4kodiak/iStock Unreleased via Getty Images

Shares of Amazon.com, Inc. (NASDAQ:NASDAQ:AMZN) have disappointed (although not as much as other stocks) in FY 2022, with a year-to-date return of (24)%. In recent days, however, questions have arisen as to whether shares of Amazon could go into a new up-leg, especially after the stock bounced off the summer lows. I believe that Amazon is still significantly overvalued based on earnings and that the risk profile is highly unattractive. High inflation, a strong USD, and headwinds for consumer spending pose challenges for Amazon’s growth, and the e-commerce firm may see resurging topline weakness in Q4!

Surprise inflation report set to hurt Amazon’s revenue prospects

Consumer prices edged from one record to another in the first half of 2022, so investors, companies and consumers are not new to the challenges that high inflation rates pose. However, the latest inflation report from August, which showed a rise in consumer prices of 8.3% year-over-year, indicates that inflation is not subsiding… potentially impacting Amazon’s forward topline estimates in seriously negative ways. While August inflation did not reach the high of June (9.1%), inflation did come in hotter than expected: the estimate was for a rise in consumer prices of 8.1%.

New York Times: US Inflation

Inflation obviously poses a big challenge for large retailers like Amazon, which depend on consumers being willing to spend money online. Persistently high inflation is a major challenge for a lot of families, and rising costs are a serious impediment to consumer spending growth. How serious the situation really is for a lot of people is shown by recent credit data: credit card debt surged $46B (+5.5% quarter-over-quarter) in the second quarter as consumers are apparently forced to borrow more money to pay for necessities. Credit card balances soared 13% year-over-year, the fastest pace in twenty years, as inflation outpaced wage growth in the second quarter.

