andresr

Investment Summary

After extensive review of the investment case, our informed appraisal of Amedysis, Inc. (NASDAQ:AMED) equity is unchanged at neutral. As a starting point, recall that our hold thesis for AMED is built on these main factors:

- Operating income, earnings growth tightening back to pre-pandemic [and unattractive] levels.

- Book value of equity has narrowed on a sequential basis since FY18, with a dominance of goodwill ‘assets’ on the balance sheet. Goodwill and intangibles made up >130% of the company’s book value at the end of Q2 FY22.

- Economic profit has also dipped into the red as AMED’s annualized return on invested capital (“ROIC”) dipped below its cost of capital.

- Unsupportive valuation and technicals.

After its latest quarter and following recent developments, we note little has changed in the investment debate for AMED. Its CEO resigned effective immediately last week, leaving the company to find a replacement and reaffirm FY22 guidance. Net-net, we rate AMED a hold on a $87 price target.

AMED Recent developments

On November 17, the company announced that its [now] former CEO, Chris Gerard, would leave the company effective immediately. No reasons were given for his departure, however, some wires note the CEO could have potentially been dismissed.

The company has reinstated former CEO Paul Kusserow, also chairman of the AMED board, as interim CEO until a replacement is made. Kusserow returns to the post of chief executive after handing over the reigns to Gerard back in 2016.

Gerard had been CEO from then until his departure last week. Prior to this, he had ~20yrs of hospice experience, per his AMED bio, having founded Integracare Home Health, sold to Kindred Healthcare in 2012.

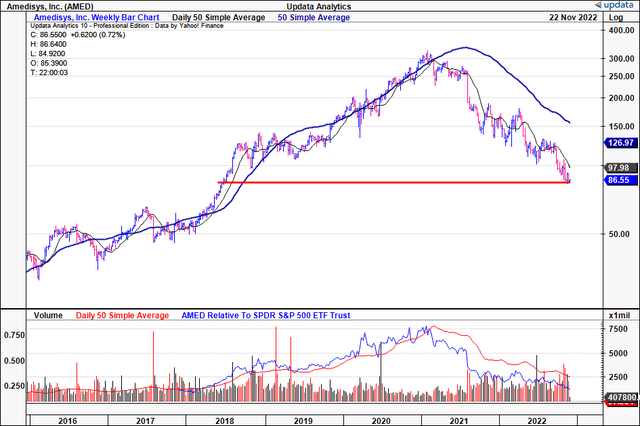

Further updates have been light on the matter and the company hasn’t released any further information. Given the stock’s underperformance since peaking in January 2021 [Exhibit 1], it will be more than interesting to see the incoming CEO’s impact to the share price. Until then, we aren’t game to speculate.

Exhibit 1. AMED price evolution and underperformance of Jan FY21′ peak. Shares now trade at their lowest mark since June FY18′.

Q3 numbers illustrate revenue, EBITDA compression

AMED posted its Q3 FY22 results on October 27. We note the persistence of headwinds throughout its P&L. Net revenue increased just 81bps YoY to ~$558mm leading to a 15% YoY decrease in core EBITDA to $62mm.

The loss was underscored by a $15mm downfall in its legacy business and $5mm additional loss from Contessa, plus additional headwinds from sequestration. Despite AMED missing some volumes this quarter, it did note the slow recovery in hospital causing a delay in demand, by impacting referral flow. That’s because a large portion of its home health and hospice admissions come from hospitals. We would agree especially based on data in the latest Kaufman Hall National Hospital Flash Report for October 2022.

Summarizing AMED’s Q3 performance, here are key contributing factors for investors to consider:

- Operating costs increased 450bps YoY to $519mm, underlined by planned wage increases and labour staff shortages. This also had an impact on AMED meeting volume demand in the quarter. Wage-related inputs added $9mm to operating costs, made up of wage increases and higher health, holiday, and workers comps of $4mm, respectively. The return of sequestration added another $4mm to costs. Subsequently, AMED “continue to be behind from a volume perspective”.

- Visiting commission costs per visit increased 700bps YoY and 400bps from Q2 FY22. The increase was again driven by labour inputs and lower volumes. As such, Medicare business per episode reduced 800bps YoY.

- Discharge rate peaked at 39 days in January, and management say median length of stay is falling. This is key for AMED looking ahead and we look to see a further decrease in median length of stay, and corresponding decrease in discharge rate/days.

- Hospice quarterly revenue was up $1mm YoY to $199mm with segment EBITDA of $43mm [$1.32/share]. This stemmed from same Net revenue/day remained flat YoY given the increase in sequestration [even the 2% hospice rate increase effective from October 1, 2021 wasn’t enough to offset this].

Alas, it was a mixed quarter for AMED, with a blend of macroeconomic and industry-specific factors pressuring its top to bottom-line growth. Last time, we noted the contraction in the company’s NOPAT and ROIC numbers whilst capital intensity continues to increase [in the last report, see: “Exhibit 6: Amed Qrtly Return on Capital Summary; FY15-Q2 FY22″].

