Daria Nipot

Investment Thesis

Amazon (NASDAQ:AMZN) is reporting Q2 results this Thursday in what many see as a high-stakes report likely to have an impact that extends beyond its ticker, setting the tone of the market in light of current macroeconomic conditions.

Management released subdued Q2 guidance in April, forecasting $116.0 billion to $121.0 billion revenue (3% to 7% YoY growth), incorporating economic challenges facing US households, including a 46% increase in mortgage payments, 10% increase in food prices, and a 44% increase in gas prices compared to the same period last year. The situation is very precarious to the point that since AMZN released its guidance, mortgage, food, and fuel prices increased by a further 19%, 2%, and 8%, respectively.

Beyond retail sales, AWS and ad revenue will provide a picture of business sentiment beyond the disappointing PMI data released in the past few months. AWS’s resilience in the face of previous recessions and soft economic conditions is a source of optimism, but that doesn’t rule out potential normalization in digital enterprise trends, similar to what we see in the retail e-commerce sector. Softening demand for AWS cloud services will have a material impact on AMZN shares, given its margins and growth contribution as consumers tighten their belts in response to the rising cost of living.

Amazon Revenue Trends

Past quarters’ challenges will likely brim over Q2 earnings this Thursday. The market’s response to Walmart’s (WMT) guidance cut yesterday demonstrates that things can get worse for AMZN shares, despite low expectations from its retail segment. Consumers are still struggling with inflation and rising interest rates, and these challenges have intensified since AMZN issued its Q2 guidance in April.

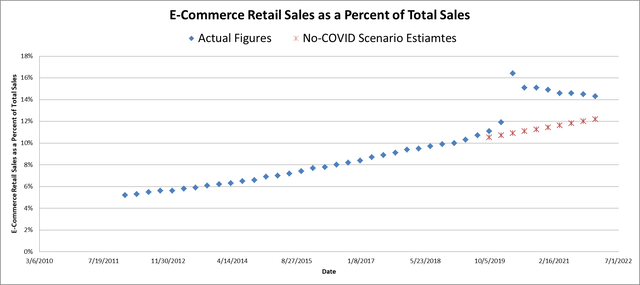

E-commerce sales as a percent of total sales have been declining as consumers revert to old purchasing habits. The coming months will reveal how much of the e-commerce activity surge is underpinned by a permanent change in consumer behavior, as opposed to temporary COVID restrictions. Before the pandemic, e-commerce was growing linearly, making it easy to interpolate the impact of COVID lockdowns on e-commerce adoption over and above the organic growth trend seen before the pandemic.

E-commerce as a percent of total retail sales has been edging closer to a no-COVID scenario estimates shown in the graph below. The company’s results on Thursday will shed light on e-commerce activity before the US Census Bureau issues its Q2 e-commerce data next month.

Author’s estimates based on Federal Reserve Bank of St. Louis data.

Most products sold on AMZN websites are inventories owned by AMZN, which we call “1P” or first-party sales. Revenue from third-party merchants or “3P” represents approximately 20% of AMZN’s revenue. 1P sales and 3P revenue often move together, mirroring the e-commerce activity for a given period. Last quarter, however, 1P sales declined 3.3%, while 3P revenue increased 7%, representing a 10.3% difference. Management increased FBA fees in January by 5% (and again in April), which could explain part of the discrepancy. The remaining delta could be a sign of a preemptive response to regulatory pressure or some concessions with regulators as management undergoes its most immense lobbying efforts since inception. We saw similar dynamics in China in the past two years when Alibaba (BABA) was navigating through regulatory pressure targeting its monopolistic practices, which ended with an official antitrust law finalized in June and officially going into effect next month. A widening gap between 1P and 3P sales in Q2 would confirm this hypothesis, showing a rare capitulation for what many see as an opportunistic corporate culture.

Earlier this year, courts dismissed the US attorney’s lawsuit against AMZN because of the narrow scope of current antitrust laws, rendering them ineffective in addressing the market power of marketplace providers such as AMZN. However, the recently introduced bills (both in the Senate and lower house) demonstrate the lawmakers’ determination to see some limits on AMZN’s influence.

Unlike Alphabet (GOOG), AMZN’s antitrust troubles don’t carry an existential threat on the company’s operations or even growth prospects beyond temporary disruptions that would shift growth to the 3P segment instead of 1P revenue. Revenue growth remains the primary driver of stock performance rather than legal challenges.

Emerging Segments: AWS and Ad Revenue

Beyond temporary share volatility, investors might overlook a downward surprise in the retail segment, but this doesn’t apply to AWS revenue. The division became the cornerstone of AMZN’s investment hypothesis, driving growth in the past few quarters. Despite representing a mere 14% of total sales, AWS contributes to more than half of operating income.

Data storage and processing are increasing exponentially, embodying a critical element of the knowledge economy, offering medium and long-term revenue tailwinds for the AWS segment. There are high expectations for AWS, and any growth below 30% could result in a selloff.

Last quarter, ad revenue demonstrated the second-highest growth after AWS. Despite representing a small portion of revenue, the high margined ad business help subsidize Amazon’s Prime expenses, namely its logistics and delivery operations.

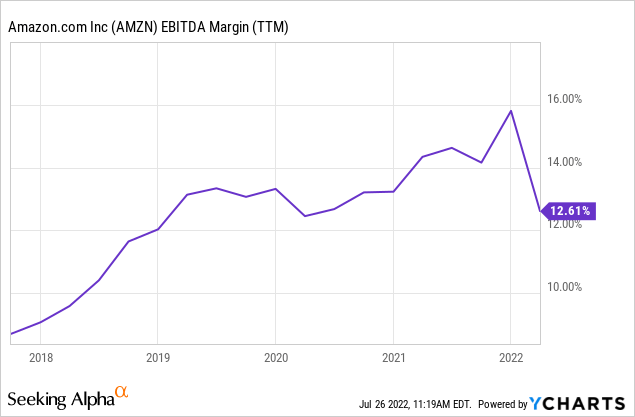

Margin Trends

AMZN’s margins will likely fall in Q2. Fuel prices grew faster than FBA and Amazon Prime January hikes. The tight labor market pushed wages at its fulfillment centers higher, contributing to tighter margins. Beyond rising operating costs, the company is set to record substantial losses on its Rivian (RIVN) position. During Q2, RIVN shares lost almost 50% of their value. Based on the company’s 158 million shares, I believe the company will report a $3.25 billion unrealized loss on equity in Q2.

Summary

AMZN’s challenges in the past quarters will likely brim over Thursday’s Q2 earnings. The economy is in worse shape than last year, and monthly data show that mortgage, food, and fuel prices have increased since the retail giant issued its quarterly guidance in April. Margins will likely fall as operating expenses rise faster than FBA and Amazon Prime fee hikes in January.

A lot rests on AWS, which rose to become the primary source of income. Beyond temporary price volatility, AMZN shares might recover from a below than expected retail sales, but this doesn’t apply to AWS. A growth rate below 30% fundamentally challenges the company’s growth hypothesis underpinning its above-average price multiples, potentially causing a stock selloff that would be difficult to recover.

Be the first to comment