Justin Sullivan

Investment Thesis

Intel (INTC) shocked the investment community by announcing absolutely horrendous Q2 results in July. In stark contrast, when AMD (AMD) reported a beat-and-raise just a week later, it was crowned the ultimate winner of the current semiconductor cycle, supposedly driven by its superior product portfolio allowing it to continue to gain market share. Lisa Su boasted that AMD was seeing no weakness.

This thesis was further affirmed when in the months following the Intel report, pretty much all other semiconductor companies reported weak results and/or guidance, including behemoths like Nvidia (NVDA) and Micron (MU). This made AMD the last company standing. Investors were patting themselves on the back.

That is, until the recent pre-announcement. The downfall could not have been more spectacular, with client revenue collapsing by 53% QoQ and 40% YoY. This compares to Intel’s 17% QoQ and 25% YoY decline in Q2 (followed by some sequential growth in Q3), which now looks outright innocuous in comparison. Nvidia also reported “just” a 44% QoQ and 32% YoY decline in gaming, despite that the narrative is that the Nvidia collapse was (mostly) due to the crypto bust.

This makes AMD go from best to worst of the pack in just one quarter.

Background

This is my third (and final) installment in my series where I replace parts of the AMD acronym. The previous articles were:

Combined, AMD has now become Amateur Marketing Delusion.

Q3 results and guidance

Despite the pre-announce, AMD still managed to report a miss-and-lower quarter. Although revenue overall was still up 29%, this is pretty much entirely due to the inorganic Xilinx piece.

Admittedly, the AMD numbers are mixed, as some segments continue to do decent. In fact, the only segment that has really been hit was the PC one, which as mentioned was down over 50% QoQ.

Given that AMD hadn’t seen any weakness when it reported its Q2 results one month into the quarter, this implies the collapse has actually been even more disastrous than these numbers already suggest. Indeed, the forward guidance – which is sequentially flat despite some segments expected to grow – implies that clients will continue to decline. Although in reality, this likely means Q4 sales would be roughly in-line with the last two months of Q3.

From a bigger picture, given that this result is significantly worse than what Intel has reported, it seems AMD is experiencing a market share decline as well, although it is not known why OEMs would necessarily prefer Intel in a downturn.

Zen 4 vs. Raptor Lake

In September, AMD launched its first Zen 4 (Ryzen 7000) CPUs on N5, retaking the process leadership it first got with Zen 2 on TSMC (TSM) N7. While the reviews were overshadowed by its higher power consumption, nevertheless this did cause much higher performance.

However, the victory lap didn’t last long, as Intel (as expected) soon launched its own next-gen Raptor Lake CPUs. In short, despite still being on the Intel 7 node, Intel managed to compete effectively against the AMD CPUs. In fact, while the Core i9 was roughly on par (although admittedly at a somewhat higher power consumption) against the Ryzen 9, the Core i7 and Core i5 both blew their respective Ryzen 7 and 5 competition out of the water, while also being a bit cheaper. In addition, since Raptor Lake still works with (the cheaper) DDR4 memory (unlike Zen 4), the actual platform cost is even more in favor of Intel.

Bottom line, while no doubt Zen 4 is a solid CPU, it does come across a bit amateurish to lose in overall value despite having a process node advantage.

Frontier fail

As another piece in the amateur theme, AMD’s Frontier exascale supercomputer seems to be having some issues.

RDN3 Intel clone?

