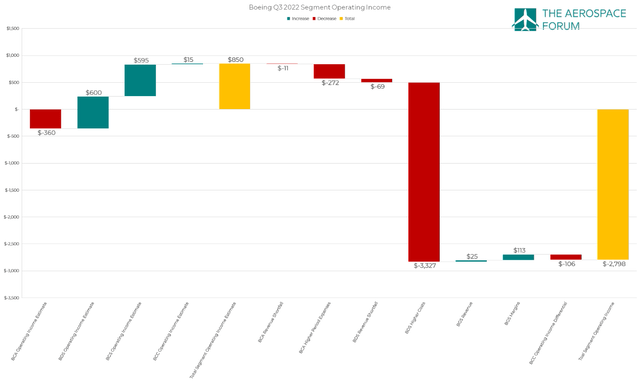

Boeing profit shortfalls (The Aerospace Forum)

BDS was expected to be contributing 70% to the segment operating income more than offsetting the -40% contribution of BCA. However, what we do see is that segment operating income for BCA was $283 million higher than expected and the offset expected from BDS was simply not there as Boeing recognized significant cost overruns on the programs in combination with lower revenues. The positive surprise from Boeing Global Services in the amount of $138 million is a drop in the ocean. Boeing’s earnings were underwhelming for BCA on higher period expenses and shockingly bad for BDS, but maybe after seeing cost overruns for multiple quarters… this is the best Boeing can do on Boeing Defense, Space & Security and the best in this case is bad.

The positive: Cash Flow

BGS was the segment that performed above expectations, but other than that, things were worse than expected. One element, however, did stand out for a good reason and that was the cash flow. Boeing delivered an impressive operating cash flow of $3.2 billion and $2.9 billion in free cash flow driven by higher deliveries, favorable timing items and a tax refund that I think might be accounting for half of the free cash flow during the quarter.

Unfortunately, no details are currently available on the size of the refund but overall I do think that while Citi recently suggested that there is too much of a focus on the Dreamliner as a value driver, the cash flow could be an indication that there is a focus on Boeing 787 deliveries for a good reason.

So, the cash flow stood out in a positive way and having that cash flow positive really is what Boeing needs to reduce its debt. During the quarter Boeing’s debt remained stable at $57.2 billion. I would have liked to see that debt come down with associated positive impact on interest expenses, but as the debt has a relatively low interest rate compared to current prevailing rates I can understand that Boeing first wants to improve its cash balance before it starts reducing the debt. Overall the net debt measured as debt minus cash and marketable securities was $42.9 billion, down from $45.8 billion. So, we probably are seeing some Commercial (deliveries and services) and Defense services strength in the cash flow and I expect that to continue as Boeing continues burning off its inventory.

Conclusion: Weak Results But Boeing Stock Remains A Buy

Results unfortunately came in significantly below expectations. Even if we adjust for the $2.8 billion in costs overruns, Boeing missed expectations by a wide margin. Now, I do not consider this to be a reason to sell shares. The free cash flow and net debt improved during the quarter and I believe going forward we will continue to see Boeing’s net debt position improve.

However, Boeing Defense, Space & Security CEO Ted Colbert has a monumental task ahead. Boeing engaged in fixed cost contracts which are now hurting the company next to its engineering shortfalls. Many of these contracts were signed at a time when Calhoun was part of Boeing’s board and as a result you can really ask yourself whether this is the man that can take Boeing to the next level in commercial aviation, space and defense. Results have greatly improved since Calhoun became the CEO of Boeing, but that was more or less the natural progress of things and I am still missing positively differentiating leadership from Calhoun.

While I do believe that Calhoun is not the man to lead Boeing to its next chapter of growth, I do believe that the buy thesis for Boeing stock still stands.

Be the first to comment