AdrianHillman

Investment Thesis

Advanced Micro Devices, Inc.’s (NASDAQ:AMD) looks ready to reclaim new heights, given the aggressive ramp-up in its R&D efforts worth $1.3B in FQ2’22. We are already starting to see some fruits from that labor by the impressive YoY market share growth in the x86 server segment by 6.8 percentage points to 22.7% in Q2’22, compared to Intel’s (INTC) continuous declines of 10.2 percentage points YoY to 69.5% then. Literally, aggressively devouring the latter’s breakfast, lunch, and dinner at the same time.

Despite the declines in the PC market thus far, AMD continues to grow its dominance in the desktop market share by 3.5 percentage points YoY to 20.6% and the notebook/ mobile market by 4.8 percentage points YoY to 24.7% in Q2’22. Most importantly, the company also grew its overall x86 market share by an impressive 8.9 percentage points YoY to a record high of 31.4% simultaneously, further destroying INTC’s long-term dominance in the segment.

Considering AMD’s current growth rate, INTC indeed has much to fear, as witnessed by the continuous plunge in the latter’s stock price thus far. It is also immediately evident that AMD is gaining immense synergies from its recent Xilinx and Pensando acquisitions, unlocking tremendous opportunities for the company moving forward.

In the intermediate term, we also expect AMD’s stock valuations to be well-supported by the continued growth in the IoT, Data Center, and automotive segments, as observed by ASML Holding (ASML) and Taiwan Semiconductor Manufacturing Company Limited (TSM) in their recent earnings call. Therefore, shielding the stock from another drastic plunge in the potential recession ahead. Friends, this bull looks hyper-charged for growth ahead.

AMD Continues To Ramp Up Its Aggressive R&D Efforts

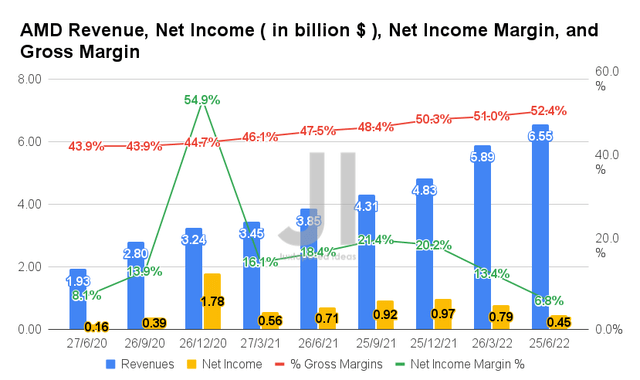

In FQ2’22, AMD reported revenues of $6.55B and gross margins of 52.4%, representing an impressive increase of 70.1% and 4.9 percentage points YoY, respectively, partly attributed to Xilinx. In contrast, the company reported declining profitability with net incomes of $0.45B and net income margins of 6.8% in the latest quarter, representing a drastic decrease of 36.6% and -11.6 percentage points YoY, respectively.

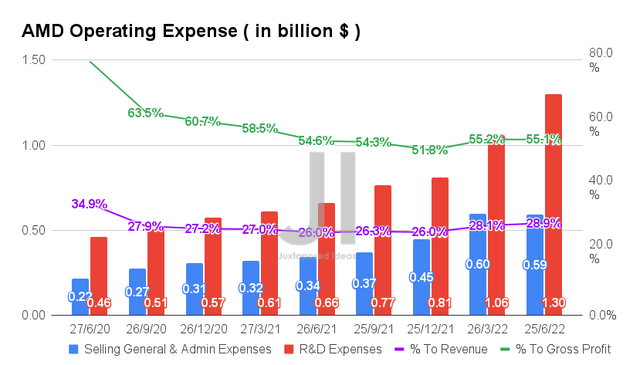

However, investors need not fret, since these are attributed to AMD’s aggressive R&D investments. By FQ2’22, the company reported R&D expenses of $1.3B, representing a massive increase of 22.6% QoQ and 96.9% YoY, partly attributed to its recent acquisitions.

