piranka/E+ via Getty Images

Produced in collaboration with Avi Gilburt and Ryan Wilday

For those who have followed the work of myself and Ryan Wilday, you know that while Bitcoin (BTC-USD) has yet to reach our expected targets for rally patterns off of both the 2018 and 2020 lows, we still see the price action as constructive. Price has been in a larger holding pattern, denoted as a flat correction off the April 2021 highs, and the larger degree of support for this perspective continues to hold. Though micro setups have developed to take BTC back to $24k, price has evaded a deeper drop. BTC has not been able to push below $30k for any significant period of time before attracting an excess of buyers who push price back up. In short, expectations for higher targets described in my various articles entitled with some iteration of “Moonpath,” still appear to be very much on track.

The guidance that we provide in Crypto Waves tends to center around Bitcoin as the core holding among digital assets, and we tend to strike a position of caution around both over-allocating into alt-coins and holding altcoins as longer-term investment. Nevertheless, we do track selected altcoins for the purposes of high-quality trade setups (not long-term investments) and view them as having a prospect of offering some shorter-term outperformance (relative to 100% Bitcoin holdings) for selected coins during specific periods.

This miniseries of articles focuses on three well-known higher market cap altcoins that demonstrate higher probability of outperformance and expectation of new all-time highs in the next bullish cycle. These are Binance Coin (BNB-USD), Polygon (MATIC-USD), and Aave Liquidity Protocol (AAVE-USD).

Since the previous article, price has strongly broken down. Not only was the long-term support level $24k reached, it was resoundingly exceeded to the downside, testing beneath $18k. As such, our longer timeframe analysis, while still quite bullish, now favors only one more swing up to new all-time highs before a much longer-term correction. As for the altcoins presented in this series, BNB, MATIC, and (upcoming) AAVE, longer-term support for new all-time highs has maintained nicely.

This article, Part II, focuses on MATIC

MATIC is the unit of payments for transactions between users on the Polygon Network. Polygon is a Layer 2.0, Proof-of-Stake network that enables construction of side-chains to the Ethereum (ETH-USD) network aimed at solving ETH’s scaling problems.

From Kraken.com: Polygon is a multi-level platform with the aim to scale Ethereum thanks to a plethora of sidechains, all of which aim to unclog with the main platform in an effective and cost-efficient manner.

The benefits of Polygon’s architecture are that their Proof of Stake model enables both inexpensive and swift processing of transactions by completing the confirmation process in a single block. This represents an enormous value add for the variety of applications running directly on Ethereum, which are subject to slow and expensive transactions.

“Polygon is a decentralised Ethereum scaling platform that enables developers to build scalable user-friendly dApps with low transaction fees without ever sacrificing on security.” Bring the World to Ethereum | Polygon

Polygon is gaining a broad array of adoption across industries. They claim over 19,000 dApps (decentralized Apps) have used the Polygon network to scale performance. Also, use of the network is currently saving an average of $140M in daily gas fees (Fees charged for using the main Ethereum network directly).

As well, in January of this year, Adidas and Prada announced open Metaverse NFT project launched on Polygon: adidas Originals and Prada Announce a First-of-its-Kind Open-Metaverse & User-generated NFT Project.

In April of 2022, Stripe launched expanded global payments with crypto transacted on Polygon: Expanding global payouts with crypto

And in May of 2022, Meta/Instagram launched on Polygon/Ethereum as a set of digital collectibles showcasing NFTs on Instagram: Introducing Digital Collectibles to Showcase NFTs on Instagram.

From an Elliott Wave perspective:

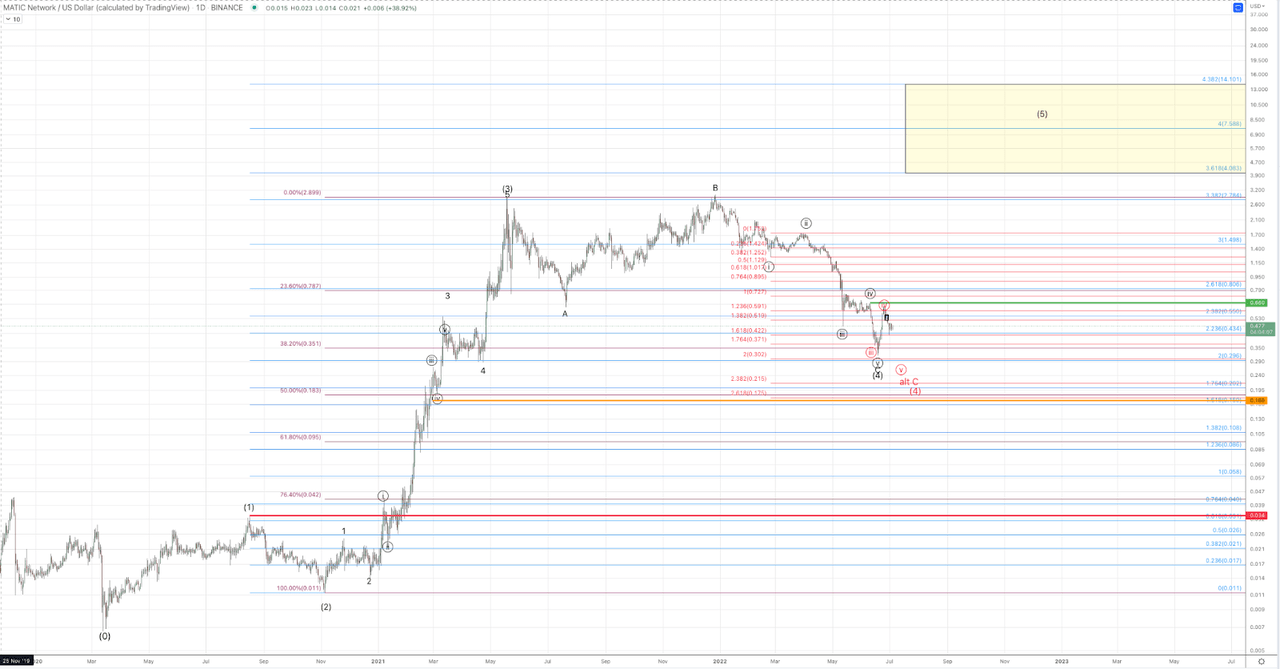

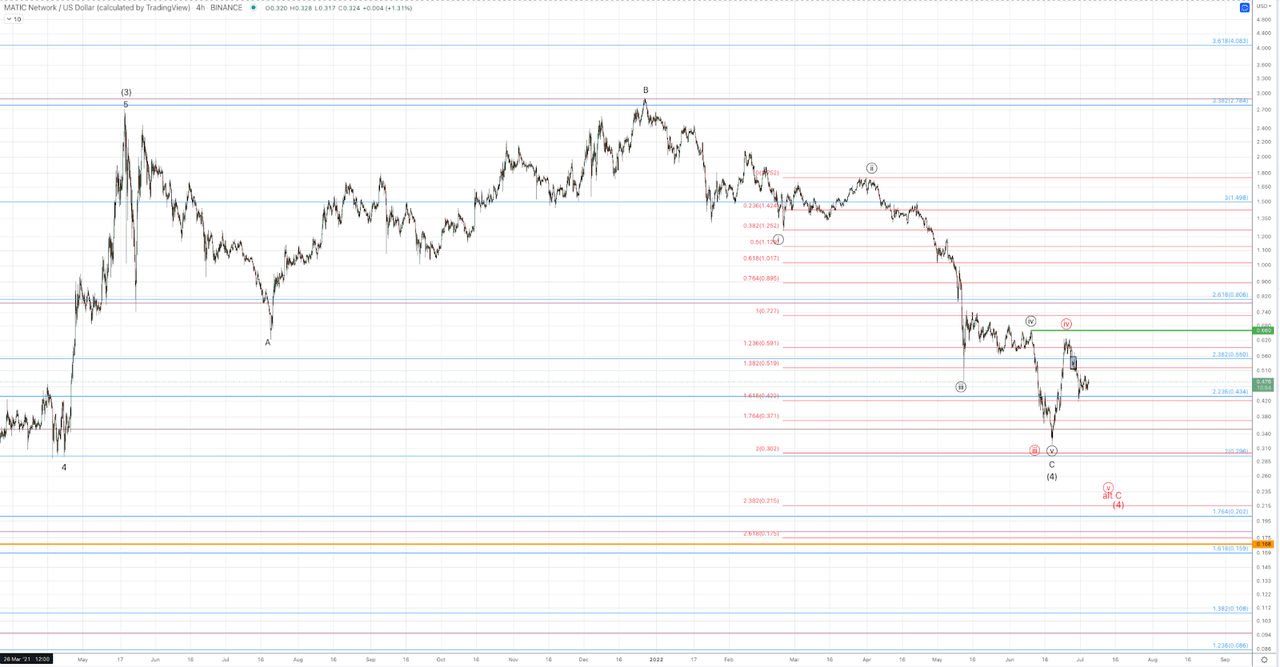

(Please see the attached charts for reference/visual aid)

MATICUSD Daily Chart (Jason Appel (Crypto Waves)) 4h MATICUSD Chart (Jason Appel (Crypto Waves))

Since the March 2020 low, MATIC has rallied in a strong impulsive fashion. In Elliott Wave, a[n] (completed) impulse is a 5 wave trending pattern that adheres following rules:

-

Waves (1), (3), and (5) of the structure are themselves counted as 5 wave moves

-

Wave (3) cannot be the shortest wave and it must be an impulse

-

Wave (4) cannot overlap into wave (1) territory

A “textbook” or “good” impulse tends to have a very extended 3rd wave, ideally exceeding 1.382x the logarithmic measurement of the wave (1), and wave (4) ideally should test the .236 – .382 retrace of wave (3) and not have any resounding break below the .500 retrace of wave (3).

Matic has completed 3 waves up, in a fashion that is characteristic of the first 3 waves of a potential impulse from the March 2020 low. From the May 2021 high (considered the high of (3) given that move from July to November counts better as 3 waves only) the ideal wave (4) support, the .382 retrace of (3) is at $0.35. Into the recent low struck on June 18, MATIC has enough waves to satisfy a standard corrective pattern for wave (4). Wave 4s generally are 3 wave moves (with the exception of a wave 4 triangle) that are labeled A-B-C. A waves are typically 3 wave moves, B waves are 3 wave moves, (also, with the exception of a B wave triangle) and C waves are 5 wave moves which often form as impulses.

From the May 2021 high to the July 2021 low we have 3 waves down, and though price made a higher high in November 2021, the move from July low counts better as a corrective, 3 wave structure. And finally, we have a 5 wave impulse down from the November 2021 high into the recent low, striking ideal wave (4) support and providing a substantial initial bounce.

