Justin Sullivan/Getty Images News

In no huge surprise, Advanced Micro Devices (NASDAQ:AMD) painted a great picture of the future opportunity in premium chips at their Financial Analyst Day. The company didn’t discuss any major headwinds to the business while impressively reaffirming previous 2022 guidance. My investment thesis is ultra Bullish on the stock based on the expanded market opportunity and the updated financial targets pointed to years of growth ahead while the stock is priced for a recession.

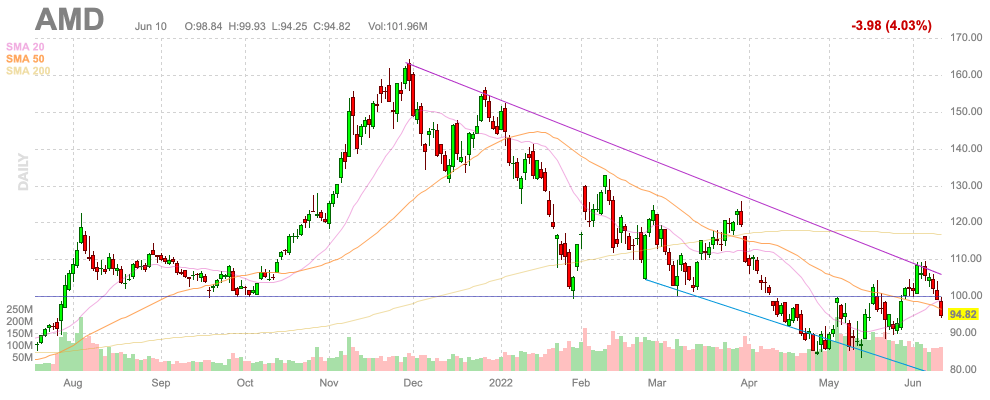

Source: FinViz

Enormous TAM Increase

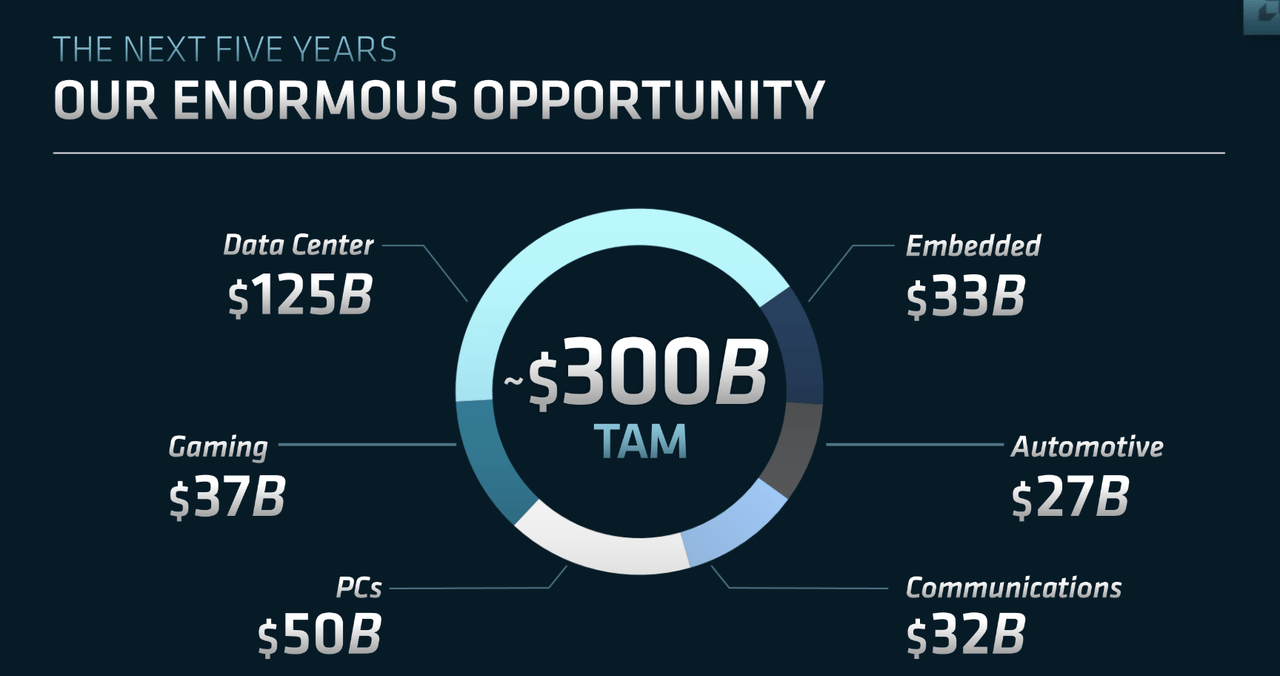

Investors only thought AMD had an enormous TAM topping $100 billion when the company presented the benefits of merging with Xilinx. Now that the deal has been done for several months, the management team presented an impressive opportunity in the years ahead.

