Jesse Grant

AMC Networks Inc. (NASDAQ:AMCX) is a globally recognized entertainment company known for its various popular and award-winning content. The company distributes content through linear networks, streaming services, as well as content licensing agreements.

With its strong presence across the linear network, the company has an extensive collection of film and television properties. Also, AMC Networks own and operate various recognized brands such as AMC, AMC+, BBC AMERICA, IFC, Sundance TV, WE TV, Acorn TV, Shudder, Sundance Now, ALLBLK, and IFC Films. Having such a diverse and globally recognized portfolio of brands provides the company with an edge over its competitors.

Recently, AMC Networks Inc. has been focusing on the overseas expansion of its streaming business called AMC+, which should bring huge value to the company’s business model. In the last year, management acquired Sentai Holding LLC, an anime-focused content producer that operated HIDIVE subscription streaming services.

Along with that, the company operates IFC films, which distributes narrative and documentary films, and operates IFC Films Unlimited. Such a strong presence in the streaming segment has been providing a significant advantage to the company’s business model.

Investment thesis

As the linear cable TV industry is facing significant backdrops, the revenue of the streaming business has been growing consistently, with the people turning from traditional cable networks towards the streaming business, AMC networks can benefit significantly as the management has been working so hard to expand in the streaming segment.

Although due to the aggressive expansion of Netflix (NFLX), Disney (DIS), and other streaming businesses the overall competition in the industry has significantly increased, the company remains focused on specifically targeted customers who love the content that has been produced by the company. This kind of focused approach might give the business model an edge over the existing players, as the company has very trendy and attractive content which might bring considerable subscribers to the AMC streaming platform.

Due to the high uncertainty about its streaming business along with its presence in the rapidly deteriorating linear cable network industry, investors have become very much cautious about the stock. As a result, the stock price has dropped more than 56% in the last 12 months despite a strong business model and a robust cash flow history.

I believe the company has been very much profitable despite its presence in the rapidly deteriorating cable network industry. Due to its focused strategy of streaming business along with the strong brand value, the company might sustain itself even with the intense competition, and in such cases, the profitability will improve significantly. Due to the recent drop in the stock price, the company has become significantly undervalued and provides an attractive opportunity

Historical performance

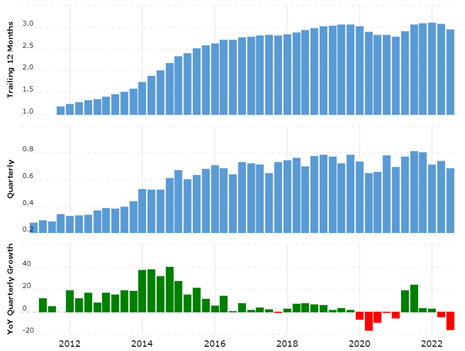

Revenue growth (macrotrends.net)

Over the period shown, revenue grew consistently but at a small pace. Along with that, the net profit increased significantly till 2018, then onwards it has been dropping consistently. The drop is led by increased expenses on SG&A, which is a result of higher subscriber acquisition costs along with high promotional costs related to the streaming business.

Also, note that over the last few years, the company has been focusing on buybacks and has bought back a significant number of outstanding shares. As a result, the total share count has reduced from 72 million in 2016 to about 42 million to date. And due to the aggressive buybacks, EPS has increased significantly despite a drop in net profits.

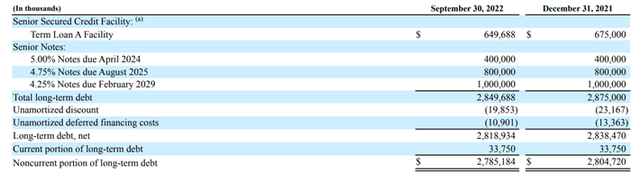

It should be noted that the company has a significant debt of over $2.8 billion, along with current assets of over $2 billion. Also, over the period, cash flow history has been significantly attractive and has produced huge cash flow from operations.

Also, over the period the company has entered into various acquisitions, but many of its acquired companies could not produce desired revenues for the company. This included the acquisition of Chellomedia in the year 2014, which was expected to produce huge revenue for the business but has not reached its expected results. Therefore, investors must keep an eye on acquisition decisions, because upon failure of the acquired company, profitability might be affected significantly.

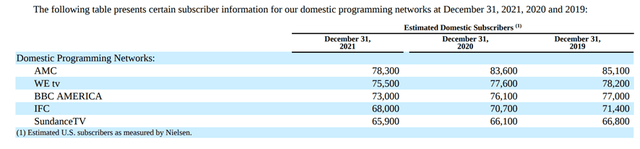

The company operates domestic networks which have a significantly high reach among the U.S. households and has a history of providing attractive and engaging content. As a consequence, this has produced significant customer viewership and customer loyalty. The strong presence in the cable TV segment will help the company to expand through the streaming business.

Risk factors

Debt maturity (quarterly report)

The company is exposed to a significantly large amount of debt, and in the next two to three years more than $1.2 billion of long-term debt is going to mature. The current economic environment has become recessionary where inflation is soaring at a significantly high rate, and if the condition persists for a longer time, it will become very difficult for the company to obtain debt refinancing. And in such cases, the stock price might get affected the most.

Also, due to the company’s strong operating history and distribution throughout the U.S. and internationally along with the robust cash flows, the credit rating agencies are bullish on AMC Networks Inc. and have given it very good ratings. This shows that the company could obtain refinancing, but the major concern lies with the fact that if the company failed to successfully operate its streaming business, its profitability might be hampered. In such a situation, the company might face trouble in obtaining debt financing.

Recent developments

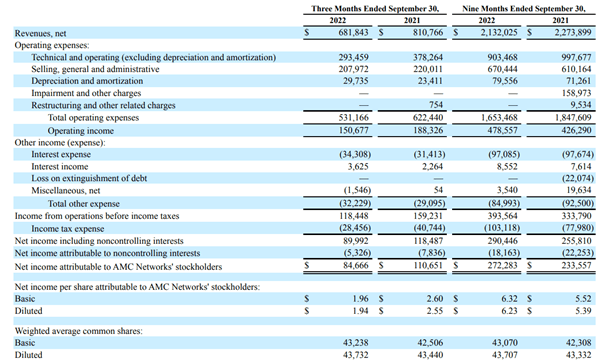

Quarterly revenue (quarterly report)

In the latest quarter, Q3 revenue dropped from $810 million to about $68 million. This was primarily as a result of the lower affiliate and reduced advertising revenues. Along with that, the net profits have dropped significantly, but the overall nine months 2022 profitability seems very attractive.

Also, the business has added about 300,000 streaming subscribers and the total subscriber count has reached 11.1 million, representing a 44% year-over-year increase in subscribers. Such a significantly high growth in the subscriber count shows that the company has a robust business model and can expand its reach at a very high rate.

Due to the drop in revenue and uncertainty about the streaming business, the AMC Networks’ stock price has dropped significantly. The total market capitalization of AMC Networks is around $932 million, whereas it has produced more than $272 million in net profits in the last nine months. This shows that the stock has become very much undervalued and selling at just 3.5 times its last nine months’ earnings. From this point, AMC Networks’ stock offers significant upside potential. AMC Networks Inc. is a Buy.

Be the first to comment