PonyWang

AMD’s (NASDAQ:AMD) shares are down 45% and the investment community is debating whether it’s a good buy at current levels. Where bulls believe the stock is undervalued, bears feel there’s more pain ahead due to macroeconomic headwinds in a recessionary environment. Fortunately, for investors, a recent data release gives us a new perspective on what the Street is doing. AMD’s short interest dropped by nearly 21% in the last cycle, suggesting the selling pressure is subsiding and that the stock may be in the process of bottoming out. Let’s take a closer look to gain a better understanding of it all.

The Shorting Exodus

For the uninitiated, short interest is basically the total number of short positions that are open and are yet to be covered at the end of each reporting cycle. A sharp buildup in the metric suggests that traders have actively bet against a company in the hopes of its stock price declining in value in the near future. Conversely, a significant drop in the metric indicates that market participants have wound up their short positions as they perceive the stock to be fairly or undervalued. So, the short interest metric basically helps us in gauging the Street’s pulse relating to any given stock.

As far as AMD is concerned, its short interest at the end of the last reporting cycle amounted to 32.59 million shares. This figure may seem huge in isolation but it’s actually dwarfed by the chipmaker’s total public float of 1.61 billion shares. This means that just 2% of AMD’s entire public float stood shorted at the end of the last cycle.

It’s also important to note that AMD’s short interest is down 21% sequentially and down 63% from its 6-month highs, indicating that short-side traders have actively wound up their positions in the name. With all the recessionary fears floating around in investing forums, one would have expected bears to bet against AMD in a bid to profit from its hypothesized price decline and its short interest should’ve surged in that scenario. But we saw its short interest decline instead, indicating that the Street doesn’t anticipate much downside in AMD’s shares from the current levels.

For the record, the data being referenced here is for the cycle spanning the second half of June. The data was released in the public domain only last week which makes it relevant and updated for our discussion here.

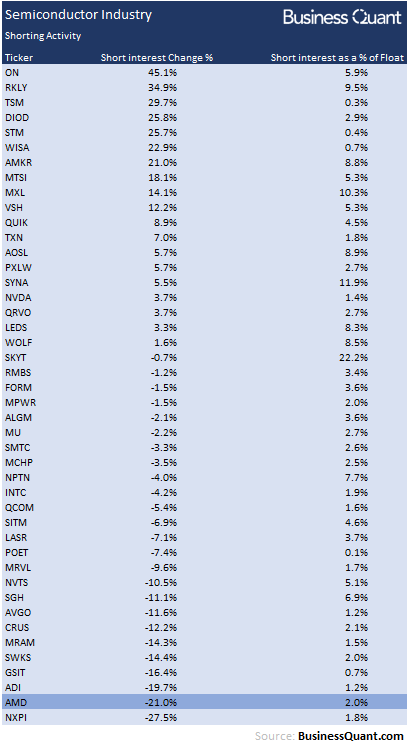

Next, I wanted to see if market participants are actively winding up their short positions in the entire semiconductor industry or if this trend is prevalent especially in AMD’s case. So, to be sure, I pulled the short interest data for over 40 other semiconductor stocks. As it turns out, AMD saw one of the highest amounts of short interest reductions in absolute terms. A few semiconductor stocks actually saw a buildup in their short interest figures in the last cycle. Also, note that AMD’s short interest as a percent of public float is much lower than some of the other rapidly growing stocks.

BusinessQuant.com

This confirms that market participants are shorting other semiconductor stocks, but they’re uncomfortable with betting against AMD. This begs the question – why are traders skeptical about shorting AMD in the first place?

Reasons for Caution

There seem to be broadly 3 reasons as to why market participants may be hesitating in shorting AMD. For starters, the chipmaker has been consistently nibbling away market share from its larger rivals, Nvidia (NVDA) and Intel (INTC), in GPU and CPU segment respectively. Every 100 basis points of market share added in AMD’s favor is bolstering its financial growth due to the smaller base effect.

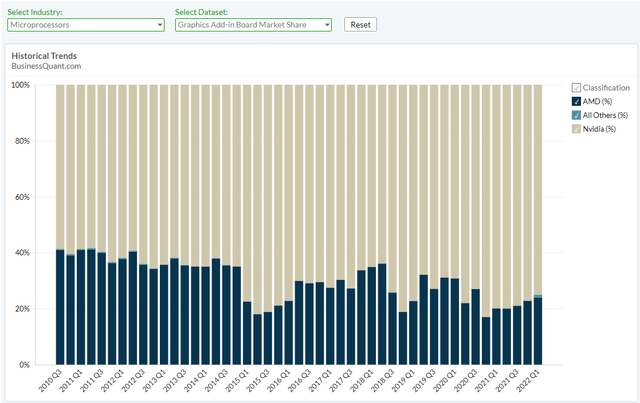

The chart below highlights AMD’s market share gains against Nvidia in the GPU space.