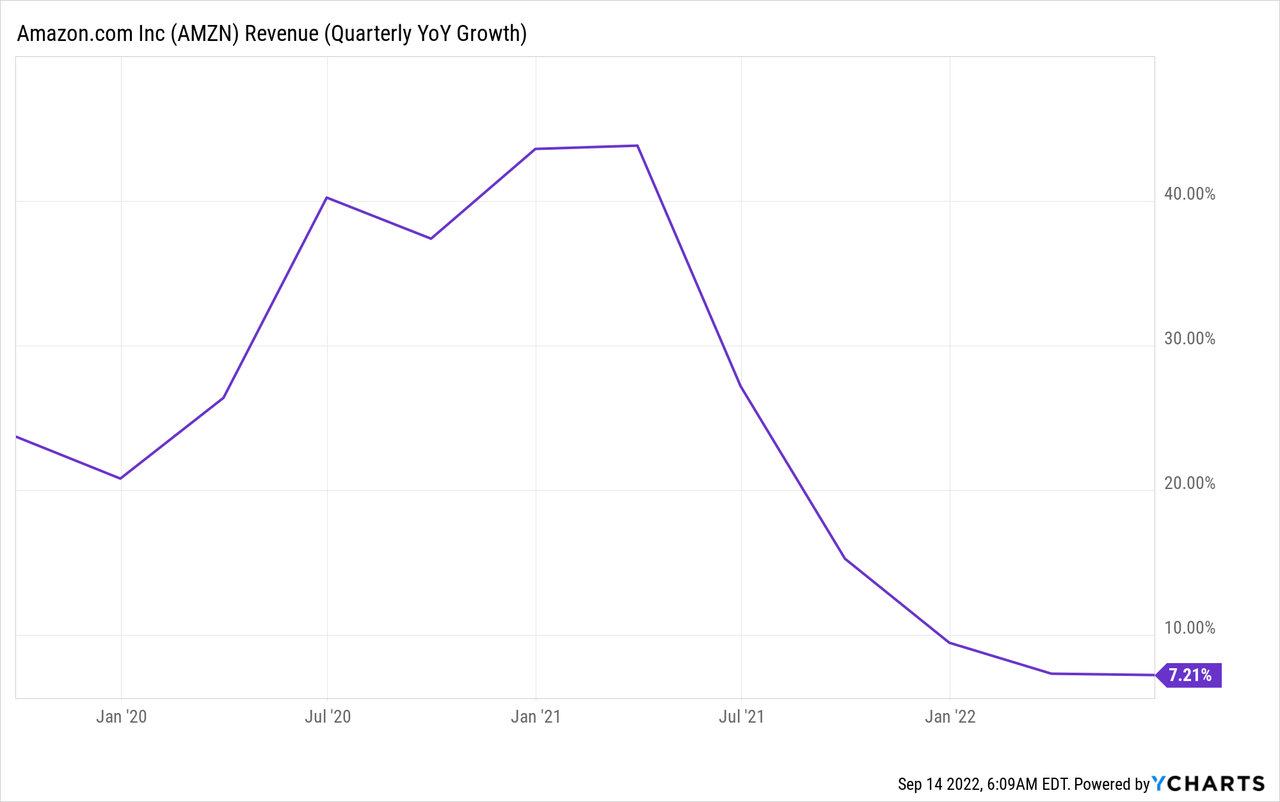

Growing credit card debt driven by higher consumer prices could become a big problem for Amazon as well… and Amazon has already seen a material slowdown in its topline growth in FY 2022. In Q2’22, Amazon reported $121.2B in revenues, showing just 7% YOY growth, which was the slowest growth for the e-commerce retailer in more than two decades.

Amazon guided for revenue growth of 13-17% in Q3’22, indicating that a reacceleration of growth may be possible despite a broader slowdown in the e-commerce market in 2022. However, I believe that the recent inflation report strongly implies the possibility of a stronger downturn in the e-commerce market… and the e-commerce segment continues to dominate Amazon’s revenue mix.

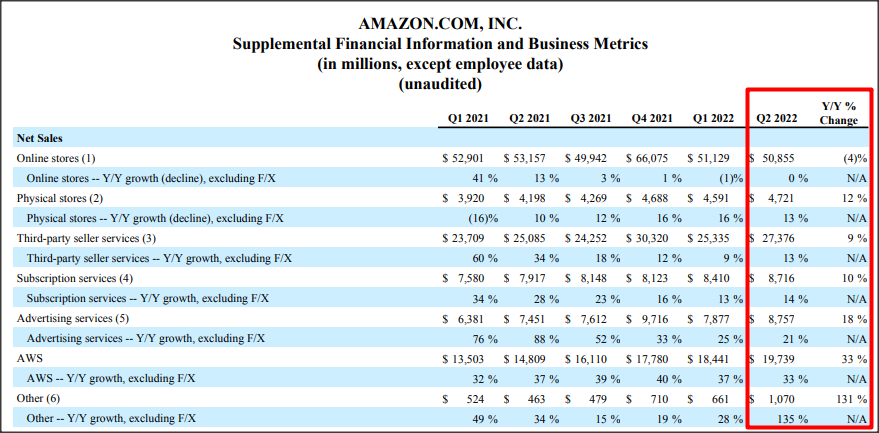

Approximately 84% of Amazon’s consolidated sales relate to the e-commerce category – both in the North America region as well as internationally – so high inflation in the U.S. is likely to remain a considerable headwind for Amazon’s core business. Amazon’s biggest revenue category – online stores – has seen a 4% YOY drop in revenue to $51.1B in Q2’22 due to growing macroeconomic challenges (slowing economic growth, sticky inflation). The only revenue categories that promise to outperform going forward are Amazon Web Services (33% YOY growth in Q2’22) and advertising services (18% YOY growth in Q2’22).

