4kodiak/iStock Unreleased via Getty Images

Amazon.com, Inc. (NASDAQ:AMZN) followed in the footsteps of other tech companies in recent days and submitted a very disappointing forecast for the fourth quarter. Amazon’s shares declined 4% yesterday, following the release of earnings from companies like Meta Platforms (META) and Alphabet (GOOG, GOOGL), which weighed upon on the stock market.

After Amazon submitted its Q4 earnings card after regular trading, the firm’s share price dropped another 13%. When the stock opens for trading today, the stock is set to trade down immediately to new 1-year lows as investors reevaluate their growth assumptions. Given the poor outlook for Q4’22 and high losses in the e-Commerce business, the stock’s risk profile remains skewed to the downside!

Earnings beat, but not much more…

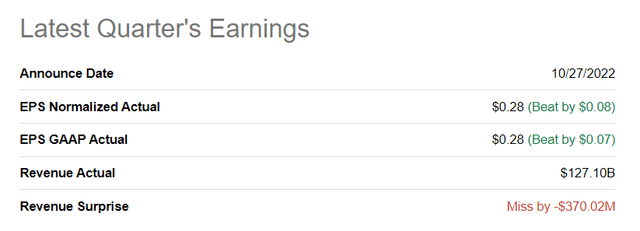

Amazon reported revenues of $127.1B for the third quarter, missing expectations by $370M. However, Amazon’s Q3 earnings beat expectations, with actual EPS of $0.28 outperforming estimates by $0.08.

Seeking Alpha: Amazon Q3’22 Results

Amazon’s earnings release was not totally bad. The e-Commerce company grew its revenues by 15% year-over-year to $127.1B in the third quarter, meeting its growth target of 13% to 17%. The revenue picture was a mixed one, however. Amazon’s North American e-Commerce business saw a re-acceleration of revenue growth in the third quarter: revenues grew 20% year-over-year to $78.8B, while revenues in Q2’22 only grew 10% in this segment.

The international e-Commerce business remained problematic for Amazon – in part because of a strong USD – where revenue growth fell 5% year-over-year to $27.7B. In Q2’22, Amazon’s international revenues slipped 12% year-over-year.

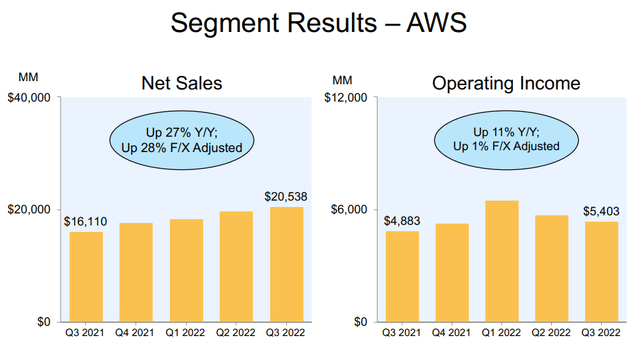

Amazon Web Services had another good quarter regarding topline growth, but Q3’22 was not as strong as expected. The cloud platform segment generated revenues of $20.5B, showing an increase of 27% year over year. I expected Cloud to do better and generate at least 30% year-over-year growth in Q3’22 after the company’s segment topline advanced 33% year-over-year in the prior quarter.

Amazon Web Services (“AWS”) is not only the fastest-growing segment for Amazon, but the business is as important for the company as it is chiefly because it is the only one that generates profits. AWS generated a third quarter operating profit of $5.4B, while Amazon’s e-Commerce operations lost a combined $2.9B in the third quarter.

Amazon: AWS Segment Revenues/Operating Income

Scary slowdown in growth for Q4’22 expected

In my work “Amazon: Judgment Day,” I warned that a weak guidance for the fourth quarter would likely determine the direction of Amazon’s stock price in the near future. I ended my article with the following sentence:

There are multiple headwinds for Amazon including high inflation, decelerating growth in the dominant e-Commerce business and possibly a weaker outlook for Q4’22 which could weigh on the company’s shares after earnings!

Amazon guided for revenues between $140B to $148B for the fourth quarter, indicating a year-over-year growth rate of only 2-8%. For the third quarter, Amazon projected 13-17% topline growth, and my own estimate for fourth quarter revenue growth was 10-14%. Amazon’s growth is clearly expected to slow down, which suggests that the third quarter was an outlier quarter. Amazon’s topline grew only 7% in Q2’22, and the outlook for Q4’22 strongly implies that the growth story, at least for now, is over at Amazon.

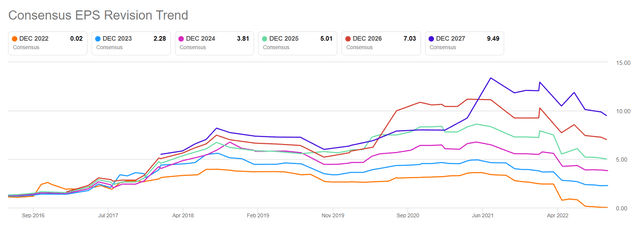

Amazon is not a buy

Amazon’s valuation and risk profile are not attractive now that analysts will respond to Amazon’s weak guidance for the fourth quarter and lower their Q4 and full-year EPS estimates. Amazon’s EPS estimates had already started to drop before the submission of the Q3 earnings sheet, and I believe EPS will see major downward revisions in the coming days.

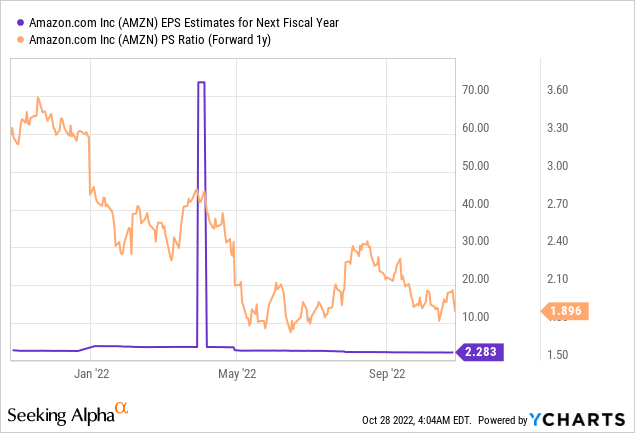

Seeking Alpha: Amazon EPS Estimates

Amazon is expected to earn $2.28 per share next year (a figure that could see major downward revisions as well) which means shares have a P/S ratio of 1.9 X. I believe the valuation will see further pressure in the near term and the stock is likely going to be dead money for the foreseeable future.

Risks with Amazon

Amazon faces a couple of major risks, including a further deceleration of its topline growth in the near future, continual pressure on Amazon’s consolidated operating margins due to a loss-making e-Commerce business, as well as a strong USD. Additionally, estimates are likely to get downgraded after Amazon submitted a disappointing forecast for Q4’22. I also see inflation as a major risk factor for Amazon going forward as it continues to weigh on consumer spending, which Amazon, as one of the world’s largest e-Commerce companies, remains vulnerable to.

Final thoughts

It’s over for Amazon. The e-Commerce company could see as little as 2% growth in Q4’22, which essentially ends the argument that Amazon is a growth stock. Growth rates in the double-digits are likely a thing of the past, and the e-Commerce company is set, I believe, to face growing top-line risks as its AWS business keeps decelerating and macroeconomic conditions deteriorate. The outlook for Q4’22 especially was a shock, and it indicates that investors may still overestimate Amazon’s potential for growth. For those reasons, I believe that the risk profile as well as Amazon’s valuation remain unattractive for investors!

Be the first to comment