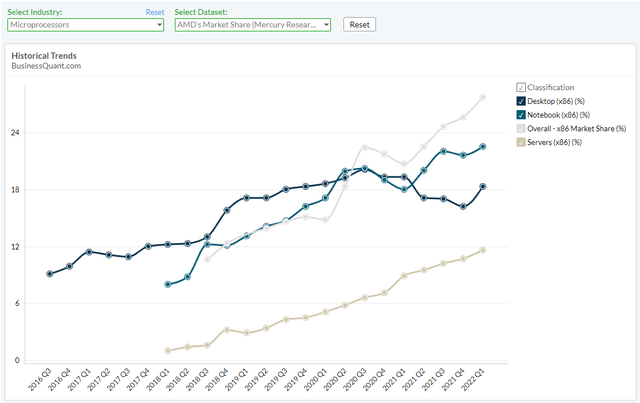

And this chart shows AMD’s market share gains against Intel in the CPU space.

There’s no telling till when will AMD continue to gain market share at the expense of its larger rivals. Fact of the matter is that AMD is scheduled to launch its next-generation 7000-series CPUs and GPUs later this year. These chips will be fabricated using Taiwan Semiconductor’s N6/N7 process and will house AMD’s next-gen chip architectures, which will again place the chipmaker in formidable position against its peers. So, as far as guesstimates go, I expect AMD’s market share gains to average around 100 basis points in each of the next 4 to 5 quarters.

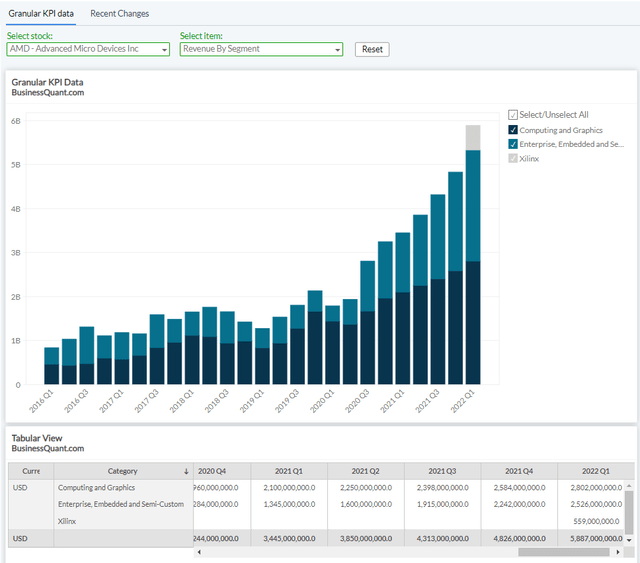

Secondly, AMD has been posting revenue growth at a breakneck pace across all its reporting segments in recent quarters. I personally feel this is a commendable feat and an enviable position to be in. But having said that, the added prospect of continued market share gains means the chipmaker’s growth momentum could stay at elevated rates even when the rest of the growth stocks tank in a recessionary environment.

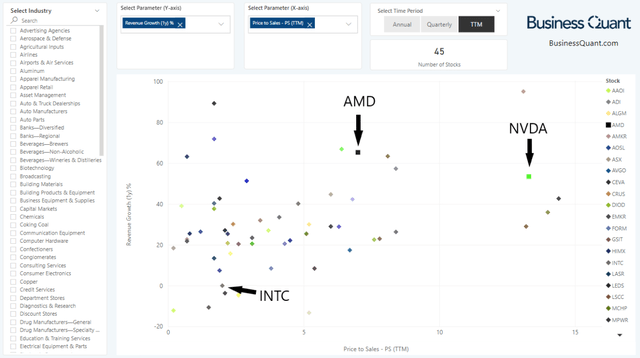

Lastly, AMD’s shares have become attractively valued after their 45% price correction over the last 6 months alone. The X-axis in the chart below highlights the Price-to-Sales (or P/S) multiples for over 40 semiconductor stocks listed on US bourses. Note how AMD is horizontally positioned slightly towards the right, indicating that its shares are trading at a modest premium compared to a broad swath of its peers. Note how AMD’s larger rival, Nvidia, is positioned further towards the right with a much higher P/S multiple.

Now, let’s shift attention to the Y-axis, which plots the revenue growth rates for the same set of companies. Note how AMD is positioned vertically higher than most of its peers, which basically highlights its elevated pace of revenue growth. The collective takeaway here is that AMD’s investors are paying a premium, to own a premium company, which makes it a fairly valued company at current levels. There are, in fact, only 3 other stocks in our study growth that are growing faster than the chipmaker and trading at a relative discount.

Short-side market participants generally prefer overvalued businesses that are deteriorating or are on the verge of deterioration, as they offer higher chances of stock price declines. However, AMD doesn’t quite fit the criteria as it presents the prospect of sales acceleration at a fair valuation. This, in my opinion, is the primary reason as to why short-side traders have continued to unwind their positions in AMD.

Investors’ Takeaway

The takeaway here is that short-side market participants are cautious about betting against AMD’s shares at current levels. This is rightly so as the stock seems to be fairly valued at the time of this writing and the business as a whole is well positioned to continue growing at its elevated rates. This should reassure AMD’s investors that the stock may be forming a bottom and that it makes for a good buying opportunity to go long at the current levels.

Good Luck!

Be the first to comment