Tom Cooper

The domestic box office still remains down around -30% compared to pre-pandemic levels. This is a challenge for AMC Entertainment (NYSE:AMC) since it may have around $400 million per year in cash burn even with a modest improvement in the domestic box office to -20% to -25% compared to pre-pandemic levels.

AMC now has around two years of cash remaining at that level of cash burn. It may be able to raise more funds via issuing APE preferred units (APE), but I don’t really see a path for AMC to be a viable business unless it can eliminate most to all of its interest costs.

The price of AMC’s bonds has deteriorated sharply since I looked at AMC in April, likely removing refinancing as a viable option to deal with its debt. This can be seen with the challenges AMC had in refinancing its Odeon debt, as it had to issue extremely high interest (12.75%) first-lien (secured by Odeon) notes at a noticeable (92 cents on the dollar) discount to par. AMC’s second-lien notes due 2026 will likely be impossible to refinance, so to deal with those notes it will either end up with massive amounts of additional dilution (if it is able to issue enough new equity) or otherwise end up restructuring.

Box Office Performance

It is becoming abundantly clear that the prior bull argument that people would return in droves to the theaters is not happening. There have been strong results from individual movies, but as a whole, the domestic box office remains well below pre-pandemic levels.

The 2022 domestic box office is currently down around -34% in a year to date comparison with 2019. There was some improvement after the Omicron wave passed in Q1 2022, but even in Q2 2022 and Q3 2022 the box office has remained down around -30% compared to 2019. In a particularly strong month such as July 2022, the box office was still down -12% compared to 2019.

| Q1 2022 | Q2 2022 | Q3 2022 | YTD | |

| Vs. 2019 | -44% | -29% | -32% | -34% |

The domestic box office was pretty typical in 2019, with the full year number of $11.36 billion essentially in-line with the five-year average (from 2015 to 2019) of $11.37 billion. Thus, the comparison to 2019 makes sense if one wants to compare to pre-pandemic business levels.

Rate Of Cash Burn

In Q2 2022, AMC reported negative $77 million in cash flow from operations and spent $36 million on capital expenditures, net of landlord contributions. This would translate into cash burn of approximately $450 million on an annualized basis.

AMC’s current cash burn is a bit inflated by it catching up on rent payments that were deferred during the pandemic. However, AMC’s current spending on capex is also well below historical levels. It was originally expecting to spend close to $300 million (net of landlord contributions) on capex in 2020. Thus those two items probably offset each other.

The second quarter is also typically the strongest quarter of the year for movie theaters. From 2015 to 2019, the domestic box office for Q2 averaged approximately 10% higher than the other quarters.

AMC may end up at around $400 million per year in cash burn if capex and rent payments end up returning to more typical levels and movie attendance improves modestly from current levels (to around -20% to -25% compared to pre-pandemic levels).

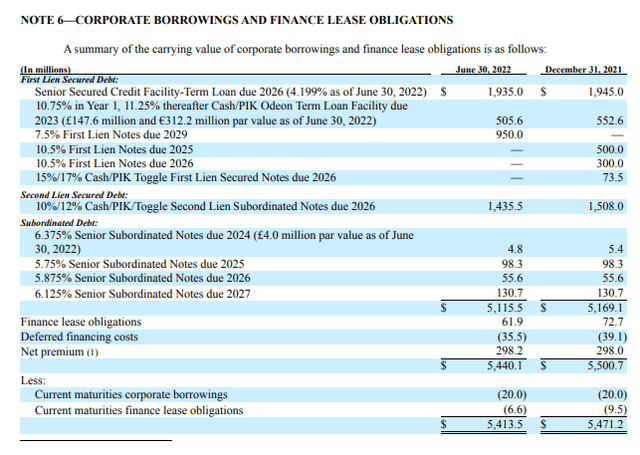

Debt Situation

AMC had $965 million in cash on hand at the end of Q2 2022. Subsequent to the end of the quarter, AMC’s subsidiary Odeon repaid its $506 million in term loans with a combination of cash on hand and proceeds from its $400 million offering of 12.75% senior secured notes due 2027 (issued at 92 cents on the dollar).

With a $400 million per year burn rate, AMC should have until mid-2024 before it completely runs out of cash, not including any proceeds it may receive from issuing more APE units.

The Odeon note offering (and term loan repayment) takes care of AMC’s nearest debt maturity, leaving it with no major debt maturities for a few years.

AMC’s Debt (amctheatres.com)

The challenge for AMC is that refinancing its notes doesn’t appear to be an option unless there is a significant improvement in movie attendance from current levels. For example, AMC’s second-lien notes due 2026 (with over $1.4 billion in principal) are currently yielding over 30% to maturity.

The Path Forward

At 80% of pre-pandemic box office, AMC may be able to operate at roughly breakeven cash flow if it didn’t have any interest costs. At 90% of pre-pandemic box office levels, it could generate around $180 million in positive cash flow per year without interest costs (currently around $365 million per year).

AMC appears generally capable of having a sustainable business if it eliminates most/all of its interest costs. If it can issue tons of APE units (and eventually AMC shares), it may be able to fund ongoing cash burn and attempt to repurchase some of its notes at a discount (as well as redeem others as they become due). If it can’t raise sufficient amounts through equity offerings, then AMC will very likely need to restructure.

In either case, AMC’s shares (and APE units) appear to have a poor long-term future. The eventual result will either be massive additional dilution or getting wiped out in restructuring.

AMC’s bonds have more potential. If AMC is able to raise enough money through equity offerings, the bonds will continue to collect interest payments and could even be redeemed in full (although it is uncertain how much AMC can ultimately raise through equity offerings). In a restructuring, AMC’s bondholders would likely end up with most/all of AMC’s new equity, and the post-restructuring company should be able to generate at least a bit of positive cash flow.

Conclusion

AMC and APE both appear to have limited long-term value due to the very high risk of either massive dilution or restructuring in the future. The hoped for box office resurgence hasn’t happened, and it seems unlikely that attendance levels at or above pre-pandemic levels cannot be sustained for any significant amount of time.

This leaves AMC in a position where it cannot refinance its debt (particularly its second-lien notes due 2026) and needs to nearly totally eliminate its interest costs if it wants to have a viable business in the future. If AMC is allowed to, it may be able to raise enough funds through various equity offerings to deal with its debt. If it can’t do that, the outcome will be a restructuring, with the bondholders ending up with AMC’s post-restructuring equity.

Be the first to comment