georgeclerk

Introduction

My thesis is that the June 2022 quarter was excellent for Amazon’s (NASDAQ:AMZN) key segments. Per the 2Q22 release, the 3 most important segments, AWS, third-party (“3P”) and advertising saw Y/Y sales increases of 33%, 13% excluding F/X and 21% excluding F/X. Their Q/Q sales went up 7%, 8% and 11%, respectively. Y/Y sales for the first-party (“1P”) segment were down 4% but this lower margin segment is less meaningful to the bottom line.

As CFO Brian Olsavsky said in the 2Q22 call, the AWS segment can be resilient by showing the value it provides as we hit a potential rough patch in the economy. On a relative basis, the numbers are showing that Apple’s (AAPL) privacy changes hurt Shopify (SHOP) merchants who advertise on Meta (META) much more than Amazon 3P merchants who use Amazon advertising.

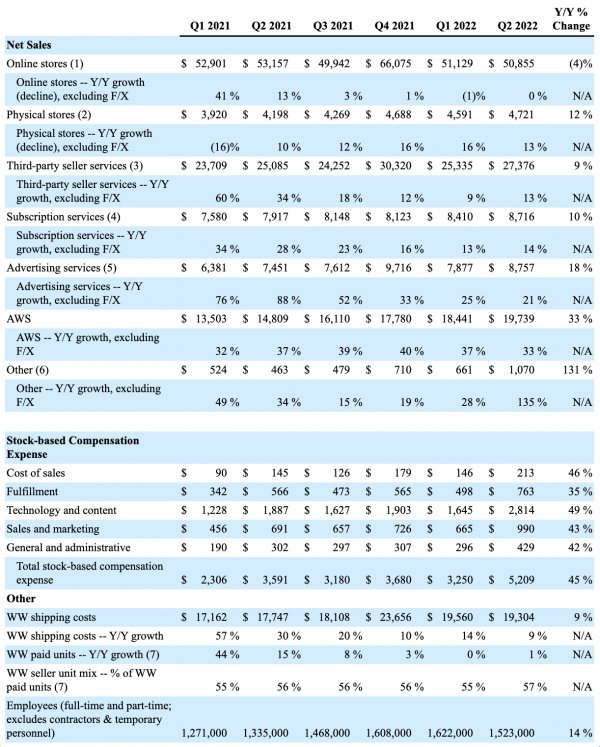

Amazon Q2 Sales By Segment

The quarterly sales increases for AWS, 3P and advertising stand out below:

segment sales (2Q22 release)

AWS

Unlike the commerce segments, we see little in the way of November and December seasonality with AWS. However, CFO Olsavsky reminds us in the 2Q22 call that the AWS segment sees a seasonal Q2 step-up in stock-based compensation such that the operating income margin is suppressed:

AWS operating income was $5.7 billion in Q2. As a reminder, this includes a portion of our seasonal Q2 step-up in stock-based compensation expense. AWS results included a greater mix of these costs, reflecting wage inflation in high-demand areas, including engineers and other tech workers as well as increasing technology infrastructure investment to support long-term growth.

Seeing as operating income for AWS went down from $6,518 million on sales of $18,441 million in 1Q22 to $5,715 million on sales of $19,739 million in 2Q22, Doug Anmuth of JPMorgan Chase asked about the AWS operating margin declining from 35% in 1Q22 down to 29% in 2Q22. CFO Olsavsky didn’t seem concerned about the quarterly differences. He noted that the AWS margins dropped sequentially and he said the margin rate in that business is going to fluctuate. He cited factors like the sales force, new regions and infrastructure capacity which can be offset by infrastructure efficiency gains. His comments about the progress with the customer base and the increasingly long commitments are encouraging. His comments about resiliency can partially mollify investors if we find ourselves enduring an extended recession:

And you said that the revenue pattern can be – and the margin on that revenue can fluctuate quite a bit quarter-to-quarter. But [we] see a lot of strength in the business right now. We’re very happy with the growth rate. We’re happy with the adoption of the cloud. As you hit a potential rough patch in the economy, I think the last time we saw this was back in 2008-ish, and we started to draw lessons from that, but we did notice that it did help our cloud business at the time because, again, when you’re trying to launch a new product or service and you have to face with building your own data center and getting capital for a data center and building it yourself or moving to the cloud and essentially buying incremental infrastructure capacity, cloud computing really shows its value.

