Justin Sullivan

Advanced Micro Devices, Inc. (NASDAQ:AMD) has been one of the victims of the tech price collapse, dropping more than 60% from a peak where it was larger by market-cap than arch-rival Intel (INTC). That weakness has come from the company’s rapid valuation increase, where we argued it was overvalued, along with general market weakness.

However, as we’ll see throughout this article, and its current valuation, AMD has become a more interesting investment proposition.

AMD New Product Launch

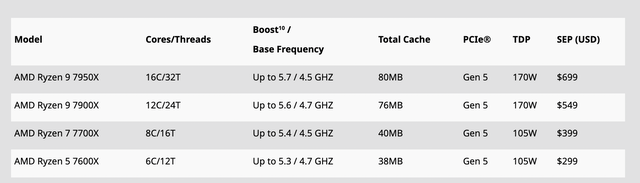

AMD has recently launched its AM5 socket platform, with support through 2025, along with its 7xxx series processors. These processors are competitive with Intel’s latest-generation processors and make AMD a viable competitor.

One important thing AMD has done is the company’s continued focus on equivalent cores, with the 1C/2T model versus Intel’s model of moving towards P/E cores. That new model has both benefits and drawbacks for the company, but if nothing else, it’s a differentiator versus customers who don’t want to move towards the P/E core setup.

The company is continuing to add additional product launches with its largest slate of launches since 2020. That will help support the company’s revenue.

AMD 3Q 2022 Results

Unfortunately, for the company, it’s having to deal with difficult results in a tightening market.

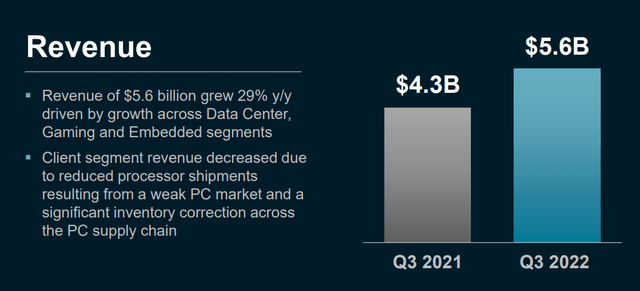

The company saw strong YoY revenue growth of $5.6 billion, supported primarily by datacenter growth, however, it did still underperform forecasts. The company is expecting that a weak PC market and inventory correction will continue to hurt it, although the 3Q also had some weakness from the anticipated launch of the company’s 7xxx series.

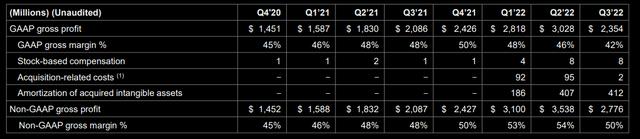

The company’s non-GAAP margins also managed to increase by 2% YoY from 48% to 50%, showing the continued strength of its overall business. As we’ve discussed before, one of AMD’s strengths as a business is the ability to continue growing both margins and revenue to grow overall earnings even faster as the company takes advantage of an improving product lineup.

The company’s GAAP margins took a hit from the Xilinx acquisition, but overall the company managed to increase non-GAAP operating income in a tough quarter.

AMD Earnings Potential

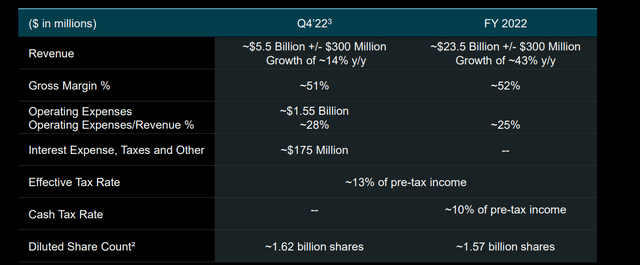

AMD is forecasting for flat earnings for 4Q 2022 despite the fact that the quarter tends to be strong, a sign of tougher times ahead.

The company still anticipates FY 2022 revenue of $23.5 billion, or 43% y/y growth, with ~14% y/y growth for the quarter. The company is cutting its diluted share count to 1.57 billion shares for FY 2022, as it’s continued to spend ~3-4% of its market capitalization annually on repurchasing shares on the open market. The company expects operating expenses to remain manageable along with margins.

AMD continues to see its total addressable market (“TAM”) at $300 billion, meaning it has a roughly 7-8% market share. Its datacenter market share has been growing substantially recently, and we expect that to continue increasing.

AMD Triple Financial Threat

AMD is continuing to improve its financials. The company has a triple financial threat that, as long as growth continues, should enable it to drive substantial shareholder rewards.

The company has managed to keep its stock-based compensation expenses low. Over the past 2 years, minus the most recent quarter weakness, AMD has managed to both rapidly grow its margins and its gross profit as its revenue has increased. The company has doubled its non-GAAP gross profit over the past 2 years.

We expect AMD to continue increasing its revenue and its margins while buying back shares opportunistically. That combination means the company’s EPS for those who invest now will continue to increase, making it a valuable investment.

Thesis Risk

The largest risk to our thesis is competition. Intel is a storied company with billions of investments and an impressive business. Nvidia is another company with an impressive portfolio of assets and investments. Both of these companies are strong competitors to AMD and could hurt the company’s ability to drive future shareholder returns.

Conclusion

It’s naïve to say that AMD’s collapse is over simply because its share price has dropped by more than 60%. Tech collapses tend to be significant and strong, especially in a Desktop environment, where capital expenditures can be postponed. The company is still reeling from an acquisition of Xilinx that we think was overpriced.

However, despite that, the company’s business model is holding up reliably well. It’s clearly turned the tide with investors who were afraid about the company’s ability to continue to compete with both Nvidia and Intel. The company has a strong financial position, it’s generating strong cash, and we expect AMD to continue generating long-term rewards.

Be the first to comment