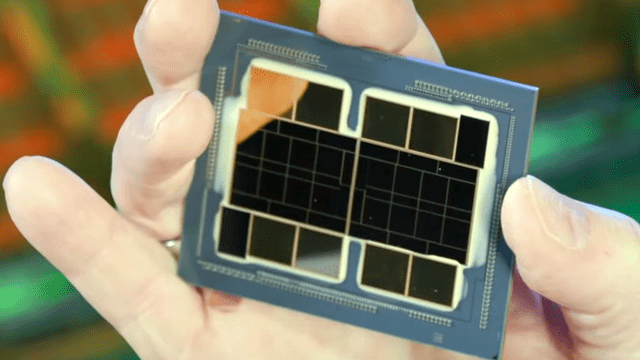

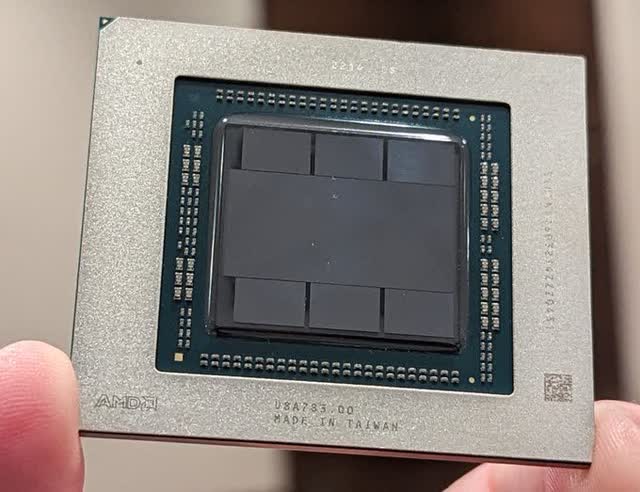

Lastly, although perhaps it may be just a coincidence, one could nevertheless wonder where AMD got its inspiration from. Consider Intel’s Ponte Vecchio and then the new AMD RDNA3 GPU:

Genoa

AMD is expected to launch Genoa soon. In an interview with The Next Platform, AMD recently said it had delayed Genoa by over a quarter in order to add CXL support. CXL, which runs on top of the PCIe 5.0 interface, is an industry standard proposed by Intel in 2019.

Nevertheless, bulls will likely accept the delayed timing as the competition (read: Intel) has had to endure far more severe delays, and AMD will get to feature-parity with Intel in this regard.

While Intel also announced it has begun shipping its own Sapphire Rapids, the CPU AMD originally expected Genoa to compete against was Granite Rapids, and Intel’s previous-gen Sapphire Rapids launch event is still two months away, scheduled for early January. As such, AMD’s “competition” against its new 96-core CPU will initially be the 40-core Ice Lake-SP. Even when Sapphire Rapids launches, Intel will still not be able to compete on core count, as the SKU that Intel called its “high volume” one only contains 34 cores. So overall, for AMD, it is easy to compete when there is no competition.

Valuation

At the time of writing, AMD’s forward valuation stands at less than 17x, which sounds reasonable for a company with multiple business units that can deliver growth over time. In addition, given the monstrous PC decline, it seems unlikely to decline much further. As such, similar to Intel, investors may perhaps subscribe to the financial bottom being reached in Q3 and Q4 (although the low-end of the guidance is below the Q3 results).

On the other hand, though, investors may question if the forward analyst estimates are already baking in the full downturn, as for example Intel recently guided far below estimates for Q4, and AMD did the same. Nevertheless, investors who aren’t impressed by Intel’s plans (such as its Q3 market share gains) and expect AMD to continue to perform solidly, could perhaps buy the stock in order to reap the upside as the macro environment improves, providing at least one tailwind.

Risks

Similar to TSMC, my thesis on AMD in the near term had actually been quite bullish, although my previous evaluation, earlier this year, concluded that AMD had become overvalued in the wake of the Xilinx merger.

From a high level, there could be two lines of reasoning. First, AMD may now have become undervalued compared to its long-term potential, as investors are now pricing in a recession (combined with a P/E multiple compression). Nevertheless, there is a chance (subjectively with a quite high probability) of a meaningful recovery as the economy gets back to growth at some point.

Secondly, however, my long-term thesis for AMD has been neutral at best given the resurgence in competition from Intel. Intel aims to regain unquestioned leadership by early 2025 with the 18A process node. Hence, depending on the exact timing and success of Intel’s plan, any AMD recovery may be more muted. Note that this does not necessarily mean Intel needs to regain (much) market share, since most analyst comments are banking on continued market share gains; until the stock crash over the last several months, investors had been counting on massive continued growth. AMD’s official long-term guidance is for over 20% growth. Hence, if the growth story evaporates, then so may the premium valuation that AMD had over the last few years.

Investor Takeaway

From a competitive standpoint, AMD looks a bit amateurish by launching a 5nm CPU that reviewers are having a hard time recommending against the new Intel 7nm CPUs. In addition, AMD also looked quite amateurish by having to pre-announce a significant Q3 miss (following the beat-and-raise Q2) that made it go from top to bottom of the pack in one fell swoop.

Since the stock has already taken a significant hit – far more so than the actual revenue, although the bottom line has been hit a bit harder too – it is not necessary to be bearish, but it does start to pose some questions regarding the status of AMD as a growth company and stock, as the only thing currently holding up the financials is the inorganic Xilinx piece. In particular, the over 50% QoQ PC decline cannot simply be overlooked as a small blemish, but seems quite a red flag.

In summary, given that the days of high growth are likely over, the stock may be rerated, and in addition the stock had still been (unsuccessfully) digesting the Xilinx merger (stock dilution). Some investors may buy or add at the current price in the expectation that the PC market will improve, but by then Intel might already be much more competitive (in the data center), which may continue to add pressure to the financials, reaffirming the thesis that the days of high organic growth may finally be over.

Be the first to comment