jiefeng jiang

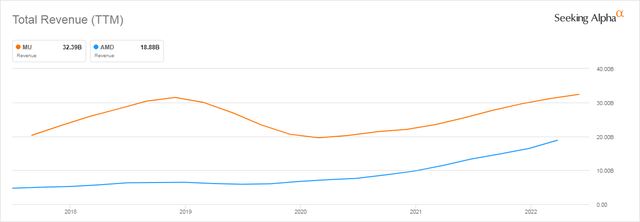

Advanced Micro Devices, Inc. (NASDAQ:AMD) and Micron (NASDAQ:MU) are two of the most successful chip manufacturers in the world. Although producing chips for different non-competitive markets they both have driven revenue higher every year for the last 3 years.

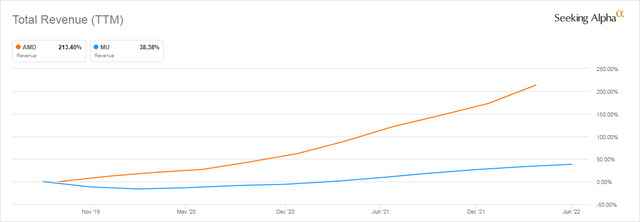

Looking at their 3-year revenue trends AMD has far outdone MU with revenue increasing by 221% vs a much lower although respectful 38% for Micron.

While MU manufactures mainly memory chips, AMD manufactures both CPUs (Central Processing Units) and GPUs (Graphics Processing Units). The interesting symbiotic relationship is every end product that AMD’s chips end up in also has scads of memory chips, oftentimes Micron’s.

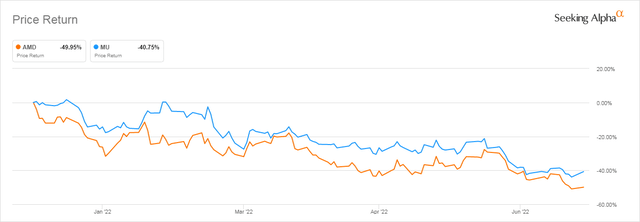

Year to date, both stocks have significantly dropped in price, Micron by 40% and AMD by 50%. This has led some analysts to question whether their large price increases over the last few years are about to take a breather.

I have written 39 articles on AMD and 21 on Micron over the last 7 plus years, many times comparing their prospects both directly and indirectly.

In this article, I will compare the current status of both companies and come up with an investment recommendation for both.

Financial metrics

Contrary to what we might guess from the introduction above, Micron and AMD have some considerable differences in key financial metrics.

The most noteworthy is the Revenue (Line 2) which shows Micron has a whopping 72% more revenue than AMD.

But both have about the same Gross Margin percentage (Line 5) so no direct advantage there.

Seeking Alpha and author

But the metrics look different when you compare them to the relative prices of the two stocks in terms of the GM (Gross Margin) percentage of MV (Market Value) and EV (Enterprise Value). In that case, MU looks much better with a Gross Margin to MV and EV of 26% and 27% (Lines 7 & 8) compared to AMD’s rather paltry 8%.

That would indicate AMD’s stock may be overvalued on a relative basis.

Overvalued may also apply to the P/E Ratio ( Line 10 ) and Price to FCF ( Line 15), both of which make Micron look very underpriced relative to AMD’s current valuation.

However, over the last 5 years, AMD has consistently had a much higher Price/Sales most likely due to its non-commodity product line even though Gross Margins are about the same between the two companies.

Analysts’ ratings are high for both AMD and Micron

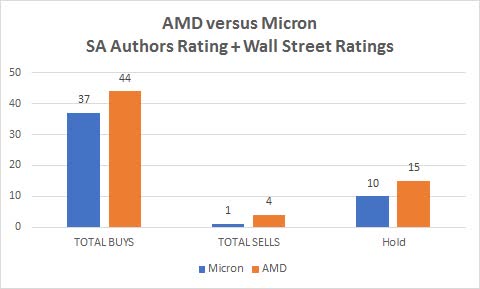

If we look at Seeking Alpha plus Wall Street analysts combined we can see that both stocks come highly recommended with a combined score of 81 buys and only 5 sells.

