4kodiak/iStock Unreleased via Getty Images

Amazon (NASDAQ:AMZN) seems to be facing a massive headwind due to regulatory pressures in US as well as important international regions. The regulatory concerns are overhyped by Wall Street because there are few issues against Amazon which will cause a long-term erosion of its growth potential. Alibaba (BABA) has seen over 60% of its stock value decline in 2021 due to regulatory issues in China. However, it should be noted that Alibaba has a very high dependence on its Chinese market. The revenue base of Amazon is much more diversified. Amazon has also built a variety of business segments that should shield against any major regulatory roadblock making Amazon stock a Strong Buy at the current price point.

A key concern for regulators is that Amazon prioritizes its own branded goods against other sellers on its e-commerce platform. However, this is the same business model used by offline retailers like Costco (COST), Walmart (WMT), Kroger (KR) and others in US. Even major European retailers like Aldi, Lidl, Tesco, and others are known to advertise their own store-branded products. Amazon’s own branded goods also form a very small fraction of total e-commerce business. If there is strong opposition to it, we could see the management reduce these products without causing a negative impact on the key metrics of the company.

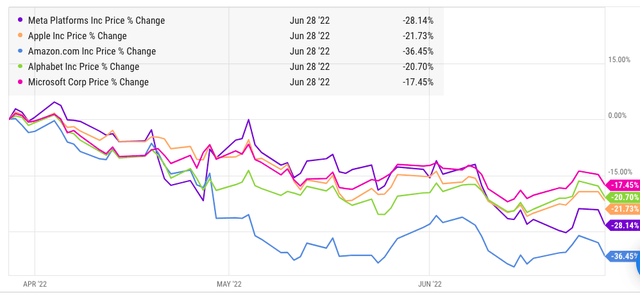

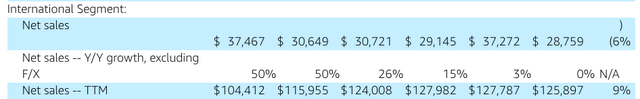

Amazon also does not have a high market share in any single segment it operates in. The market share is barely 40% in cloud computing, 10% in online advertising, and less than 10% in the total retail market. Even the e-commerce market share of the company is falling as other online competitors ramp up their own operations. This should limit any anti-monopolistic legislation against the company.

Investors looking for a buy-and-hold strategy in Amazon should not worry about regulatory challenges. The company is in a good position to weather most of the regulatory headwinds and still deliver healthy growth over the next few years.

Short-term correction phase

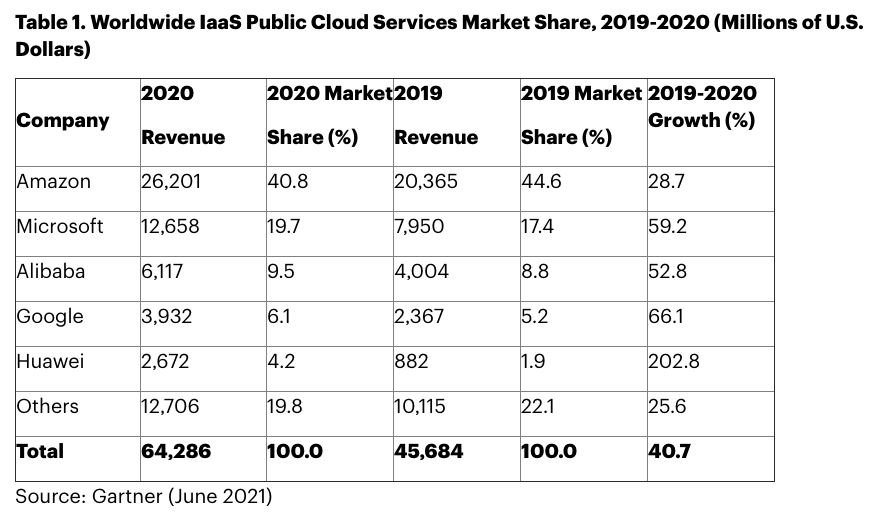

Amazon has seen a significant correction in the last three months as news of higher inflationary headwinds started trickling in. The correction in Amazon stock is higher than all other big tech companies including Apple (AAPL), Alphabet (GOOG), Microsoft (MSFT), and even Meta Platforms (META).