Again, the crucial AWS segment saw sales go up from $18,441 million in 1Q22 to $19,739 million in 2Q22. This segment’s quarterly operating income more than offset negative quarterly operating income from North American and International:

$5,715 million AWS segment

$(627) million North America segment

$(1,771) million International segment

———–

$3,317 million total quarterly operating income

Looking at operating income by segment from a trailing-twelve-month (“TTM”) perspective, we again see that AWS is key:

$22,409 million AWS segment

$(1,521) million North America segment

$(5,590) million International segment

———————–

$15,298 million total TTM operating income

Last quarter I used a multiple on the annualized operating income for a valuation range. The AWS segment is not worth less just because this quarter’s operating income is lower than last quarter’s due to a larger amount of investments in the income statement lines. This shows one of the fallacies when we oversimplify things with basic yardstick shortcuts. The annual sales run rate based on the 2Q22 figure of $19,739 million is $78,956 million. Using the more steady-state operating margin of 35% that we saw in 1Q22 as opposed to the more growth oriented margin of 29% from 2Q22, we get a steady-state annualized operating income figure of nearly $28 billion. Given the fact that the cloud business is resilient even in times of inflation, I think the lower end of this range has an elevated floor. Applying a multiple of 23 to 25x gives us a valuation range of $644 billion to $700 billion.

3P

It’s nice to read in the 2Q22 release that Amazon is taking substantial steps to protect merchants and customers from fraudulent reviews. Filing legal action against the admins of more than 10,000 Facebook groups is a serious and necessary endeavor. Combining this legal action along with Amazon’s improving AI should help improve the integrity of their 3P review system:

Amazon filed legal action against the administrators of more than 10,000 Facebook groups that attempt to orchestrate fake reviews on Amazon in exchange for money or free products. These groups are set up to recruit individuals willing to post incentivized and misleading reviews on Amazon’s stores in the U.S., the UK, Germany, France, Italy, Spain, and Japan. Amazon will use information discovered from this legal action to identify bad actors and remove fake reviews commissioned by these fraudsters that haven’t already been detected by Amazon’s advanced technology, expert investigators, and continuous monitoring.

Given the way the 3P and ad segments are putting up solid sales numbers in these difficult times, I believe the multiplier numbers in my last Amazon article were a bit pessimistic and I’m now using more optimistic ranges of 16 to 18x for 3P and 17 to 20x for ads [3P was 14 to 15x and ads were 14 to 16x]. TTM sales for the 3P segment are $107.3 billion and the operating income is $21.5 billion if we use a steady-state margin of 20%. Using a multiple of 16 to 18x gives us a valuation range of roughly $345 to $387 billion.

Advertising

Amazon is advantaged in the advertising funnel as they are at the point where customers are ready to make a purchase. This makes things much clearer from a measurement perspective, especially in today’s environment where Apple has made privacy changes that make measurement harder for other forms of advertisements that are higher up in the funnel. CFO Olsavsky explains this in the 2Q22 call:

I’ll just add a little more on advertising because you’re probably wondering again about softness – potential for softness in that or macroeconomic factors. Right now, we still see strong advertising growth. Again, it’s got to be a positive both for the customer and for the brand. I think our advantage is that we have highly efficient advertising. People are advertising at the point where customers have their credit cards out and are ready to make a purchase. It’s also very measurable.

Another problem with Apple’s privacy changes is that it now takes advertisers longer to receive campaign metrics such that timely adjustments are more difficult. The 2Q22 release explains how Amazon’s ad ecosystem is advantaged as it delivers hourly campaign metrics:

Amazon Ads launched Amazon Marketing Stream (Beta), a product that automatically delivers hourly Sponsored Products campaign metrics to advertisers or agencies through the Amazon Ads API. The Stream provides near real time performance insights to enable more effective campaign optimization, more agility in responding to campaign changes, and increased operational efficiency to help drive business growth for advertisers.

Advertising TTM sales through June were $33,962 million. This implies an operating income of $15.3 billion if we use a steady-state margin of 45%. Using a multiplier of 17 to 20x gives us a valuation range of about $260 billion to $306 billion.

