Editor’s note: Seeking Alpha is proud to welcome Richard Williams as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

SerhiiBobyk/iStock via Getty Images

Strong Buy With Blockbuster EPS Potential

AMC Entertainment Holdings (NYSE:AMC) has been hanging on despite some extremely trying times in the movie business. We’ve heard about many showings over the last 12 months where the staff outnumbered the guests – at times 2-3 to 1. Dire times, needless to say, to any true movie buff; we need the (big) silver screen! But hope might be close at hand.

Revenues at AMC as of Q1 2022 were $3.2b over 12 months. The current top 10 movies have brought in $6.1b in the last eight weeks. These are global numbers that run close to 50/50 for U.S. sales. AMC captures about 25% with its 930 domestic theaters. YTD ticket sales are $6.95b.

Industry revenues are projected to be $14b, up 48% year over year, compared to -6.7% per year since 2017. We think domestic revenues are well beyond the Street consensus and are only 12% below 2019 comps (international box office sales are off around 32% by comparison). Evidence of this comes from several movies holding on to box office sales. Starting with “Top Gun,” a number of blockbuster movies are lasting well beyond normal runs, with several lasting several weeks, not days, in theaters before going to streaming channels. “Spider Man” lasted 11 weeks, “Dr. Strange” lasted nine, and “Jurassic Park” lasted seven. All of the top 10 films are outperforming expectations for longevity by a wide margin, according to industry commentary.

Our thesis is that the surprising strength of ticket sales, which clearly include substantial repeat viewings, will drive investor sentiment beyond anything the fundamentals would suggest. While the numbers matter and are close to an inflection point into the black for cash flow – and maybe earnings, too – the real power behind the upside potential of the stock might prove to be the meme crowd (who are coming to see movies in large numbers, based on our own primary research findings) over the next four weeks until earnings hit in the second week of August.

Another GameStop-Like Short Squeeze?

AMC has 513.3m fully diluted shares and short interest of 109m (nearly 20% of the float) after selling a large quantity of stock to the public in the waning stages of the meme stock rally in January 2021. Management raised $1.8b in cash. OCF is ($595m) over the last year, FCF is ($719.7m) as well and ($295m) in Q1 2022. Clearly, operating results have been challenging recently, but we believe that Q2 2022 and the second half of 2022 will be substantially better.

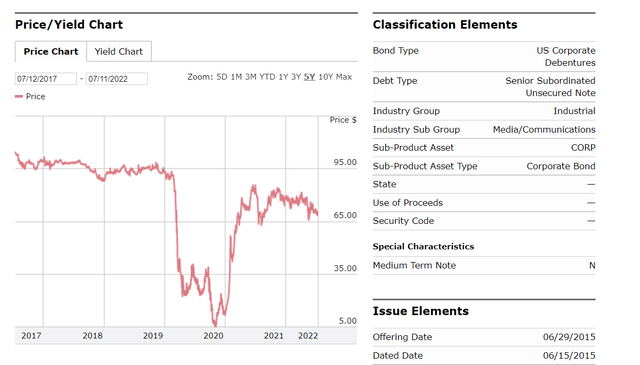

We believe AMC 5.75% June 15, 2025, bonds are an interesting alternative to the equity. They have three years to maturity and yield 21% to maturity. AMC has debt of $5.4b, $4.6b in leases, and about $2.6b in other debt and expenses. Should AMC post improved cash flow in its August EPS report, we think the bonds will react favorably to the news. According to company filings, about $100m remain of the 5.75% bonds.

AMC also invested $28m in a 22% stake in Hycroft Mining (HYMC), a gold mining outfit that was in default. Management plans to develop new initiatives to drive operating profits, while gaining a substantial play on gold prices during a time of runaway inflation that currently tops 18%, based on 1980 CPI metrics. Businesses often have trouble raising prices enough to cover the impact of inflation, which can compress margins and reduce EPS. Profits from Hycroft’s gold production normally follow inflation very closely, providing gains that can offset losses to inflation at AMC’s box offices. AMC’s stake consists of stock plus warrants ($1.07/share strike). At recent prices, the common equals 94% of the total deal value. The warrants, which trade about at the strike price, are a free five-year call on upside to Hycroft. We view this as an unusual and potentially profitable inflation hedge for AMC.

Risks

AMC might be bouncing back from a very challenging operating environment over the last two years, but it remains a heavily indebted company that is losing money, burning cash at about a $1b/year rate and has limited liquidity of approximately $1.2b. If management is unable to capitalize on the markedly improved traffic in its theaters, stock and bond holders could drive the valuations lower. Our positive thesis depends on strong operating performance by management, a return to more normal customer spending activity at the theater, and at least steady market share. The stock has appreciated by almost 50% since we identified what we believe is substantial upside potential. Should earnings disappoint next month, the stock could fall on the news.

|

AMC Entertainment 5.75% June 15, 2025, Bonds |

AMC Entertainment $98m remain out of $600m issued and are rated CCC- |

Seeking Alpha’s internal ratings have AMC’s revenue growth as an A+. Its earnings rating is also an A+. These ratings, based on the SA Quantitative Model data, indicate that strong momentum is developing in both the top and bottom lines. We agree with this conclusion based on our primary and secondary research into AMC’s August earnings report. The unexpectedly strong performance of the top 10 films since May should power a better-than-expected EPS report.

Street expectations have not, in our opinion, taken the upside potential into account in their earnings models. That suggests the EPS report in August could surprise to the upside, providing lift for the stock and potential profits for investors. We think it’s possible that AMC could reach breakeven EPS and cash flow, based on IMDB’s box office sales growth numbers.

The fixed income ratings are less favorable, which stands to reason given AMC’s cash, debt and negative cash flow situation. We think August earnings could improve this picture. If cash flow improves, then the bonds should trade higher along with the stock.

Technical Analysis

AMC has been forming a classic saucer pattern since May that has good statistical validity for producing further upside movement. It has also potentially formed a corrective ABC Elliot Wave pattern, where A-down ended in August 2021, B-up ended last September, and C-down might have completed last May on the $9.70 lows. Our proprietary supply/demand and volume-adjusted price models show favorable trends in money flows. Combined with the accelerant effect that short interest of 20% could bring, we think a blowout earnings report could provide a powerful catalyst for equity investors, traders, and meme stock players alike.

Conclusion

We think AMC stock and its bonds could trade higher on better-than-expected earnings results due out the second week of August and beyond. Street expectations are quite low and have not materially changed since the surprisingly favorable run of several of AMC’s top 10 films this year. We think that further upside could follow a report that shows the potential for breakeven in cash flow and EPS, based on industry data showing substantially higher ticket sales than expected for the films since May.

We think industry estimates will need to rise by over 20% to account for reported box office sales already booked, but before the next release of “Avatar” in December, along with other high-potential movies. While the stock has rallied from around $11 to $16.90, we expect it to have upside that could reach $30 overhead resistance. Accordingly, we would use weakness in the stock to provide potentially attractive entry points.

Be the first to comment