Figure 1: Correction in Amazon stock outpaces other Big Tech companies.

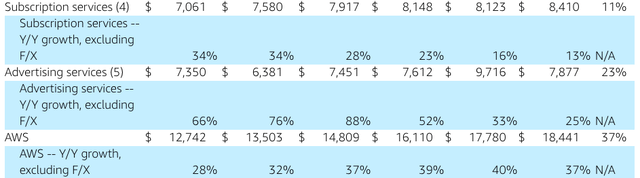

One of the reasons behind this correction has been the scary growth numbers reported by Amazon. Wall Street has seen the headline single-digit growth numbers and developed a bearish sentiment towards the stock. However, it is very important to dig deeper into the growth rates of individual segments. The most lucrative segments for Amazon are AWS, advertising, and subscription. All these three segments have reported good growth rates which has increased their contribution to the revenue mix.

The current inflationary challenge is caused due to higher energy costs and the rebound in most economies as the pandemic restrictions have reduced. These factors are likely to be transitory and do not impact the long-term growth trajectory of Amazon.

It should also be noted that Amazon had tougher comps in the latest quarter. In the year-ago quarter, Amazon delivered over 40% YoY revenue growth. Hence, the lower growth in the latest quarter was more about absorbing the pandemic-related growth jump. From next quarter, Amazon will start seeing easier comps which should help the company report better growth rates.

Amazon still faces long-term risk due to regulatory headwinds. However, the company has been able to build a strong moat to weather the regulatory storm. The revenue mix is well-diversified between AWS, advertising, subscription, e-commerce, hardware and other businesses. Amazon also receives a big chunk of revenue from different international regions which should reduce the regulatory risk in a particular region. In this aspect, Amazon is placed in a better position compared to Alibaba.

Amazon is not Alibaba

There are several differences between Amazon and Alibaba in terms of their regulatory battles. However, one of the main differences is that Alibaba had to absorb extreme regulatory pressure due to its Chinese operations. On the other hand, Amazon has recourse to courts in US, Europe, India and other regions. It has recently seen positive results from a $1 billion fine that was levied on it in Europe in July. FTC has recently launched a case against Amazon saying that it shows “deceptive” ads on its search results. While the final judgment might go against Amazon, it would not be as heavy-handed an approach as faced by Alibaba.

Amazon also went to the courts in India during its battle with another retail giant. Even though Amazon does not have a home team advantage in India, it is able to pursue all available legal options. This is a major difference from Alibaba’s position in China.

Amazon also has a wider mix of services within its revenue base compared to Alibaba. Amazon has built an enviable computing business, a strong online advertising segment, a subscription business, and is geographically very diverse.

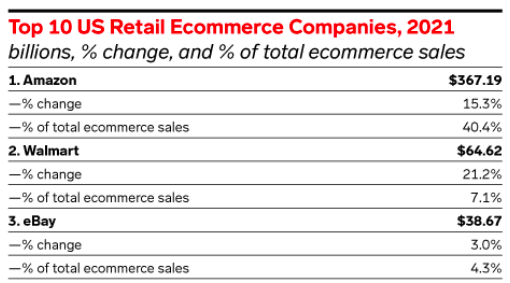

Figure 2: International segment revenue base of Amazon.

Amazon’s international segment revenue has crossed $125 billion in the trailing twelve months. This is equal to 28% of the total revenue base of the company. AWS is available across the globe and has a better economic moat than Alibaba Cloud which heavily depends on its business in China.

