jetcityimage

Introduction

Amcor (NYSE:AMCR) is the largest company in the Seeking Alpha Top Paper Packaging category with a market capitalization of nearly $18B. Originally from Australia, the company supplies packaging materials to the food, beverage, pharmaceutical, medical, household, personal care and industrial sectors. The company became big with paper packaging, but nowadays produces packaging in a variety of materials. Headquartered in Switzerland, it is a dual-listed company with both a listing on the Australian Stock Exchange and the New York Stock Exchange.

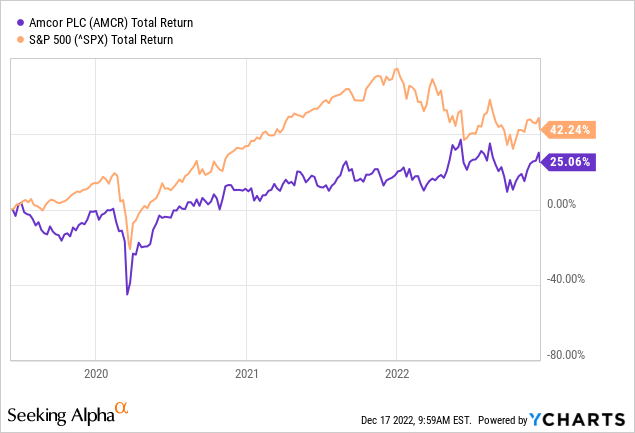

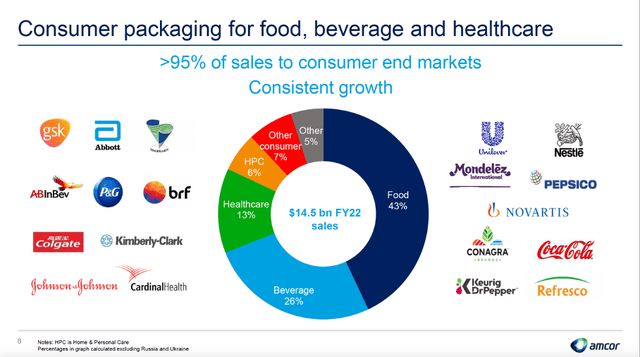

The stock went public in 2019 and since then has a total return of 25%, slightly lower than S&P 500’s 42%. The stock is a defensive one because packaging is widely used for both cyclical products and defensive products. Amcor supplies packaging for many well-known brands such as Unilever (UL), Nestle (OTCPK:NSRGY), Mondelez (MDLZ), PepsiCo (PEP), Novartis (NVS), Coca-Cola (KO) and others.

The company’s defensive nature, shareholder-friendly management and valuation make this stock worthy of buying.

Company Overview

Consumer packaging for food, beverage and healthcare (Amcor 1Q23 investor presentation)

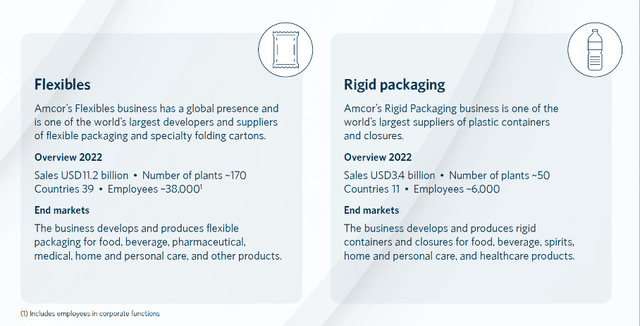

Amcor develops, manufactures and markets packaging products worldwide. The company is divided into 2 business segments:

- Flexibles (77% of fiscal 2022 revenue)

- Flexible and Film packaging products used in food, beverage, pharmaceuticals, medical, household, personal care, and industrials sector.

- Rigid Packaging (23% of fiscal 2022 revenue)

- Rigid containers used in beverage and food products (carbonated soft drinks, water, juices, sport drinks, and others), and personal care products.