Amazon: Q2’22 Revenue Growth

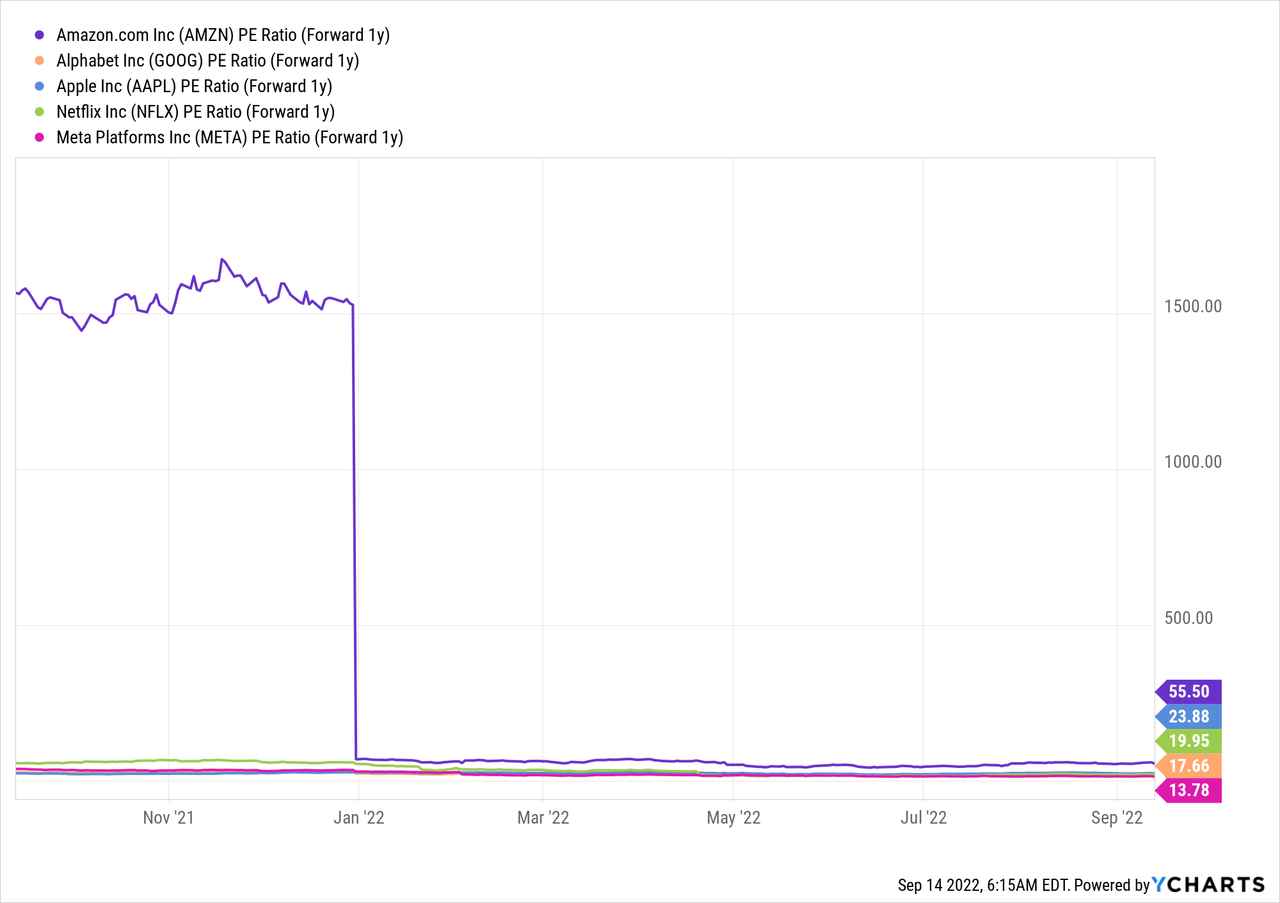

Amazon is expensive and estimates are trending down

Amazon’s shares are trading at an expensive valuation factor, and the current setup which includes multiple short-term challenges doesn’t really justify this. Amazon is expected to generate $2.29 in EPS in FY 2023, implying a P/E ratio of 55.5 X… which is the highest of any FAANG stock. Based off of forward P/E, Amazon is significantly more expensive than Alphabet (GOOG, GOOGL), and Google is super profitable and has a P/E ratio of only 17.7 X.

While I don’t like Amazon based off of inflation risks and valuation, I really like Google due to its recession-resistant free cash flows, stock buyback potential, and low valuation.

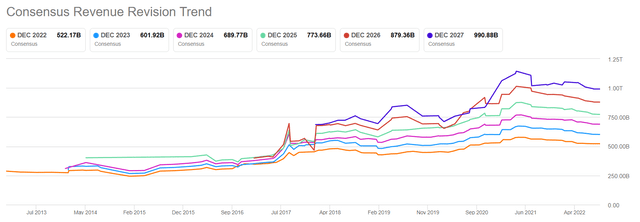

Also concerning: there have been broad-based declines in forward estimates for Amazon’s annual revenues in the last three months. Over the last 90 days, analyst have revised Amazon’s full-year earnings estimates to the downside 26 times while there were 15 upward revisions.

Seeking Alpha: Amazon Revenue Estimates

Risks with Amazon

The U.S. economy as a whole is not in a good place. Inflation remained high in August, and it is set to impact consumer spending on which Amazon depends. Amazon’s e-commerce business has seen weakness in FY 2022, and although the outlook for Q3 is relatively strong, given the circumstances, investors must expect a deceleration in growth in Q4 as inflation and weaker economic growth impact consumer spending negatively. A strong USD continues to be a challenge for Amazon’s profit growth as well. What would change my mind about Amazon is if the e-commerce company issued a strong topline outlook for Q4, announced a major stock buyback, or the USD weakened significantly.

Final thoughts

I believe it is too early to be greedy or double down on Amazon here. The August inflation report and the continually strong U.S. dollar are hurting Amazon’s growth prospects in the core e-commerce business. Besides the risk inflation poses to consumer spending, Amazon’s shares are simply too highly-priced based off of earnings. A better deal, Google, is available, and the stock is trading at a significantly lower valuation factor than Amazon!

Be the first to comment