Seeking Alpha and author

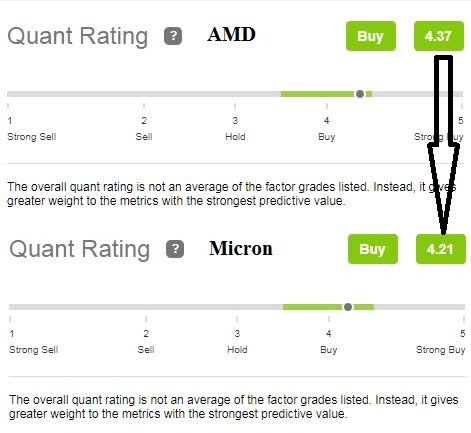

And similar votes with the Quant Ratings AMD is a Buy with a score of 4.37 and Micron is also a buy with a score of 4.21.

Seeking Alpha

Micron is in one triopoly while AMD is in two duopolies

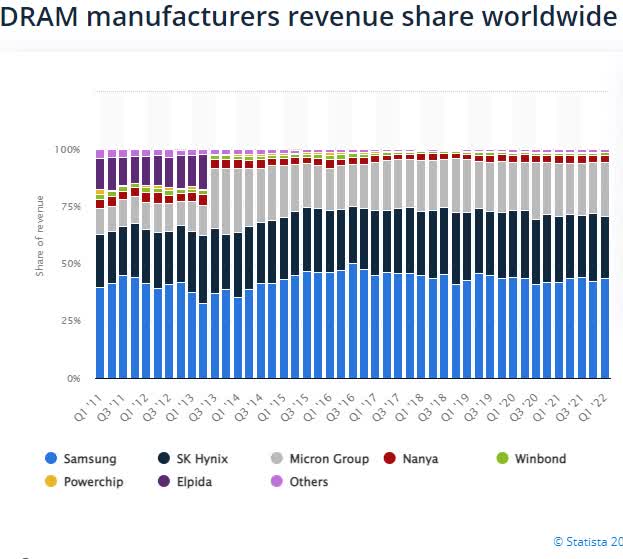

When it comes to memory products, Micron is 2nd only to Samsung which, of course, uses tons of memory in its own products. SK Hynix is also right in the race for volume.

Statista

AMD is 2nd in GPU and CPU chips to Nvidia (NVDA) and Intel (INTC) respectively.

Both AMD and Micron are largely dependent on a small number of customers

AMD has a more concentrated customer base than Micron but not by much.

Collectively, our top five customers accounted for approximately 54% of our net revenue, Hewlett-Packard Company, Microsoft Corporation and Sony Corporation each accounted for more than 10% of our consolidated net revenues. Source: CSIMarket

and

We depend on a small number of customers for a substantial portion of our business and we expect that a small number of customers will continue to account for a significant part of our revenue in the future. If one of our key customers decides to stop buying our products, or if one of these customers materially reduces its operations or its demand for our products, our business would be materially adversely affected. Source: 10-K page 39

On the other hand, Micron sells to many different customers from watchmakers to cloud providers but they are still dependent on the top 10 as shown from their 10-K:

In each of the last three years, approximately one-half of our total revenue was from our top ten customers. A disruption in our relationship with any of these customers could adversely affect our business. Source: 10-K

In 2021, 56% of our revenue was from sales to customers who have headquarters located outside the United States.

Thus, 54% of AMD’s revenue is from its top 5 customers while 56% of Micron’s sales are from its top 10 customers. My guess is Micron’s top 10 includes most or all of AMD’s top 5 which includes HP, Dell, and Lenovo.

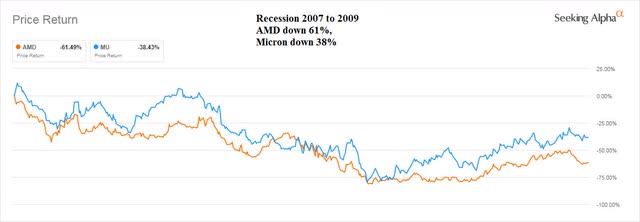

Neither company did well in the last recession

If you are concerned, as I am, of a looming recession in the next year or 18 months, knowing how a company did in the last recession can provide some investment insight.