Amcor, with its Rigid Packaging business segment, is one of the largest suppliers of rigid plastic packaging products. The company’s total revenue is $15B in fiscal 2022. The Flexibles business segment is the more profitable of the two with an EBIT margin of 14% in fiscal 2022. Rigid Packaging is also doing well with an EBIT margin of 11%. The consolidated EBIT margin is 13%, which is high when compared to companies in the same industry.

Amcor’s business segments (Amcor fiscal 2022 annual report)

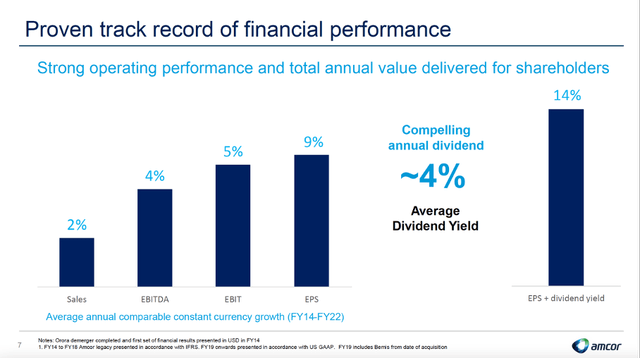

The company aims to become the largest packaging company in the world. Its strong cash flow and balance sheet provide sufficient investment capital. The goal is to increase earnings per share and dividends per share by 10% to 15% annually.

Track record (Amcor 1Q23 investor presentation)

Amcor Can Pass Through Higher Raw Material Costs

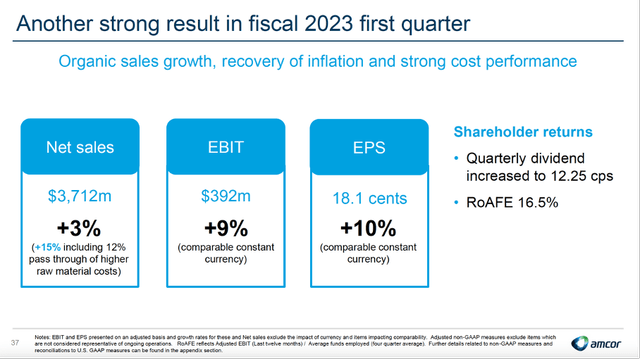

First Quarter fiscal 2023 highlights (Amcor 1Q23 investor presentation)

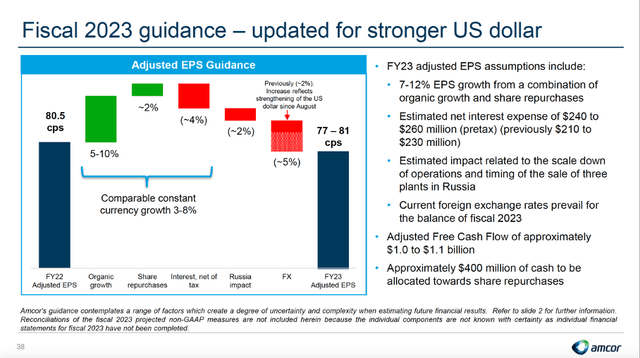

The first quarter of fiscal 2023 was another strong quarter with net sales up 3% (15% including 12% pass-through of higher raw material costs). EBIT also grew strongly by 9% on a constant currency basis, and earnings per share rose 10%. The company expects a stronger dollar for fiscal 2023 and expects earnings per share to remain flat from fiscal 2022. The company could pass on higher raw material costs but expects a currency headwind of about 5%.

Fiscal 2023 guidance (Amcor 1Q23 investor presentation)

Fiscal year 2022 was also a strong year. In fiscal 2022, net sales increased 13% on a reported basis due to the pass-through of higher raw material costs and exchange rates. At constant currency, net sales increased 4% due to favorable price/mix. Adjusted EBIT was 7% higher on a constant currency basis. Full-year volumes were also higher than last year.

Flexible Packaging segment sales increased 11% in Fiscal 2022. Volume growth in several categories was held back during the year by ongoing supply chain issues, and efforts were made to allocate limited resources to the most valuable applications, which also had a positive impact on the mix. Consequently, total volumes for the full year were largely consistent with those for the same period last year.