However, it is also important to note that the ratio of these operating costs has remained relatively controlled compared to its growing sales. By FQ2’22, the ratio to its revenues is at 28.9% and gross profits at 55.1%, representing notable increases YoY though not alarming, due to AMD’s long runway for growth. Given its forward guidance for spending 24% of its revenues on its operations for the rest of FY2022, we may expect to see sustained elevated R&D investments ahead as well.

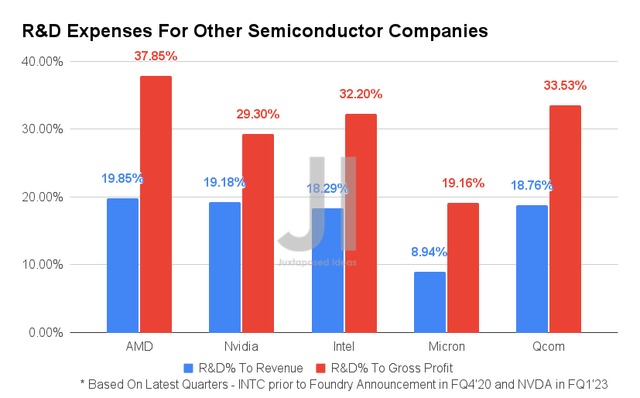

AMD is clearly investing aggressively in its future capabilities if we compare its R&D expenses to those of its peers. By FQ2’22, the company spent 19.85% of its revenues and 37.85% of its gross profits on R&D efforts. Compared to its direct competitor, INTC spent only 18.29% and 32.2%, respectively, prior to the announcement of its foundry ambitions in FQ4’20. Otherwise, an inflated ratio of 28.7% of the latter’s revenues and 78.7% of gross profits in FQ2’22. However, we do not recommend referring to these numbers, given the drastic fall of consumer demand in the PC segment then and the implication of its foundry-related expenses for the past few quarters.

In the meantime, its closest peer, Nvidia (NVDA) reported R&D expenses worth 19.18% of its revenues and 29.3% of its gross profits in FQ1’23, comparatively lower than AMD’s sum indeed. Otherwise, the company spent 19.52% of its revenues and 29.79% of its gross profits on its R&D efforts in FQ2’23. Again, not the best comparison due to the recent fall in its gaming sales. Even though not directly related to AMD due to their logic, memory, and storage focus, Micron (MU) and Qualcomm (QCOM) also spent lesser on their R&D efforts comparatively.

Some AMD investors may indeed be concerned about the reduced profitability in the short term. However, we must remind all that these strategic efforts would ensure its continued leadership in the intensely competitive semiconductor market. These investments would eventually be top and bottom lines accretive in the long term as well.

Therefore, long-term investors should be keenly awaiting AMD’s new PC product launches and technological advances in the upcoming premiere on 29 August 2022, on top of those announced in June 2022. We are especially looking forward to its Zen 4-based Ryzen 7000 Series desktop processors, which will be released by August 2022. It would directly compete with INTC’s 12th Gen Alder Lake CPUs released in November 2021 and 13th Gen Raptor Lake series likely by the end of 2022. Though we reckon the Ryzen 700 may easily score wins in the power efficiency and performance segments, a direct result of its R&D investments thus far.

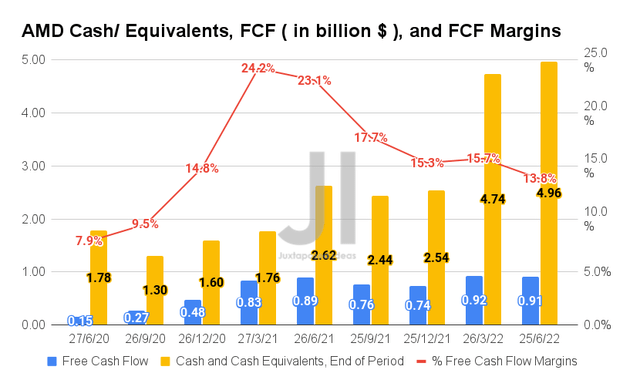

Therefore, given its improving revenues, it is no wonder that AMD has been reporting sustained Free Cash Flow (FCF) generation thus far, with an FCF of $0.91B and an FCF margin of 13.8% reported in FQ2’22. In the meantime, the company also continues to strengthen its cash and equivalents on its balance sheet to $4.96B in FQ2’22, with the aid of $2.46B in long-term debts. Therefore, AMD would have more than enough capital for its long-term growth and expansion plans in the $300B market for high-performance and adaptive computing solutions.