Gone are the fears of AMD only focusing on CPUs in the PC or data center space. Now, the chip company is morphing into other growth sectors like Automotive, Communications, AI and Metaverse spaces to produce a TAM expanding to $300 billion in 5 years.

Source: AMD Analyst Day ’22 presentation

A couple of points really stand out from the updated market opportunity. The data center TAM is forecast to surge from $45 billion by 2023 back when announcing the Xilinx deal to reach $125 billion by 2026. In addition, the Automotive and Communication groups combine for nearly $60 billion in market opportunity for sectors with no real past focus.

All of the other sectors have seen various gains predicted. PCs and Embedded will continue to grow at solid clips while Gaming is now forecast to triple in the time period due in large part to the inclusion of designing chips for the explosive growth forecast for the Metaverse.

With a company like Qualcomm (QCOM) already talking about a $16 billion backlog in Automotive, one has to wonder if a $27 billion TAM in 5 years isn’t actually low. Also, the explosion of AI workloads will push data center demand to epic levels in the years ahead.

Updated Financial Model

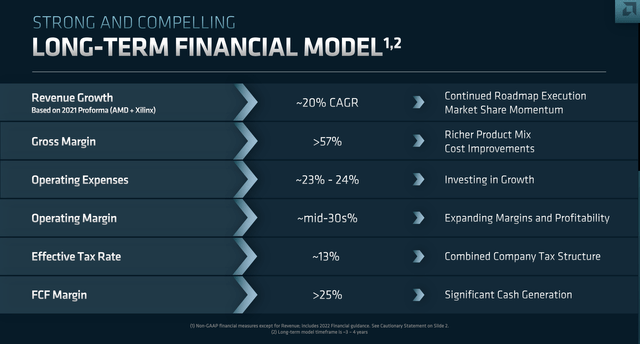

One of the most important parts of the Analyst Day was the company reiterating the guidance for 2022. While competitor Intel (INTC) predicted business was slowing, AMD provided confirmation numbers were still in line with expectations now halfway through the year.

The company provided updated long-term guidance confirming plans for compounded growth of 20%. As the market has missed for a long time, Intel has over $70 billion in sales for AMD to steal going forward, or at least allow AMD to capture all of the additional growth in the massive chip sector.

Source: AMD Analyst Day ’22 presentation

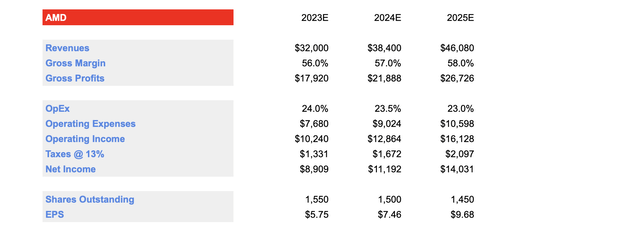

The updated model has impressive operating and free cash flow margins. Using these updated numbers with 20% growth on top of the 2022 revenue total of $26.6 billion produces the following projections for 2023, 2024 and 2025.

Source: Stone Fox Capital estimates

The updated long-term financial model doesn’t differ much from previous estimates of Stone Fox Capital. The main difference is expanding the 20% growth beyond 2023.

A couple of small alterations is the effective tax rate dipping to ~13% from a prior rate of 15% and the prediction for gross margins to top 57%. One has to wonder if AMD can reach 60% gross margins similar to Nvidia (NVDA) and match where Intel use to live.

A lot of the recent focus has been on 2022 or 2023 targets. The market finally figured out in the last year that AMD was going to see a huge bump in earnings going forward, but now the market needs to catch onto the chip company becoming a giant in the industry over the next decade. Years of compounding growth will produce EPS far in excess of the $5+ targets assigned to the 2022 and 2023 earnings streams.

The investment equation very much changes with the $5+ EPS target in 2023 becomes the base for expansion in the years beyond. When EPS targets reach $7, $8 or $9 in future years, AMD looks very compelling below $100. The financial model presented leads to an EPS of nearly $10 in 2025.

The company forecast returning over 40% of free cash flows via capital returns while building a significant net cash position. AMD only plans to spend 2% to 3% of revenues on capital expenditures while Intel projects spending $27 billion this year, or close to 40% of revenues, highlighting the vastly different business models going forward.

A global recession could definitely upset some of the strong growth projections of AMD. The stock already appears priced for missing these above targets, potentially limiting downside risk. Naturally, the other major risk, more of a long-term concern to hitting targets in 2024 and 2025, is anything that changes the dynamics with chip manufacturing where Taiwan Semiconductor (TSM) would lose the leadership position to Intel.

Takeaway

The key investor takeaway is that the updated TAM opportunity appears too big to be true, but AMD CEO Lisa Su continues to deliver. Investors have no reason to doubt the opportunity ahead or the ability of the chip company to produce 20% growth rates long into the future when the 2025 revenue target is still half of the revenues target of industry giant Intel.

Investors should continue using the weakness to load up on shares trading at forward PE multiples below the predicted growth rates.

Be the first to comment