From December 2007 through June of 2009 is the last recognized recession period and both Micron (down 38%) and AMD (down 61%) did poorly.

So neither company would be a pick if a recession is coming.

Conclusion

Both Micron and AMD have had a great run over the last few years. But since January 1, both have lost considerable ground.

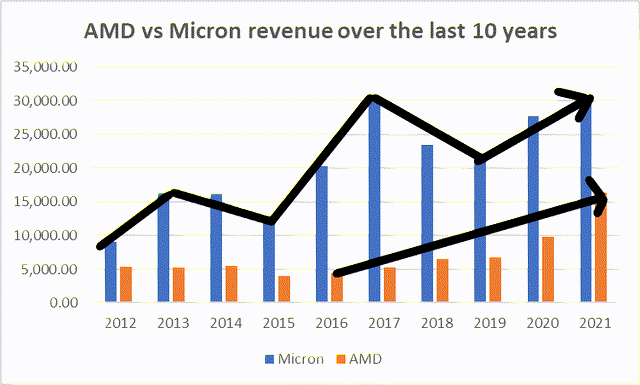

The other issue is how cyclical Micron’s business and revenue have been over long periods of time.

Here’s the 5-year revenue comparison of Micron and AMD. It is easy to see the lumpiness of MU’s revenue compared to AMD’s. This is because the memory business is much more commodity-like than the CPU/GPU business.

This is also easy to see on the following chart showing stock price over the last 10 years. Micron’s volatility is easy to see.

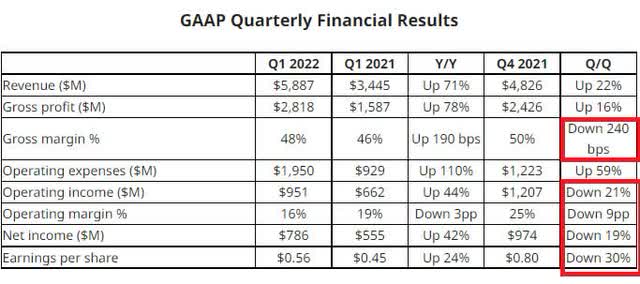

On May 3rd, AMD posted what at first glance appears to be blockbuster Q1 2022 numbers compared to Q1 2021. But when compared to last quarter (Q4 2021) there were some troubling signs such as Operating Margin down 9% and earnings per share down 30%.

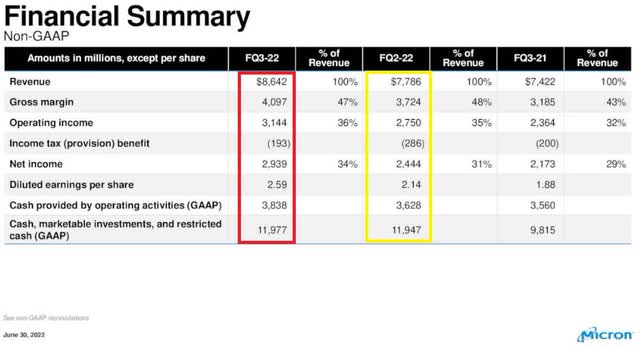

Micron, on the other hand, shows excellent results with both the previous quarter and the year-ago quarter.

The obvious investment question is whether now is the time to buy either of these two chip companies. Both have shown share price losses over the last 6-8 months in the face of continued logistics and market problems.

Considering the state of the world with chip and logistic issues, very high inflation, and war in Europe for the first time in decades, I am very wary of high-tech stocks like Micron and AMD. Without an official recession, they have been hit hard which makes me wonder where they will go if/when a real recession hits.

However, with record Q3 earnings of $2.59 and a forward PE of less than 7 Micron looks oversold and the one more likely to provide gains over the next 18 months.

AMD on the other hand looks to be facing more competitive price pressures from Intel over the next year or so.

Micron is a Buy and AMD is a Hold

Be the first to comment