Monopolistic market share

Amazon looks like a behemoth in terms of its market valuation and presence in different segments. However, it does not fulfill the basic requirement of being a monopolistic player which is a massive market share. Most of the segments where Amazon is present have a market share of less than 30%. Even businesses like cloud computing in which Amazon had a first-mover advantage have a market share of less than 50%.

Gartner

Figure 3: Market share of vendors in Infrastructure as a service.

According to the above chart by Gartner, Amazon’s cloud market share is declining while Microsoft (MSFT), Google (GOOG), and others are increasing their market share. The market share of AWS in the cloud segment is far from the monopolistic market share of Google in online search or Meta Platforms (META) in social media industry. If we see some anti-monopolistic legislation against Big Tech, Amazon would not be in the front trenches.

Similarly, Amazon’s market share in online advertising is very low compared to the duopoly of Google and Facebook. Even the e-commerce market share of Amazon is quite low considering it was a market innovator in this space.

eMarketer

Figure 4: e-commerce market share of companies.

Self-promotion

Another big regulatory issue that is mentioned for Amazon is that it promotes its own branded products against other vendors. An ideal example is AmazonBasics which become the top private label brand on its e-commerce platform. However, a similar business model is followed by every retailer. Costco’s Kirkland Signature private label is now one of the biggest private brand in US with over $40 billion in revenue. Walmart has its own range of private labels. European retailers like Aldi, Lidl, Tesco, and others are well known for promoting their own store brands. This practice has been used for several decades without any regulatory issues.

The only difference is that these companies work in the offline space while Amazon works in the online space. However, as most of these companies ramp up their own online retail platforms, they would be promoting their own private labels. This makes the argument against Amazon quite moot.

It is also important to note that most of the profits for Amazon do not come from its e-commerce business. The AWS segment alone has been contributing close to 60% of its operating income. Advertising and subscription are also very important and rapidly growing segments for Amazon. Hence, it would not be a major disruption for Amazon if it is asked to reduce the promotion of its private labels on the e-commerce platform.

Long-term growth options

A big hurdle against future growth in stock valuation for Amazon is that it is already too big. However, this argument might be wrong because a large part of Amazon’s valuation comes from its international operations. For example, Amazon’s operations in India could have a standalone valuation of over $100 billion depending on peer comparison of other players in this region. Walmart’s Flipkart in India is looking for an IPO in 2023 at close to $70 billion valuation and it does not have a streaming platform or subscription business like Amazon India.

Amazon is also improving its high-margin businesses like advertising, AWS, and subscription. Hence, even with low revenue growth, we could see faster growth in the operating income over the next few quarters which can drive bullish sentiment for the stock.

Figure 5: Amazon’s revenue growth in subscription, AWS, and advertising business.

Amazon reported over $34 billion of revenue from AWS, subscriptions, and advertising in the latest quarter. On an annualized basis this is close to $140 billion. The revenue share of these high-growth segments is over 30% in the latest quarter. Almost all the incremental revenue for Amazon is coming from these high-margin segments. This will be the key driver for future stock growth in Amazon. All these businesses face lower regulatory hurdles compared to Amazon’s e-commerce business. Hence, the regulatory headwinds are unlikely to become a long-term challenge for the company.

Investor Takeaway

Amazon is facing a number of regulatory issues, however, this will not be a big obstacle to future stock growth. Amazon has a well-diversified revenue base in different regions of the globe. This is a key advantage of Amazon compared to Alibaba which depended heavily on its business in China. Amazon does not have a monopolistic market share in a single segment where it operates. This should reduce any fines or antitrust regulations against the company.

The future valuation growth for the company will be through its AWS, subscription, and advertising business. These segments already contribute over 30% of the revenue base for Amazon and have a much higher contribution in terms of operating income. These businesses face much lower regulatory scrutiny and should allow the company to increase its operating income at a faster pace compared to overall revenue growth. Amazon stock remains a Strong Buy for investors with a longer investment horizon and it is unlikely that regulatory challenges will limit the future growth of the company.

Be the first to comment