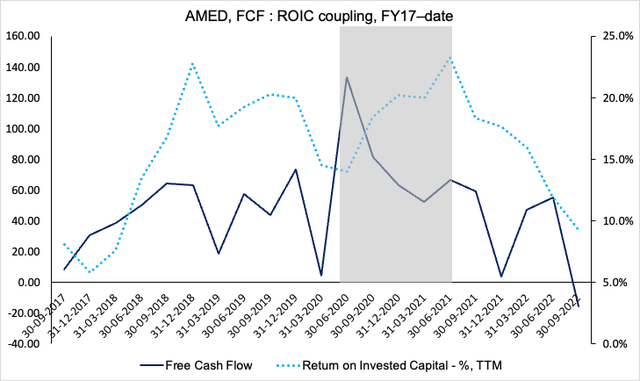

We noted similar patterns in Q3 and suggest this could be a factor to watch for AMED down the line. Note in Exhibit 2, both FCF conversion and ROIC have trended south at pace since peaking in Q2 FY20 and Q2 FY21, respectively.

Let’s take a step back to that period – we’ve highlighted it in grey, Exhibit 2. Initially, the trend was positive – we see a general outflow of FCF from Q2 FY20-Q2FY21′, coupled with an uplift in ROIC. To us, this says AMED was investing its free cash wisely and generating high return on its investments, above the cost of capital at the time.

However, the trend crossed south in late FY21′ and has continued since. This contrasts with trends observed prior to the pandemic era. Last 12 months ROIC came in at 9.2% in Q3, just 90bps above the WACC hurdle.

We now have AMED with an FCF conversion and ROIC at FY17 levels but with a FY22 market risk profile. Moreover, the declining trend in both isn’t attractive in the current macro-climate.

This, along with a weaker EPS growth outlook [discussed below], confirms our neutral view.

Exhibit 2. Positive trend in FCF/ROIC [grey highlight] across FY20-FY21 reversed course last year and continues deteriorating.

Data: HB Insights, AMED SEC Filings

Guidance points to further growth pressures ahead

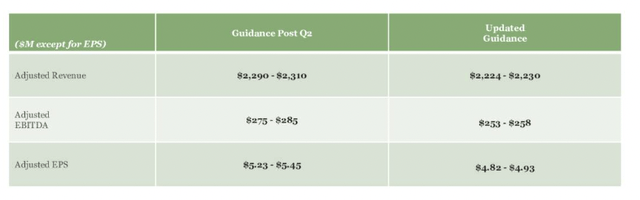

Management revised down FY22 guidance at the top line on the last earnings call and calls for $2.22-$2.23Bn [from $2.3-$2.31Bn previously]. It reflected this in adjusted EBITDA assumptions as well, reducing forecasts by 9.4% at the upper range to $258mm. Naturally, it now sees EPS in a lower range of $4.82-$4.93 as well [Exhibit 3]. Note, it printed earnings of $6.34/share in FY21.

We note the company has since reaffirmed this guidance since the departure of its CEO in an announcement.

Exhibit 3. AMED FY22 revised guidance presented at the Q3 FY22 earnings call.

Data & Image: AMED Q3 FY22 earnings call presentation, pp. 15 “Amedisys 2022 Updated Guidance: Revenue, EBITDA and EPS”

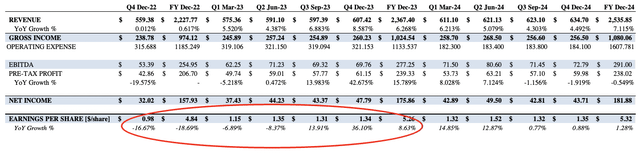

Our FY22 EPS assumptions lie within management’s range. As seen below, we see a sequential YoY decline at the bottom for AMED into Q2 FY23. We believe AMED won’t be able to meaningfully repackage pricing to cover the increase in input costs it’s seen in FY22.

Not to mention the steepening WACC hurdle and flattening ROIC we discussed earlier. This will further impact operating income and tighten EBITDA growth, by estimate.

Exhibit 4. AMED forward estimates FY22-24′ [Qrtly, Annual]

Valuation and conclusion

There are several factors to think about when valuing AMED’s stock looking ahead. Tightening ROIC, nil EPS upside into FY23 [based on our estimates] and a number of macro-headwinds all clamp upside capture down the line in our opinion.

Alas we believe the consensus’ 18x forward P/E multiple is appropriate for the stock to trade at. Applying the 18x multiple to our FY22 EPS estimates of $4.84 values the stock at $87, just $0.45 above the current market price.

With the lack of upside potential calculated in our forward estimates, this further confirms our hold thesis. Net-net, we rate AMED a hold on an $87 price target.

Be the first to comment