Additional Commerce Components

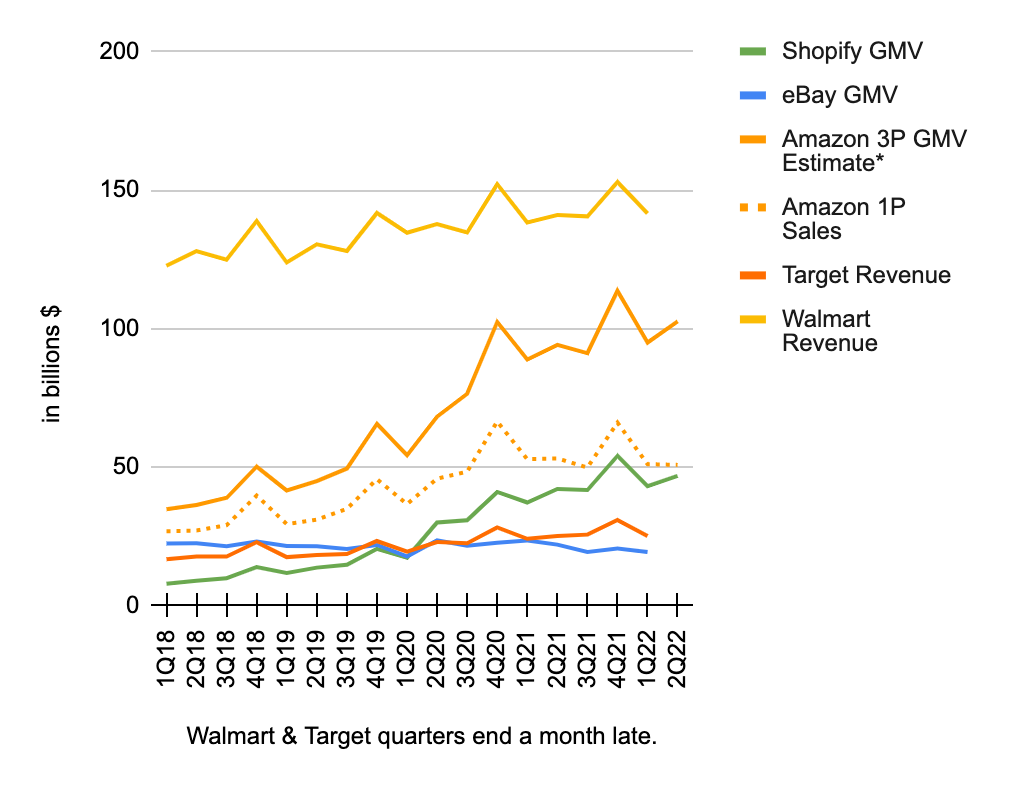

Despite the fact that the 3P segment has about double the GMV of the 1P segment, the 3P sales are only the take part of the GMV whereas the 1P sales capture everything. As such, the reported sales figure for the 1P segment is higher than the figure for the 3P segment.

I like to Amazon’s 1P and 3P GMV along with the GMV of other companies to put things in perspective:

GMV (author’s spreadsheet)

Q/Q sales for 1P were down but this segment is much less meaningful than 3P despite the higher reported sales figures. Amazon 1P TTM sales through June 2022 were $218,001 million and the implied steady-state operating income is $15.3 billion if we use a 7% margin. I think this segment is worth 10x the steady-state operating income which is about $150 to $155 billion.

I think the physical stores segment is worth about $10 billion and I assign a valuation of $0 to the subscription and “other” segments.

Other Considerations

Amazon continues to expand into other areas like healthcare and delivery. The One Medical telehealth acquisition announcement is a positive sign on the healthcare side.

AMZN Stock: Valuation Summary

Like other tech companies, Amazon over-hired during the covid pandemic but they’re making corrections and their employee headcount has gone down nearly 100,000 from 1,622,000 in 1Q22 to 1,523,000 in 2Q22.

Consolidated 2Q22 sales were $121.2 billion and the 3Q22 guidance says consolidated sales should be between $125 and $130 billion which is growth of 13% to 17% over 3Q21. This guidance anticipates an F/X hit of 390 basis points. Rather than focusing on the consolidated sales, it is becoming increasingly important for investors to look at these disparate segments separately. For example, I’d rather see consolidated 3Q22 sales of $125 billion than $126 billion if the $125 billion total is solely from increases in 3P and AWS whereas the $126 billion is solely from an increase in 1P.

Here is my valuation summary:

$644 to $700 billion AWS

$345 to $387 billion 3P

$260 to $306 billion Advertising

$160 to $165 billion Additional Commerce

$0 to $25 billion Other Considerations

————–

$1,409 to $1,583 billion

The 2Q22 10-Q shows 10,187,554,818 shares outstanding as of July 20th. Multiplying this by the July 29th share price of $134.95 gives us a market cap of $1,375 billion. The enterprise value is about $64 billion more than the market cap, seeing as we have $58.1 billion in long-term debt and $66.5 billion in long-term lease liabilities which are only partially offset by $37.5 billion in cash and $23.2 billion in marketable securities.

The bulk of my valuation range is above the market cap and the enterprise value so I think the stock is reasonably priced.

Be the first to comment