We do not yet have sufficient advance off the recent lows nor a structure of rally which strongly suggests that a lasting bottom has been struck. Similarly, the bounce is not strongly suggestive that lower lows are very likely. As such, the current shorter time frame stance is ambiguous, but without a clear 5 wave rally through $0.66, a lower low targeting $0.20-$0.27 cannot be ruled out.

At the larger degree, considering 3 waves up in an impulsive structure and price still maintaining reasonable support for wave (4), a higher high is expected to exceed the 2021 highs. Assuming price maintains necessary support, the current targets for wave (5) are $4-$14. Without a 1-2 of (5), we have a very wide range of targets, but once the 1-2 sets up with a 5 wave rally and 3 wave pullback of sufficient magnitude, we will have sufficient information to dial targets more tightly. Regarding the magnitude, please keep this in mind regarding altcoins: Specifically with MATIC, price declined approximately 90% from its 2021 high into the current (June of 2022) low and still has maintained a bullish setup. Similarly, the move from current levels to the expected target region is mostly in excess of 10x.

Should price get that lower low, such a development could be seen as an opportunity to buy cheaper. However, below $0.16 on any prolonged basis, compromises the expectation for higher highs in this (expected) 5 wave cycle from the 2020 low. As such, the risk/reward ratio implied at current levels ($0.47 as of writing) and deeper into support is quite attractive, but as always with alts, managing size and risk is absolutely necessary as the level at which this trade thesis becomes unlikely is more than 66% down.

A further note, with each smaller bearish cycle within larger bullish cycles in crypto, many altcoins do not survive, and even among those that do, very few maintain their bullish patterns. With that in mind, we see it as valuable to view trading opportunities in altcoins as just that: trading opportunities and not necessarily long-term buy and hold investments for the entirety of the holdings.

Be the first to comment