Mr. Market Continues To Upgrade AMD’s Growth Potential

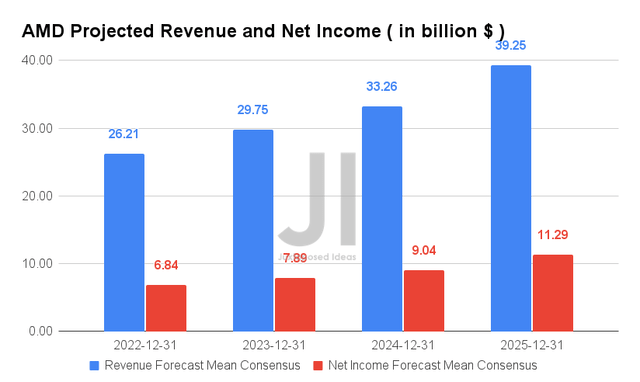

Over the next four years, AMD is expected to report revenue and net income growth at a CAGR of 24.32% and 37.48%, respectively. These numbers represent an apparent upgrade in the company’s growth by an optimistic 8.5% since previous estimates in May 2022. In addition, the market remains very confident about AMD’s projected profitability, given the growth in its net income margins from 5.1% in FY2019, to 19.2% in FY2021, and finally to 28.7% in FY2025.

In the meantime, AMD has also provided FY2022 revenue guidance of $26.3B and FQ3’23 guidance of $6.7B, representing a remarkable increase of 60% and 55.4% YoY attributed to the sustained demand in the Data Center and Embedded segments. Profitability remains stellar as well, with a gross margin guidance of 54% despite the rising inflation and global supply chain issues. Therefore, long-investors have nothing to worry about AMD’s fundamental performance ahead.

In the meantime, we encourage you to read our previous article on AMD, which would help you better understand its position and market opportunities.

So, Is AMD Stock A Buy, Sell, Or Hold?

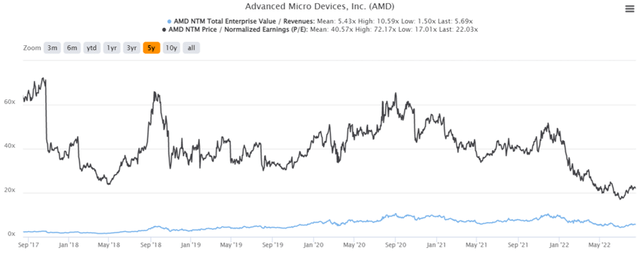

AMD 5Y EV/Revenue and P/E Valuations

AMD is currently trading at an EV/NTM Revenue of 5.69x and NTM P/E of 22.03x, slightly higher than its 5Y EV/Revenue mean of 5.43x though massively moderated from its 5Y P/E mean of 40.57x. The stock is also trading at $98.27, down 40.2% from its 52-week high of $164.46, though at a premium of 37.2% from its 52-week low of $71.60. The recent hype around the Chips Act has indeed lifted many boats, despite AMD’s perceived softer FQ3’22 guidance and Nvidia underperformance in FQ2’23.

AMD 5Y Stock Price

It is evident that consensus estimates remain optimistic for now, given AMD’s upgraded revenue growth and the price target of $123.30 with a 25.47% upside from current prices. Nonetheless, we expect this market optimism to be digested soon once the hype dies down over the next few weeks. Furthermore, investors must not forget Nvidia’s upcoming earnings call on 24 August 2022 and the Fed’s upcoming interest rate hike on 20 September 2022. Though of course, there is a chance that this pessimism has already been baked in, thereby limiting the potential downside ahead.

In the meantime, traders looking to unlock quick gains may consider selling some at these levels, if they had gotten in at the bottom in July 2022. Otherwise, long-term investors would be well advised to hold on to this stellar stock for long-term investing, while always adding during dips since the stock would likely outperform over the next decade. Long AMD!

Be the first to comment