In the Rigid Packaging segment, revenues increased 20% in fiscal year 2022 compared to the previous year, driven by volume growth and favorable price/mix benefits.

Looking ahead, Amcor reduced its risk exposure by selling its three plants in Russia and will complete the sale in the second half of fiscal 2023. Amcor still has one plant in Ukraine, which was closed at the start of the war between Russia and Ukraine.

The Management Is Shareholder-Friendly

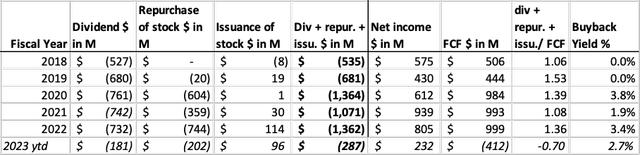

Amcor’s management rewards its shareholders by paying dividends and repurchasing shares. Share repurchases increase the dividend per share annually, increasing the dividend per share by 4% over the past year. Currently, the dividend is $0.49 and represents a dividend yield of 4.1%.

In recent years, the company paid dividends and repurchased shares in an amount more than it generated in free cash flow. As a result, the company has had to use cash from its balance sheet.

Amcor’s cash flow highlights (Amcor 1Q23 investor presentation)

Amcor repurchased $600M worth of shares in fiscal 2022, reducing the number of shares issued and outstanding by about 3%. The company expects share repurchases of ~$400M in fiscal 2023. The expected buyback yield is 2.3%.

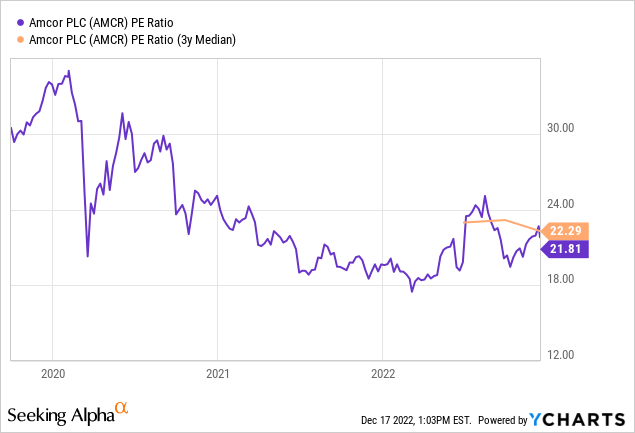

Valuation In Line With The General Market

The valuation of the stock is charted by taking the PE ratio. The PE ratio is 22, in line with the 3-year average. The company was quoting at a higher PE ratio before 2021. The stock valuation is in line with the PE ratio of the S&P 500. The stable nature of the company, and its ability to pass on higher raw material costs, ensures stable sales and earnings growth for the next few years.

Conclusion

Amcor is an Australian-based company that supplies packaging materials for various industries to major brands such as Unilever, Nestle, Mondelez, PepsiCo, Novartis and Coca-Cola. The company is divided into 2 segments: Flexible Packaging and Hard Packaging.

The Flexible Packaging segment is the largest segment and represents 77% of total revenues; the EBIT margin of this segment is the highest at 14%. The consolidated EBIT margin is also high at 13% compared to companies in the same sector. Net sales increased 3% in the first quarter of fiscal 2023 (15% of which included a 12% pass-through of higher raw material costs). Earnings per share increased 10% and EBIT rose sharply by 9% at constant currency. For fiscal 2023, the company expects a stronger dollar and flat EPS growth compared to fiscal 2022.

Amcor’s management rewards its shareholders in two ways: dividends and share repurchases. Share repurchases increased dividends per share by 4% over the past year. The current dividend is $0.49, representing a dividend yield of 4.1%. Amcor repurchased $600 million worth of shares in fiscal 2022, reducing the number of shares issued and outstanding by about 3%. In fiscal 2023, the company expects to repurchase $400 million worth of shares. The expected repurchase yield is 2.3%. The stock is valued in line with the S&P 500 PE ratio. The company’s stability and ability to pass on higher raw material costs will ensure consistent sales and earnings growth in the coming years. The company’s defensive nature, shareholder-friendly management and valuation make this stock worth buying.

Be the first to comment